Hydrogen purchase agreements

Overview of the status and impact of the innovation

What

A hydrogen purchase agreement (HPA) is a legally binding contract between a supplier of hydrogen fuel and a customer, outlining the terms and conditions for the purchase and delivery of hydrogen fuel. The agreement typically includes details such as the price, delivery schedule and quality standards for the hydrogen fuel, as well as any warranties or guarantees provided by the supplier (Hernández Vidal, 2023). The operator may produce the electricity itself with a renewable energy plant or procure electricity from a third party by entering into a corporate PPA. A HPA needs to ensure that the hydrogen is certified as green hydrogen, and needs to ensure a predictable revenue stream. That means the HPA will need to provide a long-term offtake commitment (10-15 years). A HPA scheme involves the standardisation of such contracts both at the local and international level, facilitating the trade of hydrogen and increasing transparency in the process (Reinecke et al., 2022).

Why

Having a HPA scheme in place is important because it provides long-term certainty on the acquisition of hydrogen. It is crucial to obtain financing at an early stage and decisive for bankability in the longer run. Such a scheme can facilitate the ramp-up of green hydrogen and its derivatives.

BOX 9.10 Bilateral auctions for procurement of hydrogen in Germany

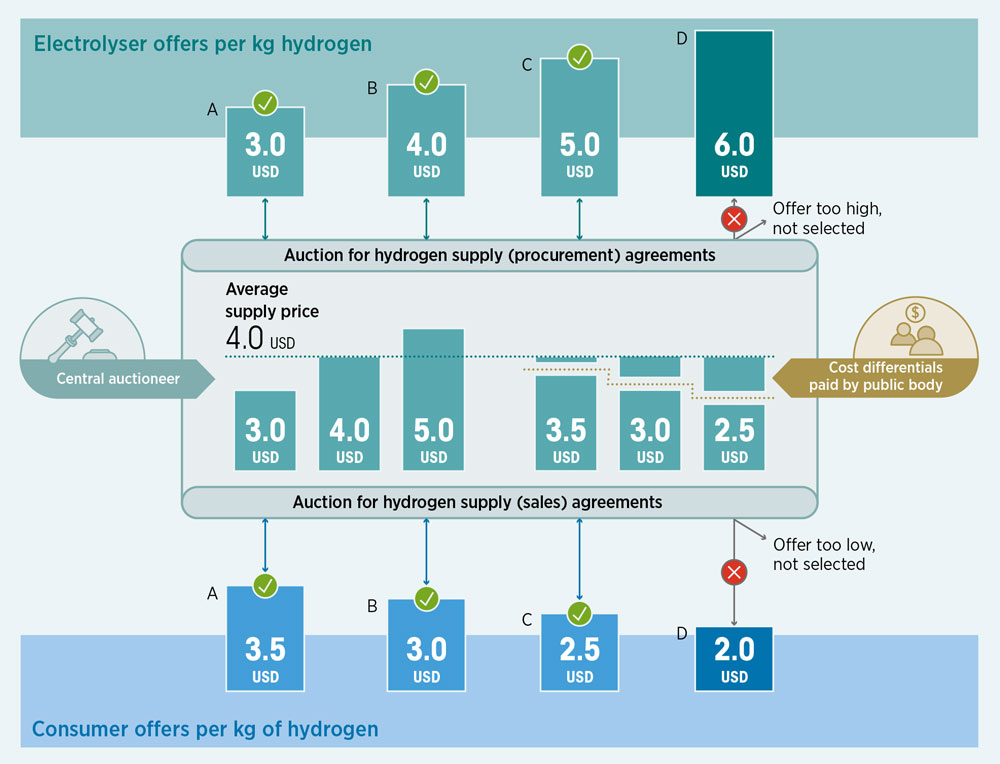

Under the H2Global funding programme, Germany designed a double auction scheme to procure hydrogen for German industry. The H2Global programme established an intermediary body called the Hydrogen Intermediary Network Company (HINT.CO) to sign long-term agreements.

Through a double auction scheme, the lowest purchase agreement and the highest sale agreement resulting from the auctions would be awarded the contract, while too high purchase offers and too low sale offers would be rejected (Figure 9.5). The public body would then cover the price difference.

FIGURE 9.5 Bilateral auction system schematic

Depending on auction design, a captive green hydrogen producer may sign both contracts, basically receiving a premium for its green hydrogen self-production. HINT.CO is supported with EUR 900 million of funding to temporarily compensate the difference between the hydrogen purchase agreements and sales agreements.

The programme expects that future adjustments to the regulatory framework will increase industrial offtakers’ willingness to pay for green hydrogen and the sale agreement price will rise over time. This will gradually reduce the need for HINT.CO to compensate for the price differential until a point is reached where the demand and supply prices are in line with each other.

Related kits

Other power innovations

Innovations (30)

-

Technology and infrastructure

- 1 Pressurised alkaline electrolysers

- 2 Polymer electrolyte membrane electrolysers

- 3 Solid oxide electrolyser cell electrolysers

- 4 Anion exchange membrane electrolysers

- 5 Compressed hydrogen storage

- 6 Liquefied hydrogen storage

- 7 Hydrogen-ready equipment

- 8 Digital backbone for green hydrogen production

- 9 Hydrogen leakage detection

-

Market design and regulation

- 10 Additionality principle

- 11 Renewable power purchase agreements for green hydrogen

- 12 Cost-reflective electricity tariffs

- 13 Electrolysers as grid service providers

- 14 Certificates

- 15 Hydrogen purchase agreements

- 16 Carbon contracts for difference

- 17 Regulatory framework for hydrogen network

- 18 Streamline permitting for hydrogen projects

- 19 Quality infrastructure for green hydrogen

- 20 Regulatory sandboxes

-

System planning and operation

-

Business models