World Energy Transitions

Outlook 2022

Executive Summary

In 2022, the need for the energy transition has become even more urgent.

Compounding crises underscore the pressing need to accelerate the global energy transition. Events of recent years have accentuated the cost to the global economy of a centralised energy system highly dependent on fossil fuels. Oil and gas prices are soaring to new highs, with the crisis in Ukraine bringing new levels of concern and uncertainty. The COVID-19 pandemic continues to hamper recovery efforts, while citizens worldwide worry about the affordability of their energy bills. At the same time, the impacts of humancaused climate change are increasingly evident around the globe. The Intergovernmental Panel on Climate Change (IPCC) warns that between 3.3 and 3.6 billion people already live in settings highly vulnerable to climate change.

Short-term interventions to ameliorate immediate challenges must be accompanied by a steadfast focus on a successful energy transition in the medium and long term. Governments today shoulder the challenging task of tackling seemingly opposing agendas of energy security, resilience, and affordable energy for all. In the face of uncertainty, policy makers must be guided by the overarching goals of arresting climate change and ensuring sustainable development. Any other approach, notably investing in new fossil fuel infrastructure, will only perpetuate the existing risks and raise the long-established threats of climate change.

Acceleration of the energy transition is essential for long-term energy security, price stability and national resilience

Given the inadequate pace and scope of the transition, anything short of radical and immediate action will diminish – possibly eliminate – the chance of staying on the 1.5°C or even 2°C path. In 2021, IRENA stressed the importance of a wide-ranging shift in the current trajectory across all energy uses. While some progress has been made, it falls woefully short of what is required. The stimulus and recovery efforts associated with the pandemic have also proved a missed opportunity, with only 6% of the G20’s1 USD 15 trillion in recovery funding in 2020 and 2021 being channelled towards clean energy (Nahm et al., 2022).

Acceleration of the energy transition is also essential for long-term energy security, price stability and national resilience. Some 80% of the global population lives in countries that are net energy importers. With the abundance of renewable potential yet to be harnessed, this percentage can be dramatically reduced. Such a profound shift would make countries less dependent on energy imports through diversified supply options and help decouple economies from wide swings in the prices of fossil fuels. This path would also create jobs, reduce poverty, and advance the cause of an inclusive and climate-safe global economy.

Overhauling the plans, policies, fiscal regimes and energy sector structures that impede progress is a political choice. With each passing day the cost of inaction pulls further ahead of the cost of action. Recent developments have demonstrated that high fossil fuel prices, in the absence of alternatives, result in energy poverty and loss of industrial competitiveness. But in the end, it is political will and resolve that will shape the transition path and determine whether it will lead to a more inclusive, equitable and stable world.

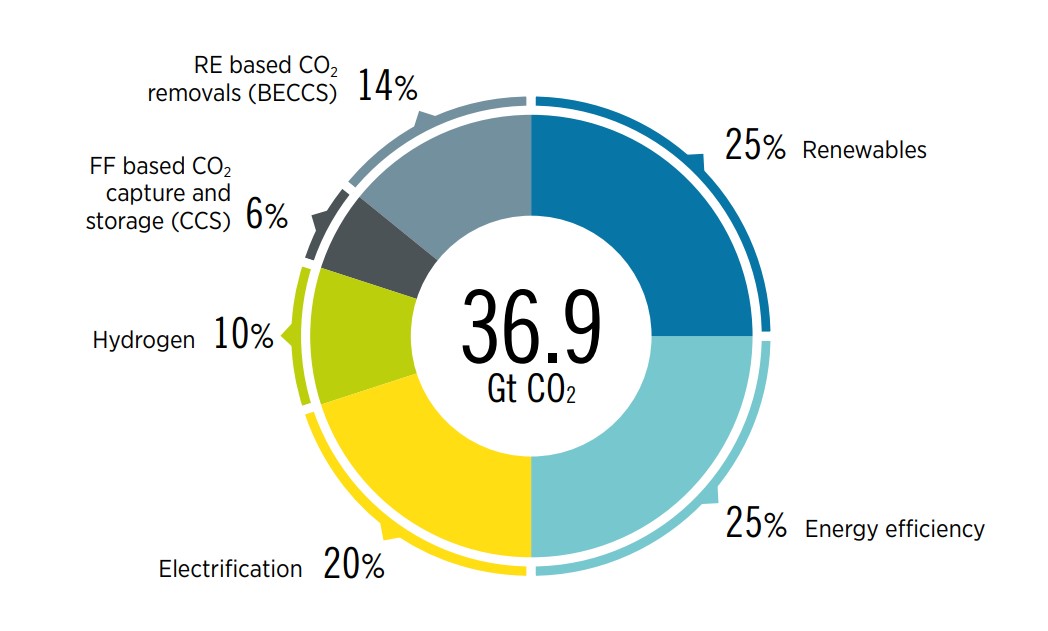

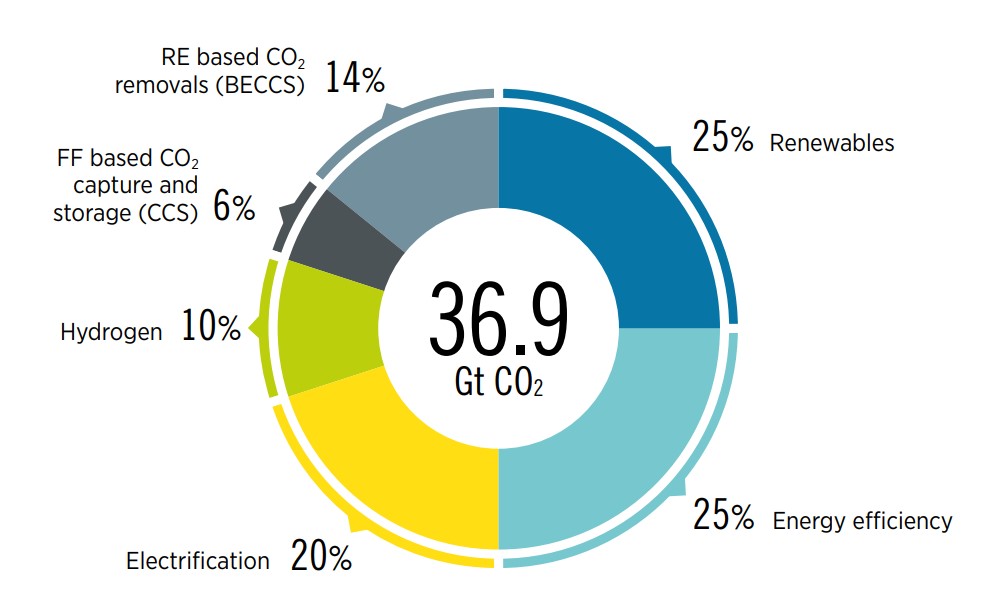

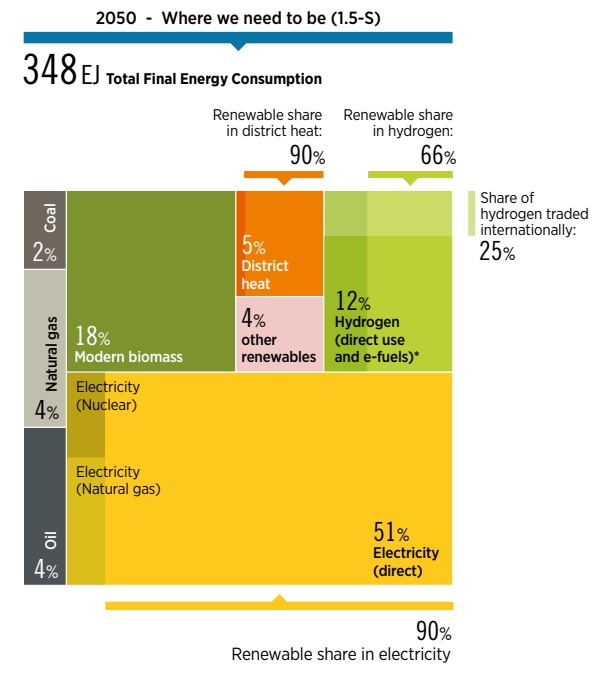

Towards the 2050 goal

IRENA’s 1.5°C pathway positions electrification and efficiency as key drivers of the energy transition, enabled by renewables, hydrogen, and sustainable biomass. This pathway, which requires a massive change in how societies produce and consume energy, would result in a cut of nearly 37 gigatonnes of annual CO2 emissions by 2050. These reductions can be achieved through 1) significant increases in generation and direct uses of renewables-based electricity; 2) substantial improvements in energy efficiency; 3) the electrification of end-use sectors (e.g. electric vehicles and heat pumps); 4) clean hydrogen and its derivatives; 5) bioenergy coupled with carbon capture and storage; and 6) last-mile use of carbon capture and storage (see Figure ES.1).

FIGURE ES.1 Reducing emissions by 2050 through six technological avenues

CCS = carbon capture and storage; BECCS = bioenergy with carbon capture and storage; GtCO2 = gigatonnes of carbon dioxide; RE = renewable energy; FF = fossil fuel..

End-use decarbonisation needs to be given greater priority to reduce reliance on fossil fuels in industry, transport and domestic heating

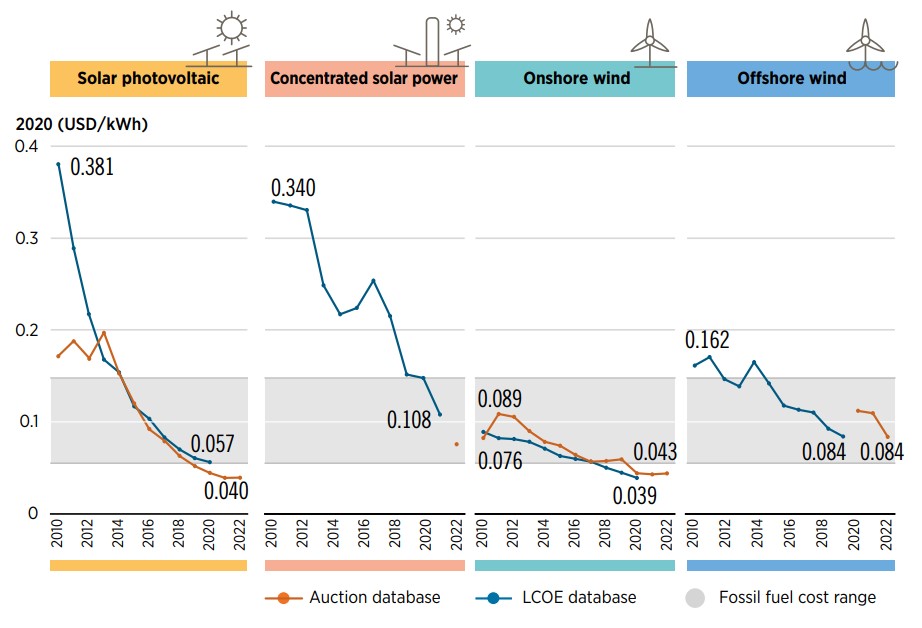

Renewables-based electricity is now the cheapest power option in most regions. The global weighted-average levelised cost of electricity from newly commissioned utility-scale solar photovoltaic (PV) projects fell by 85% between 2010 and 2020. The corresponding cost reductions for concentrated solar power (CSP) were 68%; onshore wind, 56%; and offshore wind, 48%. As a result, renewables are already the default option for capacity additions in the power sector in almost all countries, and they dominate current investments. Solar and wind technologies have consolidated their dominance over time and, with the recent increase in fossil fuel prices, the economic outlook for renewable power is undeniably good.

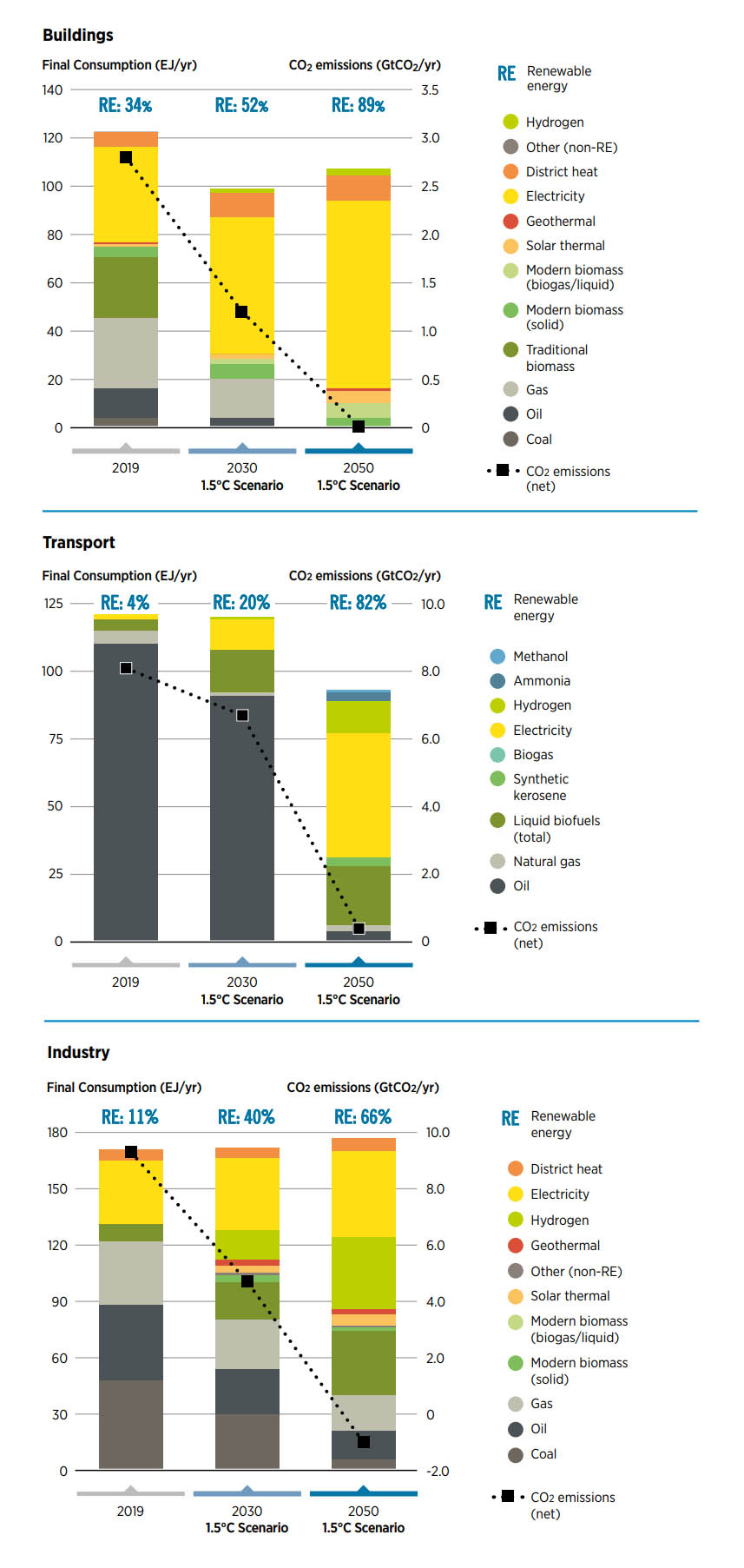

Decarbonisation of end uses is the next frontier, with many solutions provided through electrification, green hydrogen and the direct use of renewables. Despite good global progress in deployment of renewables in the power sector, the end use sectors have lagged, with industrial processes and domestic heating still heavily reliant on fossil gas (see Table ES.1). In the transport sector, oil continues to dominate. In these sectors, deeper penetration of renewables, expanded electrification and improvements in energy efficiency can play a crucial role in alleviating concerns about prices and security of supply.

