Investments in Renewables: IRENA Analyses Where that Money is, and isn’t, Coming From

Newsletter

The energy system is transforming, and doing so rapidly. Renewable energy capacity additions are exceeding fossil fuel generation investments by a widening margin and the record 162GW of new renewable power added in 2016 represented 60 per cent of all new power capacity additions in that 12-month period.

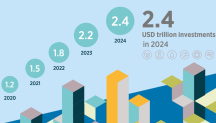

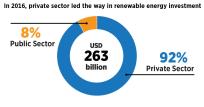

Underpinning these capacity additions were global investments in excess of USD 260 billion in 2016, down from the record USD 330 billion the previous year due in part to lower technology costs. But where are those investments coming from? And which technologies are attracting the lion’s share of that investment?

IRENA’s new report, ‘Global Landscape of Renewable Energy Finance’ outlines key global investment trends between 2013-2016, offering a comprehensive overview of capital flows by region and technology. The report also examines the differing roles and approaches of private and public finance, highlights the emergence of viable risk mitigation instruments, and provides an outlook for renewable energy finance in 2018 and beyond.

A key finding of the report is that to date, relatively low levels of capital are flowing from the world’s major institutional investors. In fact, Institutional and private equity investors have contributed less than 1% each to global renewable energy investment in the last three years. Their investment peaked in 2015 at around USD 3 billion and USD 2 billion.

One potential reason for their lack of commitment to low-carbon investments so far could perhaps be that the asset size is not significant enough to attract them yet. Once developers can present multi-billion dollar portfolios of operational projects institutional investors may be more inclined to engage.

So as renewable energy scales up, where is that investment coming from? And importantly where is it flowing too? Some of the key findings of the report include:

- Despite lower investment in 2016, versus 2015 (from USD 330 billion in 2015 to USD 263 billion in 2016) 2016 saw record increases in installed renewable plant capacity.

- The falling cost of solar and wind was a significant driver of falling renewable energy investment – a positive for energy consumers.

- Solar PV and wind power dominate global spending on new renewables projects, moving from 83% of total finance in 2013, to 93% of total renewable energy investment in 2016.

- Offshore wind represented a steadily rising share of total wind investment. While all technologies (including solar PV and onshore wind) saw falling investment in 2016.

- Offshore wind investment increased fourfold since 2013 accounting for a USD 25 billion, 25% share of total wind investment in 2016 and is poised for further growth

- Investment in geothermal power was stable, averaging USD 2 billion per year over 2013-2016.

- China commands more renewable energy investment than any other country and renewables investment in India has more than doubled between 2013-2016.

- Investment in geothermal power was stable, averaging USD 2 billion per year over 2013-2016.

- Western Europe saw investment peak in 2015 at USD 73 billion before falling to USD 53 billion in 2016.