World Energy Transitions Outlook 2023

Executive summary

The energy transition is off-track. The aftermath of the COVID-19 pandemic and the ripple effects of the Ukraine crisis have further compounded the challenges facing the transition. The stakes could not be higher - every fraction of a degree in global temperature change can trigger significant and far-reaching consequences for natural systems, human societies and economies.

Limiting global warming to 1.5°C requires cutting carbon dioxide (CO₂) emissions by around 37 gigatonnes (Gt) from 2022 levels and achieving net-zero emissions in the energy sector by 2050. Despite some progress, significant gaps remain between the current deployment of energy transition technologies and the levels needed to achieve the goal of the Paris Agreement to limit global temperature rise to within 1.5°C of pre-industrial levels by the end of this century. A 1.5°C compatible pathway requires a wholescale transformation of the way societies consume and produce energy.

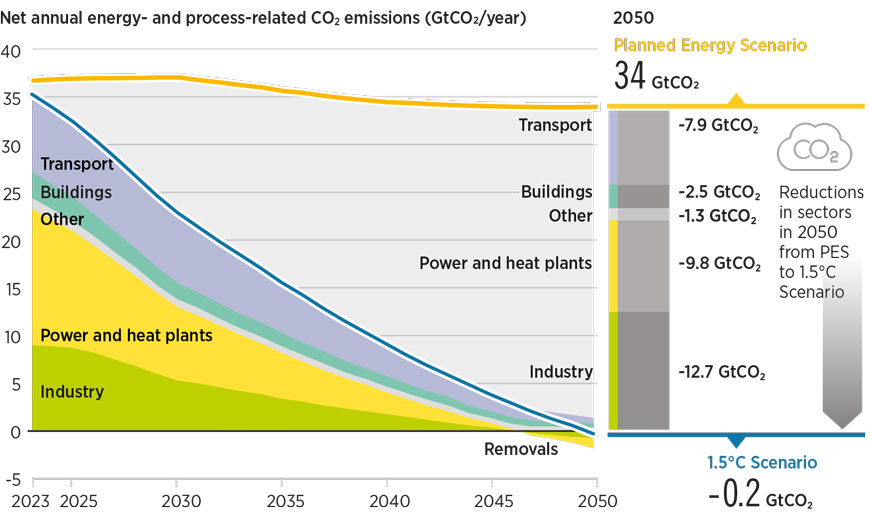

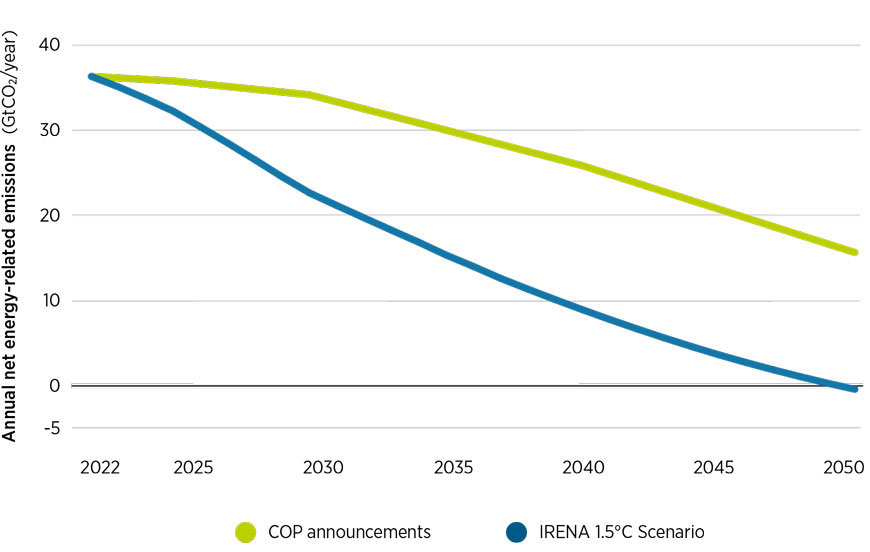

Current pledges and plans fall well short of IRENA’s 1.5°C pathway and will result in an emissions gap of 16 Gt in 2050. Nationally Determined Contributions (NDCs), long-term low greenhouse gas emission development strategies (LT-LEDS) and net-zero targets, if fully implemented, could reduce CO₂ emissions by 6% by 2030 and 56% by 2050, compared to 2022 levels. However, most climate pledges are yet to be translated into detailed national strategies and plans - implemented through policies and regulations - or supported with sufficient funding. According to IRENA's Planned Energy Scenario, the energy-related emissions gap is projected to reach 34 Gt by 2050, underscoring the urgent need for comprehensive action to accelerate the transition.

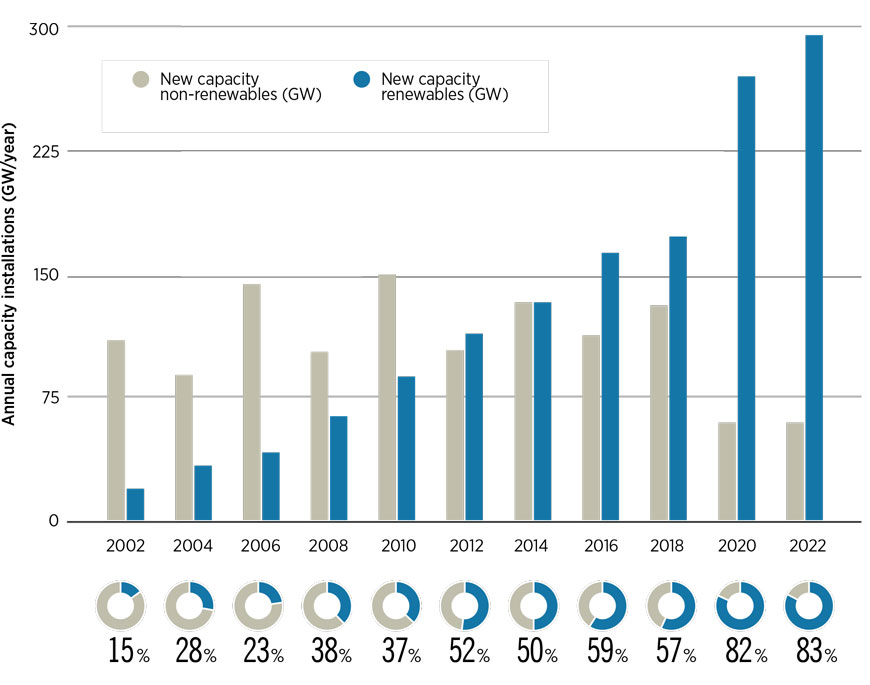

Annual deployment of some 1 000 GW of renewable power is needed to stay on a 1.5°C pathway. In 2022, some 300 GW of renewables were added globally, accounting for 83% of new capacity compared to a 17% share combined for fossil fuel and nuclear additions. Both the volume and share of renewables need to grow substantially, which is both technically feasible and economically viable.

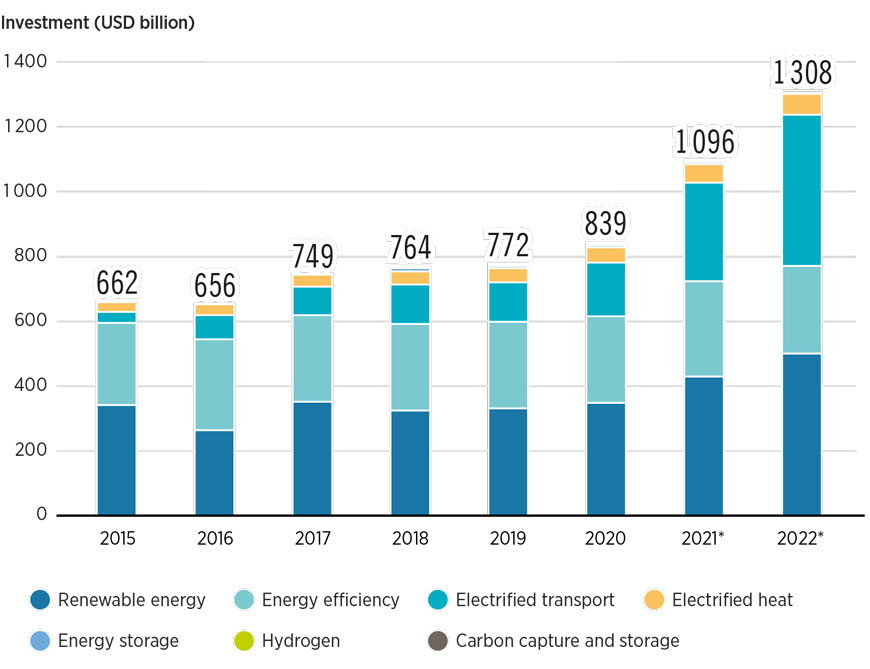

Policies and investments are not consistently moving in the right direction. While there were record renewable power capacity additions in 2022, the year also saw the highest levels of fossil fuel subsidies ever, as many governments sought to cushion the blow of high energy prices for consumers and businesses. Global investments across all energy transition technologies reached a record high of USD 1.3 trillion in 2022, yet fossil fuel capital investments were almost twice those of renewable energy investments. With renewables and energy efficiency best placed to meet climate commitments - as well as energy security and energy affordability objectives – governments need to redouble their efforts to ensure investments are on the right track.

