Financing the Future

Newsletter

In 2015, $286 billion was invested in renewable energy. That is an enormous sum of money by many measurements, but is it enough, and are we on track to meet the energy demands of the future with renewables?

“Unfortunately it’s not even close to enough,” said Joanne Jungmin Lee of IRENA’s Knowledge, Policy, and Finance Centre. “More money must be invested in renewables to meet the world’s growing energy demand and to realise their socioeconomic and environmental benefits.”

IRENA estimates that deploying renewables on the scale necessary to limit global temperature rise below 2 degrees would require current investment to double by 2020, and triple by 2030 to around US$ 900 billion annually.

Lee admits it’s a huge sum but thinks it’s achievable — given renewable energy’s increasing cost-competitiveness — if sound policies and targeted financial instruments are used to enable markets and attract more investment from the private sector. “It’s unlikely that more money can come from the public sector above its current levels, which is about 15% of total investment in renewables, so we must focus on attracting private investors by making renewables more attractive” she said.

Removing barriers and reducing risk

Making renewables more attractive for investors means removing market barriers and mitigating risks. Governments and public finance institutions can provide technical assistance and grants for project preparation and development, while structuring and designing on-lending and co-lending options can improve access to finance and build local lending capacity.

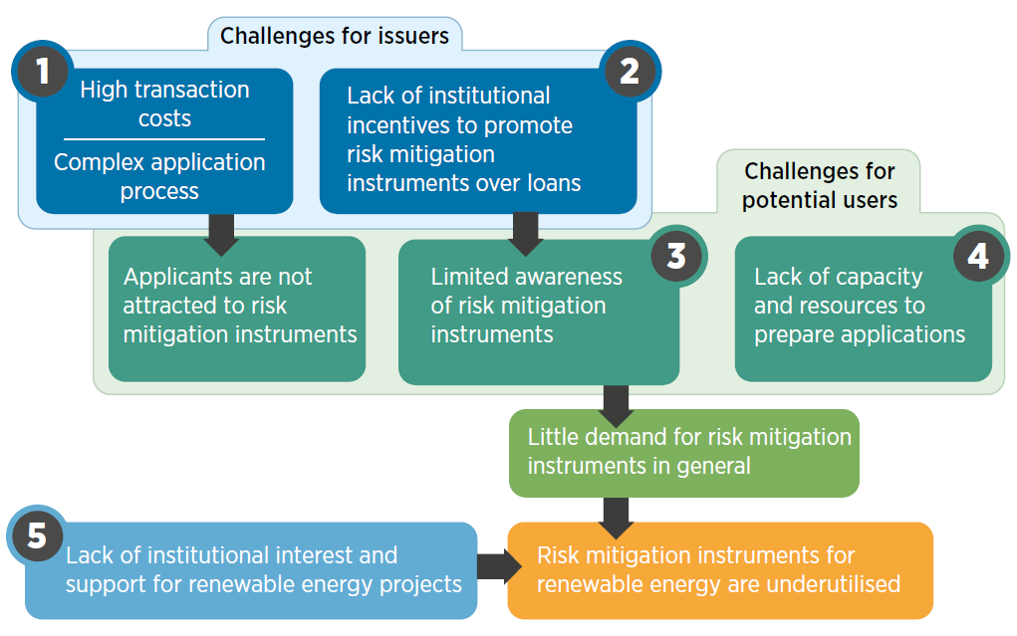

“Through public finance institutions, private investors and lenders can get access to risk mitigation instruments like guarantees, currency hedging instruments and liquidity facilities,” explains Lee. “However, the use of guarantees in renewable energy investment remains limited. In 2014 IRENA completed a survey of different public finance institutions around the world, and found that on average these institutions only spent around 4% of their total infrastructure risk mitigation issuance value on renewables.”

IRENA's analysis shows that guarantees are often underutilised in renewable energy projects due to lack of product awareness and high transactions costs, preference for loans over guarantees, and a lack of general institutional support for renewable energy.

By increasing awareness of existing risk mitigation instruments, streamlining institutional procedures, redirecting institutional incentives to enable greater provision of risk mitigation instruments, and promoting the importance of renewable energy investment to the issuers of risk mitigation instruments, could make the ‘toolbox’ of public finance institutions play a more influential role in attracting further large-scale investment from the private sector.

Standardising project documentation such as Power Purchasing Agreements, and aggregating small projects, will also make renewable energy project more accessible to mainstream investors, says Lee.

Areas for action

Recent analysis from IRENA has identified 5 key areas where governments, public finance institutions, and other investors can take action, including:

- Using tools and grants to support project preparation, which are vital to advance renewable energy projects from initiation to full investment maturity.

- Directing dedicated resources to local financial institutions and designing on-lending facilities to improve access to capital and build local lending capacity.

- Leveraging private investment by increasing the use of existing guarantees and developing new, targeted risk mitigation instruments to address power-off taker, currency and liquidity risks.

- Standardising contracts and project documentation processes to facilitate aggregation of projects while governments develop guidelines for green bonds issuance to mobilise more capital market investment.

- Developing dedicated financing facilities to issue risk mitigation instruments and support design and implementation of structured finance mechanisms for renewables.

To learn more about renewable energy finance and ways to scale up renewable energy investments, check out IRENA’s newest publication Unlocking Renewable Energy and Investment: the role of risk mitigation and structured finance. The publication identifies policies and tools that can help scale up investment and includes documentation of successful applications.