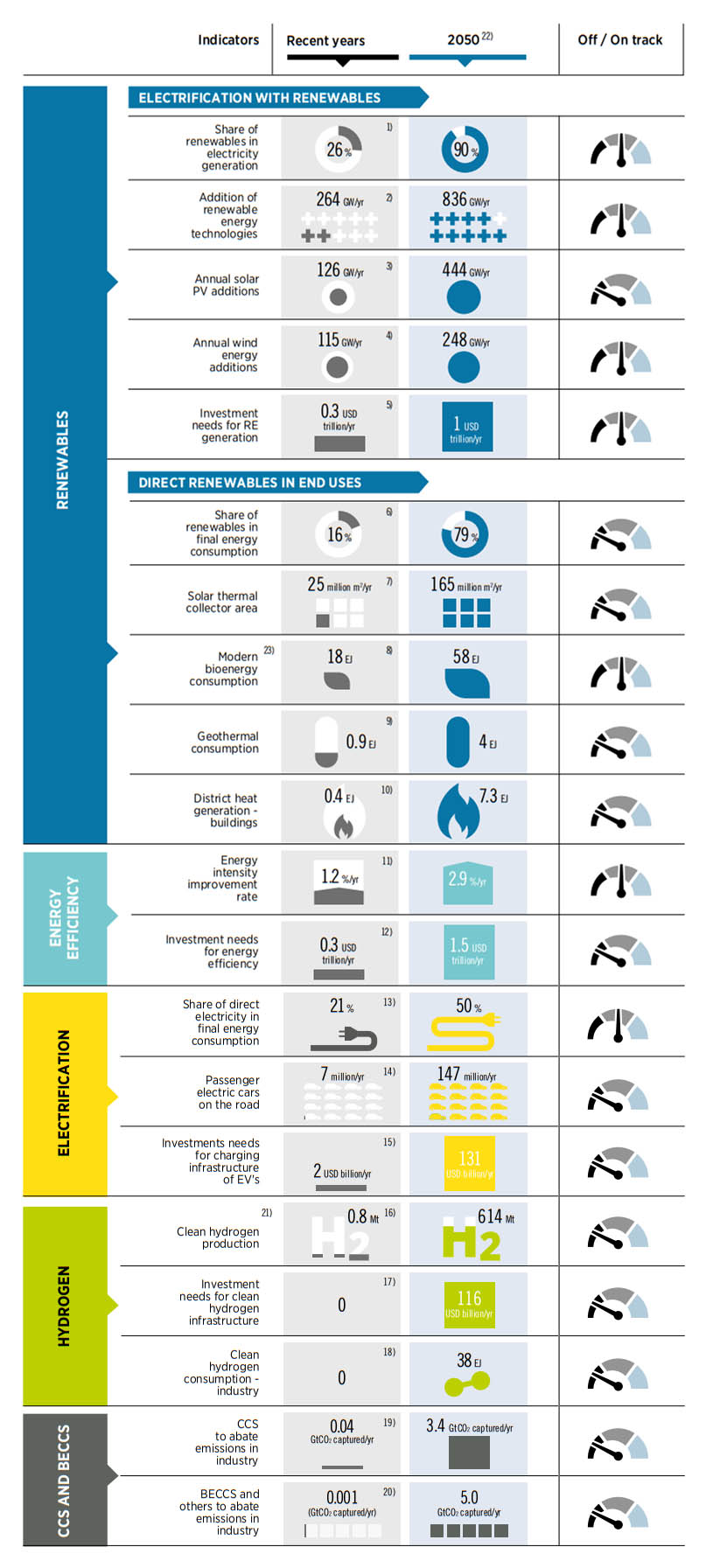

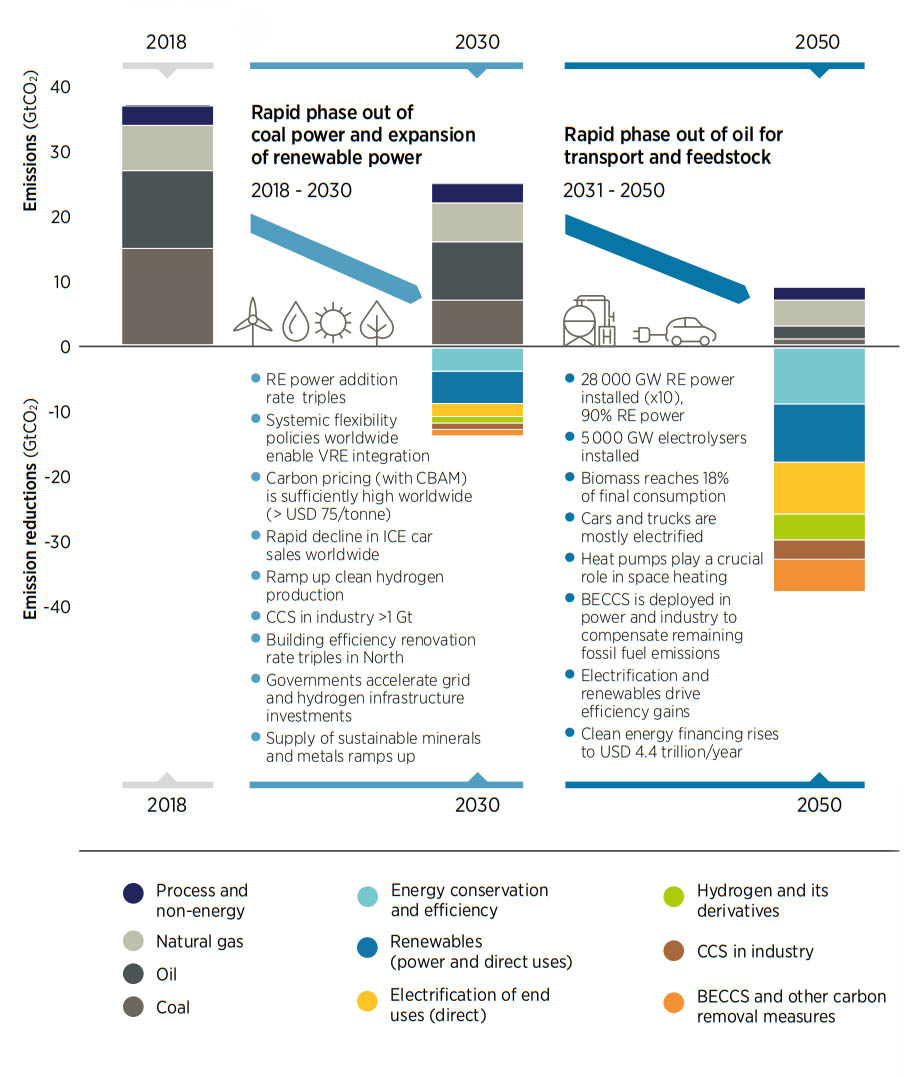

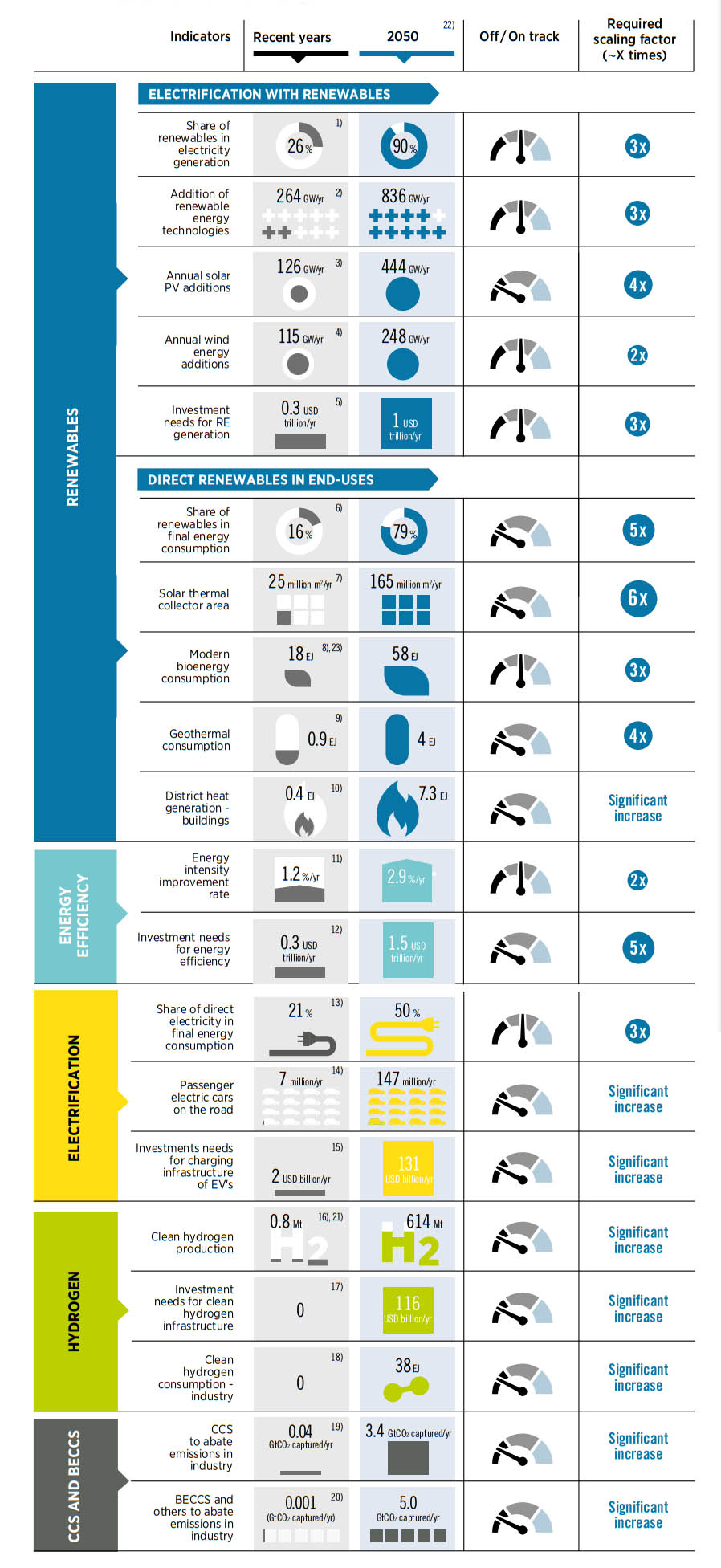

Despite some progress, the energy transition is far from being on track, and radical action is needed to change its current trajectory. Achieving the 2050 climate target depends on sufficient action by 2030, with the coming eight years being critical for accelerating the renewables-based transition. Any near-term shortfall in action will further reduce the chance of staying on path for the 1.5°C climate goal. Accelerated action is a no-regrets strategy and, when carefully implemented, allows the realisation of the benefits of a just and inclusive energy transition.