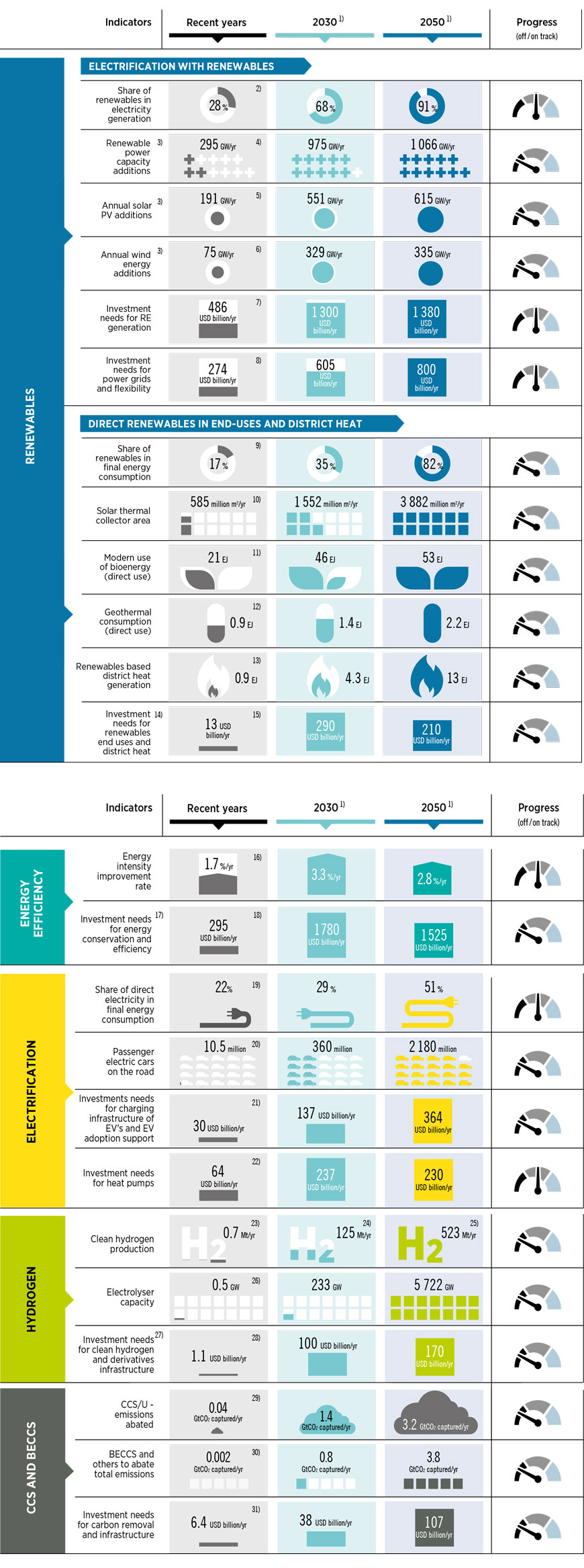

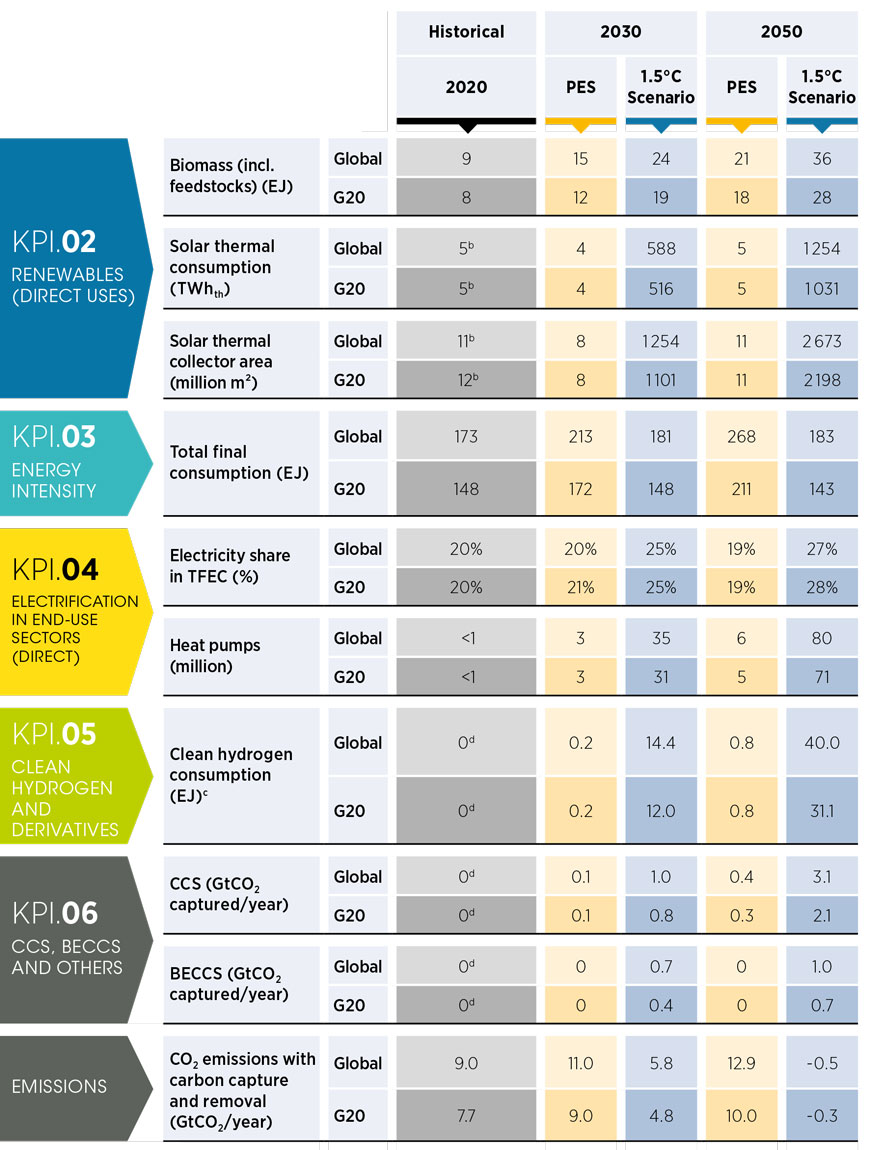

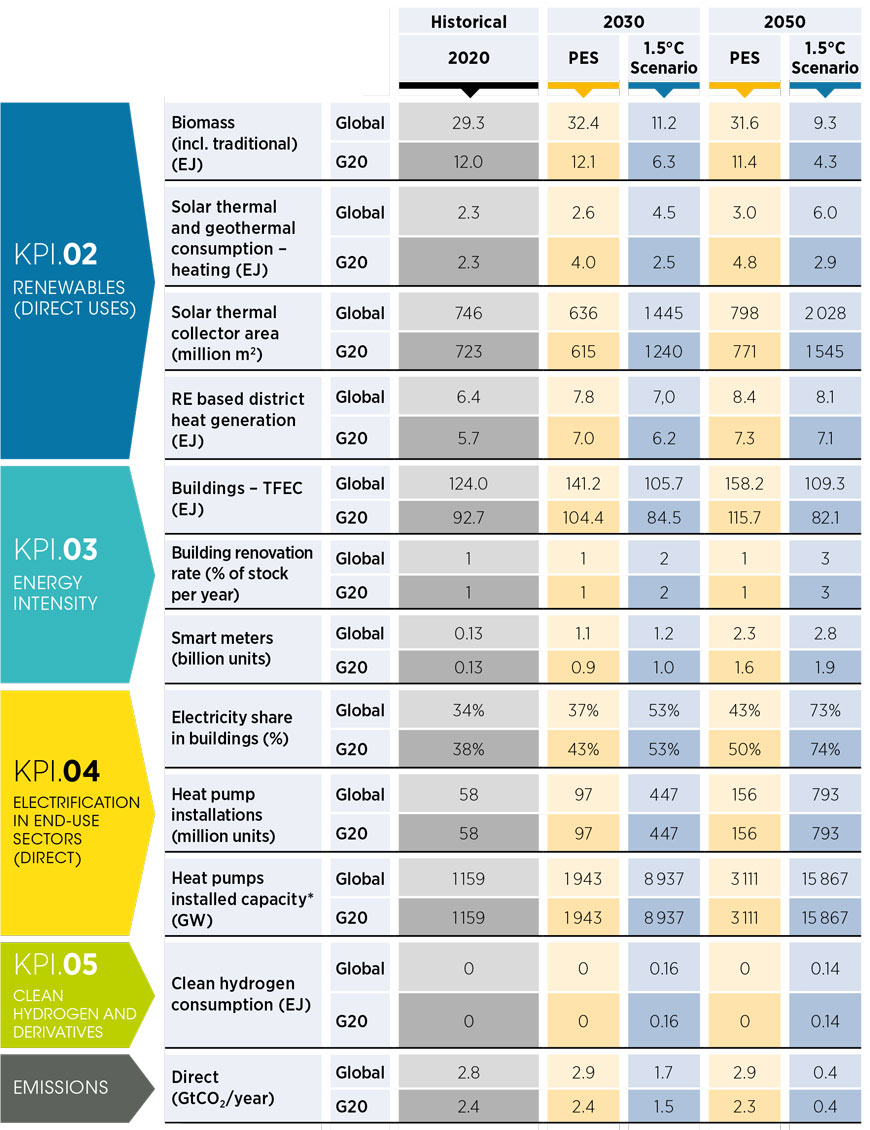

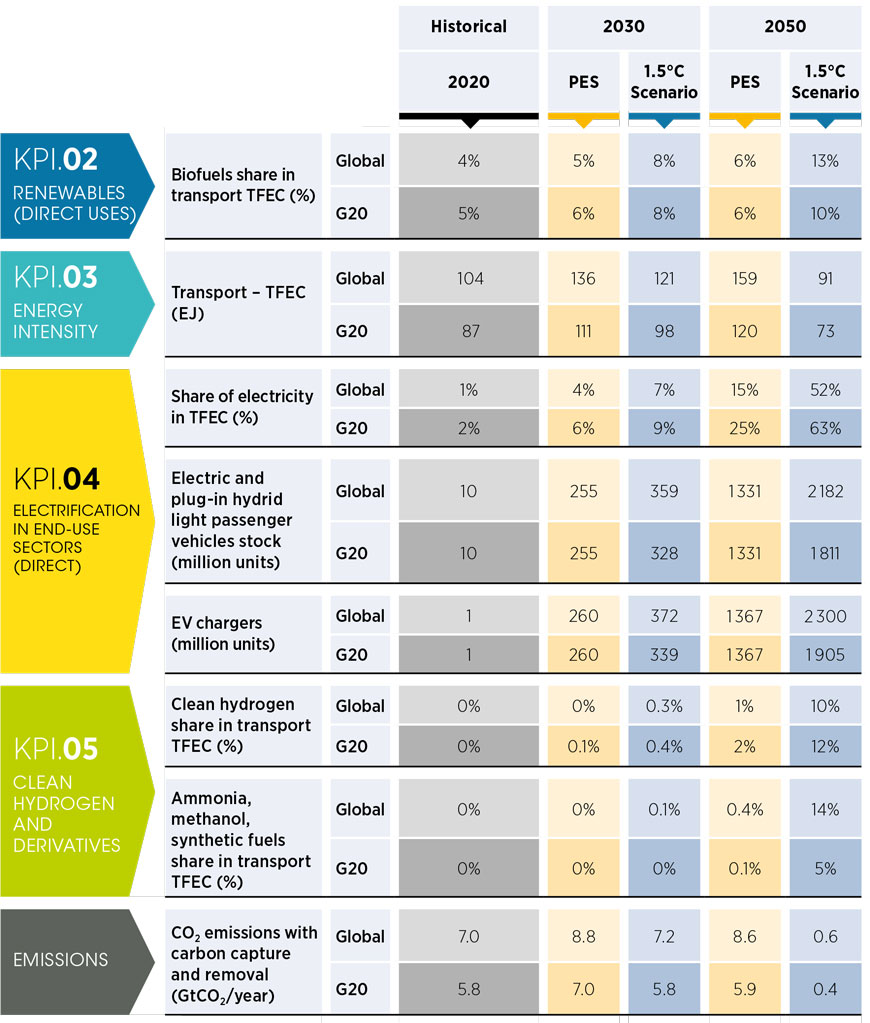

Every year, the gap between what is achieved and what is required continues to grow. IRENA’s energy transition indicators (Table S1) show significant acceleration is needed across energy sectors and technologies, from deeper end-use electrification of transport and heat, to direct renewable use, energy efficiency and infrastructure additions. Delays only add to the already considerable challenge of meeting IPCC-defined emission reduction levels in 2030 and 2050 for a 1.5°C trajectory (IPCC, 2022a). This lack of progress will also increase future investment needs and the costs of worsening climate change effects.

TABLE S1 Tracking progress of key energy system components to achieve the 1.5°C Scenario

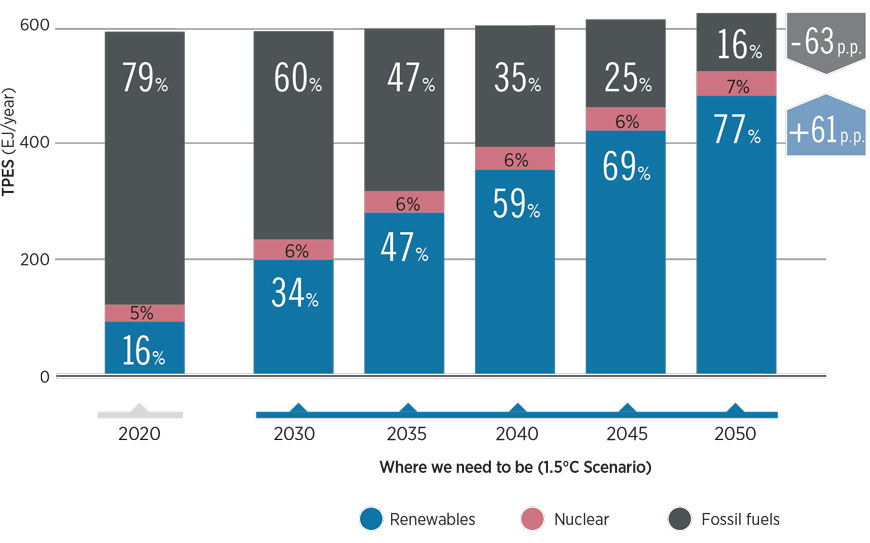

The share of renewable energy in the global energy mix would increase from 16% in 2020 to 77% by 2050 in IRENA’s 1.5°C scenario. Total primary energy supply would remain stable due to increased energy efficiency and growth of renewables. Renewables would increase across all end-use sectors, while a high rate of electrification in sectors such as transport and buildings would require a twelve-fold increase in renewable electricity capacity by 2050, compared to 2020 levels. Globally, annual renewable power capacity additions would need to reach an average of 1 066 GW per year from 2023 to 2050 under the 1.5°C scenario.

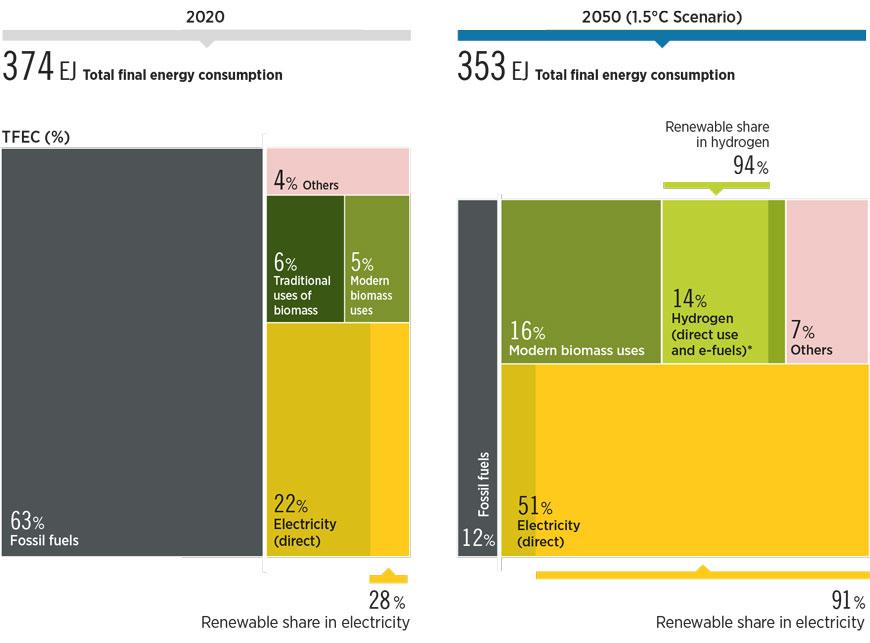

Electricity would become the main energy carrier, accounting for over 50% of total final energy consumption by 2050 in the 1.5°C scenario. Renewable energy deployment, improvements in energy efficiency and the electrification of end-use sectors would contribute to this shift. In addition, modern biomass and hydrogen would both play more significant roles, meeting 16% and 14% of total final energy consumption by 2050, respectively.

By 2050, 94% of hydrogen would be renewables-based in the 1.5°C scenario. Hydrogen would play a key role in the decarbonisation of end-uses and flexibility of the power system. The 1.5°C Scenario envisages that total final energy consumption would decrease by 6% between 2020 and 2050, due to efficiency improvements, deployment of renewables, and changes in behaviour and consumption patterns.

An enduring investment gap

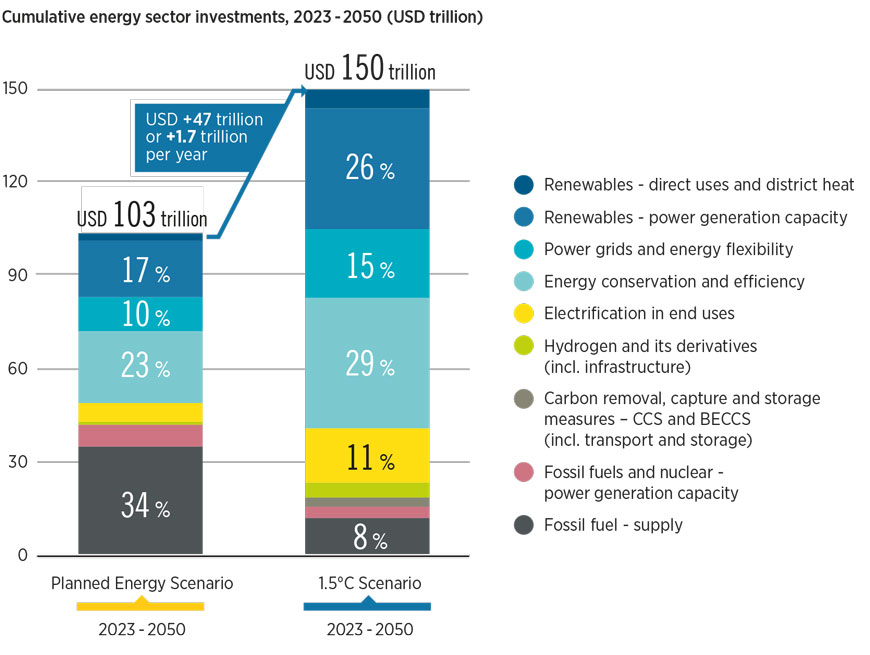

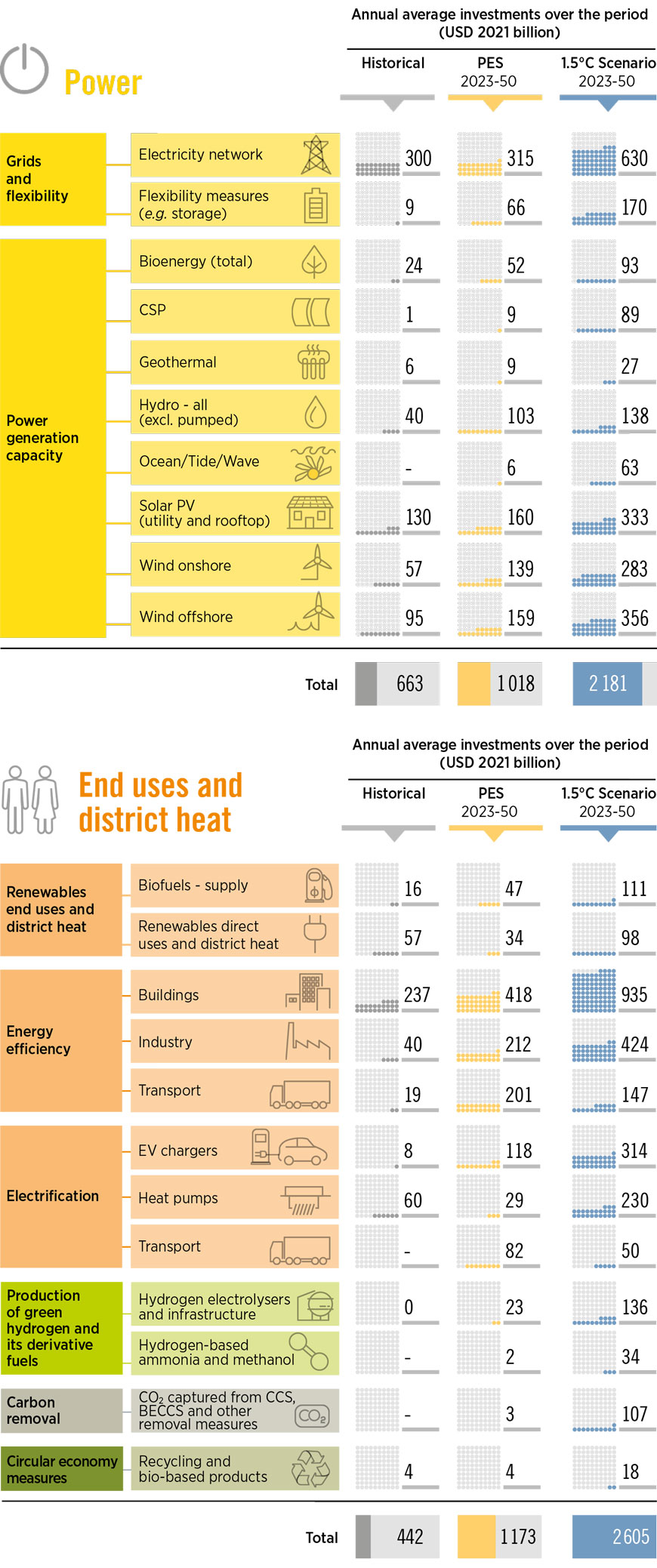

A cumulative USD 150 trillion is required to realise the 1.5°C target by 2050, averaging over USD 5 trillion in annual terms. Although global investment across all energy transition technologies reached a record high of USD 1.3 trillion in 2022, annual investment must more than quadruple to remain on the 1.5°C pathway. Compared with the Planned Energy Scenario - under which a cumulative investment of USD 103 trillion is required – an additional USD 47 trillion in cumulative investment is required by 2050 to remain on the 1.5°C pathway. Around USD 1 trillion of annual investments in fossil fuel-based technologies currently envisaged in the Planned Energy Scenario must therefore be redirected towards energy transition technologies and infrastructure.

