New IRENA Report Presents Options to Boost Renewable Energy Investment

Newsletter

Beijing, China, 30 June 2016 – A new report released today on the margins of the G20 Energy Ministers meeting in Beijing provides policy makers, financial institutions and project developers with a range of options to help scale up investment in renewable energy.

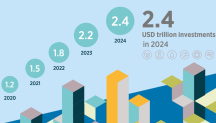

To meet global climate and sustainable development goals, investment in renewable energy must double by 2020 and more than triple by 2030. Unlocking Renewable Energy Investment: the role of risk mitigation and structured finance, finds that reaching this level of investment is entirely possible. It will require policymakers and public finance institutions to employ a portfolio of approaches that target different investment constraints facing private finance, which will make up the majority of new investment in renewables.

“Renewables lie at the heart of the global energy transformation, which offers an economically attractive answer to energy security, energy access and climate change,” said Adnan Z. Amin, IRENA Director-General. “Markets worldwide can respond to the economic realities of renewables today and attract large-scale investors into the renewables sector.”

“This new report demonstrates that scaling up renewable energy investment to the levels required is possible through policy and financial tools at hand today,” added Mr. Amin. “Governments and other stakeholders now have the tools to take the actions needed to meeting global climate and sustainable development goals.”

The report analyses various financial instruments and structures and offers an all-in-one guide to scale up renewable energy investment worldwide. Case studies and survey results provide insights on challenges, opportunities and best-practices in different markets. The report identifies five main action areas where policy makers and public finance institutions can address risks and barriers facing renewable energy projects:

- Tools and grants to support project preparation are vital to advance renewable energy projects from initiation to full investment maturity.

- Governments and public finance institutions should increase financing of local financial institutions and design on-lending facilities to improve access to capital and build local lending capacity.

- Public finance institutions should focus on leveraging private investment by increasing the use of existing guarantees and developing new, targeted risk mitigation instruments to address power-off taker, currency and liquidity risks.

- Capital market players should increasingly shift to standardised project documentation and processes to allow for the aggregation of projects while governments develop guidelines for green bonds issuance to mobilise more capital market investment.

- In accordance with the G20 Toolkit of Voluntary Options for Renewable Energy Deployment, dedicated financing facilities can be developed to issue risk mitigation instruments and support design and implementation of structured finance mechanisms for renewables.

Download the full report here.