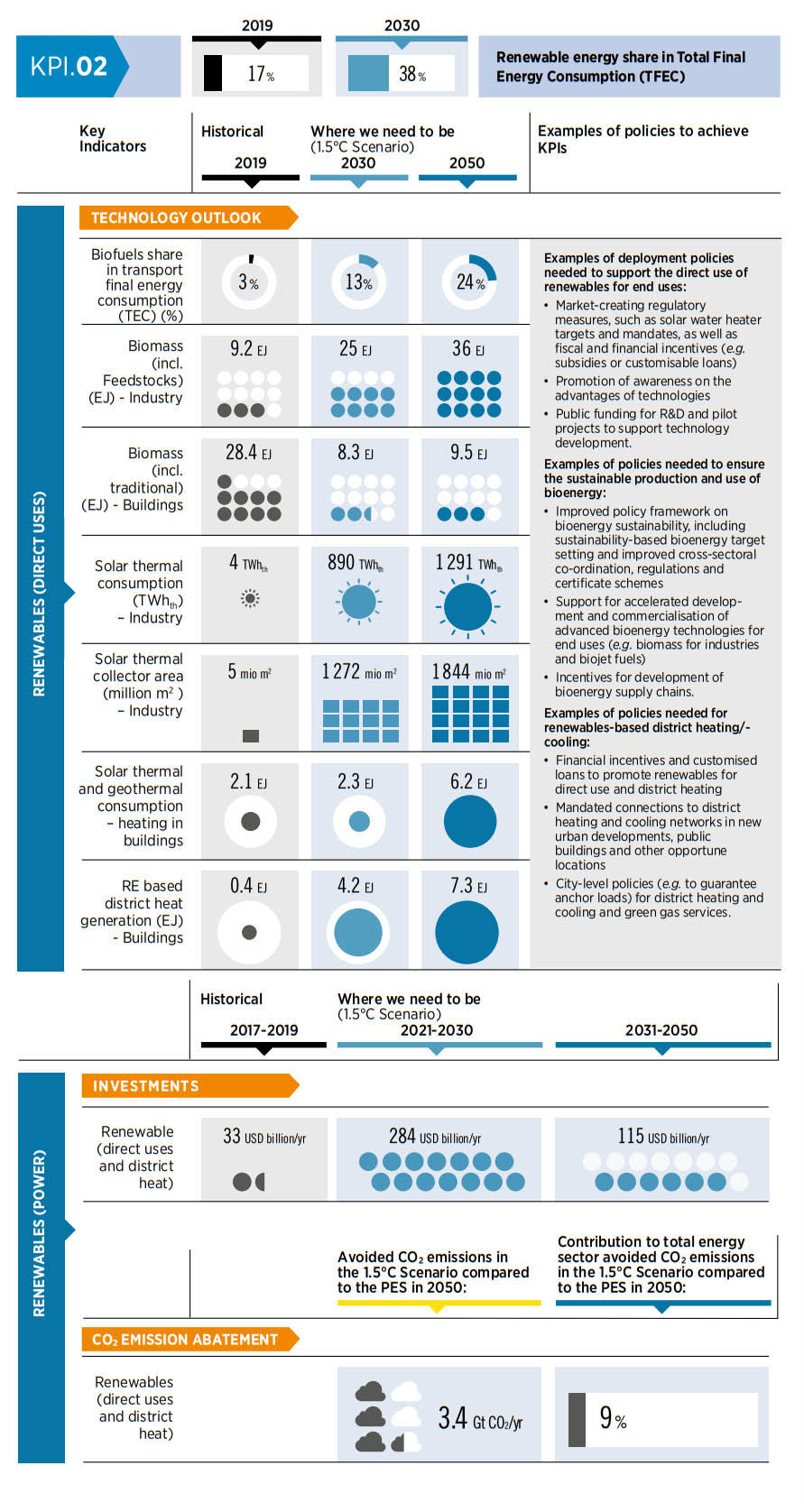

TABLE ES.1 A roadmap to 2050 – tracking progress of key energy system components to achieve the 1.5°C target

2030 priorities

This 2022 edition of the World Energy Transitions Outlook sets out priority areas and actions to reach the 2030 milestone using presently available solutions that can be deployed at scale. Progress will depend on political will, well-targeted investments, and a mix of technologies, accompanied by policy packages to put them in place and optimise their economic and social impact. The top priorities are discussed below; they will have to be pursued simultaneously to put the energy transition on track to the 1.5°C goal.

Resolutely replacing coal power with clean alternatives, notably renewables, is vital. In recent months, gas scarcity and high prices have resulted in a slowdown of the global coal phase out, making an even stronger case for more aggressive deployment of renewables. It is evident that phase out is a complex task for countries heavily reliant on coal, especially given the imperative of a just and fair transition for affected workers and communities. Concerted action and international co-operation are therefore essential for timely progress. Replacing coal in industry must be tackled as well, as almost 30% of all coal is used in iron and steel, cement, and other industries. The coming years will be decisive for innovation, industry action, and international co-operation in these sectors.

Phasing out fossil fuels assets should be done in tandem with measures to eliminate market distortions and incentivise energy-transition solutions. This will involve phasing out fossil fuel subsidies and ensuring that the full costs (environmental, health and social) of burning fossil fuels are reflected in their prices, thereby eliminating existing market distortions. Fiscal policies, including carbon pricing, should be implemented and adjusted to enhance the competitiveness of transition-related solutions. Such interventions should be accompanied by a careful assessment of their social and equity impact, particularly on low-income populations, to ensure that they do not exacerbate energy poverty or have other socially regressive effects.

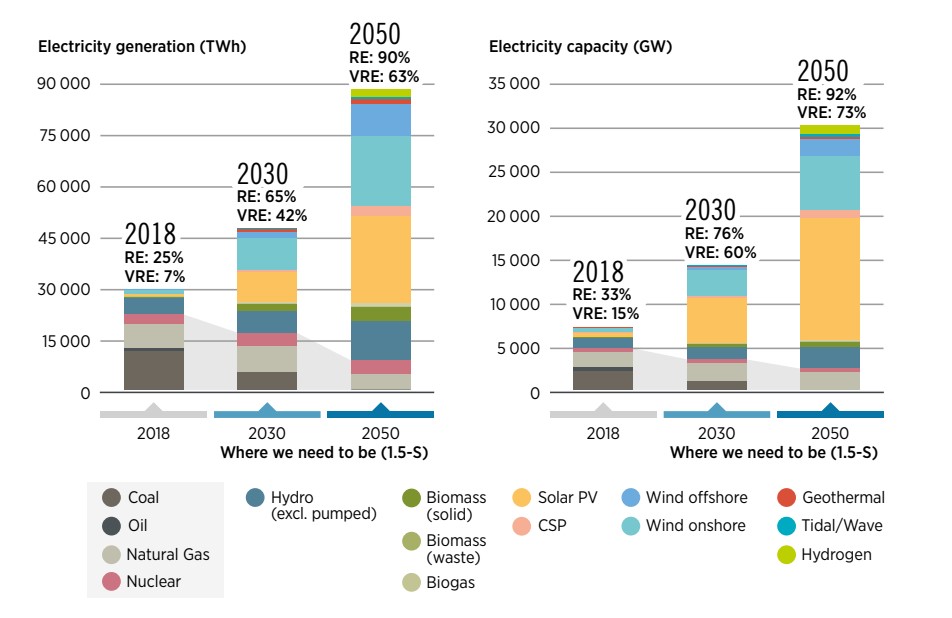

To fulfil the 1.5°C Scenario, the electricity sector will have to be thoroughly decarbonised by mid-century, with solar and wind leading the transformation

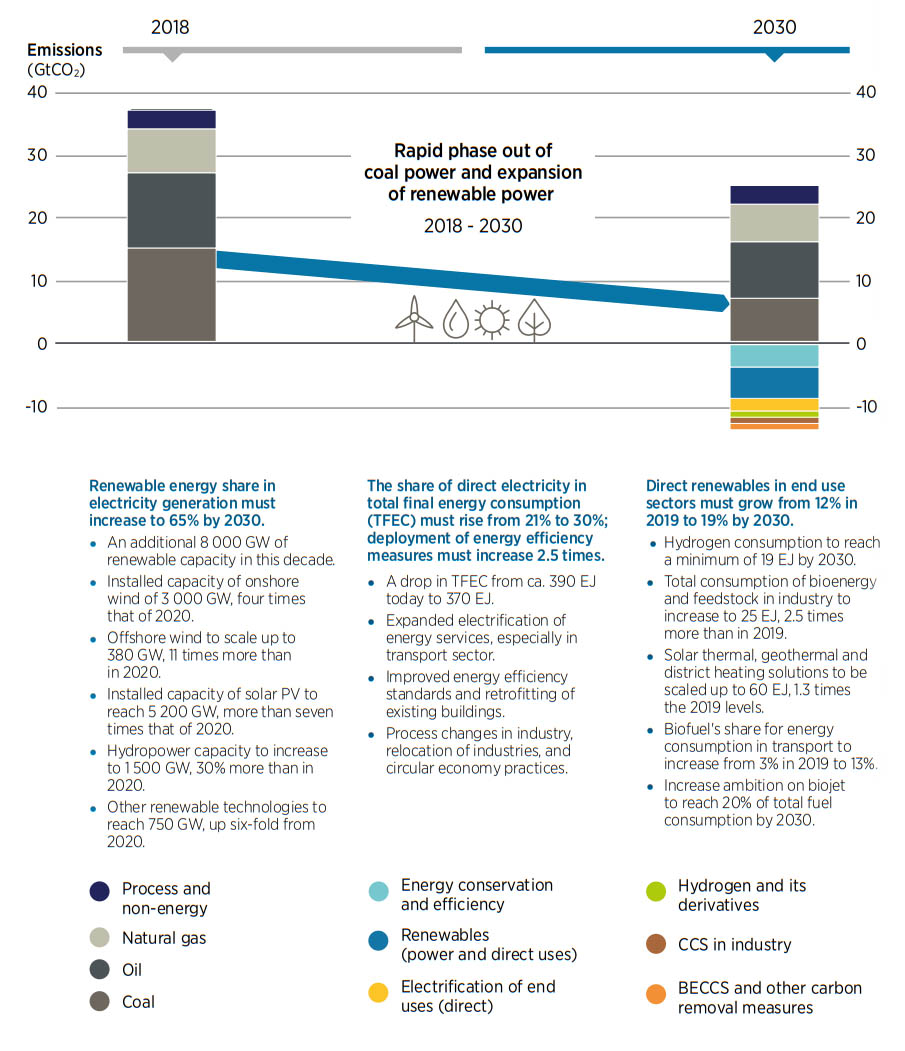

Ramping up renewables, together with an aggressive energy efficiency strategy, is the most realistic path towards halving emissions by 2030, as recommended by the IPCC (see Figure ES.2). In the power sector, renewables are faster and cheaper to deploy than the alternatives. But to meet the IPCC goal, annual additions of renewable power capacity will have to be three times the current rate of deployment. Such an increase is possible if the right conditions are in place. Technology specific targets and policies are especially needed to support less mature technologies, such as ocean energy and CSP.

Infrastructure upgrades, modernisation, and expansion are needed to increase system resilience and build flexibility for a diversified and interconnected system capable of accommodating high shares of variable renewable energy. The idea that fossil gas alone will be required to integrate higher shares of variable solar and wind is being fast overtaken by the improved economics of alternative sources of flexibility. But in addition to many technological solutions, markets will need to be adapted, both in liberalised and regulated systems. The current structure was developed during the fossil fuel era, to reduce operational costs of large, centralised power plants with differing fuel and opportunity costs. In the age of variable renewable energy, electricity should be procured considering the characteristics of decentralised generation technologies, with no fuel or opportunity cost.