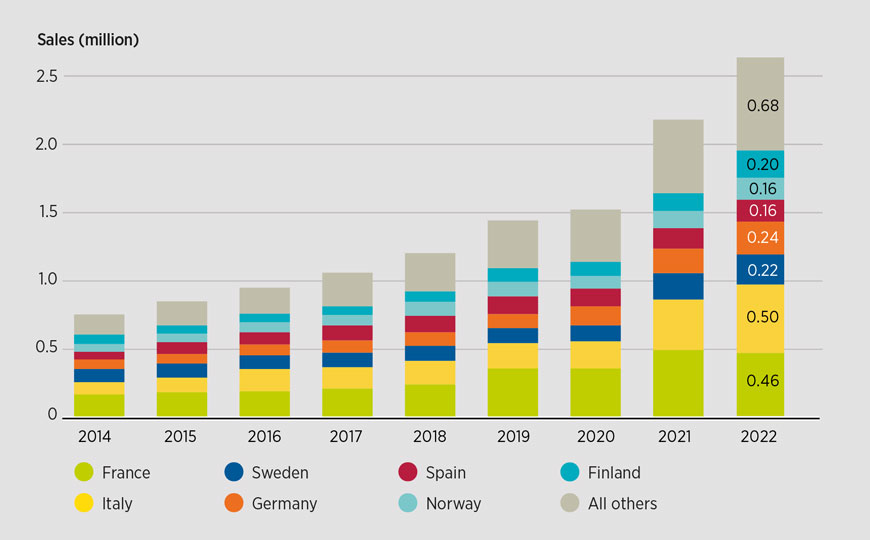

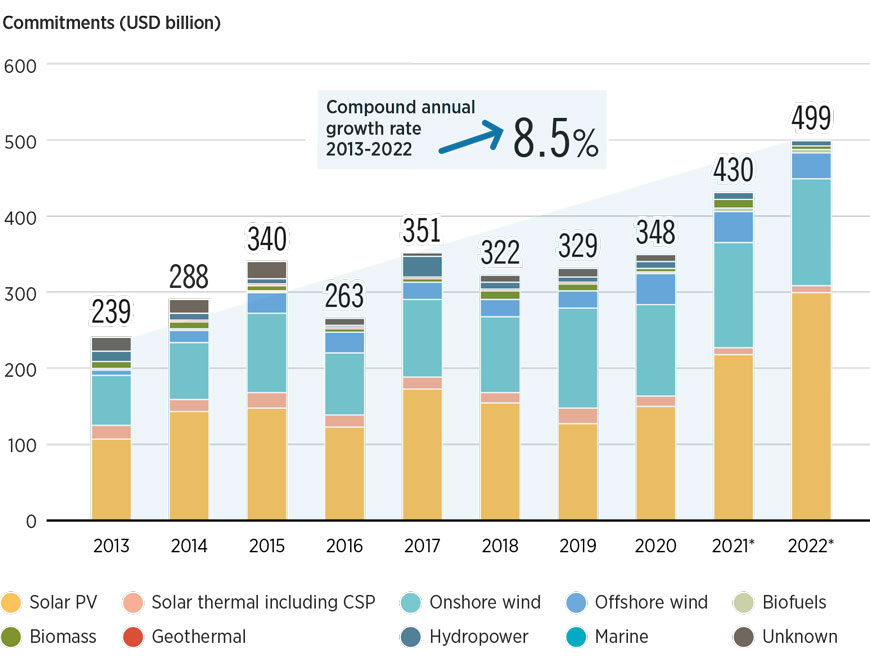

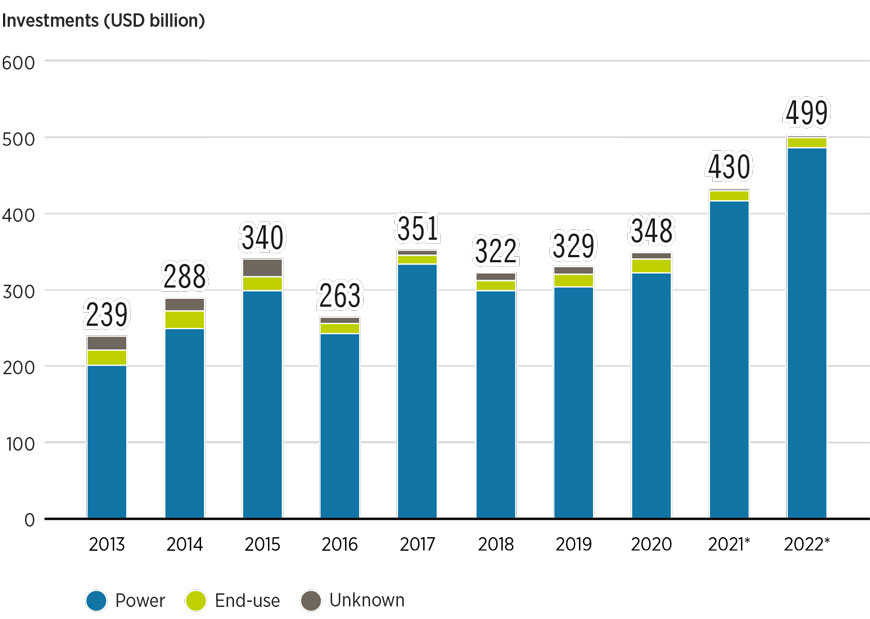

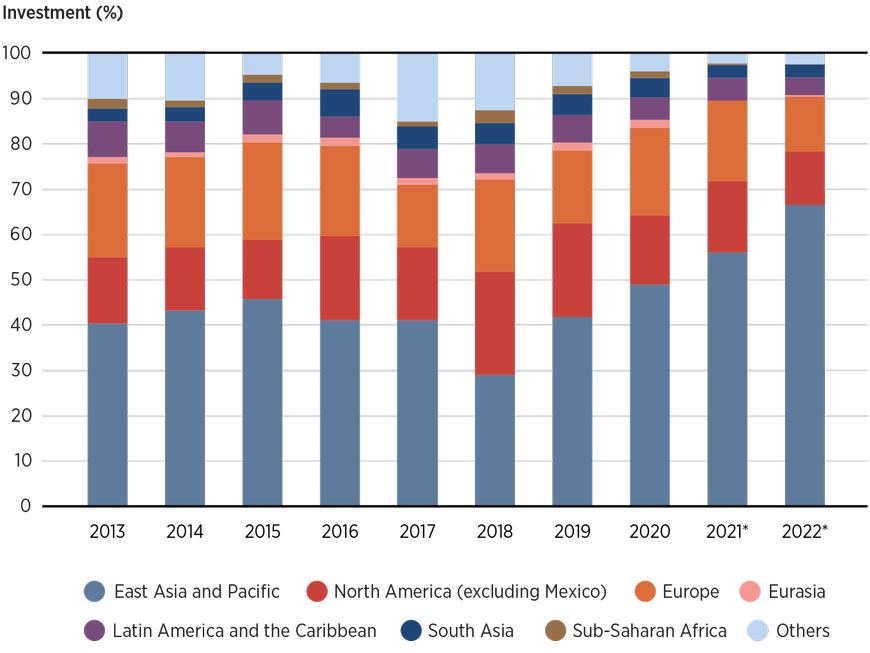

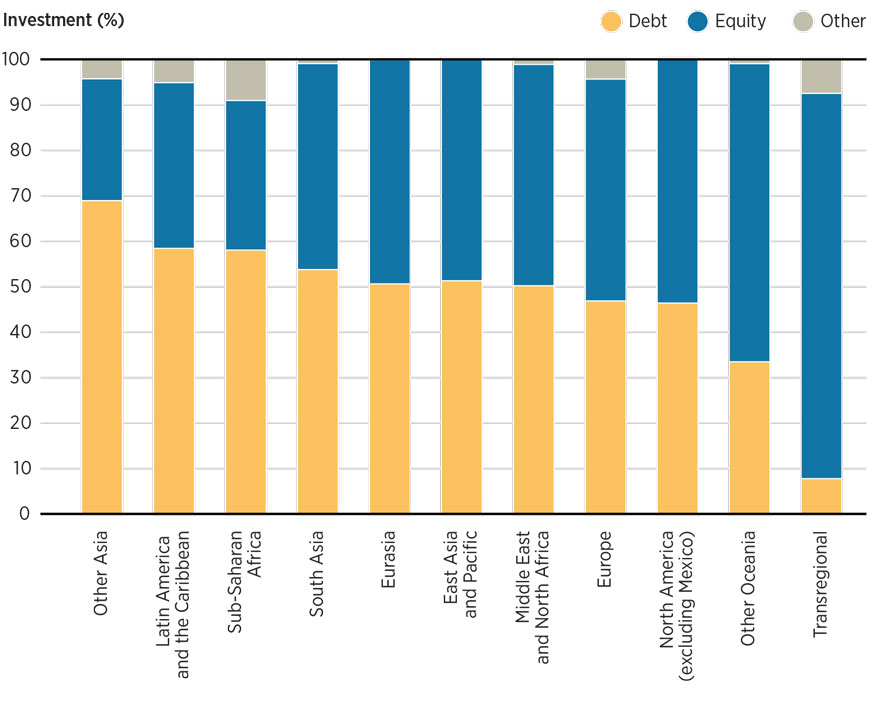

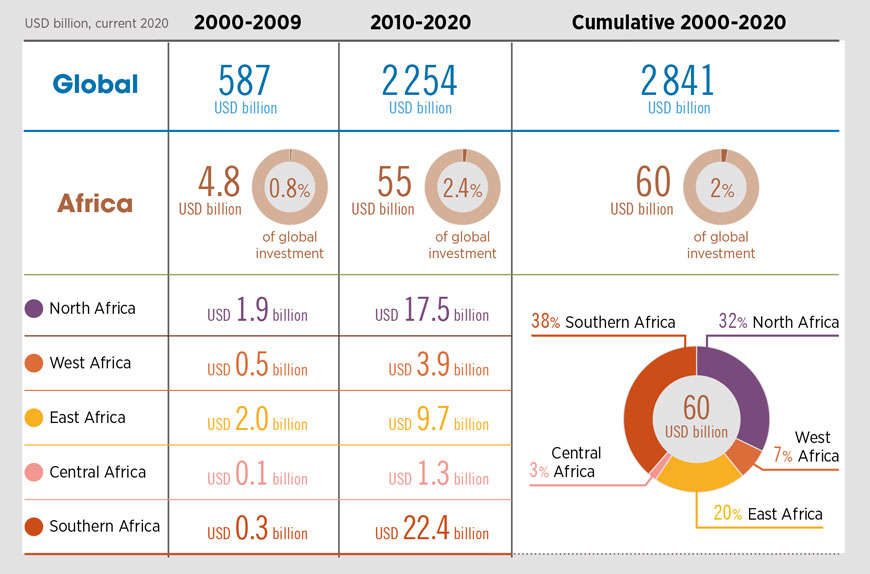

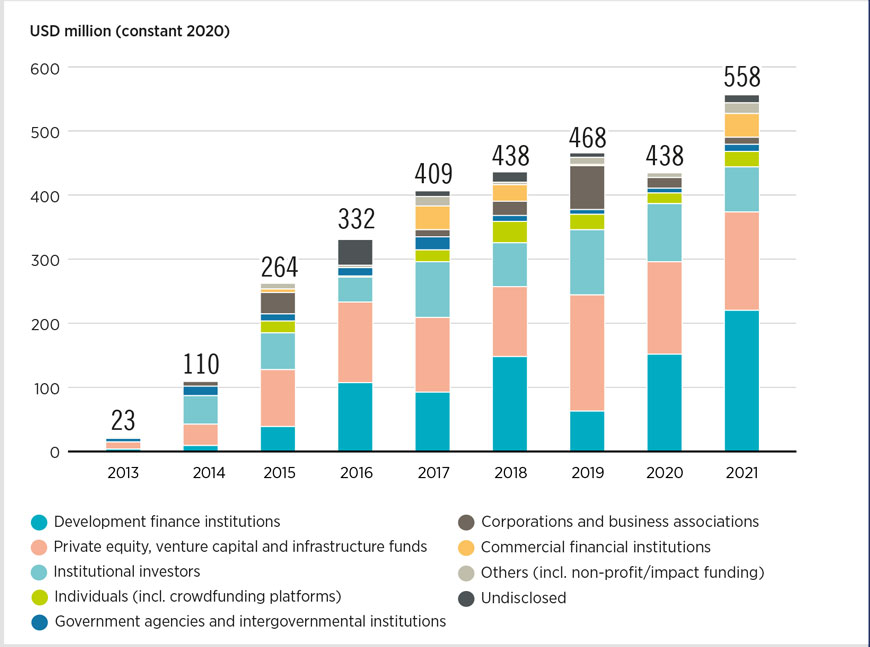

Renewable energy investment remains concentrated in a limited number of countries and focused on only a few technologies. Investment in renewable energy (including both power and end-uses) reached USD 0.5 trillion in 2022 (IRENA and CPI, 2023); however, this is around one-third of the average investment needed each year in renewables under the 1.5°C Scenario. Furthermore, 85% of global renewable energy investment benefitted less than 50% of the world’s population and Africa accounted for only 1% of additional capacity in 2022 (IRENA, 2023a; IRENA and CPI, 2023). Investments in off-grid renewable energy solutions in 2021 amounted to USD 0.5 billion (IRENA and CPI, 2023) – far below the USD 15 billion needed annually to 2030. While many technology choices exist, most investments were in solar PV and wind power, with 95% channelled toward these technologies (IRENA and CPI, 2023). Greater volumes of funding need to flow to other energy transition technologies such as biofuels, hydropower and geothermal energy, as well as to sectors beyond power that have lower shares of renewables in total final energy consumption (e.g. heating and transport).

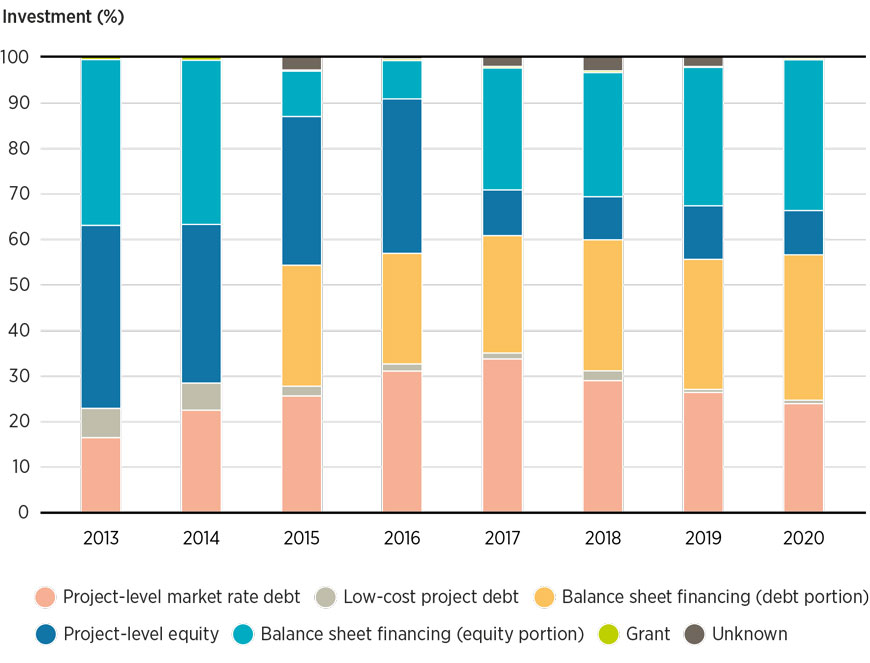

Some 75% of global investment in renewables from 2013 to 2020 came from the private sector. However, private capital tends to flow to the technologies and countries with the least associated risks, be they real or perceived. In 2020, 83% of commitments in solar PV came from private finance, whereas geothermal and hydropower relied primarily on public finance - only 32% and 3% of investments in these technologies, respectively, came from private investors in 2020 (IRENA and CPI, 2023). Stronger public sector intervention is required to channel investments towards countries and technologies in a more equitable way.

Public finance and policy should crowd in private capital, but greater geographical and technological diversity of investment requires targeted and scaled-up public contributions. For many years, policy has focused on mobilising private capital. Public funding is urgently needed to invest in basic energy infrastructure in the developing world, as well as to drive deployment in less mature technologies (especially in end uses such as heating and transport, or synthetic fuel production) and in areas where private investors seldom venture. Otherwise, the gap in investment between the Global North and the Global South could continue to widen.

Overcoming barriers to the transition

Policy makers need to strike the right balance between reactive measures and proactive energy transition strategies that promote a more resilient, inclusive and climate-safe system. Several of the root causes of current crises stem from the fossil fuel-based energy system, such as overdependence on a limited number of fuel exporters, inefficient and wasteful energy production and consumption, and the lack of accounting for negative environmental and social impacts. An energy transition based on renewables can reduce or eliminate many of these. It is therefore the speed of the change that will determine the levels of energy security and economic and social resilience at the national level and offer new opportunities for improved human welfare globally.

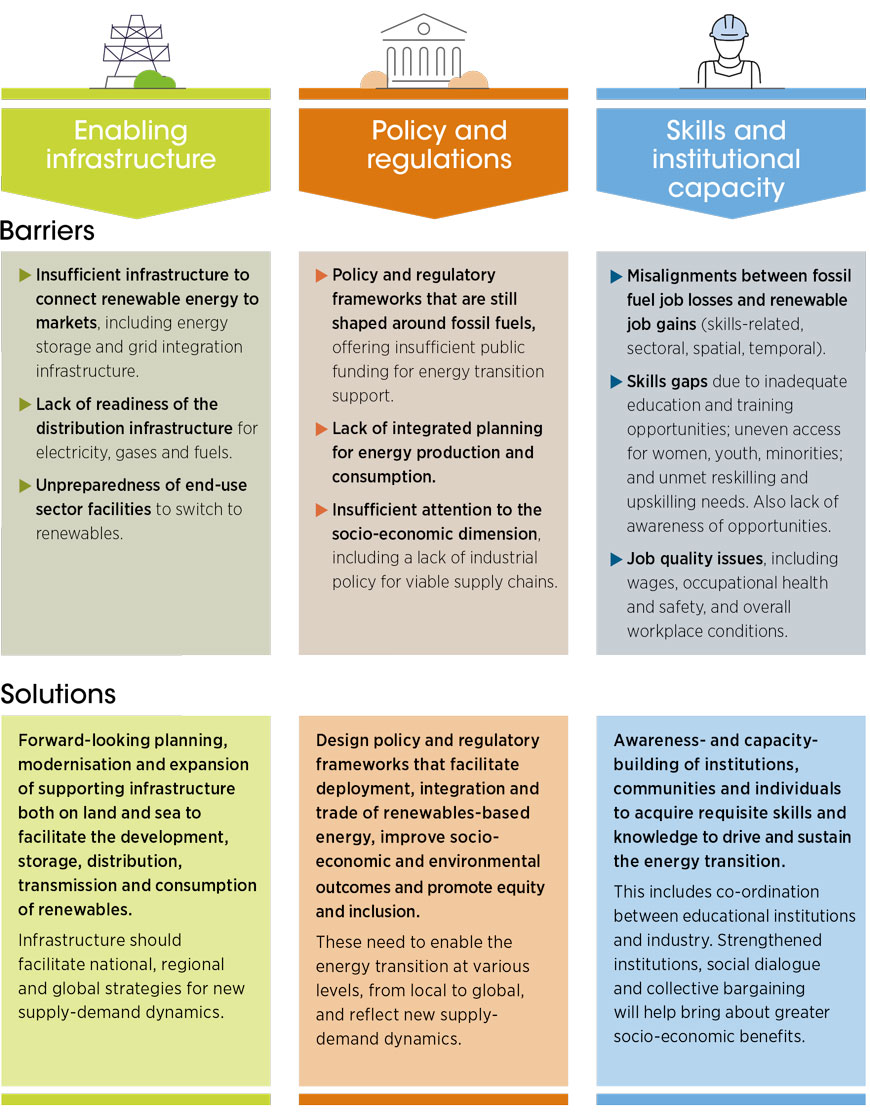

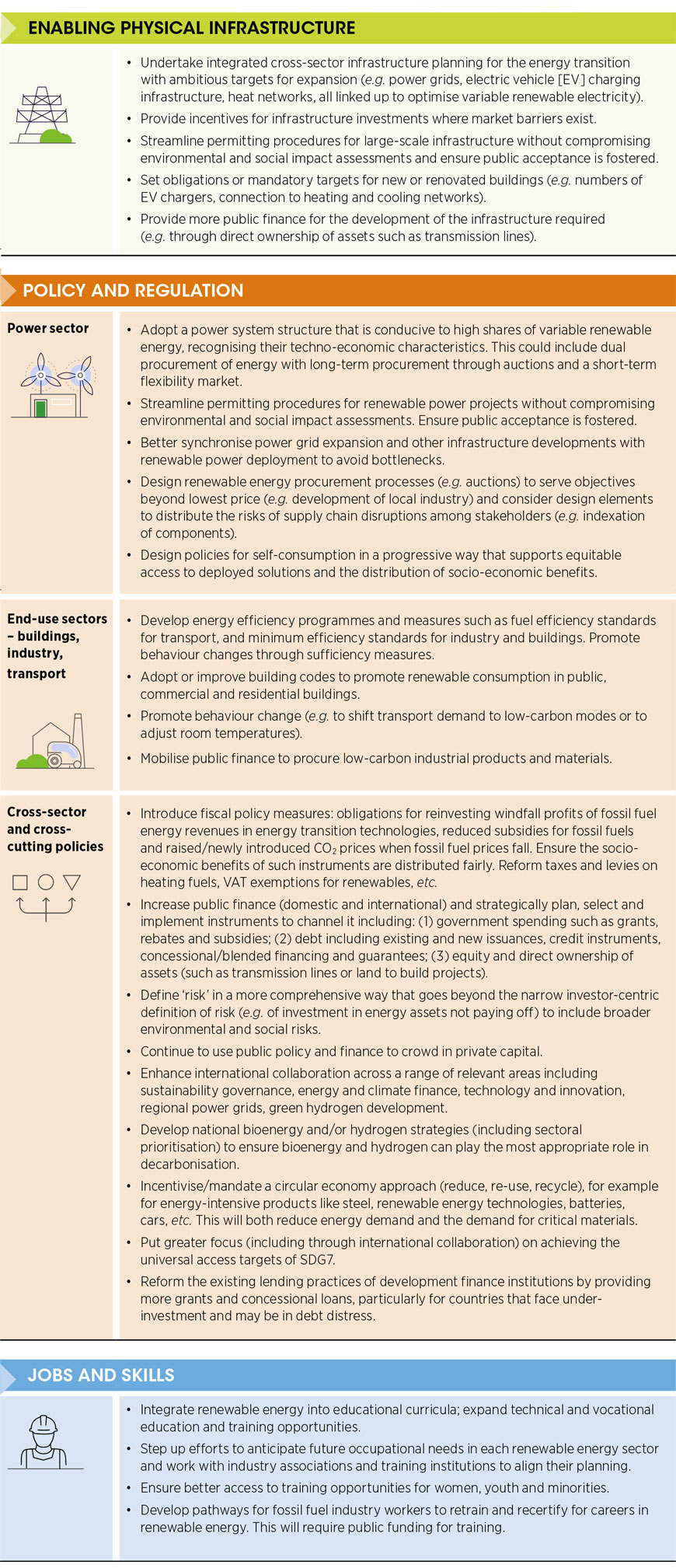

Accelerating progress worldwide requires a shift away from structures and systems built for the fossil fuel era. The energy transition can be a tool with which to proactively shape a more equal and inclusive world. This means overcoming existing barriers across infrastructure, policy, workforces and institutions that hamper progress and impede inclusivity (Figure S2).

