Solving the Chicken and Egg Problem: Auctions for Green Hydrogen

Newsletter

Green hydrogen (hydrogen produced from renewable energy) has received increasing attention across the energy sector in recent years, given its capability to decarbonise ‘hard to abate’ sectors (such as steelmaking) and provide seasonal storage for power grids rich in variable renewable energy (VRE).

IRENA’s World Energy Transitions Outlook includes hydrogen as one of the main solutions to achieve the 1.5°C climate goal. The Outlook indicates that hydrogen can provide 10 per cent of needed emissions reductions worldwide by 2050. This will require five terawatts (TW) of electrolyser capacity (to separate water into hydrogen and oxygen using electricity).

However, today there is no green hydrogen demand, little hydrogen infrastructure, and no global electrolyser capacity of few hundred megawatts. The whole situation creates the so-called chicken and egg problem: at USD 4–6 per kg – compared to the USD 1–2/kg for fossil fuels-based hydrogen – green hydrogen production costs inhibit demand. But without demand, investments remain too risky for wide-scale green hydrogen production that could compress costs.

The hydrogen chicken and egg problem must be tackled, and policymakers have a crucial role to play. Firstly, there is a need for a broader policy framework for the green hydrogen sector. But tailored policies are also needed to address some barriers and support the sector in the same way solar photovoltaics and wind energy were supported more than one decade ago. IRENA has identified several policy options to support the green hydrogen supply, one of which is particularly promising – auctions.

Just as auctions have been deployed across the world to deliver new renewable power capacity and lower the cost of clean energy technologies, so too could they be implemented to promote green hydrogen. Auctions for carbon contracts for differences (CCfDs) using emissions trading system (ETS) would allow selected, hard-to-abate industries under the ETS scheme to secure a stable income for an agreed period, provided they use green hydrogen. The selected winners, who bid for a certain strike price, would receive the difference between the strike price and the market price of the emission allowances from the government. This would cover the costs of green hydrogen investments, and attract financing for green hydrogen projects. CCfD auctions are already being considered in various hydrogen strategies.

An alternative auction design could be set to facilitate trading in green hydrogen without the need for any physical exchange. In this case, a public intermediary could auction long-term purchase agreements with producers (with the lowest bid being selected), and separate service agreements with off-takers in the hard-to-abate sectors (with the highest bid being selected), who then could start decarbonising their processes. Carbon taxes or ETS revenues could be used to compensate for the initial price differences borne by the public intermediary.

