-

-

IRENA (2020), Electricity Storage Valuation Framework: Assessing system value and ensuring project viability, International Renewable Energy Agency, Abu Dhabi.

Copied

/-/media/Files/IRENA/Agency/Publication/2020/Mar/IRENA_storage_valuation_2020.pdf

Copied

Electricity Storage Valuation Framework

Newsletter

Assessing system value and ensuring project viability

Electricity storage could be a crucial factor in the world’s transition to sustainable energy systems based on renewable sources. Yet electricity markets frequently fail to account properly for the system value of storage.

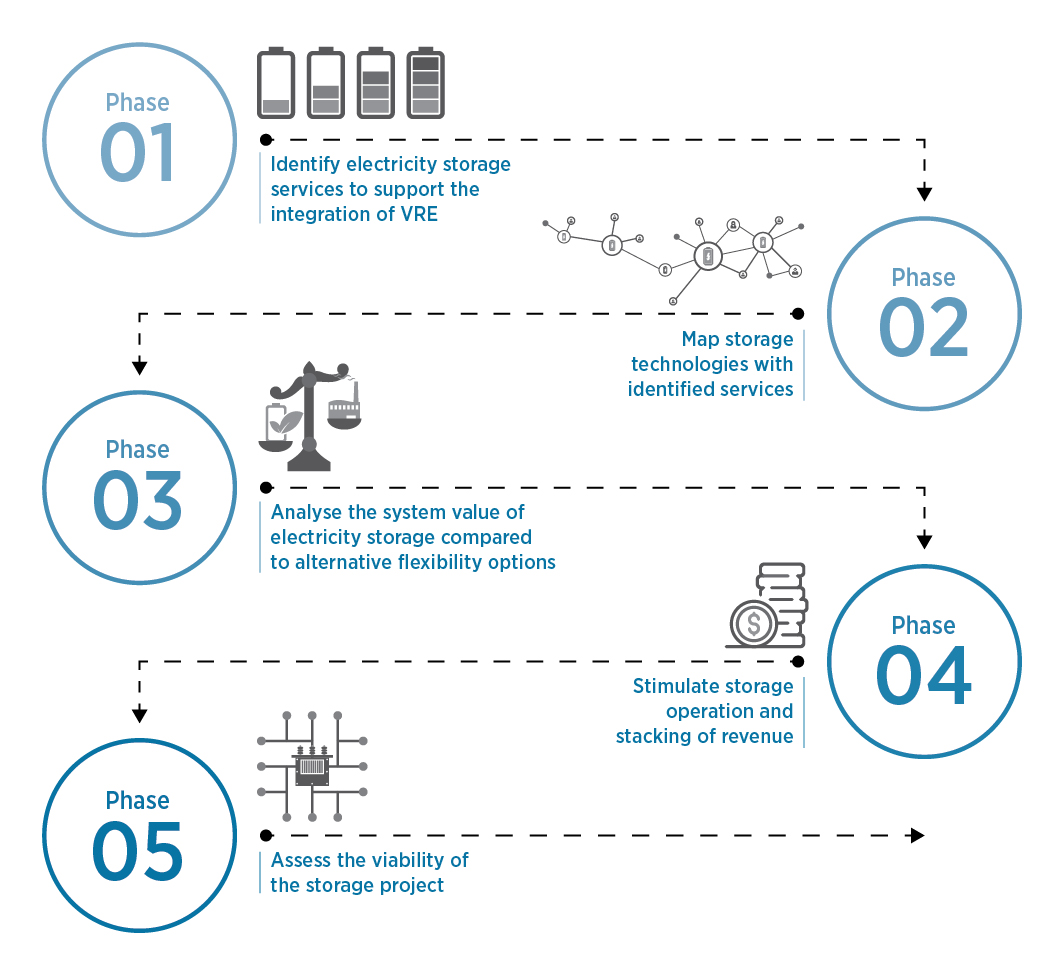

This report from the International Renewable Energy Agency (IRENA) proposes a five-phase method to assess the value of storage and create viable investment conditions. IRENA’s Electricity Storage Valuation Framework (ESVF) aims to guide storage deployment for the effective integration of solar and wind power.

The three-part report examines storage valuation from different angles:

- Part 1 outlines the ESVF process for decision makers, regulators and grid operators.

- Part 2 describes the ESVF methodology in greater detail for experts and modellers.

- Part 3 presents real-world cases, including examples of cost-effective storage use and maximised service revenues.

Among other findings:

- Increasing solar and wind penetration brings new challenges for policy makers, regulators and power utilities in terms of system planning and operation.

- Electricity storage helps to address key technical and economic challenges related to variable renewable energy (VRE) integration.

- Storage services help to manage the variability and uncertainty that solar and wind use introduce into the power system.

- By providing multiple services simultaneously, electricity storage permits revenue stacking for greater profitability.

- Some storage technologies are intrinsically more suited than others for certain services. For instance, batteries provide rapid response to signals, opening the way for new, high-value system services.

- Electricity storage could accelerate off-grid electrification, enable far higher shares of VRE, and indirectly help to decarbonise the transport sector.

- Poor accounting for storage value results in so-called “missing money”, with market revenues too low to entice investors.

- IRENA’s ESVF modelling methodology shows how to overcome the valuation challenge and properly assess the value of electricity storage to the power system.