More can be done in the short term. While the energy transition undoubtedly requires time, there is significant potential to implement many of the available technology options today. Upward trends in the deployment of these solutions demonstrate that the technical and economic case is sound. However, comprehensive policies are needed across all sectors to ramp up deployment, as well as to instigate the systemic and structural overhaul required to realise climate and development objectives.

FIGURE S1 Key energy transition barriers and solutions

A profound and systemic transformation of the global energy system must occur within 30 years

The Global Stocktake at the 2023 United Nations Climate Change Conference (COP28) must serve as a catalyst for scaling up action in the years to 2030 to implement existing energy transition options. Whilst planning must provide room for innovation and additional policy action, a significant scale up of existing solutions is paramount. For example, advancing efficiency and electrification based on renewables is a cost-effective avenue for the power sector, as well as for transport and buildings. Clean hydrogen and its derivatives, and sustainable biomass solutions, also offer various solutions for end uses.

The period following COP28 will be pivotal for efforts to curb climate change and achieve the sustainable development goals outlined in the 2030 Agenda. The energy transition is crucial for delivering on economic, social and environmental priorities. It is imperative for governments, financial institutions and the private sector to urgently re-evaluate their aspirations, strategies and implementation plans to realign the energy transition with its intended trajectory.

Developing structures for a renewables-based energy system

A profound and systemic transformation of the global energy system must be achieved within 30 years. This condensed timeframe necessitates a strategic shift that expands beyond the focus on decarbonisation of energy supply and energy consumption, toward designing an energy system that not only reduces carbon emissions but also supports a resilient and inclusive global economy. As a result, planning needs to extend beyond borders and the narrow confines of fuels to focus on the requirements of the new energy system and the economies it will sustain.

Focusing on the enablers of a renewables-dominated system can help address the structural barriers that hinder progress in the energy transition. Pursuing fuel and sectoral mitigation measures is necessary, but is insufficient to transition to an energy system fit for the dominance of renewables. From energy production and transportation to processing coal, oil and gas, the global infrastructure dedicated to energy will need to change. This will have impacts on power generation, industrial production and manufacturing, as well as on rail, pipelines, shipyards and other means of supplying fossil fuels. Enhancing the focus on systems design will help accelerate the development of a new energy infrastructure and sustain its implementation.

Governments can proactively shape a renewables-based energy system, overcome the flaws and inefficiencies of current structures, and more effectively influence outcomes. The simultaneous, proactive shaping of physical, policy and institutional structures will be essential to realising development and climate objectives, and achieving a more resilient and equitable world. These underpinnings should form the pillars of a structure that supports the energy transition:

Physical infrastructure upgrades, modernisation and expansion will increase resilience and build flexibility for a diversified and interconnected energy system. Transmission and distribution will need to accommodate both the highly localised, decentralised nature of many renewable fuels, as well as different trade routes. Planning for interconnectors to enable electricity trade, and shipping routes for hydrogen and derivatives, must consider vastly different global dynamics and proactively link countries to promote the diversification and resilience of energy systems. Storage solutions will need to be widespread and designed with geo-economic impacts in mind. Public acceptance is also critical for any large-scale undertaking and can be secured through project transparency and opportunities for communities to voice their perspectives.

Policy and regulatory enablers must systematically prioritise the acceleration of the energy transition and a reduction in the role of fossil fuels. Today, the underlying policy and regulatory systems remain shaped around fossil fuels. While it is inevitable that fossil fuels will remain in the energy mix for some time, their share must dramatically decrease as we approach mid-century. Policy frameworks and markets should therefore focus on accelerating the transition and provide the essential underpinnings for a resilient and inclusive system.

A well-skilled workforce is a lynchpin of a successful energy transition. Work by IRENA and the International Labour Organization (ILO) has shown that the renewable energy sector employed some 12.7 million people worldwide in 2022, growing from about 7.3 million in 2012. Energy transition modelling indicates that tens of millions of additional jobs will likely be created in the coming decades as investments grow and installed capacities expand. A broad range of occupational profiles will be needed. Filling these jobs will require concerted action in education and skills building, and governments have a critical role in coordinating efforts to align the offerings of the education sector with projected industry needs - whether in the form of vocational training or university courses. To attract talent to the sector, it is crucial that jobs are decent, and that women, youth and minorities have equal access to job training, hiring networks and career opportunities.

The way forward: Prioritising bold and transformative actions

Achieving the necessary course-correction in the energy transition will require bold, transformative measures that reflect the urgency of the present situation. A considerable scale-up of renewables needs to go hand-in-hand with investments in enabling infrastructure. Comprehensive policies are needed not only to facilitate deployment but also to ensure the transition has broad socio-economic benefits.

Net-zero commitments must be embedded in legislation and translated into implementation plans that are adequately resourced. Without this crucial step, climate announcements remain aspirational, and the necessary progress out of reach. The current energy system is deeply woven into socio-economic structures that have evolved over centuries. This means significant structural change must occur in a condensed timeframe of less than three decades to successfully deliver on the goals of the Paris Agreement.

Every investment and planning decision concerning energy infrastructure today should consider the structure and geography of the low-carbon economy of the future. Energy infrastructure is long-lived, so investment in fixed infrastructure should consider the long term. Electrification of end uses will reshape demand. Renewable power will require existing infrastructure to be modernised, with grid reinforcement and expansion on both land and sea. Green hydrogen production will also occur in locations other than today’s oil and gas fields. The technical challenges and economic costs of redesigning infrastructure should be accounted for, and the environmental and social aspects adequately addressed from the outset.

A just and inclusive energy transition will help to overcome deep disparities that affect the quality of life of hundreds of millions of people. Energy transition policies must be aligned with broader systemic changes that aim to safeguard human well-being, advance equity among countries and communities, and bring the global economy in line with climate, broader environmental and resource constraints.

Supporting developing countries to accelerate the energy transition could improve energy security while preventing the global decarbonisation divide from widening. A diverse energy market would reduce supply chain risks, improve energy security and ensure local value creation for commodity producers. Access to technology, training, capacity building and affordable finance will be vital to unlock the full potential of countries’ contributions to the global energy transition, especially for those rich in renewables and related resources.

Human welfare and security must remain at the heart of the energy transition. Systemic changes beyond the energy sector will be needed to overcome pervasive problems related to human welfare and security, as well as deeply embedded inequalities; a renewables-based energy transition can help alleviate some of the conditions that underly these issues. The more the energy transition can help solve these broad challenges, the more its popular acceptance and legitimacy will rise, provided also that community needs and interests are well represented and integrated into transition planning.

Rewriting international co-operation

The dynamism of energy sectors and geopolitical developments necessitates greater scrutiny of international co-operation modalities, instruments and approaches to ensure their relevance, impact and agility. To achieve a successful energy transition, international co-operation needs to be enhanced and redesigned. The centrality of energy to the global development and climate agenda is undisputed, and international co-operation in energy has increased exponentially in recent years. This co-operation plays a decisive role in determining the outcomes of the energy transition and is a critical avenue for achieving greater resilience, inclusion and equality.

The expanding variety of actors engaged in the energy transition requires an assessment of roles to leverage respective strengths and efficiently allocate limited public resources. The imperatives of development and climate action, coupled with changing energy supply and demand dynamics, require coherence and alignment around priority actions. For instance, investment in systems for cross-border and global trade of energy commodities will require international co-operation on an unprecedented scale. It is, therefore, essential to reconsider the roles and responsibilities of national and regional entities, international organisations, and international financial institutions and multilateral development banks to ensure their optimal contribution to the energy transition.

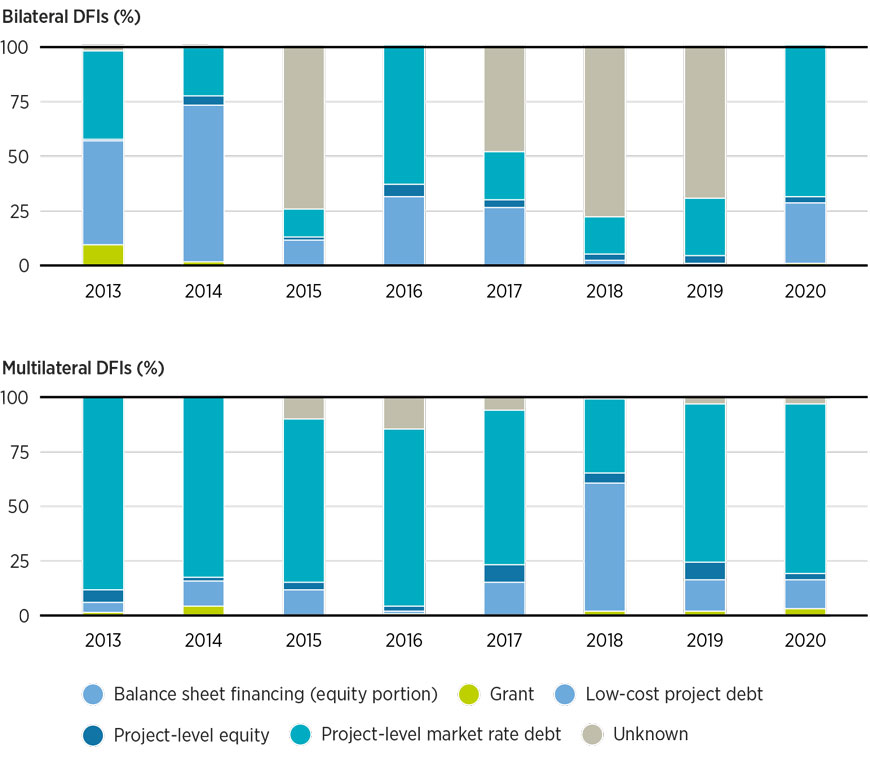

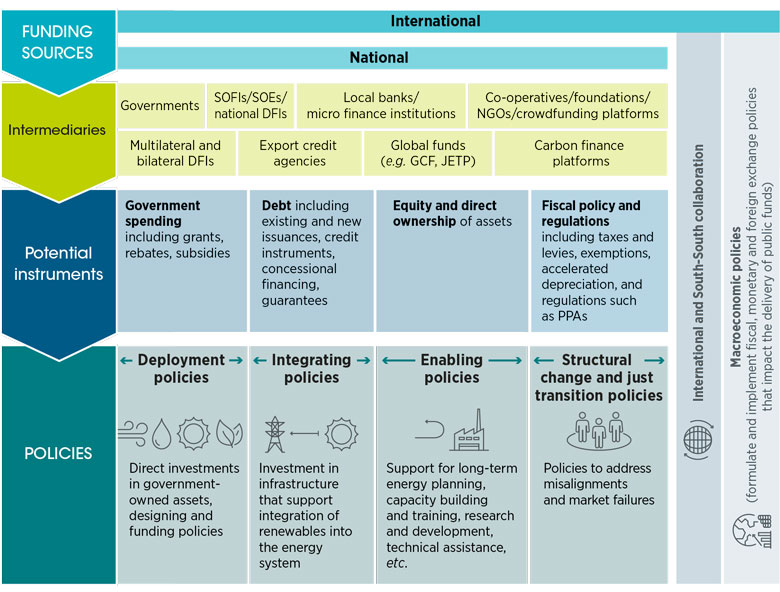

Achieving the energy transition will require collective efforts to channel funds to the Global South. In 2020, multilateral and bilateral development finance institutions (DFIs) provided less than 3% of total renewable energy investments. Going forward, they need to direct more funds, at better terms, towards large-scale energy transition projects. Moreover, financing from DFIs was provided mainly through debt financing at market rates (requiring repayment with interest rates charged at market value) while grants and concessional loans amounted to just 1% of total renewable energy finance (IRENA and CPI, 2023). These institutions are uniquely placed to support large-scale and cross-border projects that can make a notable difference in accelerating the global energy transition.

Introduction

The year since the publication of the 2022 edition of the World Energy Transitions Outlook has been a challenging one for decision makers. With the world still reeling from the economic effects of the pandemic, the consequences of events in Ukraine escalated what has become one of the worst energy crises in decades. At the same time, the scale of the global climate emergency has become ever more obvious. Unprecedented heat waves in Europe, widespread flooding in Pakistan and the worst drought on record in the Horn of Africa are just a few of the recent extreme weather events that have been linked to climate change. The Intergovernmental Panel on Climate Change (IPCC), in a synthesis report published in March 2023, stressed the need for rapid and far-reaching transitions across all sectors and systems (IPCC, 2023).

As the International Renewable Energy Agency (IRENA) has urged in previous editions of the World Energy Transitions Outlook, a set of complementary transitions - in renewables-based electrification, energy efficiency, and direct uses of renewables in transport, industry and buildings - offer a pathway to the IPCC’s 1.5°C climate target based on technologies and measures that are, for the most part, already available. The past year has demonstrated the clear benefits of this renewables-based pathway in strengthening energy security, reducing the negative effects of fossil fuel price volatility, and making energy more affordable. Renewables have become increasingly competitive relative to fossil fuels in many cases, offering the potential to hold down energy costs while allowing countries to reduce their dependence on imports.

The impacts of the global energy-related challenges countries have faced over the past year - such as rising energy prices, inflation, higher capital costs and energy insecurity - would have been less severe if countries had invested earlier in transition technologies and associated infrastructure in the power and heat sectors. Further delays will compound these challenges. Nonetheless, it is not too late to change course.

Several energy transition indicators show that despite the crisis, there is resilience in the various components of the energy transition, with some even picking up speed. Overall, however, the energy transition is not on track; each year the gap grows between what is being done and what is required. Too many decision makers have been addressing the energy crisis in ways that are incompatible with the longer-term need for profound transformation, not only of the energy sector but of the economy and society as well. The slow pace of progress now will increase investment needs in the future, both to produce the energy we need and to cope with worsening climate change effects. The simultaneous, proactive reshaping of physical, policy and institutional structures will be essential to the realisation of a more resilient, productive and equitable world.

This first volume of the World Energy Transitions Outlook 2023 proposes a 1.5°C-compatible pathway to 2050, while documenting the progress achieved to date in the deployment of investment and energy transition solutions. It presents ways to deal with the short-term energy crisis while remaining on the energy transition path; contains new analysis and information; provides perspectives on the latest developments and progress in energy scenarios and investments; and offers new views on enabling finance and frameworks. The second volume of the outlook, to be published later in 2023, will examine the socio-economic impacts of the energy transition.

2023 Volume 1

This volume comprises three chapters:

- Chapter 1 presents transition pathways to 2030 and 2050 under the Planned Energy Scenario and the 1.5°C Scenario, examining the required technological choices and emission mitigation measures to achieve the 1.5°C Paris climate goal. In addition to the global perspective, the chapter presents transition pathways at the G20 level, and emphasises the G20’s role in reducing emissions and accelerating the deployment of low-carbon technologies. Along with the latest information on the Nationally Determined Contributions from the 2022 United Nations Climate Change Conference (COP27), the emissions gap to the 1.5°C target is discussed. Additionally, it includes an examination of responses to the current energy crisis and their implications for the energy transitions. The chapter concludes with recommendations for policy actions to respond to the present energy crisis and longer-term climate goals.

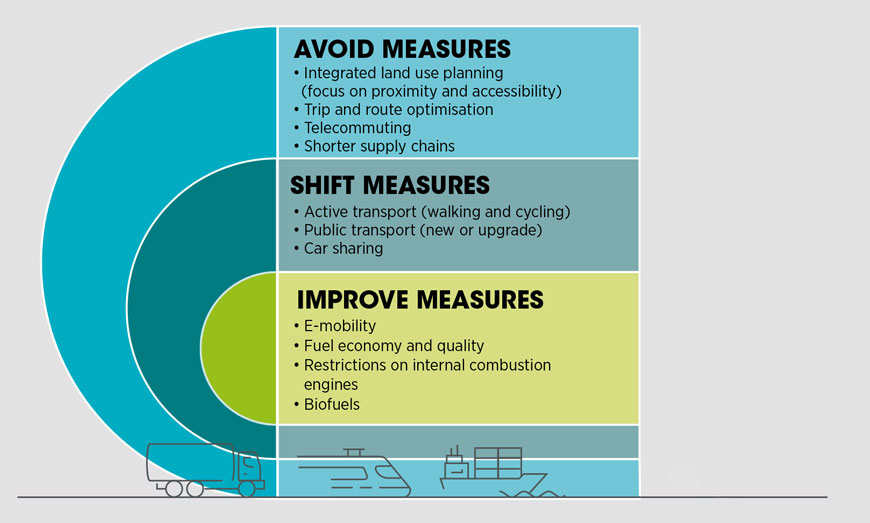

- Chapter 2 provides sector- and technology-specific details of the transition to 2030 and 2050. The analysis shows that a range of technologies and strategies must be deployed. Renewables must play a dominant role in all end-use sectors, notably electricity, green hydrogen and synthetic fuels produced from renewable power. Bioenergy and biomass feedstocks must also play a growing role, especially in industry and transport. Institutional and regulatory frameworks and policies to propel the energy transition are examined for the power sector, supplies of emerging fuels and end-use sectors.

