Carbon contracts for difference

Overview of the status and impact of the innovation

What

An important issue for green hydrogen development is the critical lack of offtakers, which reflects the low level of current demand. Indeed, the majority of planned hydrogen production facilities do not have agreements with any offtakers. The main obstacle is the high cost of green hydrogen compared with hydrogen produced from fossil fuels.

CCfDs would help to ensure that a low-CO2 industry is in place without needing to wait until a combination of economic conditions is present to justify the investment. CCfDs would cover a proportion of the cost difference between a conventional and a low-carbon product. More crucially, they would stabilise revenue streams by removing the risk of CO2 price volatility for project investors. As a result, they could considerably increase the economic feasibility and bankability of projects. Because of the enhanced certainty of pay-offs, projects can increase the proportion of debt in overall project financing compared to equity, and therefore further support the development of green hydrogen projects in end-use sectors where this is a “no-regret” decarbonisation solution (IRENA, 2022g). Owing to the enhanced certainty of pay-offs, projects can increase the proportion of debt in overall project financing compared to equity, and therefore further support the development of green hydrogen projects in end-use sectors where this is a “no-regret” decarbonisation solution (IRENA, 2022g).

Why

CCfDs would help to ensure that a low-CO2 industry is in place without needing to wait until a combination of economic conditions is present to justify the investment. CCfDs would cover a proportion of the cost difference between a conventional and a low-carbon product. More crucially, they would stabilise revenue streams by removing the risk of CO2 price volatility for project investors. As a result, they could considerably increase the economic feasibility and bankability of projects. Because of the enhanced certainty of pay-offs, projects can increase the proportion of debt in overall project financing compared to equity, and therefore further support the development of green hydrogen projects in end-use sectors where this is a “no-regret” decarbonisation solution (IRENA, 2022g). Owing to the enhanced certainty of pay-offs, projects can increase the proportion of debt in overall project financing compared to equity, and therefore further support the development of green hydrogen projects in end-use sectors where this is a “no-regret” decarbonisation solution (IRENA, 2022g).

BOX 9.11 CCfD implementation

Under the RePowerEU initiative, the European Commission’s plan to make Europe independent from Russian fossil fuels before 2030, the Commission will subsidise green hydrogen for industry using a carbon contract for difference (CCfD) to cover fuel switching costs. To promote hydrogen in industrial processes, the German government will provide investment grants and launch a CCfD programme, which is mainly aimed at the steel and chemical industries.