FIGURE ES.2 Emission reductions 2018-2030

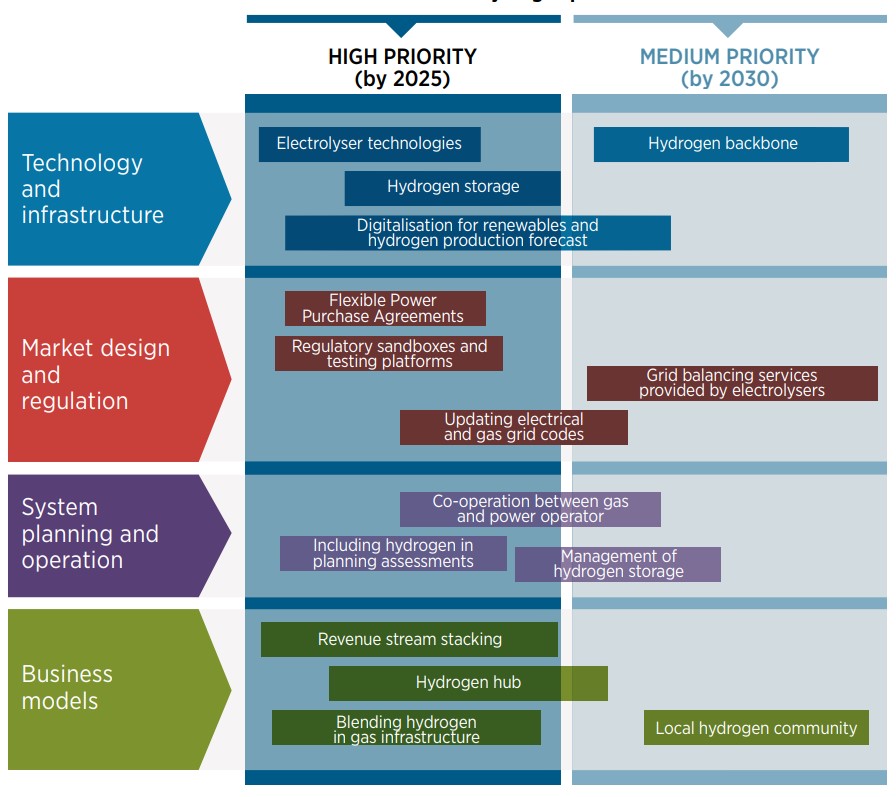

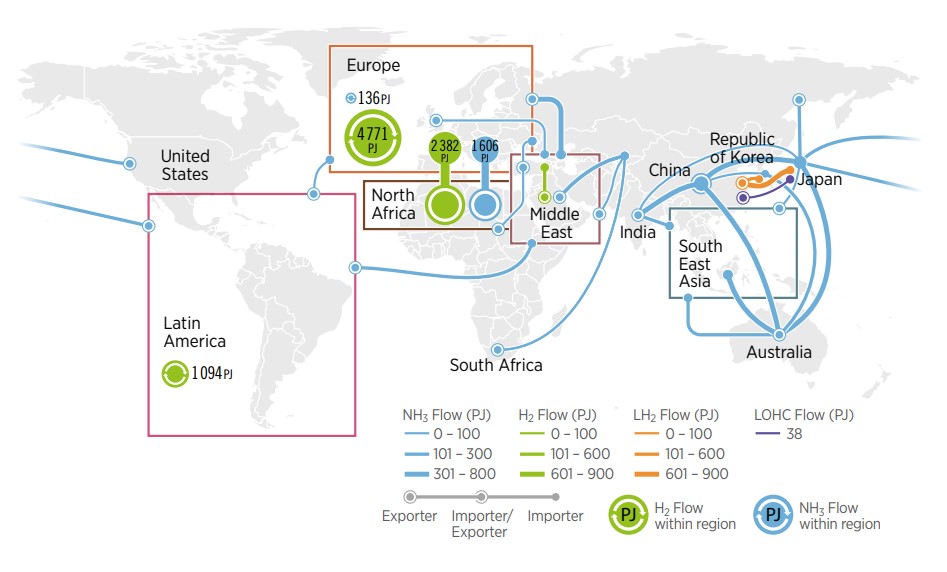

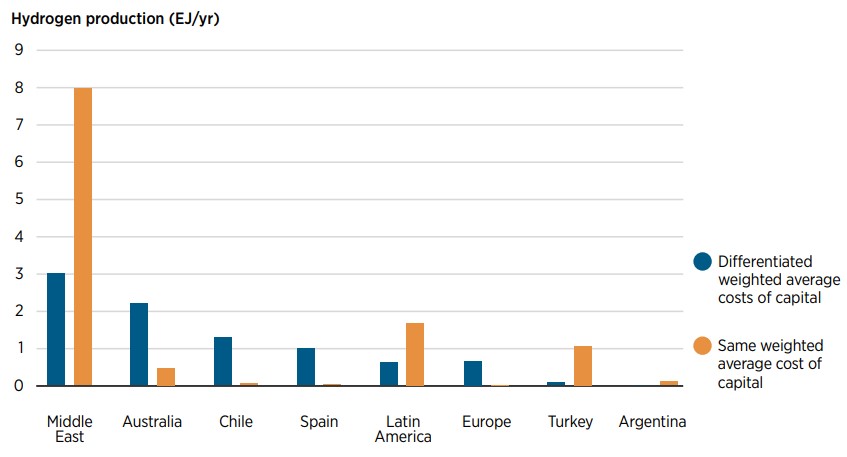

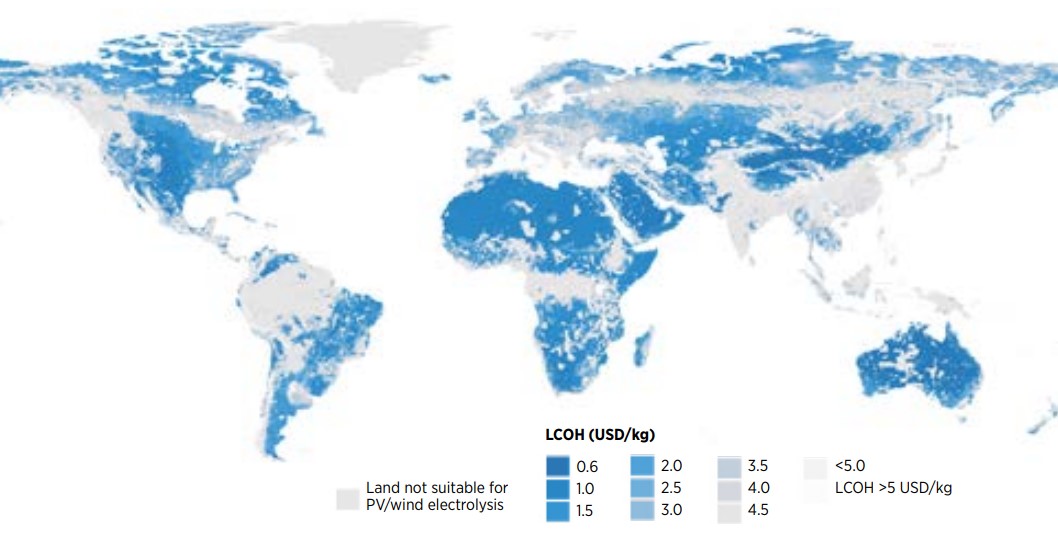

Green hydrogen should move from niche to mainstream by 2030. In 2021, only 0.5 GW of electrolysers were installed; cumulative installed capacity needs to grow to some 350 GW by 2030. Hydrogen commands a great deal of policy attention, so the coming years should bring concrete actions to develop the global market and reduce costs. In this regard, the development of standards and guarantees of origin, along with support schemes to cover the cost gap for green solutions, will ensure that hydrogen offers a meaningful contribution to climate efforts in the long term.

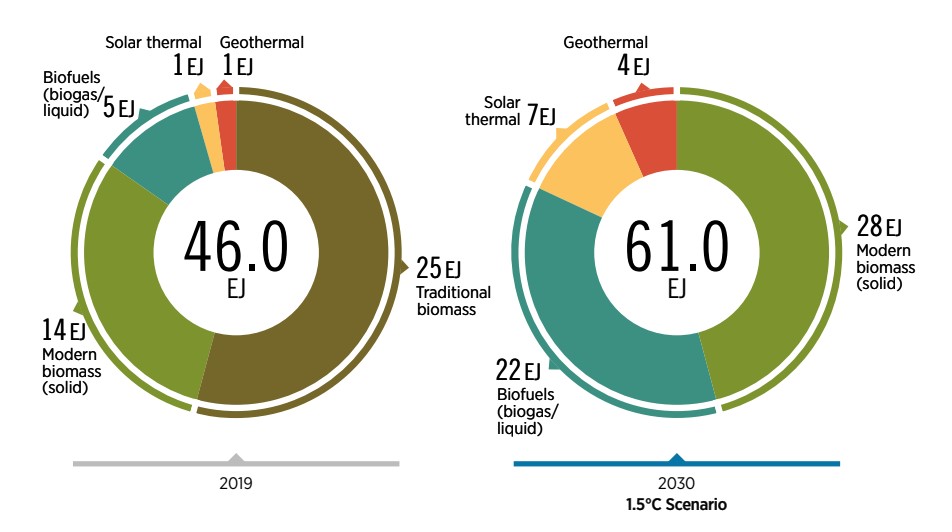

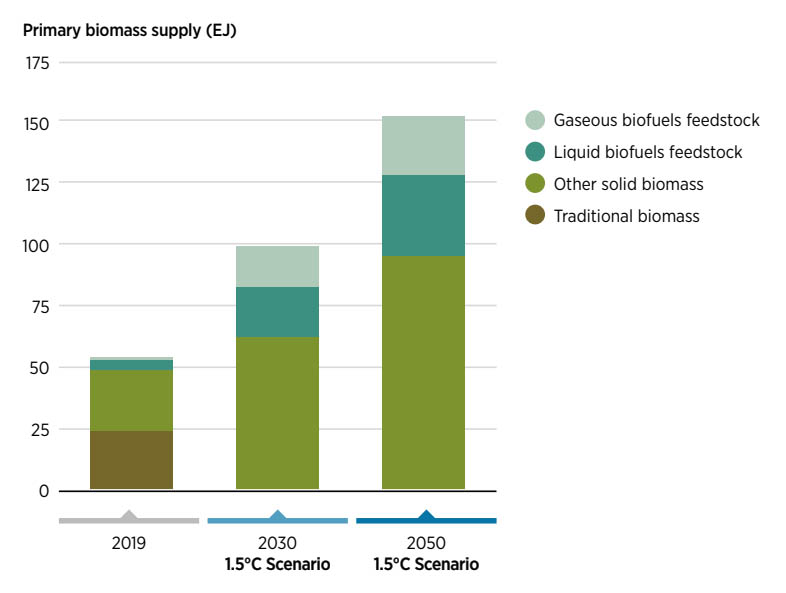

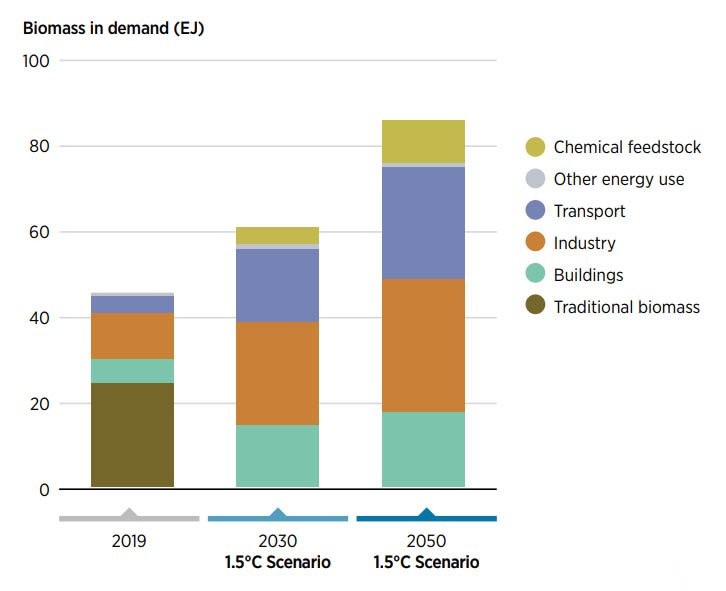

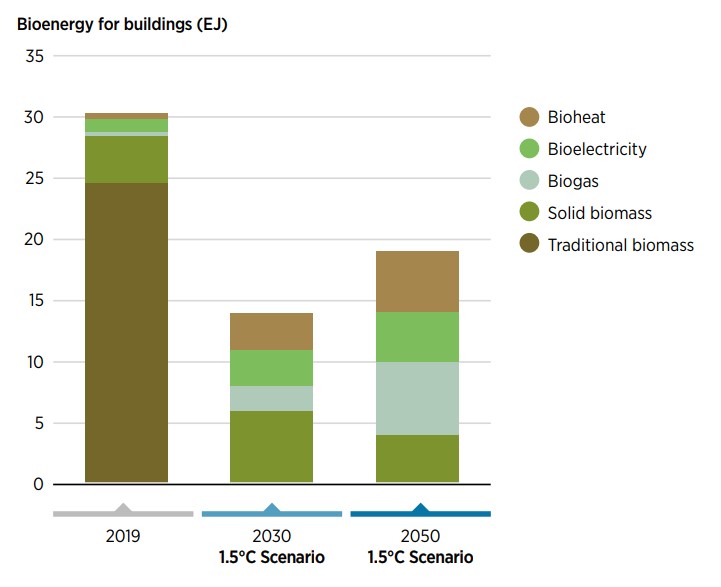

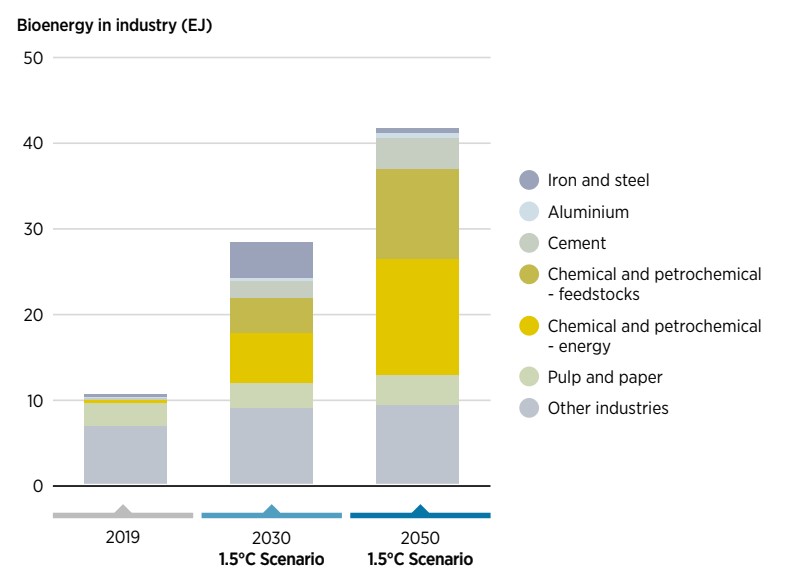

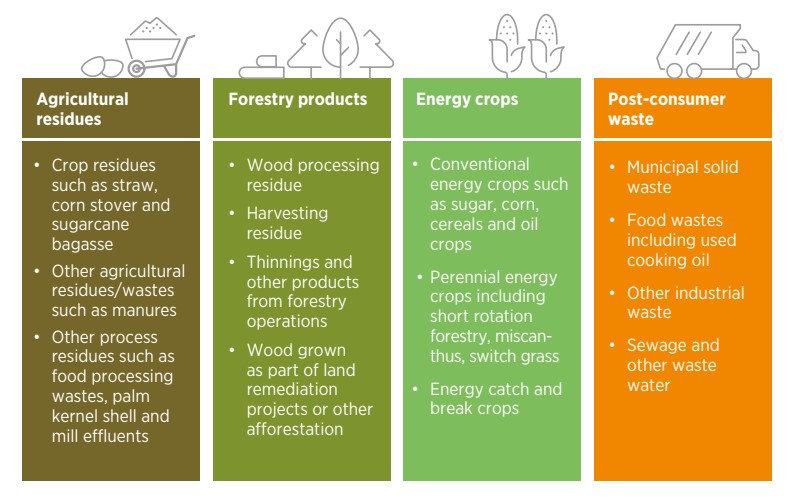

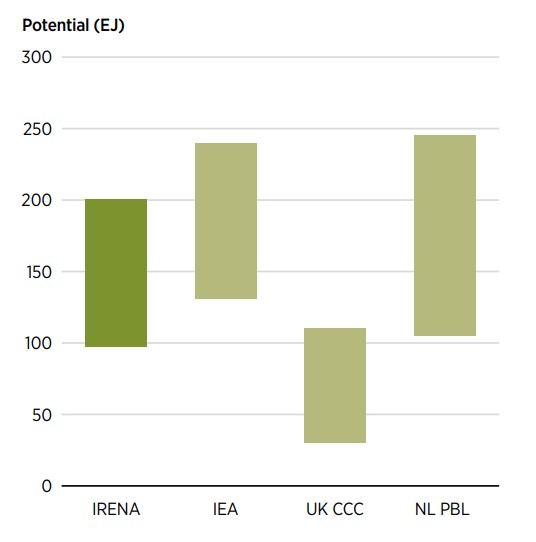

Modern bioenergy’s contribution to meeting energy demand, including demand for feedstock, will have to triple by 2030. At the same time, the traditional use of biomass (such as firewood) needs to be replaced by clean cooking solutions. There is scope for biomass supply to expand, but the expansion will need to be managed carefully to ensure sustainability and minimise adverse outcomes. Policies that promote the wider use of bioenergy need to be coupled with strong, evidence-based sustainability procedures and regulations.