- Chapter 3 identifies the investments required by 2030 and 2050 under the 1.5°C Scenario, comparing them with current levels. After exploring how governments can balance short- and long-term energy transition investment needs, the chapter examines the pressing need to accelerate investment in infrastructure. Recent trends in energy-transition investment are analysed by technology, region and source of funding. To achieve both an overall scale-up of deployment and a truly global energy transition, public finance (both national and international), co-ordinated regulation, and policy support will play crucial roles in the deployment of renewable energy, especially in regions and countries that have not been able to attract private capital.

Understanding the socio-economic consequences of the transition pathways (at different levels of ambition) is a fundamental aspect of proper planning and policy making. Policy makers need to know how their choices will affect people’s well-being and overall welfare, just as they need to be aware of the potential gaps and hurdles that could affect progress. For the energy transition to yield its full benefits, countries will require a comprehensive policy framework that not only transforms energy systems, but also protects people, livelihoods and jobs.

The climate policy baskets that underlie IRENA’s macroeconometric model, the results of which will be presented in the forthcoming second volume of the World Energy Transitions Outlook 2023, contain a range of measures (e.g. investments in public infrastructure, increased social spending, and cross-sectoral carbon pricing and subsidies) to support a just and inclusive transition, in addition to policies that deploy, integrate and promote energy transition technologies.

Foreword

The recent Synthesis Report of the IPCC Sixth Assessment has delivered a sobering message - our collective ability to adhere to a 1.5°C pathway hangs in the balance. This decade, our success in reducing greenhouse gas emissions will determine whether global temperature rise can be limited to 1.5°C or even 2°C. The ramifications of each fraction of a degree cannot be overstated - particularly for the world's most vulnerable populations, who are already suffering the destructive impacts of climate change. The ubiquity of climate-induced disasters - be they floods, droughts or fires - demonstrates the pressing need for a course correction.

Within the timeframe to 2030, we must simultaneously realise the goals of the sustainable development agenda and significantly reduce emissions. Energy plays an essential role in climate course correction and the realisation of sustainable development. IRENA’s 1.5°C pathway, set out in the World Energy Transitions Outlook, positions electrification and efficiency as key transition drivers, enabled by renewable energy, clean hydrogen and sustainable biomass. Increasingly, countries are positioning these technological avenues at the centre of their climate action, as well as their economic, energy security and universal access strategies.

This volume of the World Energy Transitions Outlook 2023 provides an overview of progress by tracking implementation and gaps across all energy sectors. It shows that most of the progress achieved to date has been in the power sector, where a virtuous circle of technology, policy and innovation has taken us a long way; but the scale and extent of implementation fall far short of what is required to stay on the 1.5°C pathway. An equally concerning trend is the geographic concentration of these deployments, which remains limited to a few countries and regions. This pattern, which has persisted for the past decade, has excluded almost half of the global population, and particularly those in countries with significant energy access needs.

The business case for renewables is strong, but deeply entrenched barriers stemming from the systems and structures created for the fossil-fuel era continue to hamper progress. The World Energy Transitions Outlook sets out a vision for overcoming these barriers. It envisages three pillars that would form the foundations for a way forward: first, building the necessary infrastructure and investing at scale in grids, and both land and sea routes, to accommodate new production locations, trade patterns and demand centres; second, advancing an evolved policy and regulatory architecture that can facilitate targeted investments; and finally, strategically realigning institutional capacities to help ensure that skills and capabilities match the energy system we aspire to create.

This also requires a realignment of the way in which international cooperation works. Multilateral financing institutions should prioritise building the infrastructure that would underpin the new energy system. This would coherently and simultaneously help deliver development and climate priorities, triggering virtuous economic and social dynamics. Importantly, this would enable private sector investment in countries and regions that currently face barriers such as high capital costs. The bulk of this funding should be in the form of concessional loans, whilst for the most vulnerable such as least developed countries (LDCs) and small island developing states (SIDS), a share of grant funding is needed.

Our collective promise was to secure a climate-safe existence for current and future generations. We simply cannot continue with incremental changes; there is no time for a new energy system to evolve gradually over centuries, as was the case for the fossil fuel-based system.

The energy transition must also become a strategic tool to foster a more equitable and inclusive world. The upcoming 28th Conference of the Parties to the UNFCCC (COP28) and the Global Stocktake must not only confirm our deviation from a 1.5°C pathway but also provide a strategic blueprint to steer us back on track. It is my belief that the World Energy Transitions Outlook can offer critical input to shaping our collective action following this important climate action milestone.

Director-General, IRENA

Acknowledgements

This report was developed under the guidance of Rabia Ferroukhi and Roland Roesch and was led by Ute Collier and Ricardo Gorini. The executive summary was led by Elizabeth Press.

The chapters were authored by Sean Collins, Jinlei Feng, Maria Vicente Garcia, Krisly Guerra, Diala Hawila, Melda Jabbour, Maisarah Abdul Kadir, Rodrigo Leme, Gayathri Prakash, Faran Rana, Nicholas Wagner and Mengzhu Xiao. Modelling co-ordination was provided by Rodrigo Leme and Chapter drafting by Mengzhu Xiao.

Significant contributions were provided by IRENA colleagues and consultants: Emanuele Bianco, Ines Jacob, Stuti Piya, Gandhi Pragada (ex-IRENA), Pablo Rimancus and Michael Taylor.

Valuable input, support and comments were provided by IRENA colleagues, consultants and advisors: Abdullah Abou Ali, Arina Anisie, Simon Benmarraze, Francisco Boshell, Yong Chen, Isaline Court, Jaidev Dhavle, Nazik Elhassan, Gerardo Escamilla, Isaac Elizondo Garcia, Dolf Gielen (ex-IRENA), Luis Janeiro, Karan Kochhar, Martina Lyons, Asami Miketa, Raul Miranda, Paula Nardone, Athir Nouicer, Juan Pablo Jimenez Navarro, Pablo Ralon, Michael Renner, Daniel Russo, Danial Saleem, Lucio Scandizzo, Gondia Sokhna Seck, Aakarshan Vaid (ex-IRENA), Iris van der Lugt, Adrian Whiteman and Badariah Yosiyana.

Editorial and communications support were provided by Francis Field, Stephanie Clarke, Nicole Bockstaller, Daria Gazzola and Manuela Stefanides. The report was copy-edited by Steven B. Kennedy and a technical review was provided by Paul Komor. The graphic design was provided by weeks.de Werbeagentur GmbH.

IRENA is grateful for the generous support of the German Federal Ministry for Economic Affairs and Climate Action.

Highlights

- Despite the progress achieved to date, the deployment of energy transition technologies falls far short of the levels required to achieve the 1.5°C Paris climate goal. A 1.5°C-compatible pathway requires a complete transformation of how societies consume and produce energy. To secure the outcomes of this scenario, the world will need to reach net-zero emissions in the energy sector by 2050, requiring reductions in annual energy-related carbon dioxide (CO₂) emissions of about 37 gigatonnes (Gt) compared with estimated levels in 2022 - which are expected to represent an all-time high. By 2050, global energy consumption will need to drop by 6% from 2020 levels through substantial improvements in energy efficiency, while the share of renewables in the global energy mix will have to rise to 77% by 2050, up from 16% in 2020. All end-use sectors will have to use more renewables, and the requisite scale of electrification in the transport and buildings sectors will require a twelve-fold increase in renewable electricity capacity by 2050, compared to 2020 levels.

- Member countries made commendable commitments at the 27th United Nations Climate Change Conference (COP27) in Egypt - including Nationally Determined Contributions (NDCs), long-term low greenhouse gas emission development strategies (LT-LEDS) and net-zero targets. Yet, these will fail to achieve the 1.5°C climate goal by 2050, leaving an emissions gap of about 16 Gt of CO₂ in 2050. In addition, NDCs and other climate pledges must be translated into national strategies and plans. These, in turn, must set targets (e.g. for renewable energy) and be implemented through policies, regulations and other measures that cover all aspects of the energy sector in order to attract sufficient funding. A rapid acceleration of these efforts is needed to close the gap and achieve the climate goals articulated in the Paris Agreement.

- The energy crisis has led many governments to implement short-term measures to secure energy supplies and protect consumers, such as new investments in fossil fuel infrastructure (e.g. liquefied natural gas [LNG] terminals) and subsidies for consumers. Governments need to ensure that short-term measures are aligned with the longer-term aims of the energy transition by redoubling their efforts to achieve energy efficiency and renewable energy deployment. The potential rewards should be persuasive; a 1.5°C-compatible energy system holds the promise of long-term energy security and price stability. Energy efficiency, combined with renewables, can make countries less dependent on fossil fuel imports, diversify supply options, promote energy trade and co-operation, and help decouple economies from volatile international fossil fuel price fluctuations.

1.1 Transforming the global energy system

A profound and systemic transformation of the global energy system must occur within the next 30 years if the world is to avoid devastating consequences from climate change and a steady erosion of energy security. This condensed time frame necessitates a strategic shift that moves beyond the decarbonisation of supply towards an energy system that cuts carbon emissions while supporting a resilient and inclusive global economy. Planning must therefore transcend the borders of technology to focus on the broader exigencies of the new energy system and the economies it will sustain.

The simultaneous, proactive reshaping of physical, policy and institutional structures will be essential to the realisation of a more resilient, productive and equitable world. The pillars of the energy transition required to deliver that world are (1) physical infrastructure, (2) policy and regulatory enablers and (3) skills and capacities (see Box 1.1).

A rapid transformation of the energy system is needed by 2050

The current structures contain many barriers that hamper the transition. A diversified and interconnected energy system requires the modernisation and expansion of infrastructure. Transmission and distribution systems will need to accommodate the highly localised, decentralised nature of many renewable sources, along with the various trade routes involved. With regard to the interconnectors required to trade electricity and shipping routes for hydrogen and derivatives, planning must consider a staggering array of global dynamics, proactively linking countries to promote diverse and resilient energy systems. Public acceptance, which is critical for any large-scale undertaking, can be secured through transparency in planning and implementation and by providing opportunities for communities to voice their perspectives.

BOX 1.1 Key energy transition pillars

- PHYSICAL INFRASTRUCTURE: forward-looking planning, modernisation and expansion of supporting infrastructure on land and sea to facilitate the development, storage, distribution and transmission, and consumption of renewables. Infrastructure should facilitate national, regional and global strategies for new supply-demand dynamics.

- POLICY AND REGULATORY ENABLERS: design of policy and regulatory frameworks that facilitate deployment, integration and trade of renewables-based energy, improve socioeconomic and environmental outcomes and promote equity and inclusion. These need to enable the energy transition at various levels, from local to global, and reflect new supply-demand dynamics.

- SKILLS AND CAPACITIES: awareness- and capacity-building institutions, communities and individuals to acquire the requisite skills, knowledge and expertise to drive and sustain the energy transition. Strengthened institutions, social dialogue and collective bargaining will help bring about greater socio-economic benefits.

Today, although more policy initiatives and regulatory measures seek to promote renewable sources and reduce greenhouse gas emissions (as shown in the subsequent chapters), the underlying policy and regulatory systems are still geared toward fossil fuels. Whilst it is inevitable that fossil fuels will remain in the energy mix for some time, their share must be dramatically reduced as the mid-century mark approaches. Policy frameworks and markets should therefore focus on accelerating the transition and establishing the underpinnings of a resilient and inclusive system.

A skilled workforce is a linchpin of the energy transition. In a series of socio-economic studies conducted since 2016 (IRENA, 2016a, 2020a, 2021a, 2022a), IRENA and the International Labour Organization have shown that the renewable energy sector employed some 12.7 million people worldwide in 2022, up from 7.3 million in 2012. Both the private and public sectors will require a broad range of occupational profiles, including upskilled staff in the public sector (government, agencies and regulators) to undertake transition planning and craft appropriate regulations. To attract talent to the sector, jobs must offer decent wages and opportunities, with equal access for women, youth and minorities in search of training, hiring networks and career opportunities. 1

International co-operation on energy will also need to be enhanced and redesigned. With the centrality of energy to the global development and climate agenda undisputed, international co-operation has increased in recent years, helping to steer the energy transition. The speed at which energy sectors respond to geopolitical developments makes it imperative that co-operative modalities, instruments and approaches remain agile and relevant. For their own good, and for that of the developing world, the G20 countries – that account for the bulk of global emissions - must act in concert, raising their climate ambitions and fulfilling their pledges. For the developing world, collaboration is crucial if countries are to leapfrog systems already nearing obsolescence in the developed world and thereby avoid misplaced investments.

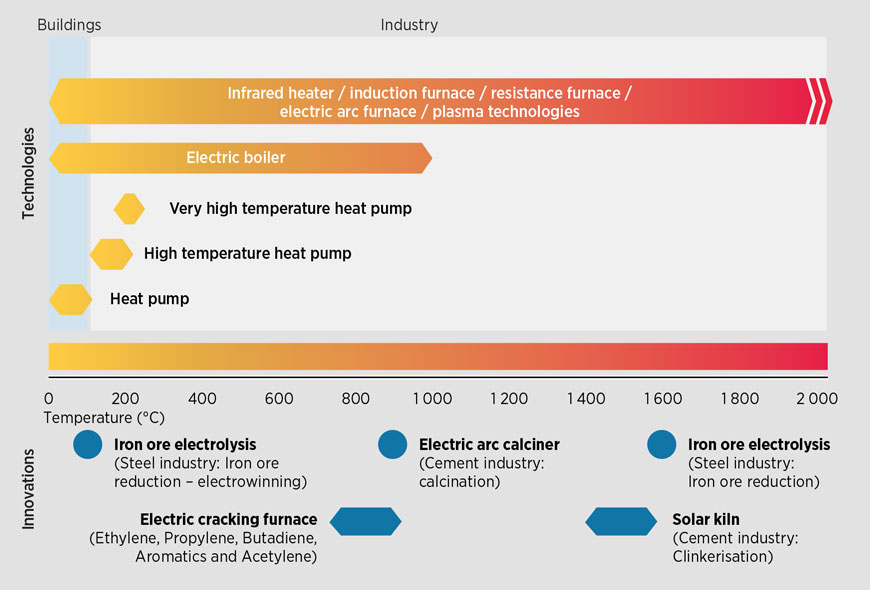

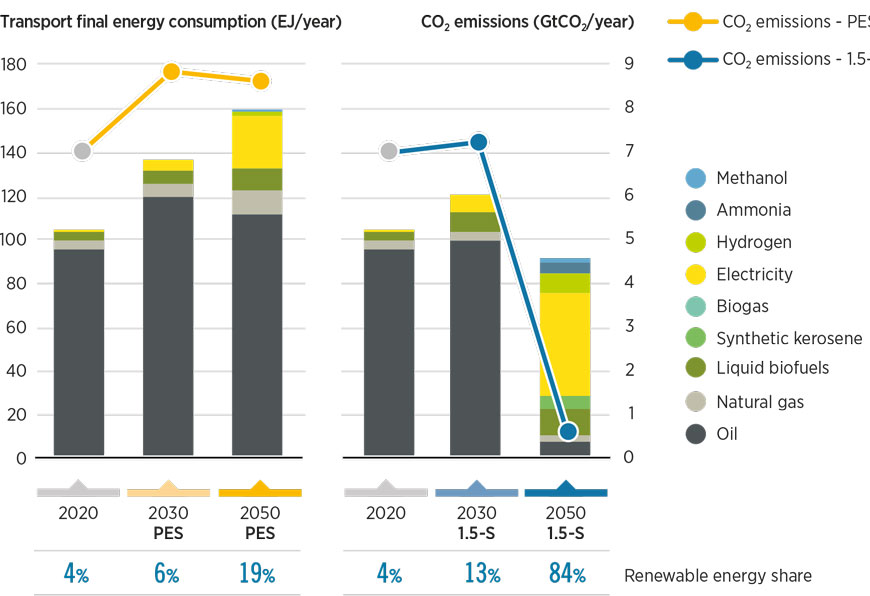

Specific combinations of technologies in certain country and institutional settings can drive energy transitions in end-use sectors. They can also change supply-side and transformational processes, depending on institutional conditions, resource availability and infrastructure. But a common factor across all countries is the need to electrify heat and transport using renewable electricity, efficiency measures and the direct use of renewables (bioenergy, solar and hydrogen).

This chapter presents possible energy system transition pathways under a 1.5°C Scenario aligned with the IPCC special report on limiting global warming to no more than 1.5°C by 2050 (IPCC, 2022a). It examines the technological changes and mitigation measures required through 2030 and 2050. The chapter also explores the implications of the current energy crisis, proposing a set of measures governments can take to alleviate the crisis whilst helping to accelerate the energy transition.

This 2023 edition of the World Energy Transitions Outlook focuses closely on the transition pathways in the Group of Twenty (G20) countries and emphasises their role in reducing emissions and strengthening the deployment of low-carbon technologies.