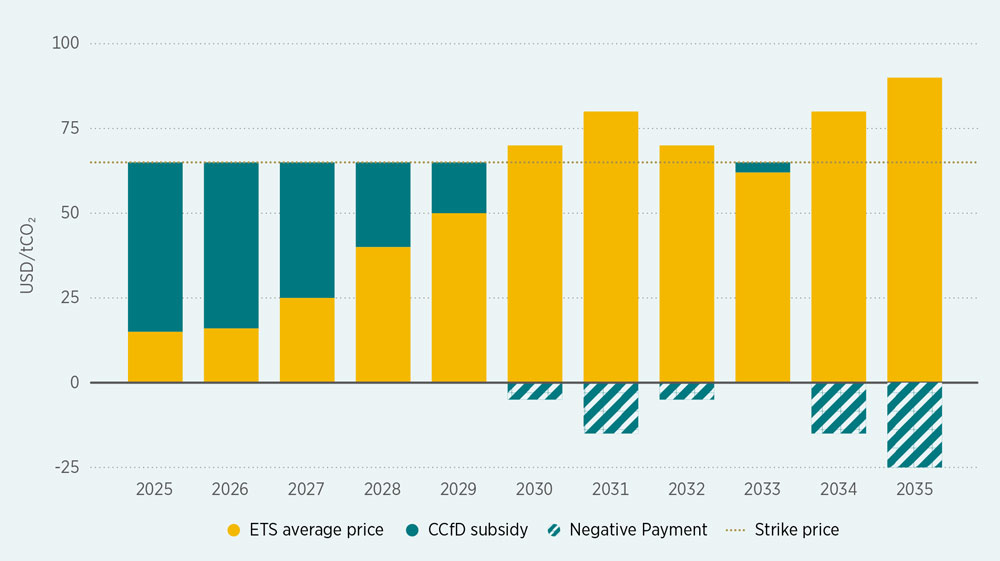

It should be noted that CCfDs would not be expected to have a large impact on government budgets. This is because CCfDs with high strike prices would only be available to kick-start commercial projects, followed by lower strike prices as the processes mature, to be eventually phased out when the technology becomes widespread and the market for green products is established. Moreover, the government would not pay the full strike price of the CCfD. Rather, it would only pay the difference between the strike price and the actual observed Emissions Trading System allowance price. Thus, if the carbon price rises steadily over time, the net annual cost would fall and eventually become negative. Estimates indicate that CCfD prices in Europe may be in the order of a few million euros per country to decarbonise 10% of the hard-to-abate sectors (Sartor and Bataille, 2019; Agora Energiewende, 2020).

FIGURE 9.6 Relationship between average Emissions Trading System (ETS) price and CCfD subsidy at strike price of USD 65/tCO₂

Notes: CCfD = carbon contracts for difference; ETS = Emissions Trading System.

BOX 9.12 Clean hydrogen production tax credit

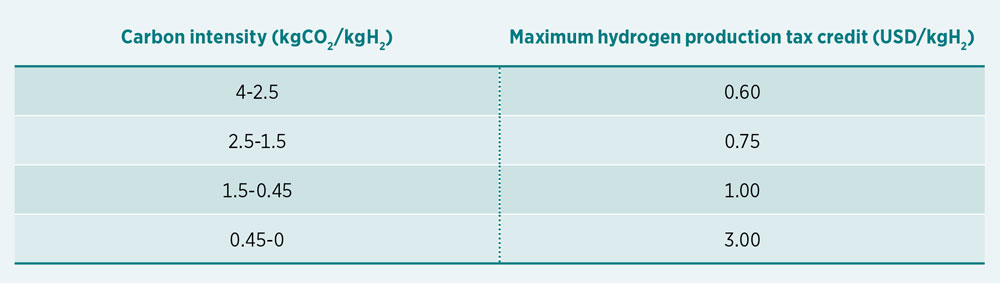

Under the US Inflation Reduction Act of 2022 (IRA), the clean hydrogen production tax credit is a new ten-year mechanism to incentivise the production of hydrogen up to USD 3/kg. The credit support is linked to the amount of CO2 emissions up to a maximum level of 4 kgCO2eq/kgH2 (kilograms of carbon dioxide equivalent per kilogram of hydrogen).

The credit provides a four-tier incentive based on such carbon intensity (Table 9.4).

TABLE 9.5 Amount of hydrogen production tax credit, by degree of carbon intensity

In addition, projects can also elect to claim up to a 30% investment tax credit under Section 48, “Advanced Energy Project Credit (Extends IRC Code Section 48c)”, that also creates funding for manufacturing projects producing fuel cell electric vehicles, hydrogen infrastructure or electrolysers.

Green hydrogen producers from renewable electricity can also benefit from the renewable electricity production tax credit (Section 45 and 45Y) with a financial support of USD 2.6 cents/kWh in 2023, and inflation adjustment of 2% per year in future years, up to 2032.

Related kits

Power to hydrogen innovations

Innovations (30)

-

Technology and infrastructure

- 1 Pressurised alkaline electrolysers

- 2 Polymer electrolyte membrane electrolysers

- 3 Solid oxide electrolyser cell electrolysers

- 4 Anion exchange membrane electrolysers

- 5 Compressed hydrogen storage

- 6 Liquefied hydrogen storage

- 7 Hydrogen-ready equipment

- 8 Digital backbone for green hydrogen production

- 9 Hydrogen leakage detection

-

Market design and regulation

- 10 Additionality principle

- 11 Renewable power purchase agreements for green hydrogen

- 12 Cost-reflective electricity tariffs

- 13 Electrolysers as grid service providers

- 14 Certificates

- 15 Hydrogen purchase agreements

- 16 Carbon contracts for difference

- 17 Regulatory framework for hydrogen network

- 18 Streamline permitting for hydrogen projects

- 19 Quality infrastructure for green hydrogen

- 20 Regulatory sandboxes

-

System planning and operation

-

Business models