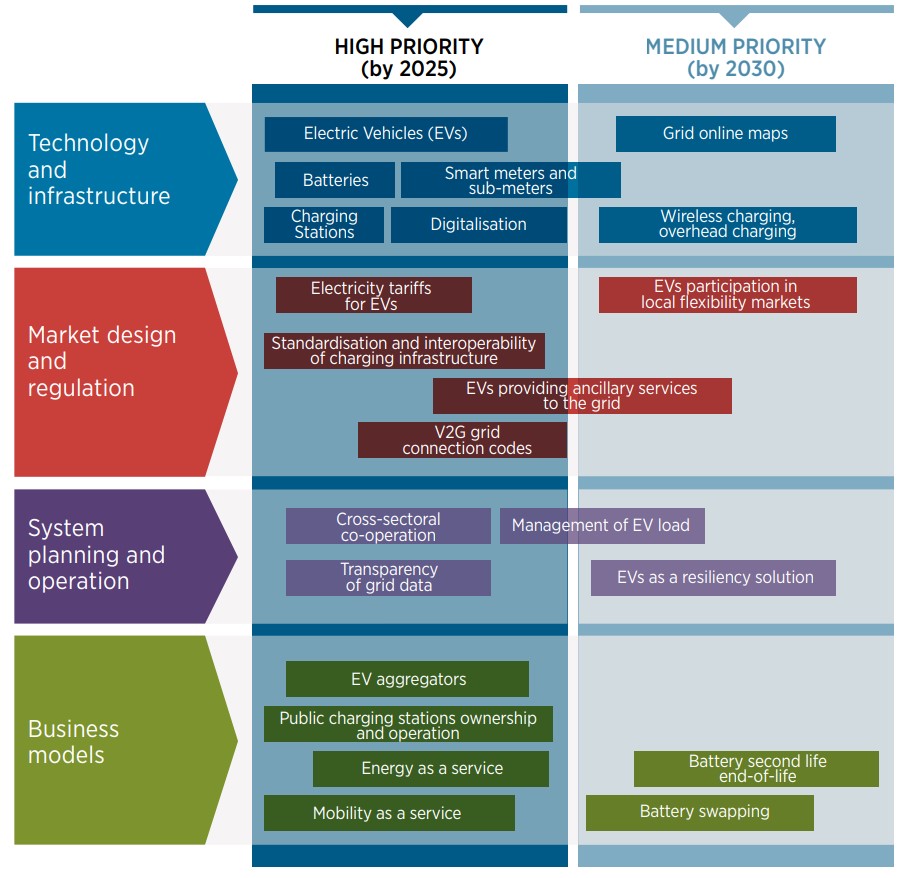

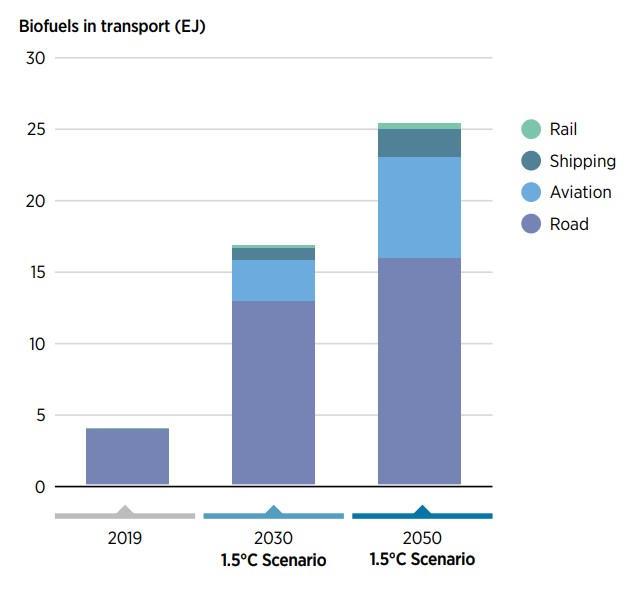

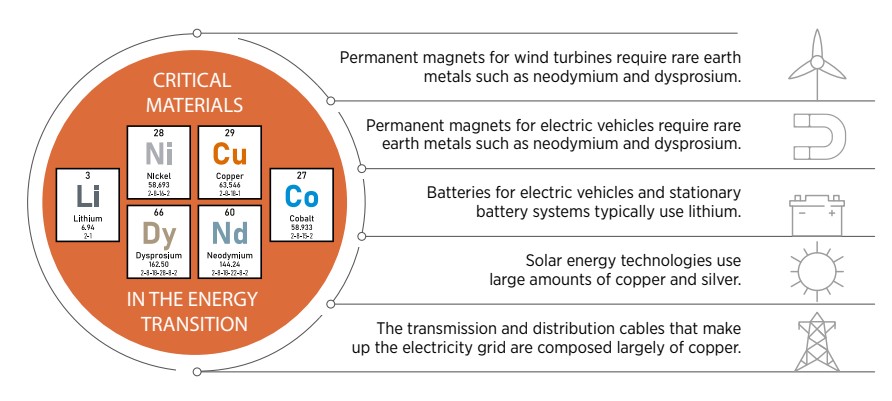

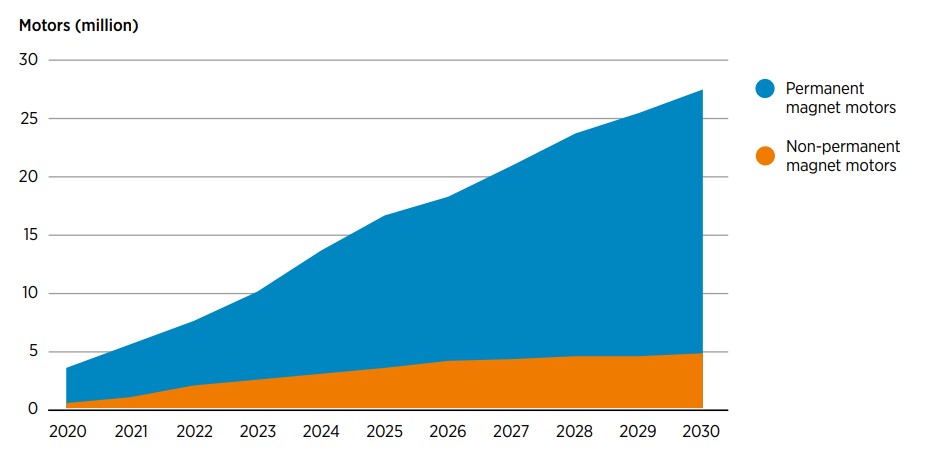

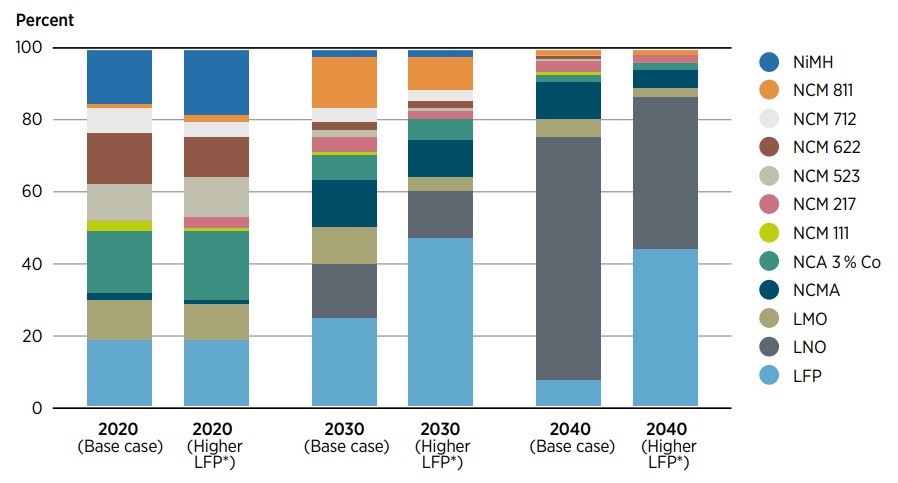

The majority of car sales by 2030 should be electric. Electromobility is a bright light of the energy transition progress, with EVs already at 8.3% of global car sales in 2021 (EV-Volumes, 2022). This share will rise rapidly in the coming years. Annual battery manufacturing capacity is set to quadruple between 2021 and 2025, to approximately 2 500 GWh. However, EV growth ultimately depends on a massive ramp-up of recharging infrastructure in the coming decade, as well as financial and fiscal incentives to promote the uptake of EVs, charger mandates, and bans on combustion engine vehicles. In addition, greater efforts should be made to reduce travel demand and to promote a switch to public transport and cycling where possible.

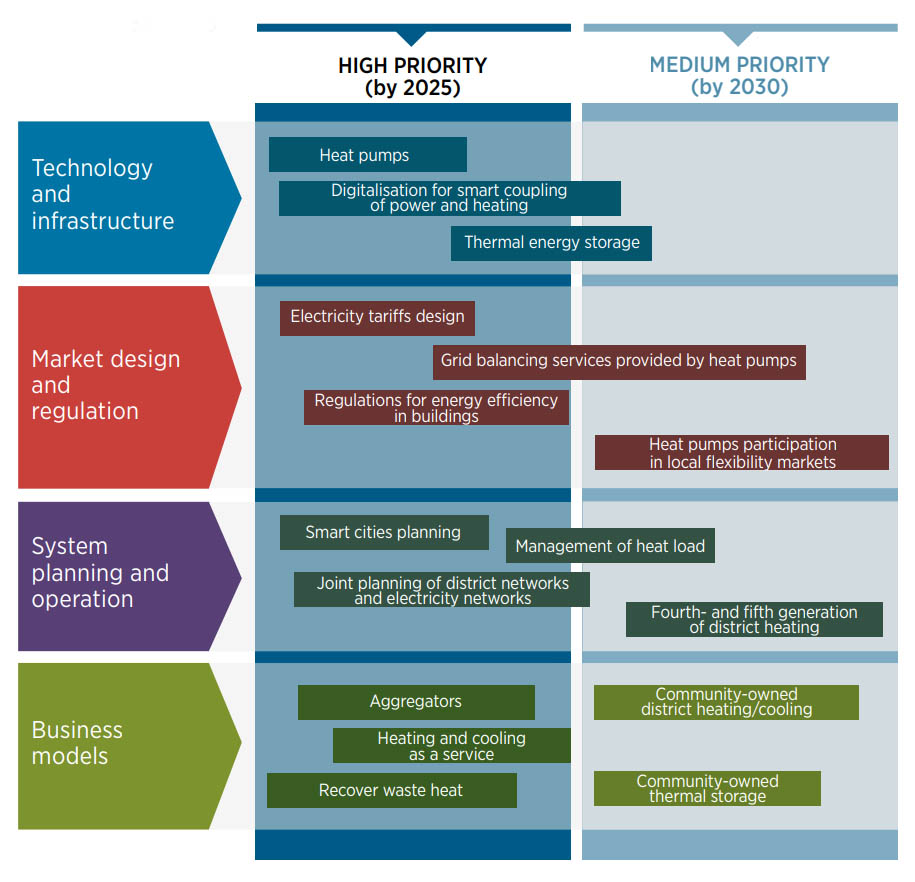

All new buildings must be energy efficient, and renovation rates should be significantly increased. Improving the measures and regulations for buildings can make an immense difference in the near term. Decarbonising heating and cooling will require changes to building codes, energy performance standards for appliances, and mandates for renewables-based heating and cooling technologies, including solar water heaters, renewables-based heat pumps and geothermal heating. The effort to decarbonise heating and cooling will have to be sustained over the coming decades, but the measures just mentioned should be put in place without delay.

Accelerated deployment of green hydrogen and sustainable biomass are key solutions to decarbonise hard-to-abate sectors while also contributing to energy security

It is time for urgent action; countries need to set more ambitious targets and implement measures to ramp up energy efficiency and deployment of renewables

Demand-side management would help alleviate multiple challenges in the short term while contributing to the long-term security of energy and materials supply. Transforming the energy system is not simply about switching energy sources; it extends to ensuring the efficient use of energy across sectors. Innovation, recycling, and the circular economy will play significant roles in the pursuit of efficiency over the medium and long term. The coming years should see increased investment in research and development (R&D) and pilot projects along the value chains of all six of the technological avenues described above. This should be accompanied by efforts to cut unnecessary consumption and to move away from a system based on continuously increasing consumption.

Increasing ambition in national energy plans and in the Nationally Determined Contributions made under the 2015 Paris Climate Agreement must be firm enough to provide certainty of direction and guide investment strategies. The agreement on the Glasgow Climate Pact requested that parties revisit and strengthen the 2030 targets in their NDCs by the end of 2022 in line with the 1.5°C goal set out in the Paris Agreement. In addition to increasing ambition in their revised NDCs, Parties need to develop national implementation plans that include clearly defined targets, including efficiency, renewables and end uses.