1.2 The 1.5°C Scenario: Global perspectives

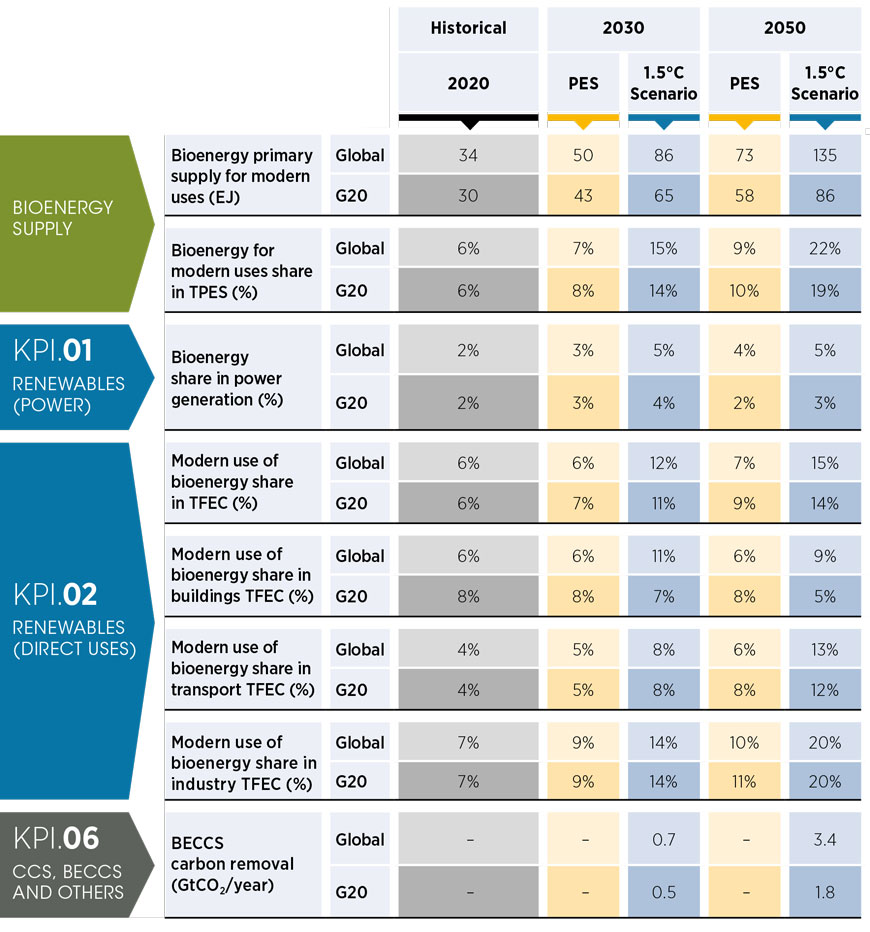

As in previous editions, IRENA uses six performance indicators to monitor progress towards the 1.5°C pathway:

- Use of renewables to generate electricity: comprising two sub-indicators; 1) the amount of electricity generated from renewables and 2) the share of renewables in the total electricity generated.

- Direct uses of renewables: comprising two sub-indicators; 1) the share of renewable energy in total final energy consumption and 2) the quantity of modern bioenergy used.

- Improvements in energy intensity.

- The electrification of end-use sectors.

- Production and supply of clean hydrogen and derivative fuels.

- The amount of carbon dioxide captured and removed by various methods.

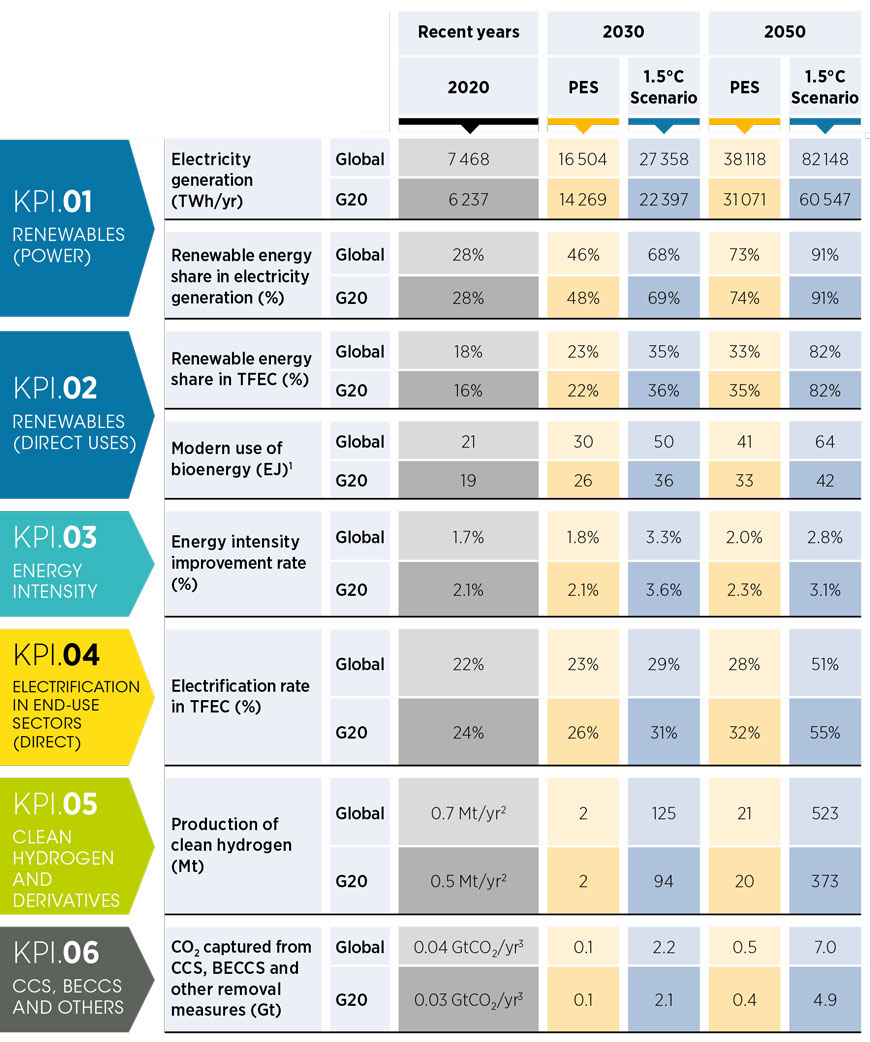

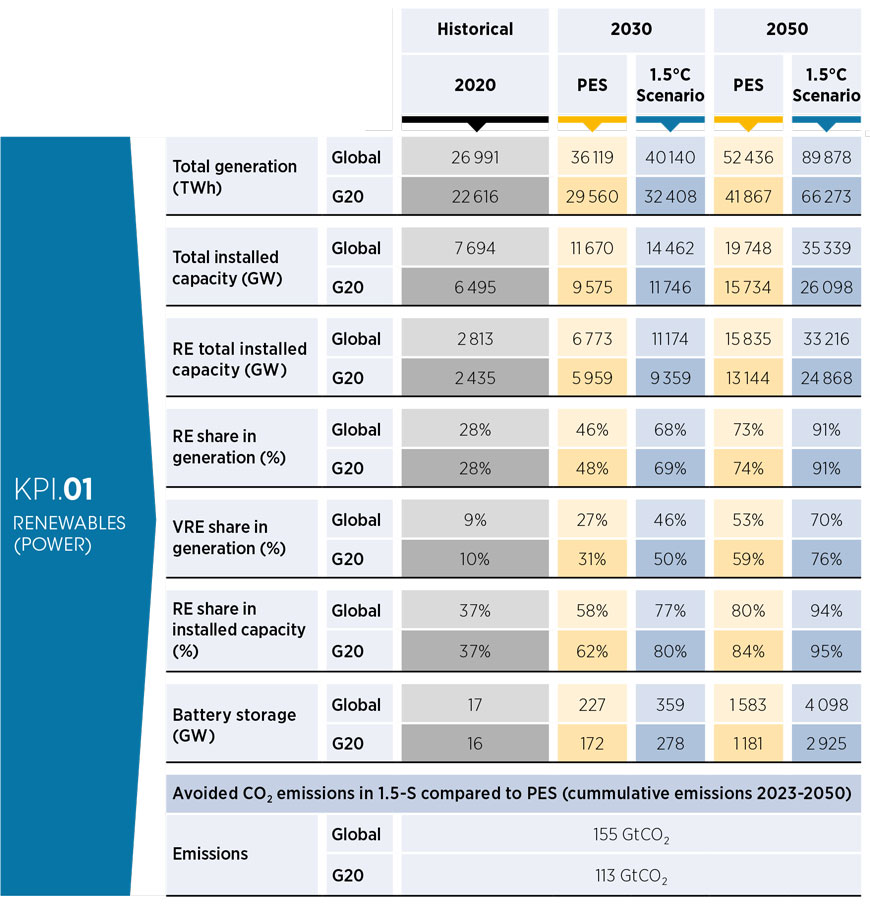

Table 1.1 details the 2020 standing of the six indicators, both globally and in the G20, compared with projections of their standing in 2030 and 2050 under the 1.5°C Scenario and a reference scenario based on current plans.

TABLE 1.1 Key performance indicators for achieving the 1.5°C Scenario compared with the Planned Energy Scenario in 2030 and 2050

1. Includes non-energy uses.

2. Operational project capacity through October 2022 (IEA Hydrogen Project Database).

3. Operational project capacity through March 2023 (IEA CCUS Database).

BECCS = bioenergy with carbon capture and storage; CCS = carbon capture and storage; CO₂ = carbon dioxide; EJ = exajoule; G20 = Group of Twenty; Gt = gigatonne; KPI = key performance indicator; Mt = megatonne; PES = Planned Energy Scenario; TFEC = total final energy consumption; TWh/yr = terawatt hours per year.

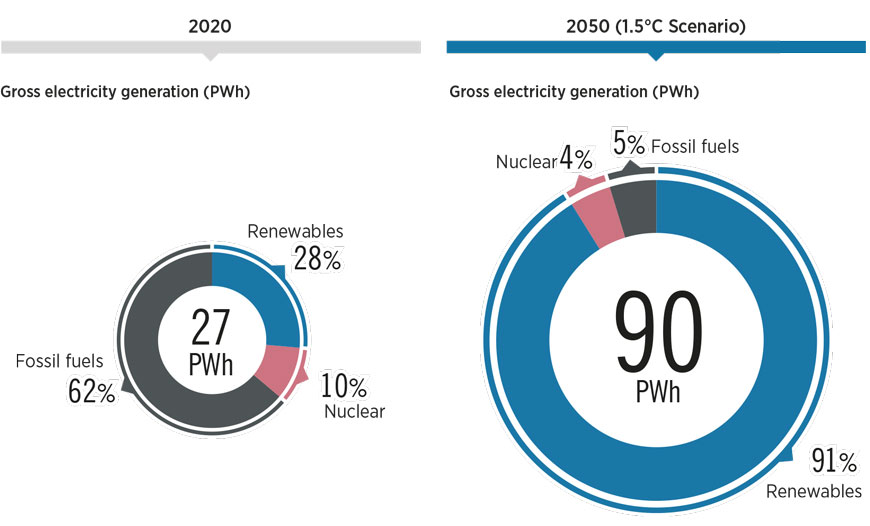

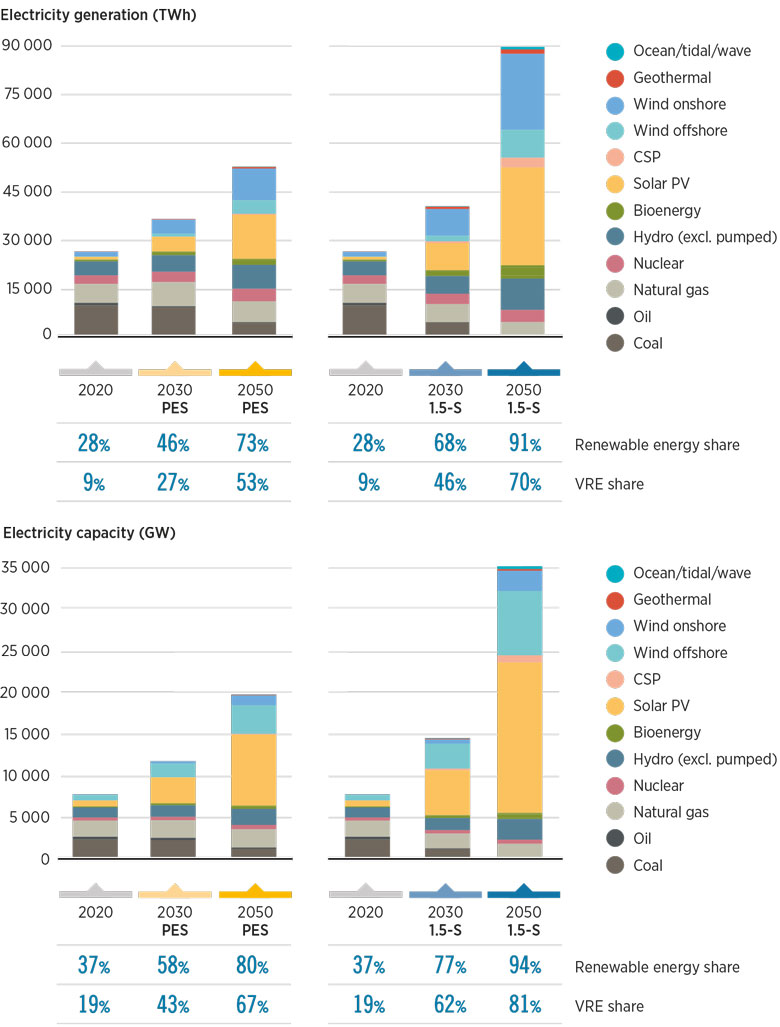

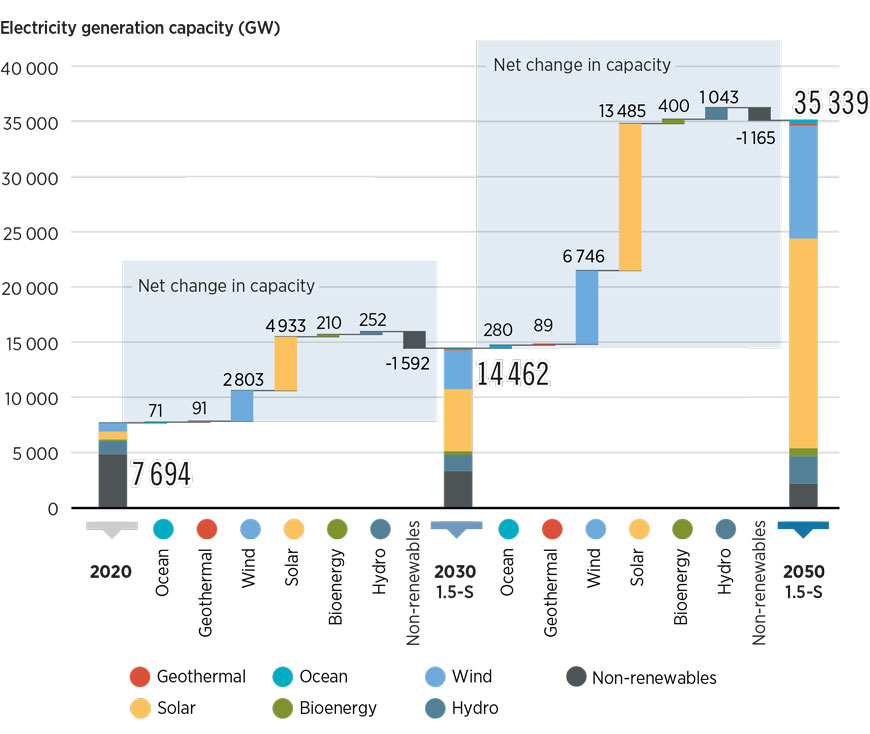

Under the 1.5°C Scenario, electricity generation would more than triple from 2020 to 2050, with 91% of the total electricity supply coming from renewable sources, compared to 28% in 2020 (see Figure 1.1). Coal- and oil-based power generation would experience a sharp decline over the decade before being phased out entirely by mid-century. By 2050, natural gas would provide 5% of total electricity needs, with the remaining 4% being met by nuclear power plants. The transition features a synergy between increasingly affordable renewable power technologies and the wider adoption of electric technologies for end-use applications, especially in transport and heat. The electrification of transport, heat and other end uses implies that global renewable power generation capacity would need to expand by a factor of almost 12 by end-2050, compared to 2020 levels, in order to meet the 1.5°C target. A detailed analysis can be found in Chapter 2.

FIGURE 1.1 Power generation needs to more than triple by 2050 in the 1.5°C Scenario

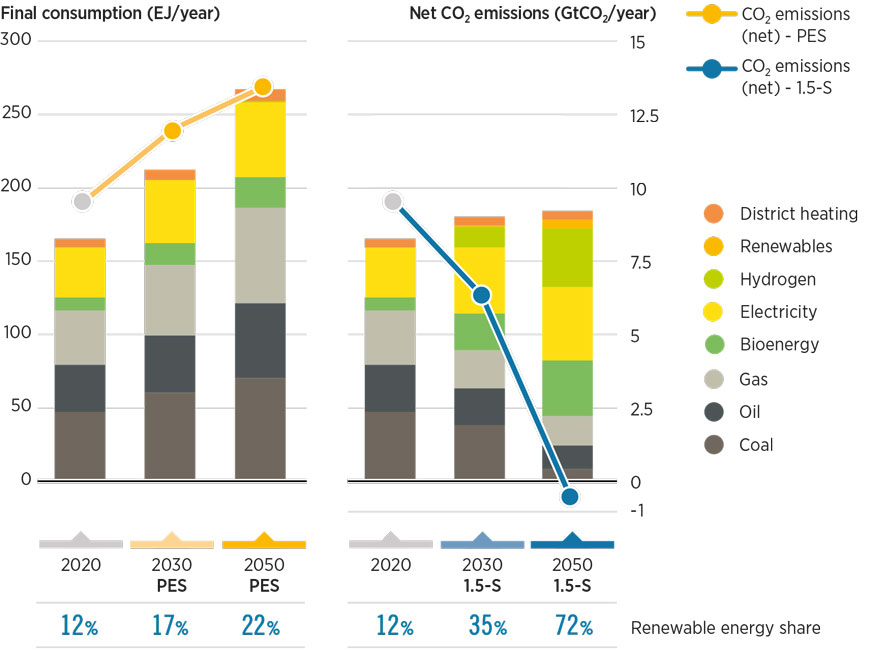

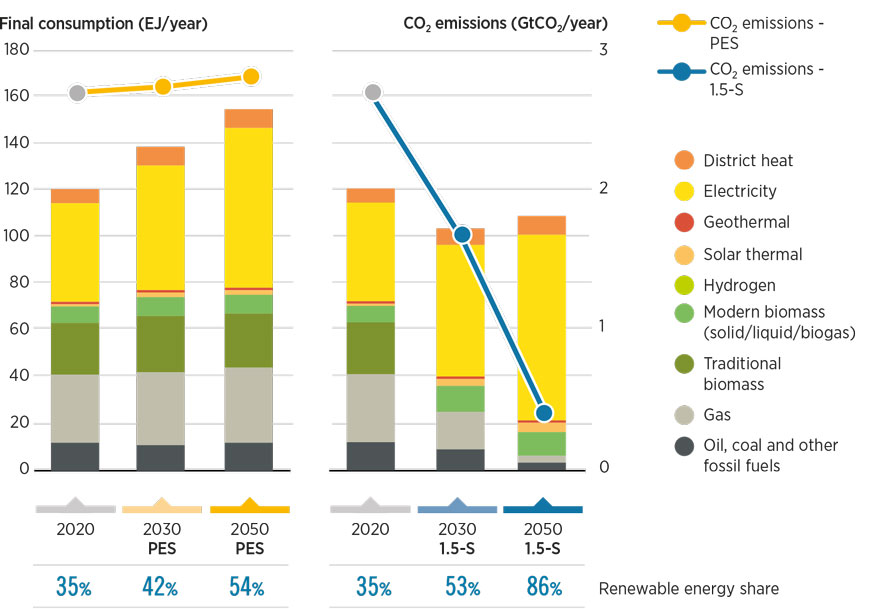

The scale-up would grow the share of renewable energy in total final energy consumption (TFEC) from 18% in 2020 to 82% by 2050. The 1.5°C Scenario envisages electricity becoming the main energy carrier, accounting for over 50% of TFEC (see Figure 1.2). Renewable energy deployment, improvements in energy efficiency and the electrification of end-use sectors contribute to this shift. In addition, modern biomass and hydrogen are projected to play more significant roles, with 16% and 14% of TFEC by 2050, respectively. Notably, 94% of hydrogen production is expected to come from renewables, indicating a growing reliance on clean energy sources (IRENA, 2022b, 2022c, 2022d). The pathway also suggests that TFEC could fall 6% between 2020 and 2050, suggesting a potential trend towards decarbonisation and a more sustainable energy future.

