Hydrogen

About

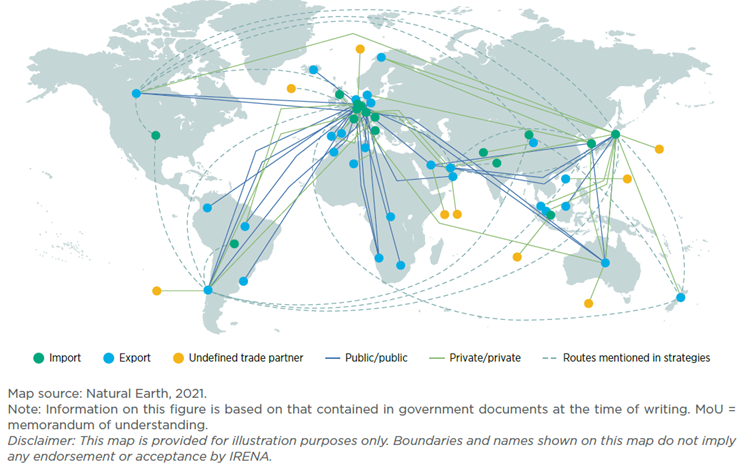

Hydrogen is likely to influence the geography of energy trade. With the costs of renewable energy falling, but those of transporting hydrogen high, the emerging geopolitical map is likely to show growing regionalisation in energy relations. Renewables can be deployed in every country, and renewable electricity can be exported to neighbouring countries via transmission cables. In addition, hydrogen can facilitate transport of the renewable energy over longer distances via pipeline and shipping, thus unlocking untapped renewable resources in remote locations. Some existing natural gas pipelines, with technical modification, could be repurposed to carry hydrogen.

Countries with an abundance of low-cost renewable power could become producers of green hydrogen, with commensurate geoeconomic and geopolitical consequences. Green hydrogen production could be most economical in locations that have the optimal combination of abundant renewable resources, space for solar or wind farms, and access to water, along with the capability to export to large demand centres. New energy hubs could arise in places that exploit these factors to become centres of hydrogen production and use.

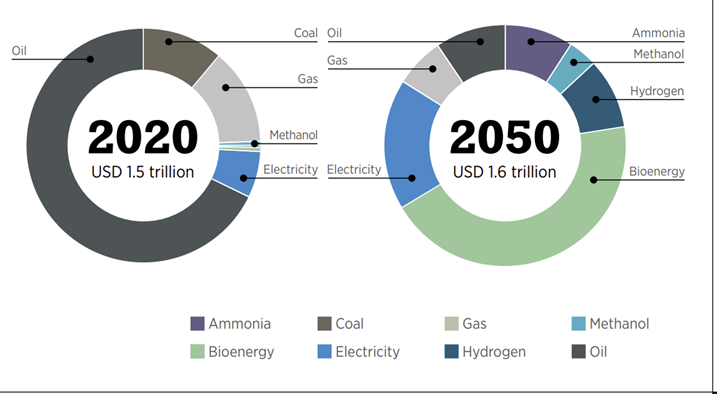

The hydrogen business is likely to be more competitive and less lucrative than oil and gas (see Figure 10). Clean hydrogen may not generate returns comparable to those of oil and gas today. Hydrogen is a conversion activity, not an extraction business, and has the potential to be produced competitively in many places. This may limit the possibilities of capturing economic rents akin to those generated by fossil fuels, which today account for some 2% of global GDP. Moreover, as the costs of green hydrogen fall, new and diverse participants are likely to enter the market, making hydrogen even more competitive.

Hydrogen trade and investment flows are expected to spawn new patterns of interdependence and bring shifts in bilateral relations. A fast-growing array of bilateral deals indicates that these will be different from the hydrocarbon-based energy relationships of the 20th century. More than 30 countries and regions have hydrogen strategies that include import or export plans, indicating that cross-border hydrogen trade is set to grow considerably. Countries that have not traditionally traded energy are establishing bilateral relations centred on hydrogen-related technologies and molecules (see Figure 11). As economic ties between countries change, so might their political dynamics.

Past Events

More events-

11 December 2024 Virtual

Policies and measures for green hydrogen deployment in Türkiye

-

19 November 2024 Virtual

Workshop for Green Hydrogen in the Islamic Republic of IRAN

-

22 March 2024 Virtual

9th Collaborative Framework on Green Hydrogen