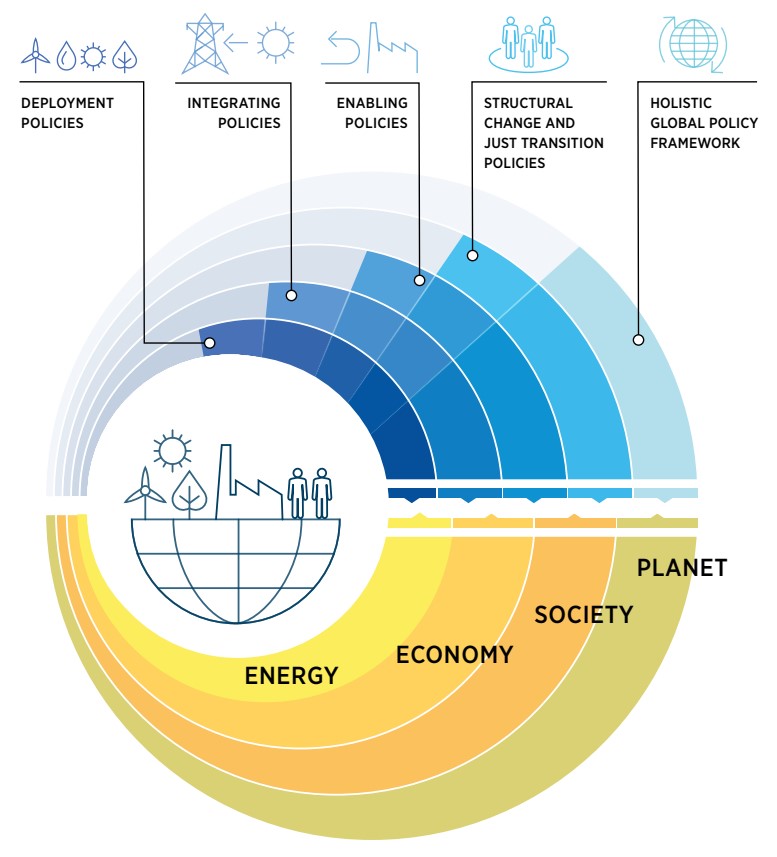

A comprehensive set of policies covering all technological avenues is needed to achieve the necessary levels of deployment by 2030. Deployment policies should support market creation, thus facilitating reductions in technology costs and their scale up and increases in investment levels aligned with energy transition needs. Strong institutions will be needed to co-ordinate structural and just transition policies and manage potential misalignments. Only a holistic global policy framework can bring countries together to orchestrate a just transition that leaves no one behind and strengthens the international flow of finance, capacity and technologies.