FIGURE 1.2 Breakdown of total final energy consumption by energy carrier between 2020 and 2050 under the 1.5°C Scenario

Total primary energy supply remains stable due to increased energy efficiency and growth of renewables (see Figure 1.3). The share of renewable energy in primary energy supply would grow from 16% in 2020 to 77% in 2050. The energy mix would change drastically in the process, with a net gain of 61 percentage points of renewable energy share in total primary energy supply, driven by a mix of end-use electrification, renewable fuels and direct uses. Achieving this level of renewable energy penetration is critical to meeting global climate goals and would require significant investment and policy support, as well as continued innovation.

FIGURE 1.3 Total primary energy supply by energy carrier group, 2020-2050 under the 1.5°C Scenario

Renewables would account for 77% of primary energy supply by 2050 in the 1.5°C Scenario

The energy transition should aim to deliver improved energy intensity across the economy through a range of energy efficiency technologies, complemented by structural and behavioural changes. Energy intensity improvements are associated with a combination of deployments of renewable and efficient technologies in end-use sectors, along with extensive electrification.

Power demand would need to grow three-fold by 2050 through extensive electrification of end-use sectors - 37% supplied by solar and 36% by wind. By 2030 the installed capacity of renewable power would need to expand almost four times to set the world on track for the transition. Specifically, the share of variable renewable energy (VRE) in the generation mix would need to increase from the current 9% to 46% by 2030, requiring additional flexibility in the operation of the energy system for economic and security reasons.

Much improved energy efficiency, structural and behavioural changes are all needed under the 1.5°C Scenario

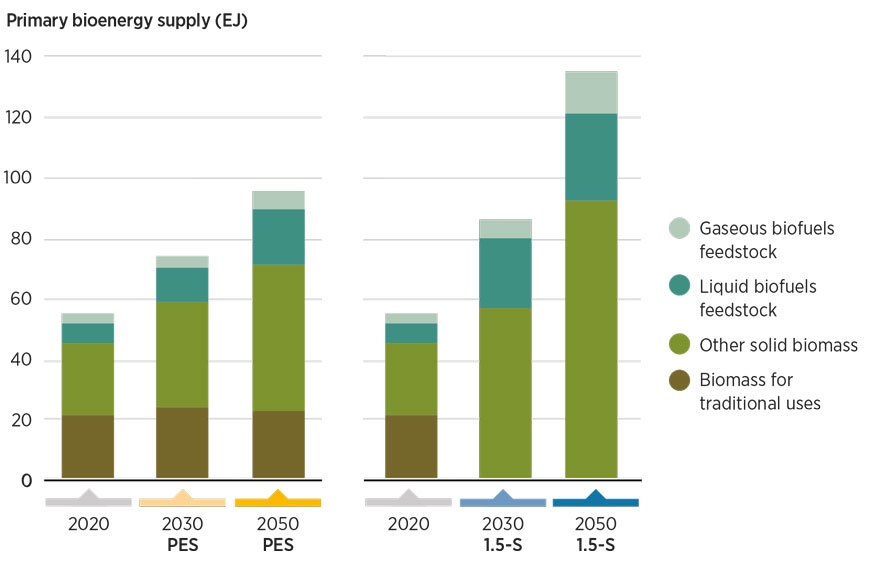

Bioenergy for modern uses in various forms (i.e. solid biomass, biogas, biomethane and liquid biofuels) would supply 22% of total primary energy by 2050 - 2.5 times present levels. In the transport sector, sustainable biofuels would meet 13% of TFEC by 2050.

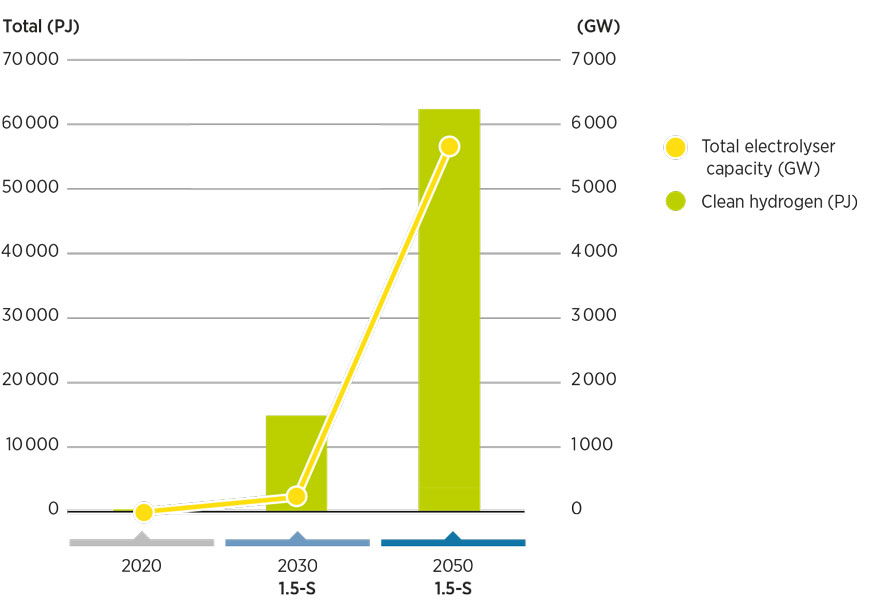

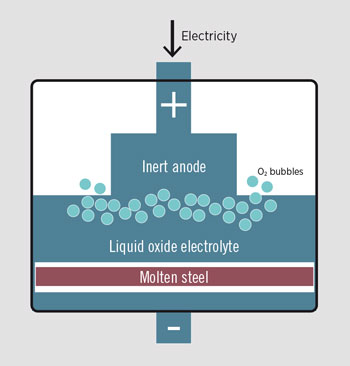

From its negligible levels in 2020, the production of clean hydrogen, both for direct use as well as use of derivative fuels, should ramp up to 523 Mt by 2050. Hydrogen and its related compounds – ammonia, methanol and kerosene – would account for 14% of final energy use by 2050. Early investment in the green hydrogen supply chain (electrolysis, fuel cells, transport pipelines, storage caverns, etc.) is vital to the uptake of hydrogen applications in end-use sectors and to carbon reduction goals. This is especially the case for hard-to-decarbonise sectors like air, marine and heavy-duty transport, as well as some primary industrial processes. By 2030 IRENA expects that 50 Mt of green hydrogen would be required, which would need to scale up ten-fold by 2050.

With only 0.04 Gt of carbon captured in 2020, removal and storage measures - from carbon capture and storage (CCS) to bioenergy with carbon capture and storage (BECCS) and other methods – should be scaled up to remove 7 Gt by 2050. Although ambitious expansions of renewables and efficiency measures account for most emission reductions, remaining carbon dioxide (CO₂) emissions from fossil fuels - primarily in industrial processes and some transport – would require CCS technologies together with CO₂ removal measures. A total of 109 Gt of CO₂ would require removal between 2023 and 2050. CCS from bioenergy will be important in power, heat and cogeneration plants, as well as in some industrial applications. Meanwhile, fossil fuel-based carbon capture and utilisation (CCU) and CCS are vital processes for removing emissions in cement, iron, steel and chemicals production. Captured carbon needs to reach 2.2 Gt by 2030 from current negligible levels, with the main focus being industrial processes.

In the Planned Energy Scenario, the reference case of this study, annual emissions would decline only slightly to 34 GtCO₂ in 2050 (see Figure 1.4). By contrast, to meet Paris Agreement commitments, IRENA’s 1.5°C Scenario plots a steep and continuous drop to net-zero CO₂ emissions by 2050. The Scenario depends on a steep reduction in global CO₂ emissions through 2030, followed by a continued downward trajectory, reaching net zero by 2050. To accomplish this, substantial efforts beyond those already planned in sectors such as power, heat and industry would be needed, with negative emissions delivering the necessary additional carbon reductions.

FIGURE 1.4 Estimated trends in global CO₂ emissions under the Planned Energy Scenario and 1.5°C Scenario, 2023-2050

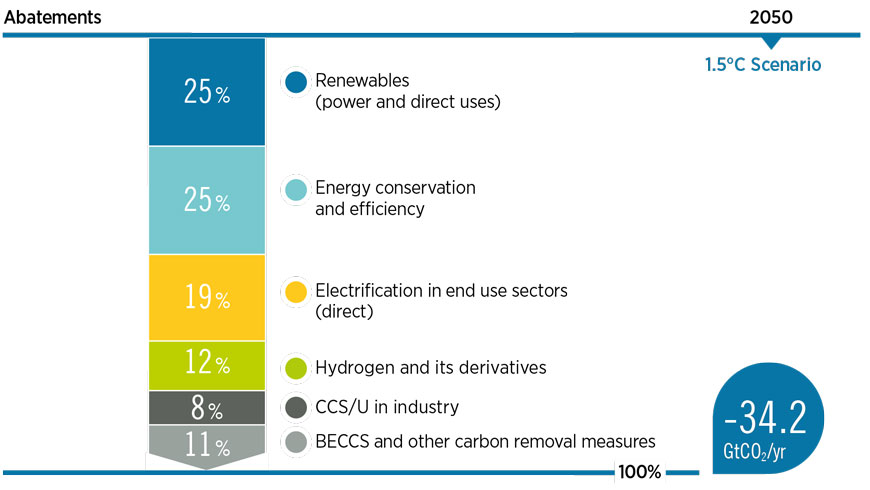

If all the above-mentioned technologies and measures were achieved, global CO₂ emissions could be reduced dramatically, reaching negative emissions of 0.2 GtCO₂/year by 2050 (i.e. removing more CO₂ than is produced). The largest declines would come from the use of renewables in power generation and for direct uses in heat and transport, combined with energy conservation and efficiency; together these would make up more than half the cuts in global CO₂ emissions, followed by a 19% contribution from the direct electrification of various end-use sectors and 12% from the use of hydrogen and its derivatives, including synthetic fuels and feedstocks (see Figure 1.5). As noted above, the remaining CO₂ in the period to 2050 would need to be captured and stored either through CCS/CCU, BECCS or other carbon removal measures such as direct air capture, soil carbon sequestration, enhanced mineralisation, ocean-based CO₂ removal and afforestation or reforestation.

IRENA also compiles several regional renewable energy and energy transition outlooks. These studies provide deeper regional and country insights into the technologies, measures, policies and impacts associated with the transition. They also provide views on regional co-operation and joint actions (see Box 1.2).

FIGURE 1.5 Carbon dioxide emissions abatement under the 1.5°C Scenario in 2050

BOX 1.2 IRENA’s regional studies

IRENA has produced several regional renewable energy and energy transition outlooks. These studies provide deeper regional and country insights into the technologies, measures, policies and impacts entailed by the transition. They also provide views on regional co-operation and joint actions.

Renewable energy roadmap for Central America: Towards a regional energy transition (IRENA, 2022l) is a technical assessment of the future energy landscape in Belize, Costa Rica, El Salvador, Guatemala, Honduras, Nicaragua and Panama. The report contributes to the debate around decarbonising the energy sector in Central America. Integrated regional planning is vital for the energy transition, in which energy and climate policies are linked to country commitments. With this proposition in mind, the roadmap evaluates how well the region’s renewable and low-carbon technologies are integrated into its end-use and power sectors; a “flexibility” analysis of the regional power system is included (IRENA, 2022l). A key finding is that the energy transition should focus on the transport and power sectors. The energy system decarbonisation will cost an estimated USD 1 930 billion in total – including investment in new installed power capacity and grids, operation and maintenance, fuel costs and end-use technology – in the most ambitious scenario. An even more costly investment, of USD 1 950 billion, is seen in the event that current energy policies are implemented between 2018 and 2050.

The future energy landscape of the Association of Southeast Asian Nations (ASEAN) is assessed in Renewable energy outlook for ASEAN: Towards a regional energy transition (IRENA, 2022m). The ASEAN countries Brunei Darussalam, Cambodia, Indonesia, the Lao People’s Democratic Republic, Malaysia, Myanmar, Philippines, Singapore, Thailand and Viet Nam are undertaking an integrated regional plan for the transition, linking energy and climate policies with actual country commitments. Meanwhile, member countries are identifying a low-carbon energy pathway powered by renewable energy, increased efficiency, and related transition technologies and measures. As a growth driver of global energy demand over the next three decades, the ASEAN region will be an important partner in climate change efforts. The region’s integrated regional approach will expand the total renewable energy capacity from 2 770 GW to 3 400 GW by 2050 under the 1.5°C Scenario. The assessment shows that in the 1.5°C Scenario, the total costs of energy supply can be reduced by as much as USD 160 billion, cumulatively, by 2050. Additionally, avoided externalities from the 1.5°C Scenario range from USD 508 billion to USD 1 580 billion, cumulatively, to 2050. The outlook concludes that the 1.5°C Scenario can be achieved at a lower cost while energy emissions are reduced.

IRENA is also working on regional outlooks for Africa, South America and Europe that analyse the entire energy system, providing empirical evidence on the macroeconomic impacts of the energy transition, including in the context of development and climate goals.

1.3 Implications for the 1.5°C Scenario of revised NDCs and other pledges

Global energy-related CO₂ emissions grew by 0.9%, or 321 Mt, in 2022, to reach a new high of 36.8 Gt (IEA, 2023a). As noted above, IRENA’s 1.5°C Scenario plots a steep and continuous drop to net-zero CO₂ emissions by 2050. Beyond energy-related emissions, those related to land use must decline and become negative in the approach to 2050 so that the overall burden on the remaining carbon budget is at least neutral. Although COP27 redoubled mitigation targets, more is required to bridge the gap to the 1.5°C target. The emissions gap between the trajectory defined by the COP announcements and the 1.5°C Scenario in 2050 remains at 16 Gt.

Stronger NDCs, LT-LEDS (as defined in article 4.19 of the Paris Agreement) and net-zero targets, if fully implemented, could cut CO₂ emissions by 6% by 2030 and 57% by 2050, compared with 2022 levels. However, most climate pledges have yet to be translated into detailed national strategies and plans, implemented through policies and regulations, or supported with sufficient funding. In their NDCs, several countries identify an urgent need for the means to implement their emissions-reduction goals, which the current energy crisis may make even more difficult.

Commitments from outside the NDC process, beyond 2030, are also emerging. By April 2023, 130 countries, 126 regions and 246 cities had made net-zero commitments for 2050 (Net Zero Tracker, 2022). Private companies have also made pledges. Of the 2 000 largest publicly traded companies globally, almost 900 are said to be considering a net-zero target (Net Zero Tracker, 2022). Many, however, have not yet backed their targets with operational plans and strategies, raising questions about what they will achieve (Energy Tracker Asia, 2022).

Net-zero commitments need to be translated into operational plans and strategies

By May 2023, 193 parties had ratified the Paris Agreement, while 194 had submitted NDCs. 2 Of the 166 parties that submitted new or updated NDCs, 99 (representing 81% of global GHG emissions) had enhanced their ambitions, revising their targets upwards. The remaining 67 (together accounting for about 14% of global emissions) submitted NDCs with the same emission-reduction targets as in their first NDCs, lower targets, or targets that are not easily comparable with their initial NDCs (Climate Watch, 2022). Despite the enhancements, the new climate pledges do not significantly change the emissions projections of current pledges; a wide gap remains between the climate pledges announced in the run-up to COP28 and what is needed to reach the 1.5°C target. Figure 1.6 shows the estimated future global CO₂ emissions in gigatonnes (Gt) based on 1) a trajectory that aligns with the announcements made up to COP27 and 2) the IRENA 1.5°C Scenario. To be aligned with the IRENA 1.5°C Scenario, CO₂ emissions in 2030 would need to be about 23 GtCO₂, compared to 34 GtCO₂ under the COP announcements trajectory.

FIGURE 1.6 CO₂ emission trajectories based on COP announcements and the 1.5°C Scenario

COP = Conference of the Parties (United Nations Climate Change Conference); GtCO₂ = gigatonne of carbon dioxide.

The COP announcements’ trajectory includes all NDCs, LT-LEDS and net-zero targets communicated by the parties as of October and November 2022, respectively. This trajectory is based on an “optimistic” climate analysis that assesses the highest ambition (i.e. lowest emission levels) of the full NDC implementation, including both conditional and unconditional contributions.