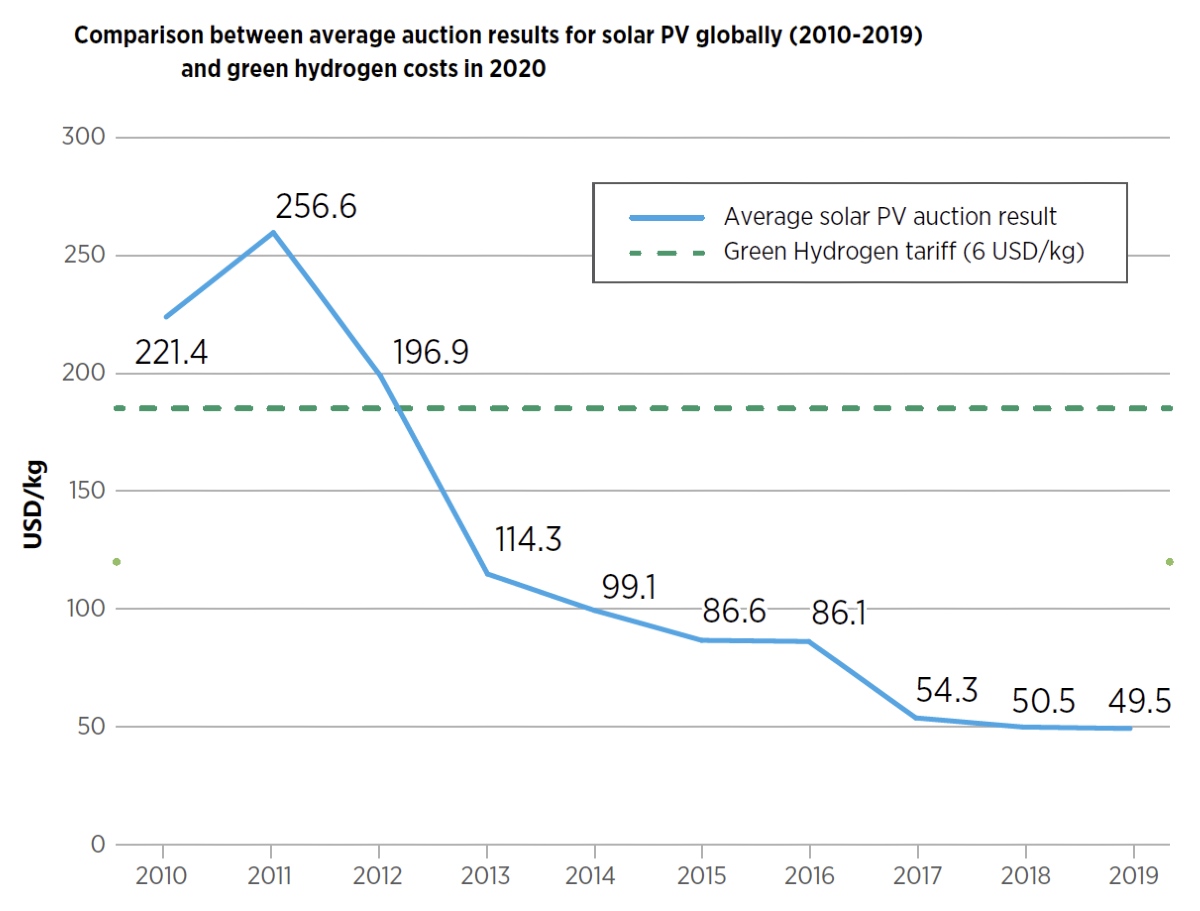

These costs are expected to get lower, the same way the costs of utility-scale solar photovoltaics (PV) and onshore wind have been reduced to below operating costs of existing coal-fired plants, due to steadily improving technologies, more competitive supply chains, improved developer experience, and economies of scale created through auctions. Over time, today’s green hydrogen tariff of USD 6/kg (around USD 180/MWh) would be lower than the feed-in tariff schemes used to promote solar PV electricity in its infancy, and below the average auctions results for solar PV until 2013 (see below figure). When cost parity with fossil fuels-based hydrogen is achieved with the support of an enabling policy framework, a competitive market could be established, and green hydrogen will break free from the chicken and egg problem.

Expert Insight by:

Emanuele Bianco

Programme Officer, Knowledge, Policy and Finance Centre, IRENA

Expert Insight by:

Diala Hawila

Programme Officer, Knowledge, Policy and Finance Centre, IRENA

© IRENA 2025

Unless otherwise stated, material in this article may be freely used, shared, copied, reproduced, printed and/or stored, provided that appropriate acknowledgement is given of the author(s) as the source and IRENA as copyright holder.

The findings, interpretations and conclusions expressed herein are those of the author(s) and do not necessarily reflect the opinions of IRENA or all its Members. IRENA does not assume responsibility for the content of this work or guarantee the accuracy of the data included herein. Neither IRENA nor any of its officials, agents, data or other third-party content providers provide a warranty of any kind, either expressed or implied, and they accept no responsibility or liability for any consequence of use of the content or material herein. The mention of specific companies, projects or products does not imply that they are endorsed or recommended, either by IRENA or the author(s). The designations employed and the presentation of material herein do not imply the expression of any opinion on the part of IRENA or the author(s) concerning the legal status of any region, country, territory, city or area or of its authorities, or concerning the delimitation of frontiers or boundaries.