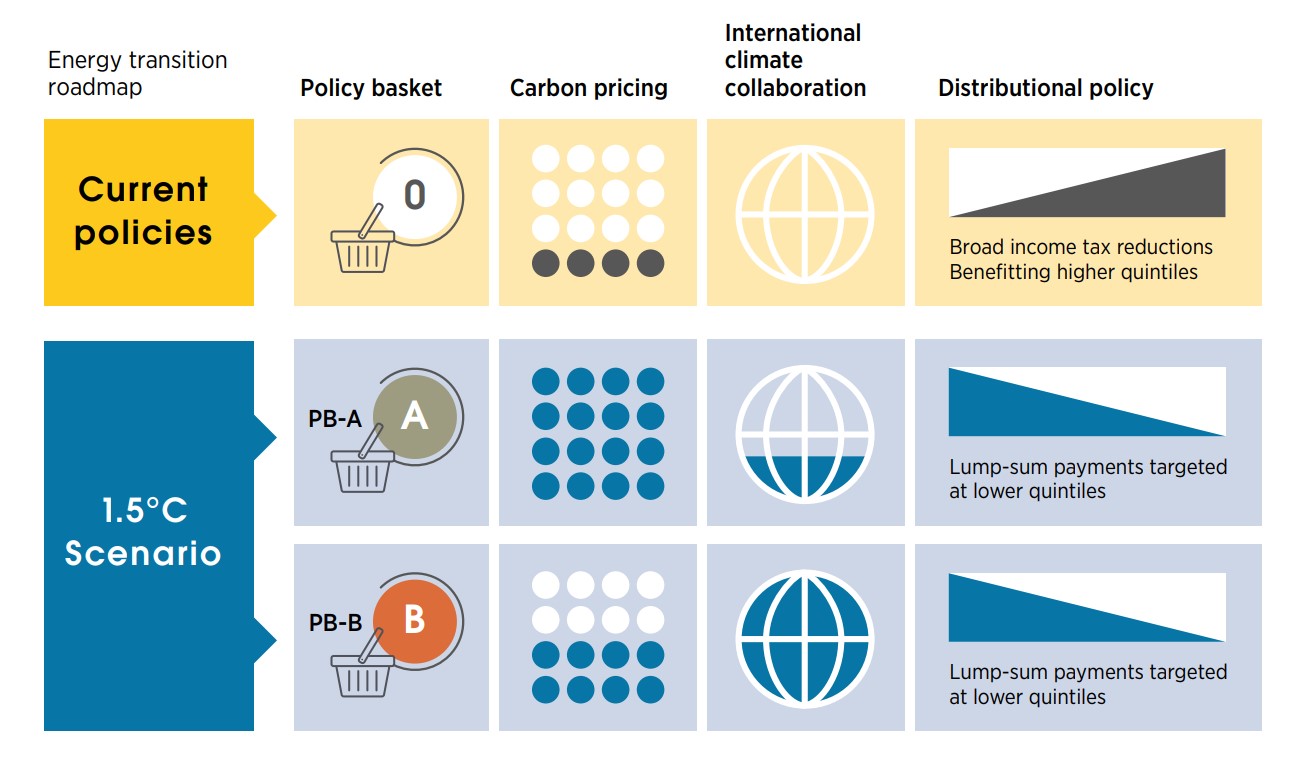

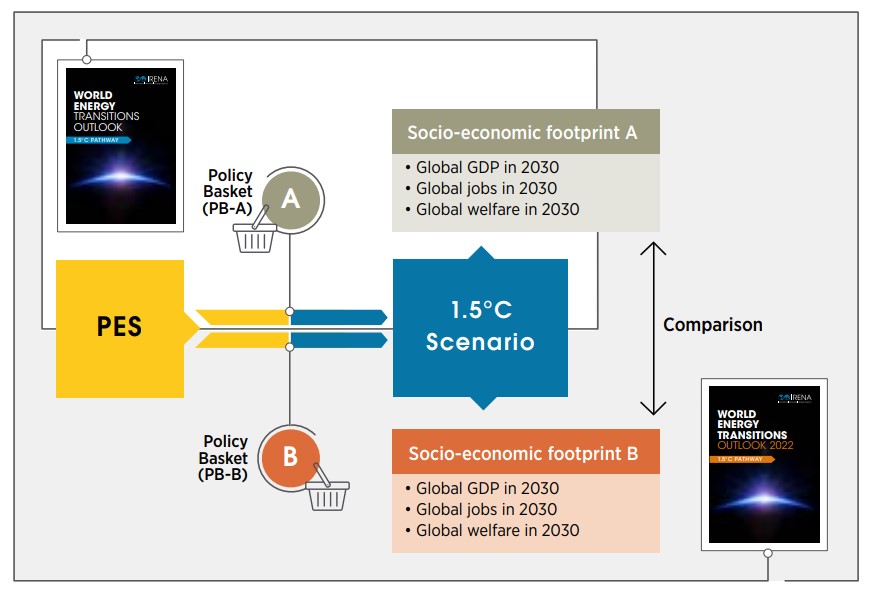

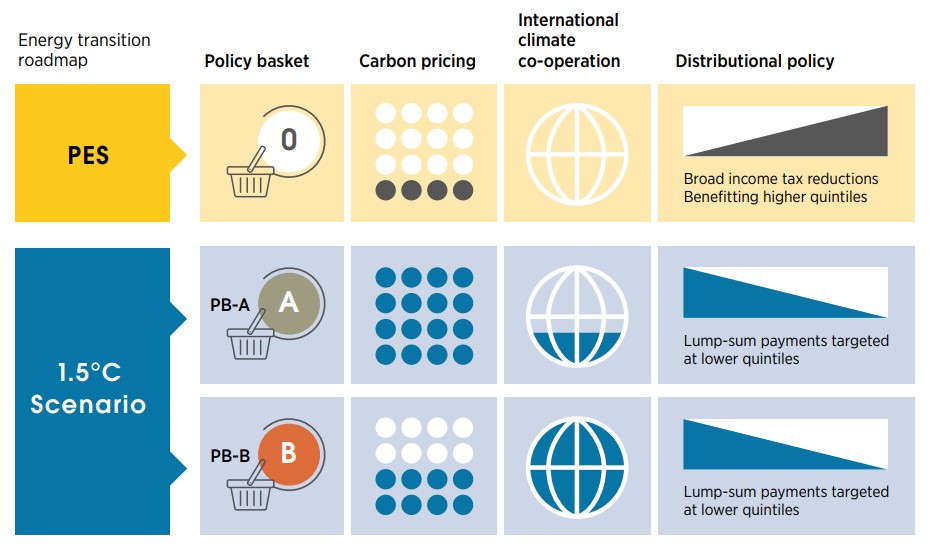

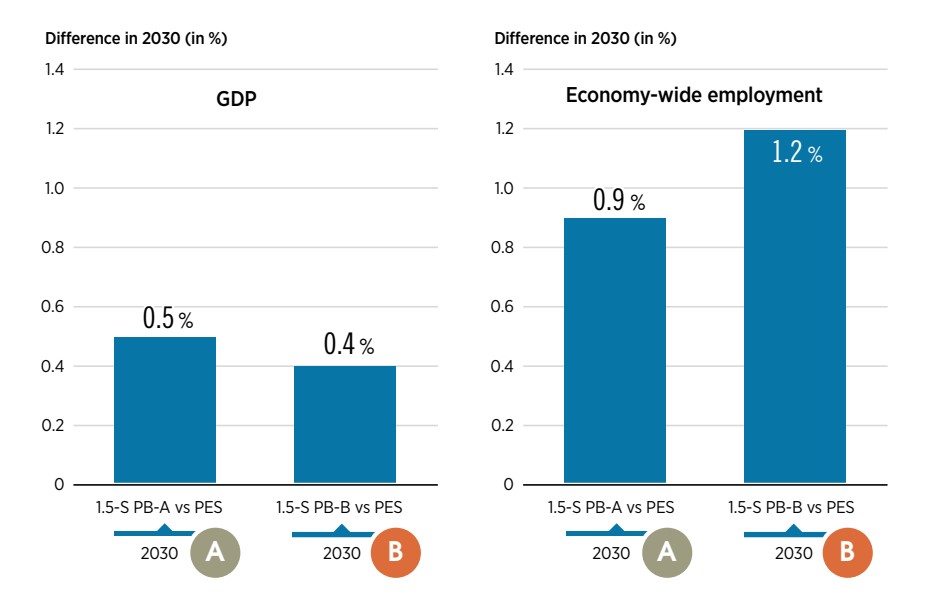

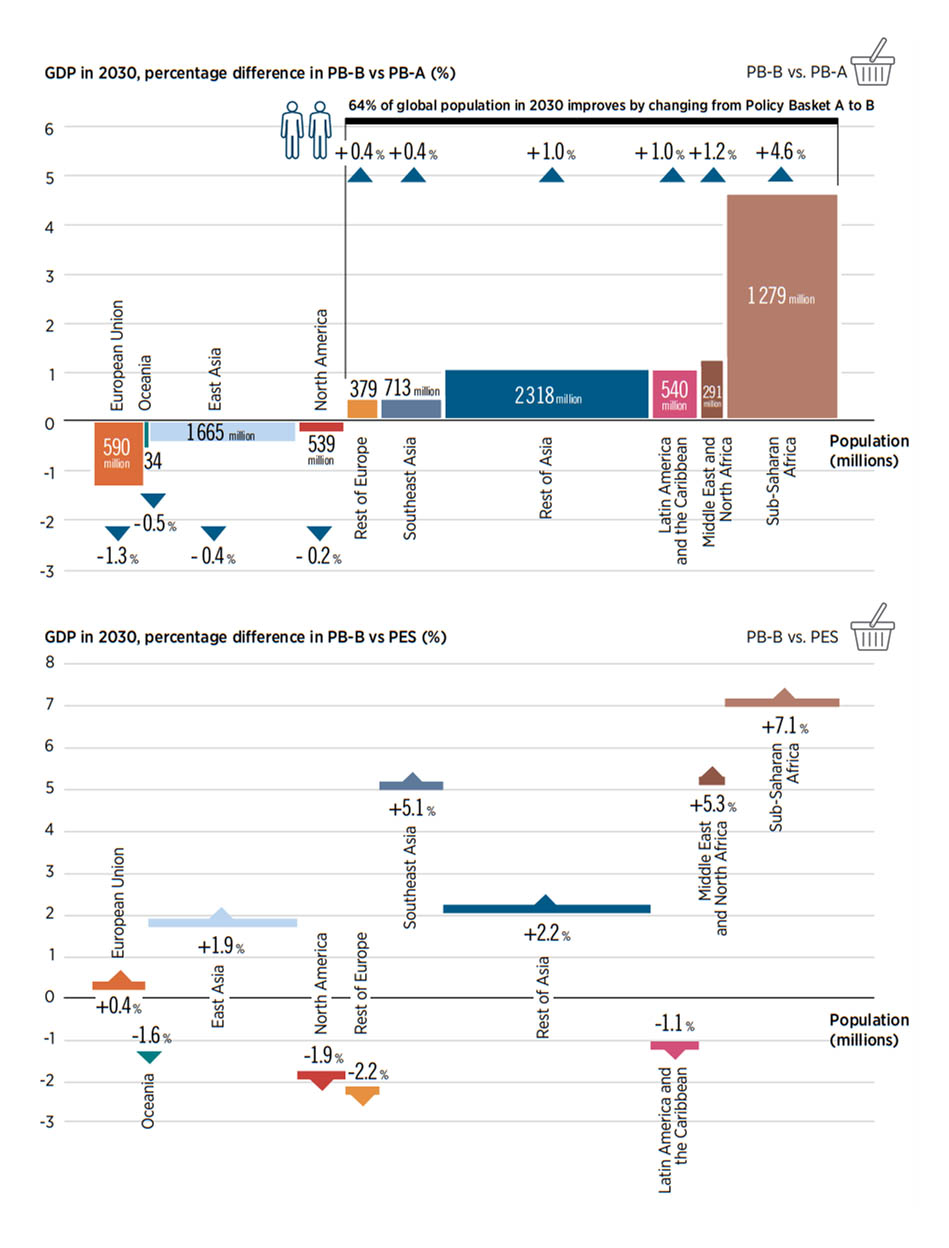

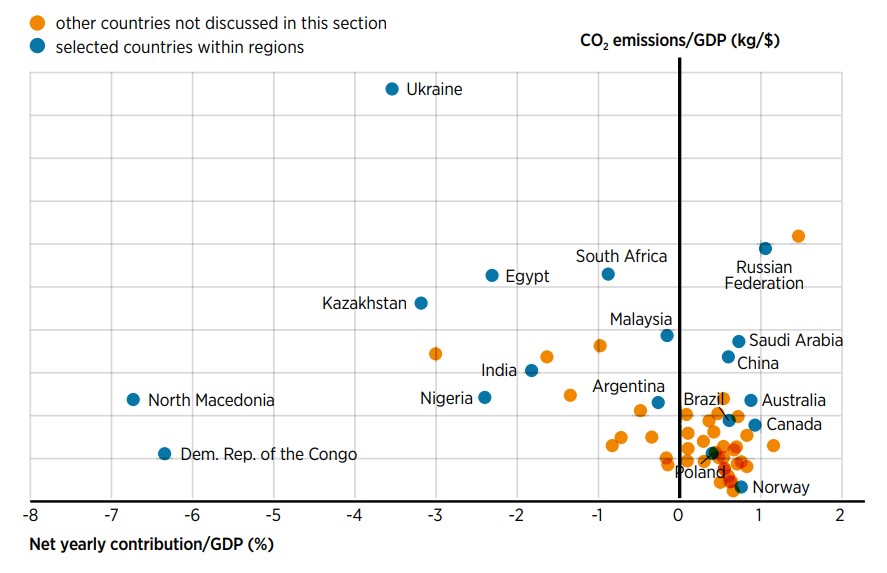

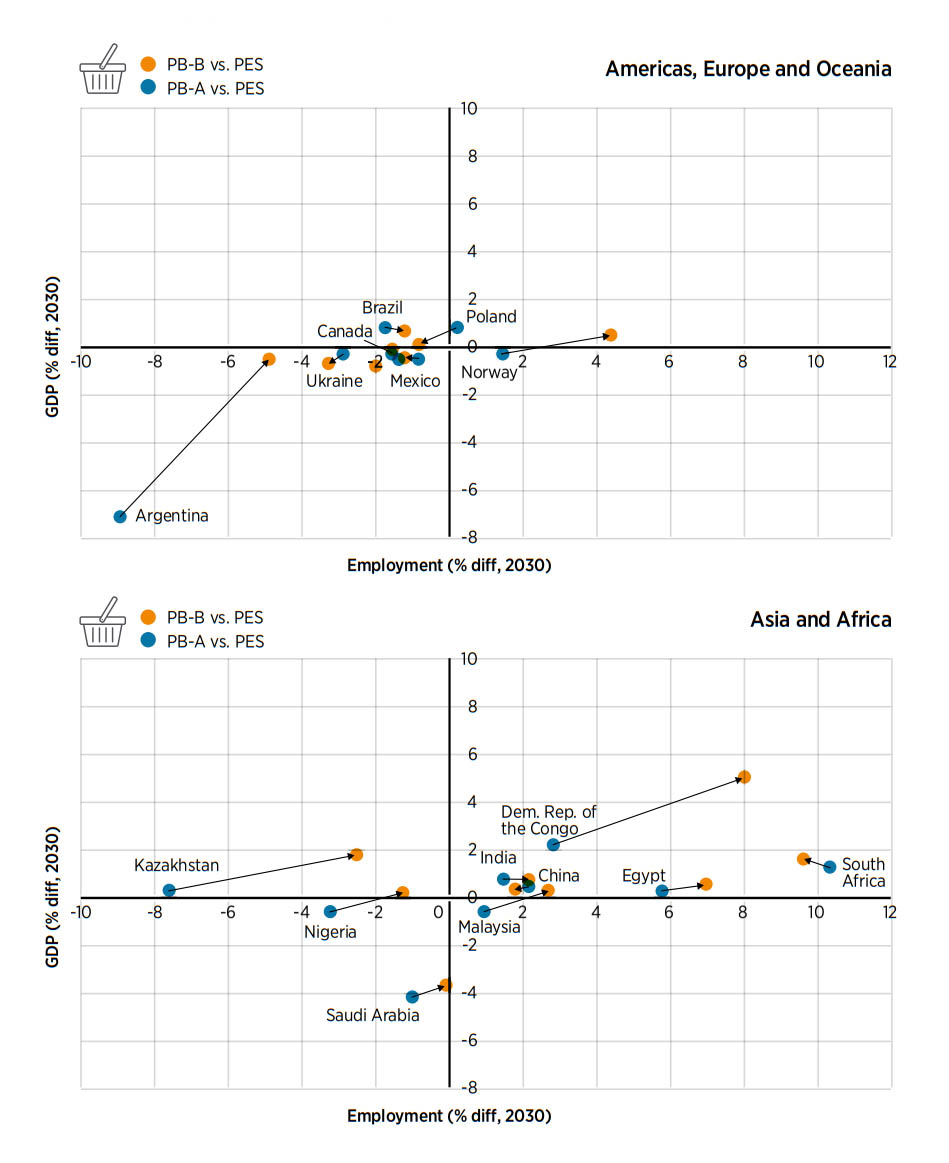

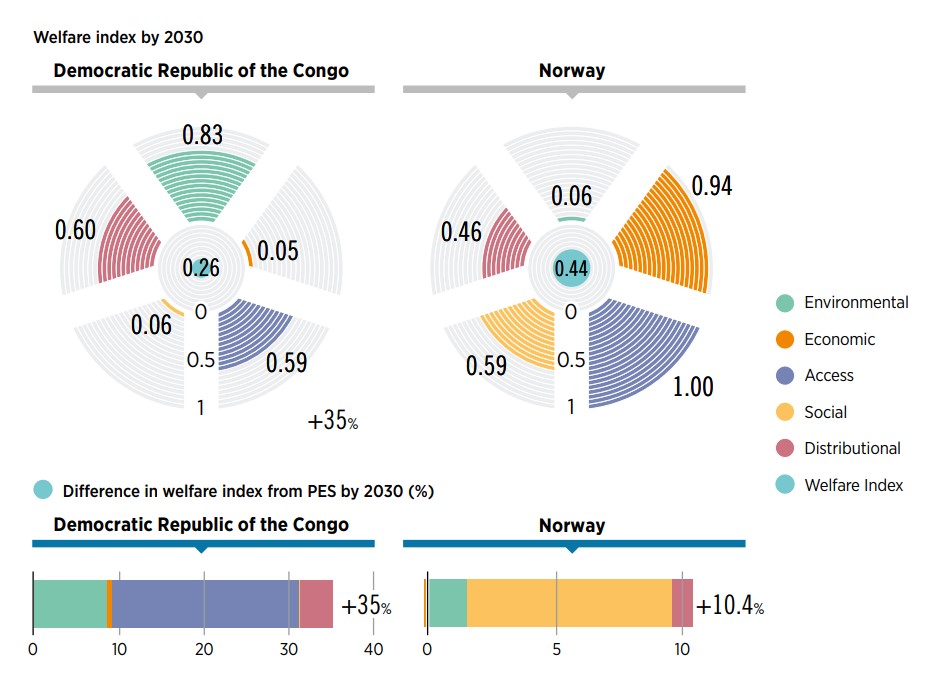

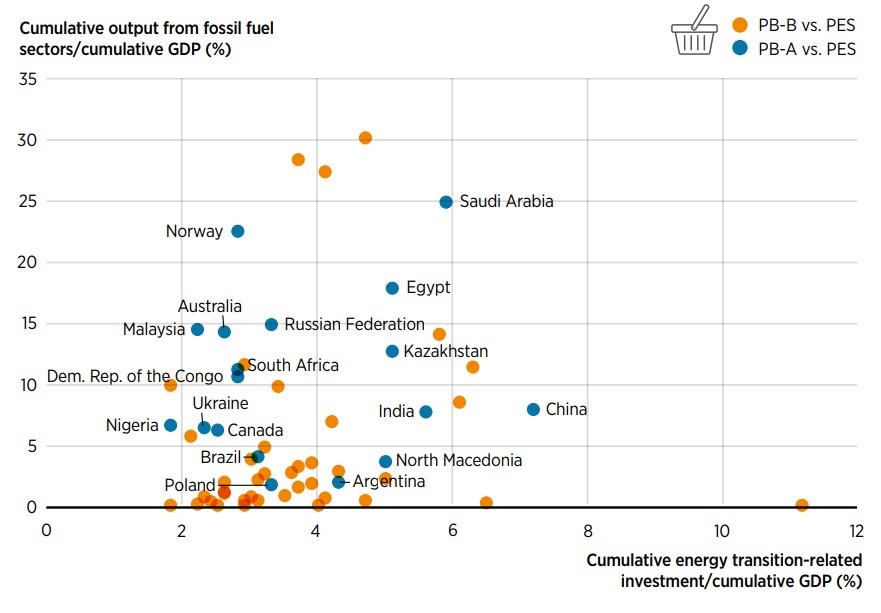

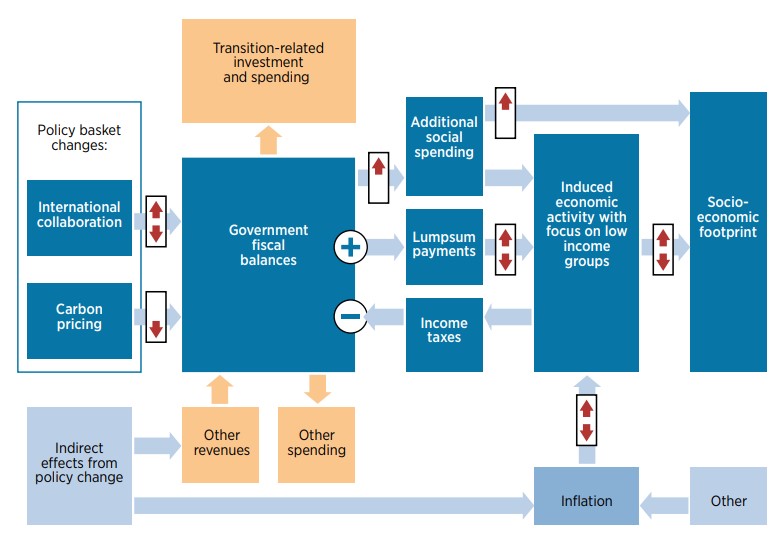

IRENA’s socio-economic analysis shows that progressive policy and regulatory measures generate greater benefits from the energy transition. To gain insights about the impact of different policy baskets, a sensitivity analysis examines how the more ambitious energy transition pathway, 1.5°C Scenario, can result in different socio-economic outcomes depending on variations in international collaboration, carbon pricing, progressive fiscal measures and other government programmes (distributional policy). Figure ES.3 illustrates the main differences between the current Policy Basket (PB-O) and those used for the 1.5°C Scenario in this sensitivity analysis (Policy Baskets A and B).

FIGURE ES.3 Conceptual differences across the policy baskets considered in this analysis

Policy Basket B (PB-B) on the other hand, imposes a lower carbon tax (but still higher than today’s real-world levels), combined with stronger international collaboration.

Policy Basket O (PB-O) current policies

Distributional policy: An additional key difference between the 1.5°C Scenario and current policies lies in the extent to which fiscal revenues and expenditures address distributional issues. Both PB-A and PB-B include more progressive within country distributive policies. The key impact of moving from Policy Basket A to B under the 1.5°C Scenario is the significant improvement in the distribution of socio-economic benefits because of the combined effect of higher international collaboration (between countrydistributional policy), lower carbon pricing and improved within-country distributional policies. Under the more progressive PB-B, a clear majority of the world’s population would be better off.