Renewable energy is clearly vital to the energy transition, but targets for its deployment are not included in every NDC. As of mid-October 2022, 183 parties had included renewable energy components in their NDCs; of these, 143 had a quantified target. Of the total targets, 108 focus on power; and 31 focus on heating and cooling, transport or cooking. Only 12 parties had committed to a percentage of renewables in their overall energy mixes. Of the 108 parties with defined targets for renewables in the power sector, 47 presented them only in the form of additions – mostly in the form of capacity (gigawatts, GW) and a few in terms of output (gigawatt hours, GWh). Of the 61 parties with targets defined as a share of the power mix, 13 commit to achieving a renewable energy share lower than 24%, 23 commit to a share between 25% and 59%, 13 commit to shares between 60% and 89%, and 12 to shares between 90% to 100% (IRENA, 2022e).

BOX 1.3 The Paris Agreement Global Stocktake

The Global Stocktake evaluates progress on the world’s efforts to reduce greenhouse gas emissions; adapt and build resilience to climate impacts; and align financial support with the scale and scope needed to tackle the climate crisis. Its outcomes will provide valuable information on the remaining gaps and opportunities to bridge them to reach the goals of the Paris Agreement.

IRENA’s WETO tracks the gaps between the Planned Energy Scenario and 1.5°C Scenario targets for 2030 that could contribute to the discussion of global stocktake with detailed analysis on technology avenues (section 1.2), policy (chapter 2) and investments (chapter 3).

IRENA also works closely with countries to support the development and implementation of renewable energy policies and strategies. This includes providing technical assistance and capacity building to help countries to increase the share of renewable energy in their energy mix (section 1.4). This work can be useful for many international processes, including the global stocktake.

IRENA roadmaps provide a framework for countries to set targets and develop policies for the deployment of specific renewable energy technologies. For example, IRENA has developed technology roadmaps for a range of renewable energy technologies, including wind power, solar photovoltaics, hydropower, and bioenergy. These roadmaps provide a comprehensive assessment of the current state of the technology, as well as its potential for growth and deployment. The roadmaps also provide guidance on policy and regulatory frameworks that can support the deployment of the technology, as well as measures to address technical and institutional barriers.

By providing these technology roadmaps, IRENA helps countries to develop effective policies and strategies for the deployment of renewable energy technologies, which in turn can help to accelerate the energy transition and reduce greenhouse gas emissions. These roadmaps also provide valuable information for the global stocktake process, by highlighting the potential for different renewable energy technologies to contribute to the achievement of the Paris Agreement goals.

Overall, IRENA aims to make a critical contribution to the global stocktake process through assessing progress towards the Paris Agreement goals and identifying opportunities for further action on renewable energy.

For renewable energy pledges or targets in NDCs to be realised, they need to be aligned with renewable energy targets set under each respective country’s institutional energy framework, such as those in national energy plans and laws. As of mid-October 2022, 149 countries had targets for renewable power in their national policies and plans but only 82 of these had comparable targets in NDCs. In most countries, renewable energy targets in NDCs do not align with those included in national energy plans (IRENA, 2022e). By aligning renewable energy targets in NDCs with national energy plans, the targets become more effective and credible. In so doing, they reinforce intended signals to investors, developers and other players across the supply chain, strengthening the renewable energy sector. In some cases, national targets would need to be established or updated. In other cases, they would need to be reflected in the next round of NDCs.

In order to keep the world on track to achieve the energy transition under IRENA’s 1.5°C Scenario by 2050, the level of ambition of renewable energy power targets set in national plans and strategies for 2030 would need to almost double. In fact, non-ambitious targets may effectively act as a cap on renewables, hindering rather than promoting their deployment. The higher target is readily achievable, as current targets are below the market pace and lag recent deployment levels.

Countries are currently aiming for average annual renewable power capacity additions of 262 GW by 2030 in their national targets. This is below the capacity installed in the past two years, which amounted to 294 GW and 264 GW in 2022 and 2021, respectively, even against the backdrop of the COVID-19 pandemic and the related supply chain disruptions, the crisis in Ukraine and global inflation.

Renewable energy targets in NDCs and national energy plans need to be better aligned

Although many developing countries have set ambitious renewable energy targets in their NDCs, most are conditional on external support from developed economies. For instance, in small island developing states (SIDS), more than half of the 11.5 GW targeted capacity by 2030 remains conditional on the provision of international support in the form of financing, technical assistance, technology transfer, capacity building and other forms of support based on each country’s national context (Rana and Abou Ali, 2022). Providing such support will allow developing countries to capitalise on their renewable energy resources to mitigate and adapt to their climate-induced vulnerabilities while ensuring energy security and sustainable socioeconomic growth.

BOX 1.4 Insights from analysing the alignment between LTES and LT-LEDS

Climate and renewable energy commitments must be matched by implementation. Aligning pledges with national energy plans is a priority not only for NDCs but also for longer-term strategies. IRENA’s (2023d) report, Long-term energy scenarios and low-emission development strategies: Stocktaking and alignment, compares 24 official long-term energy scenario (LTES) documents and 36 long-term low greenhouse gas emission development strategies (LT-LEDS) covering 45 countries to gauge how well the two processes are aligned at the institutional and technical levels, and investigate areas for improvement.

The report reviews the governance frameworks developed for LTES and LT-LEDS reports, including co-ordination, stakeholder consultations and type of publication. It also looks at scenario-supporting elements, from infrastructure to social factors and other constraints.

The report finds that aligning LTES and LT-LEDS processes leads to more robust mitigation plans; planning documents produced by multiple or interdisciplinary ministries lay out scenarios that cover more elements of the transition. LTES and LT-LEDS processes can also complement one another in various ways; LTES have 10-20% more quantitative representation of energy production, transmission and distribution, and storage than LT-LEDS, and LT-LEDS have approximately 10-15% more quantitative representation of socio-economic elements than LTES. Both LTES and LT-LEDS need to improve their representation of hydrogen and e-fuel infrastructure in scenarios; however, less than 50% of all scenarios have quantitative representation of those elements. This could risk overestimating the potential for application of those technologies, and possible misallocation of investments.

At a minimum, it is recommended that climate change mitigation strategies be based on scenarios, as this leads to more scientifically robust co-ordination of planning with the resulting proposals. Thirty six out of the fifty three LT-LEDS published as of October 2022 have featured scenarios as their main tool to outline alternative pathways and targets, and to quantitively assess the short- and medium-term policies needed to reach their long-term goals.

1.4 The energy crisis and its implications for the energy transition

Over the past few years, global events have complicated action on the energy transition and climate action. A global energy crisis brought about by rebounding demand following the COVID-19 pandemic, adverse weather and reduced fossil fuel supplies escalated in early 2022 owing to the fallout from the Ukraine crisis. The rapid rise in energy prices affected countries around the world, either directly or indirectly. Energy supplies tightened in Europe, particularly supplies of natural gas from Russia. The ensuing high prices affected households and businesses across Europe and spilled over to food production and other commodities, affecting vulnerable households and developing countries (UN, 2022). Among the world’s most vulnerable regions, Sub-Saharan Africa experienced a 6% rise in extreme poverty in 2022 (IEA, 2022a), with the energy crisis compounding economic pressures in the region.

In response to the energy crisis, a number of governments announced measures to address supply shortages and mitigate price hikes. While some of the measures focused on demand reduction, faster renewable energy deployment and support for green hydrogen, others called for additional fossil fuel investments or other steps incompatible with the energy transition.

Support is needed to help developing countries realise ambitious renewable energy targets

The European Commission presented its REPowerEU plan in May 2022. Focusing on diversification, energy savings and accelerating clean energy, the plan seeks to make the European Union (EU) independent of Russian fossil fuels well before 2030. As part of the European Green Deal and the REPowerEU plan, the EU provisionally agreed in March 2023 to speed up its rollout of renewable energy with stronger legislation. This action raised the EU’s binding renewable target for 2030 to 42.5%, with the ambition to reach 45% (European Commission, 2023). The EU is also promoting hydrogen infrastructure and plans to produce 10 Mt of green hydrogen, and to import another 10 Mt by 2030. Spain, France and Portugal have agreed to build an undersea pipeline to transport hydrogen from the Iberian Peninsula to France and the rest of Europe, strengthening the EU’s energy independence (Sullivan, 2022).

At the same time, since the onset of the Ukraine crisis in February 2022, investments of at least USD 50 billion in new infrastructure for liquefied natural gas (LNG) have been announced, including floating and fixed terminals and new pipelines. Most of these investments in diversifying imports have been made in European countries - among them Finland, Germany, Greece, Italy, the Netherlands and Spain. The new LNG storage terminals will give the European Union at least 60 billion cubic metres of annual capacity (Aposporis, 2022; Bloomberg, 2022; Esau, 2022; Habibic, 2022; Jewkes, 2022; Karres, 2023; Kurmayer, 2022; Landini, 2022; Reuters, 2022a, 2022b; Sharma, 2022). In addition, the EU passed an act classifying natural gas as a “transitional” energy source for sustainable investment, with technical and emission standards set for corresponding projects.

To help European households and businesses, several governments provided consumer subsidies to soften the rise in energy prices. As a result, estimated 2022 fossil fuel subsidies were the highest ever (IEA, 2023b). For example, France provided subsidies to farmers to mitigate petrol price increases; in 2023 it announced a 15% cap on power and gas price increases for households (Struna, 2022). The UK government introduced the Energy Bills Support Scheme and the Energy Bills Support Scheme Alternative Fund, which provided a one-time GBP 400 payment to households to help with bills over the winter of 2022-2023 (Mawhood, Bolton and Stewart et al., 2022). The German government agreed to a relief package worth up to EUR 200 billion to cushion the impact of expensive energy until 2024 (Amelang and Wettengel, 2022).

Renewables and energy efficiency can both help alleviate the energy crisis and achieve the energy transition

Although many countries have kept renewable energy at the top of their investment lists, they risk ending up with stranded assets in their LNG contracts and infrastructure – both complicate the “phasing out” of natural gas. Governments will naturally prioritise short-term responses to the energy crisis, but they need to maintain their strategic direction at the same time. A comprehensive range of measures is needed to scale up deployment and help achieve long-term transition goals (see Table 1.2). Renewables and energy efficiency are consistent with climate commitments, and improve both energy security and energy affordability for all. Multilateral action is critical, yet each country and each region will need to tailor its own response to its current resources, infrastructure, access to finance and localised challenges (UN, 2022).

TABLE 1.2 Key measures to accelerate the energy transition

1.5 Conclusions

This chapter has shown that the 1.5°C climate target can be achieved through the application of a range of policies and technical strategies, including many existing solutions. Powered by renewable energy, clean hydrogen and sustainable biomass, electrification and energy efficiency are driving the transition; but the scale and extent of the transformation are attainable only through a rapid and systemic transformation of the energy system. A speedy shift away from the current fossil fuel-based system is obviously vital. On top of a major scale-up of renewables in the power sector, all end-use sectors will be required to commit not only to the direct use of renewables but also to major efficiency upgrades, process changes, circular economy approaches and behavioural changes.

Chapter 2 explores how the energy transition will transform individual sectors and discusses the policy approaches that can bring it about.

Highlights

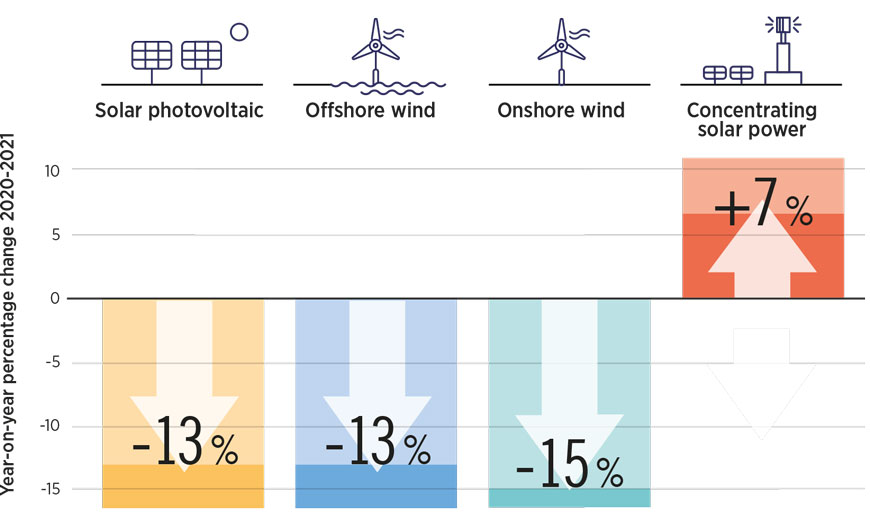

Power sector

- The costs of renewable electricity continue to decline globally, and renewables are now the most affordable power generation option in most regions. In 2021, 163 gigawatts (GW) of renewable power generation capacity produced electricity that cost less than the electricity generated from the cheapest source of new fossil fuel-based capacity. These 163 GW accounted for 73% of the total new renewable power generation capacity added globally. The global weighted average levelised cost of electricity (LCOE) of newly commissioned utility-scale solar PV projects fell by 88% between 2010 and 2021. The LCOE of CSP fell by 68%, and onshore and offshore wind by 68% and 60%, respectively. Renewables are now the default option for capacity addition in the power sector, where they dominate investments.

- The energy transition requires a rapid expansion of renewables-based electricity generation. Under the 1.5˚C Scenario, end-use sectors would see rapid electrification by 2050, causing global electricity demand to triple from that of 2020 to reach over 87 000 terawatt hours (TWh). Under the 1.5°C Scenario, renewables’ share in the power generation mix would grow from 28% to 91% (7 468 to 82 148 TWh) in the period from 2020 to 2050. Installed renewable power capacity would grow from 2 813 GW to 33 216 GW over this period, necessitating annual additions of 1 066 GW of new renewablesbased generation capacity between 2023 and 2050. Variable renewable energy (solar PV and wind) would dominate the transformation of the global electricity sector and account for 70% of electricity generation. Smart, digitalised measures for enhanced flexibility will be needed to accommodate daily and seasonal variability.

- Achieving the 1.5°C Scenario will require countries to adopt and implement ambitious targets and policies to support the massive scale-up in renewable power required. Auctions are a good way to harness competition while also pursuing broader policy objectives, such as system integration, socioeconomic benefits, and the development of local supply chains for enhanced energy security and independence. Apart from policy instruments supporting the expansion of renewable energy, the energy transition requires an enabling environment for relevant projects, including permitting processes that address environmental and social impacts but minimise delays in project delivery.

Energy transition fuels

- Fuels such as hydrogen and its derivatives (e.g. ammonia and methanol) will play a unique role in the energy transition, especially for industrial processes and certain transport modes. Under the 1.5°C Scenario, the total demand for these fuels would need to grow to 15 exajoules (EJ) and 63 EJ by 2030 and 2050, respectively. By 2050, total hydrogen demand would need to be met entirely with clean hydrogen, the majority of which is green hydrogen. This would require rapid expansion of both renewable power and electrolyser capacity. Green hydrogen is still in its infancy, and policy support is needed to scale it from a niche to a mainstream energy source. Policy support could include proactive planning, target setting, financial and fiscal support, green hydrogen quotas, etc.

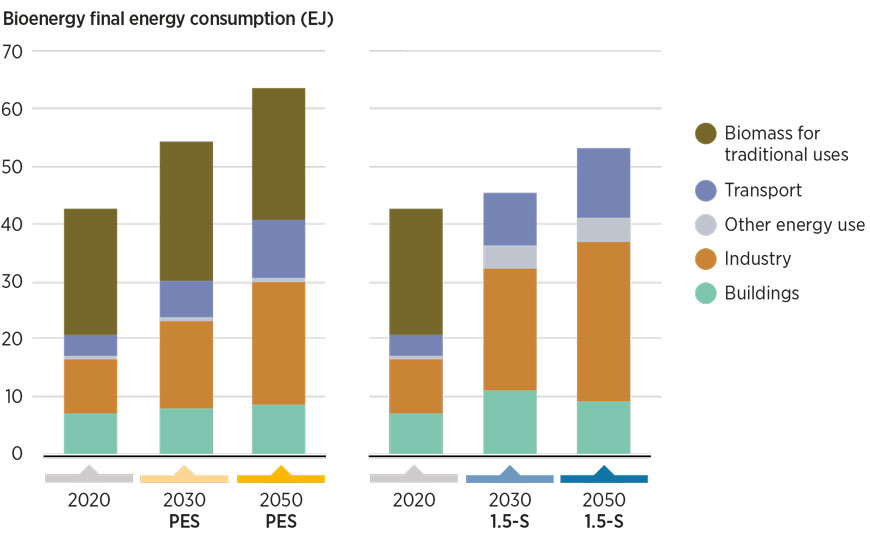

- Bioenergy plays a key role in the energy transition. Under IRENA’s 1.5°C Scenario, bioenergy’s share in the primary energy supply would grow to 22% in 2050. By the same year, the share of modern uses of bioenergy in TFEC would grow to 15% globally. The industry sector would account for the majority of this consumption (52%), followed by transport (23%), buildings (18%) and other categories (8%). Bioenergy would need policy support in the form of biofuel blending quotas, mandates and obligations; grants, subsidies and tax rebates for bioenergy projects and infrastructure; and research, development and demonstration (RD&D) for novel technologies. To ensure the environmental, social and economic benefits of bioenergy are maximised, countries would have to implement regulations and certificates, and promote partnerships to ensure sustainability of biomass feedstock and the entire supply chain. More broadly, bioenergy deployment should be based on the local context and co-ordinated with other sectoral strategies.

End-use sectors

- Hard-to-decarbonise industry sectors require a range of solutions to become aligned with the 1.5°C target. These include options based on green hydrogen, bioenergy, direct electrification, and the integration of CCS and BECCS to tackle residual emissions, as well as energy efficiency and circular economy principles. These approaches would reduce the sector’s energy consumption to c. 180 EJ by 2050, with electricity as the main energy carrier (27%), followed by bioenergy, district heating and other renewables (27%) and green hydrogen (22%). Scale-up of these solutions would require various policy measures to create the initial market demand for renewables-based, low-carbon industrial materials and products; improve their cost-competitiveness; accelerate the advancement of novel technologies; and promote the sharing of knowledge and experiences. Key policy tools include industrial decarbonisation roadmaps, green public procurement, support for research and development, and circular economy approaches. International collaboration in technology transfer and investments is urgently needed to support the industrial decarbonisation process in developing countries.