-

-

ESCAP, UNFCCC RCC Asia-Pacific, ADB, Climate Bonds and IRENA (2025). A Call to Action: Developing Sustainable Capital Markets, Financing Energy Transitions, and Building Project Pipelines. ESCAP Financing for Development Series, No. 6. Bangkok: ESCAP.

Copied

https://www.irena.org/-/media/Files/IRENA/Agency/Publication/2025/Jun/ESCAP_IRENA_PAR_Call_to_action_FFD-6_2025.pdf

Copied

A Call to Action: Developing Sustainable Capital Markets, Financing Energy Transitions, and Building Project Pipelines

Newsletter

The 6th edition of the United Nations Economic and Social Commission for Asia and the Pacific (UN ESCAP) Financing for Development series offers a comprehensive overview of sustainable debt capital markets, energy transition financing and green project pipelines in the Asia and the Pacific region.

The report is a joint product issued by UN ESCAP, IRENA, the Climate Bonds Initiative, the Asian Development Bank, and the Regional Collaboration Centre (RCC) for Asia and the Pacific of the United Nations Framework Convention on Climate Change (UNFCCC).

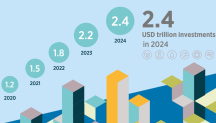

A co-authored chapter by UN ESCAP and IRENA examines investment trends in energy transition technologies, prevailing challenges to accelerated financing, as well as opportunities to facilitate a renewables-based transition for Asia and the Pacific. As the region with the biggest population and energy needs, progress in Asia and the Pacific’s energy transition will be crucial for global climate goals. The region faces several complex challenges, including a dependence on fossil fuel assets, nascent renewable energy industries in many sub-regions, uneven distribution of energy transition investments across countries, varied levels of institutional and market capacity, and insufficient infrastructure to facilitate the deployment of energy transition technologies.

As policymakers, industries and communities in the region navigate the challenges of achieving energy security, energy affordability and decarbonisation, IRENA and UN ESCAP offer a set of key policy recommendations, based on: 1) fossil fuel subsidy and pricing reforms; 2) coherence of policy frameworks; 3) the modernisation and expansion of transmission and grid infrastructure; 4) stronger partnerships between governments and investors, including for carbon finance structures; and 5) innovative financing mechanisms for a sustainable energy transition.