The way forward

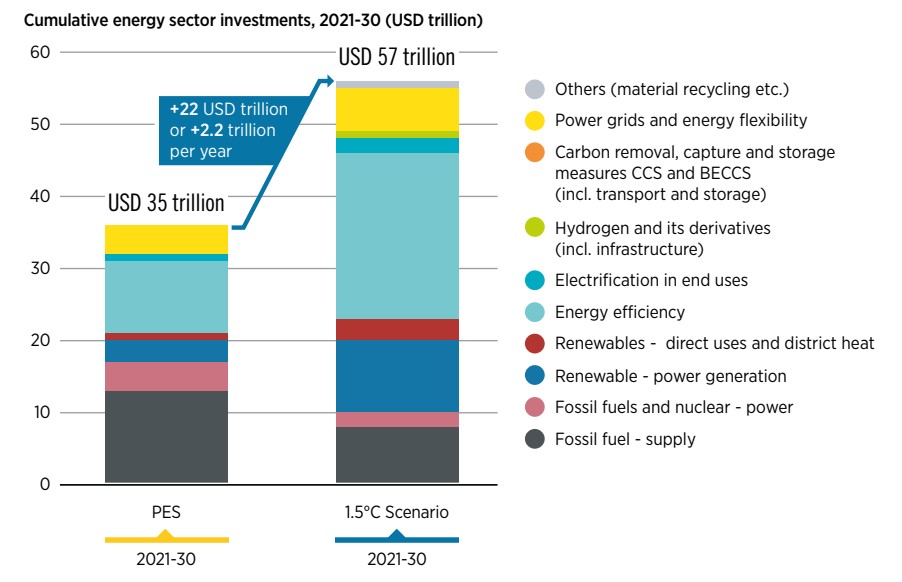

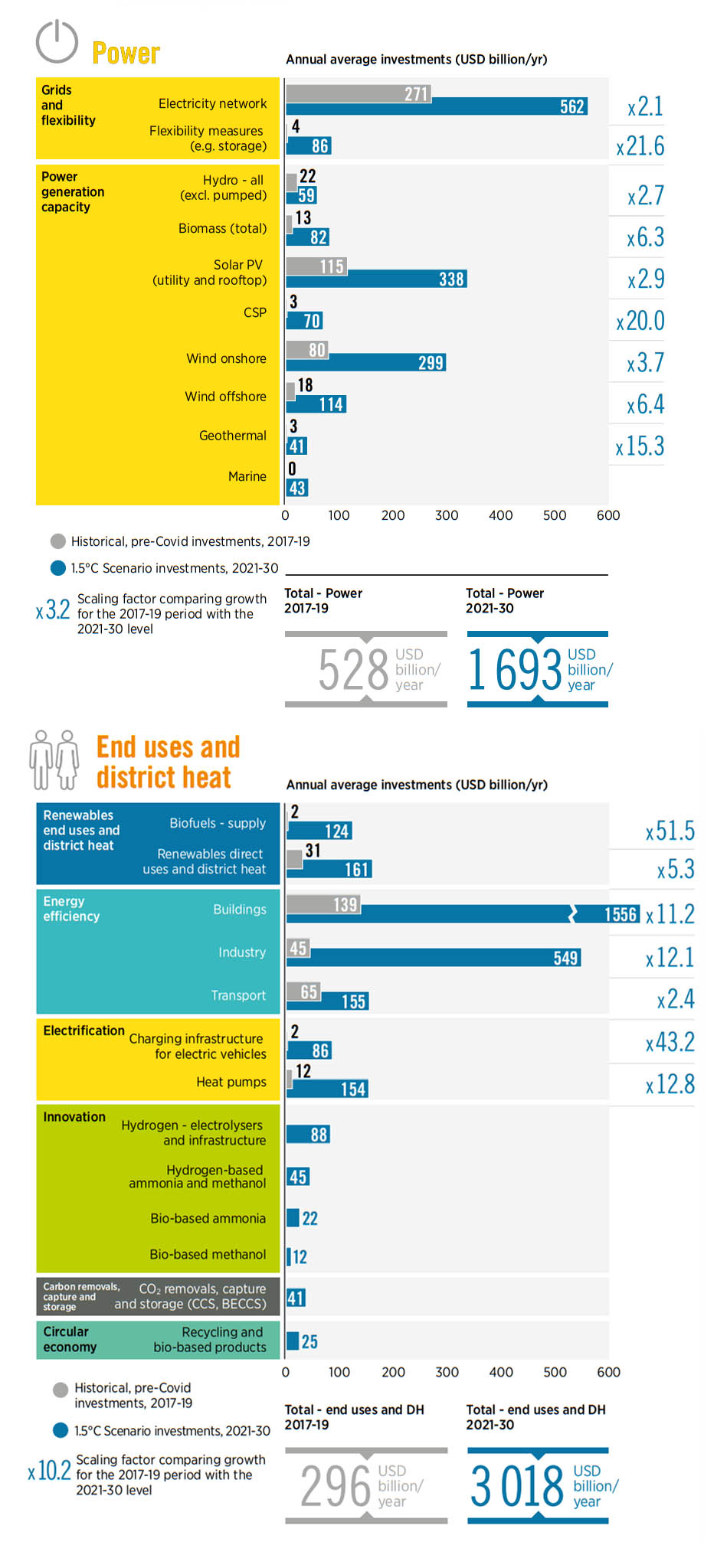

The 1.5°C Scenario will require investments of USD 5.7 trillion per year until 2030. Investment decisions are long-lived, and the risks of stranded assets are high, so decisions should be guided by long-term logic. IRENA estimates that USD 0.7 trillion in annual investments in fossil fuels should be redirected towards energy transition technologies. Measures to eliminate market distortions, coupled with incentives for energy transition solutions, will facilitate the necessary changes in funding structures. Most of the additional capital is expected to come from the private sector. But public financing will also have to double in order to catalyse private finance and create an enabling environment for speedy transition with optimal socio-economic outcomes.

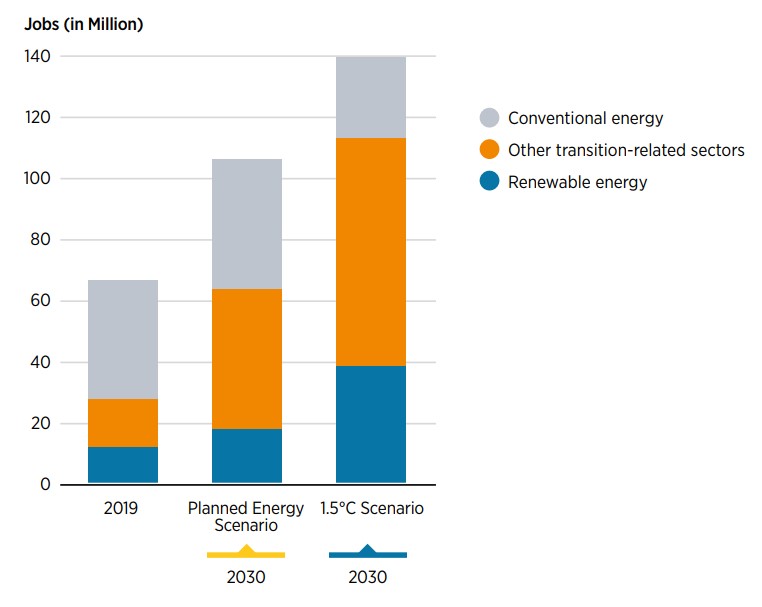

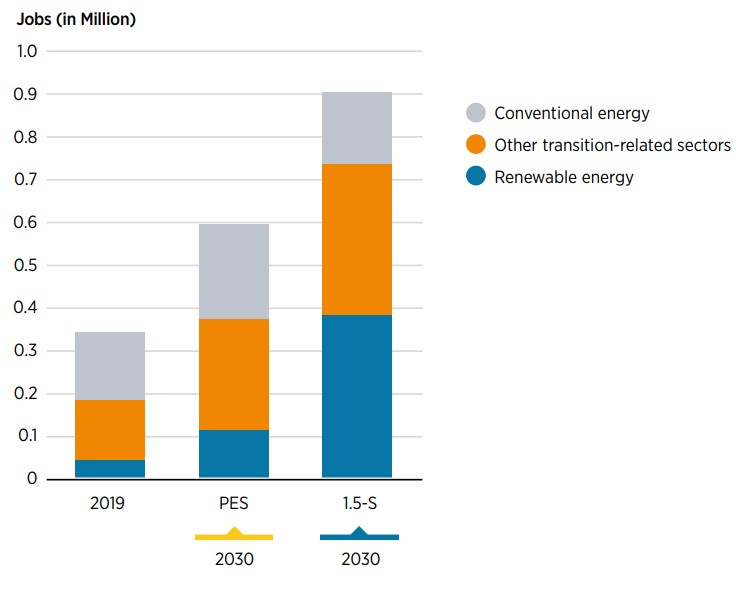

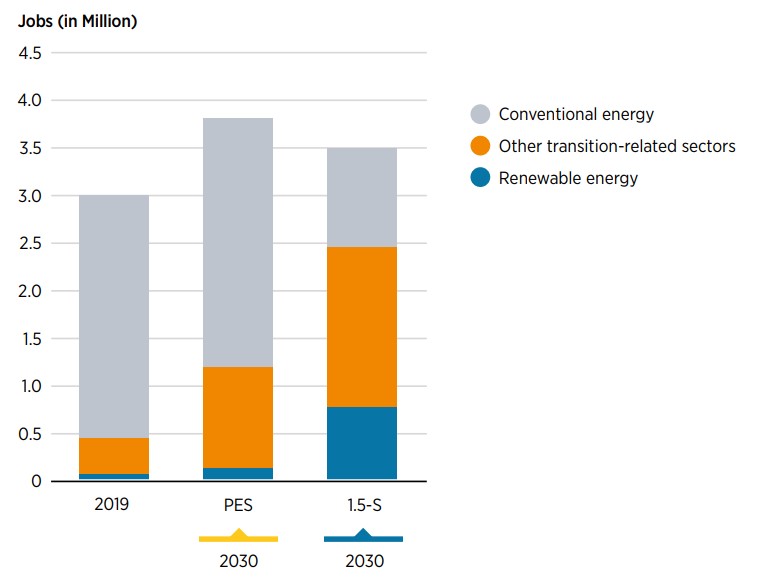

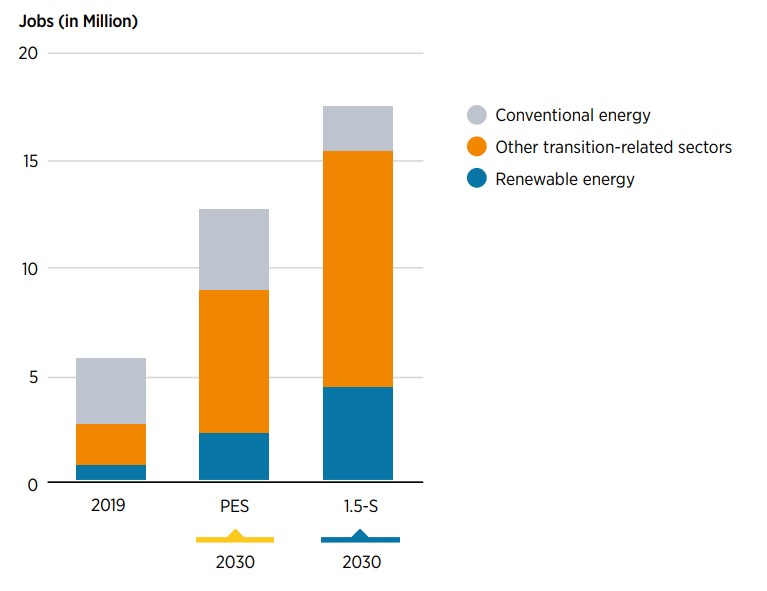

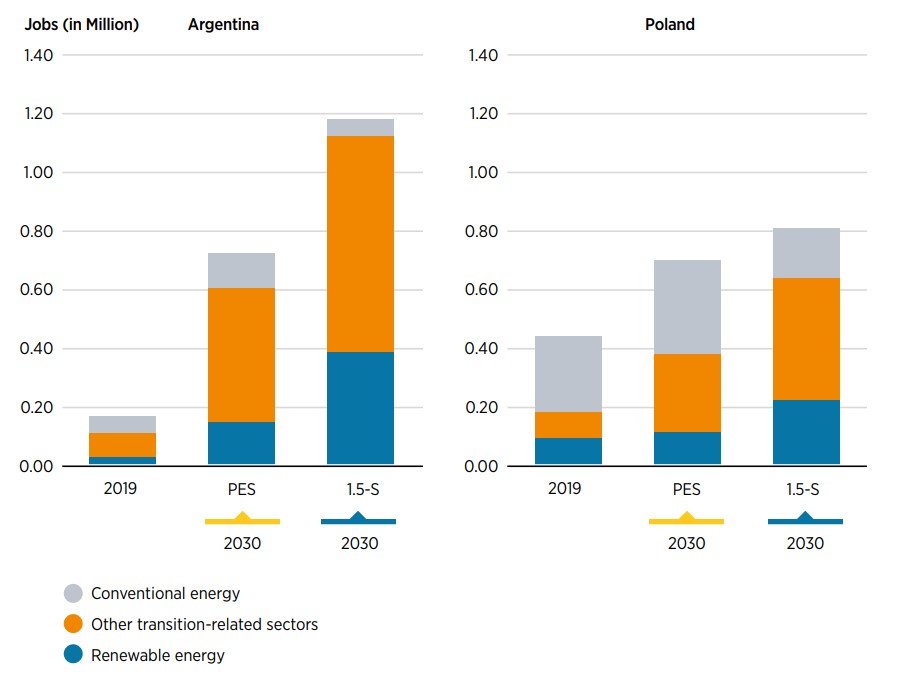

By 2030, the 1.5°C-aligned energy transition promises the creation of close to 85 million additional energy transition-related jobs compared to 2019 and support a boost in global gross domestic product (GDP). The additional 26.5 million jobs in renewables and 58.3 million extra jobs in energy efficiency, power grids and flexibility, and hydrogen more than offset losses of 12 million jobs in the fossil fuel and nuclear industries. Meeting the human resource capacity necessary to fill these newly created jobs requires a scaling up of education and training programmes as well as measures aimed at building an inclusive and gender-balanced transition workforce. While global GDP is boosted under the 1.5°C pathway, the analysis presented in this report reveals that regional and country-level variances will depend highly on policy and regulatory measures and international co-operative flows of financial assistance and knowledge.

The largest energy consumers and carbon emitters will have to implement the most ambitious plans and investments by 2030. This will require going beyond long-term decarbonisation commitments and setting out concrete operational targets, plans and policies for the short and medium term. G20 and G7 countries have a critical role in leading the global energy transition effort at the international level. Funds and knowledge must be made available to less wealthy nations to advance the quest for an inclusive and more equitable world.

Globally and in most countries, higher socio-economic benefits are obtained under the 1.5°C pathway than under the business-as-usual scenario. To support these positive outcomes, however, progressive policies and programmes will be essential. As analysed in this report, their key impact is the significant improvement in the distribution of the socio-economic benefits of the transition across societies and geographies.

A renewables-based energy transition can help solve multiple issues at the same time: energy affordability, energy security and the climate crisis

IRENA’s Energy Transition Welfare Index shows that the 1.5°C pathway

improves global welfare significantly. The Index, with its five

dimensions,2

provides a holistic vision of the transition’s socioeconomic impacts. The

following insights deserve particular attention:

- Assessing the impact of policies on the socio-economic footprints of transition roadmaps conveys a better understanding of the lived experience of the transition. Policy makers should explore these impacts and adjust their plans to ensure maximum shared benefits of climate policies.

- Implementing more progressive fiscal and regulatory measures and programmes, both domestically and internationally, will temper the regressive impacts of carbon taxes while improving the distribution of transition benefits and burdens.

- Enabling a rapid transition that complies with climate goals requires political commitment to support higher levels of international co-operation. By 2030, international climate collaboration should dramatically increase from current levels. Introducing these higher levels of international co-operation and more progressive distributional policies will ensure a fair and just transition.

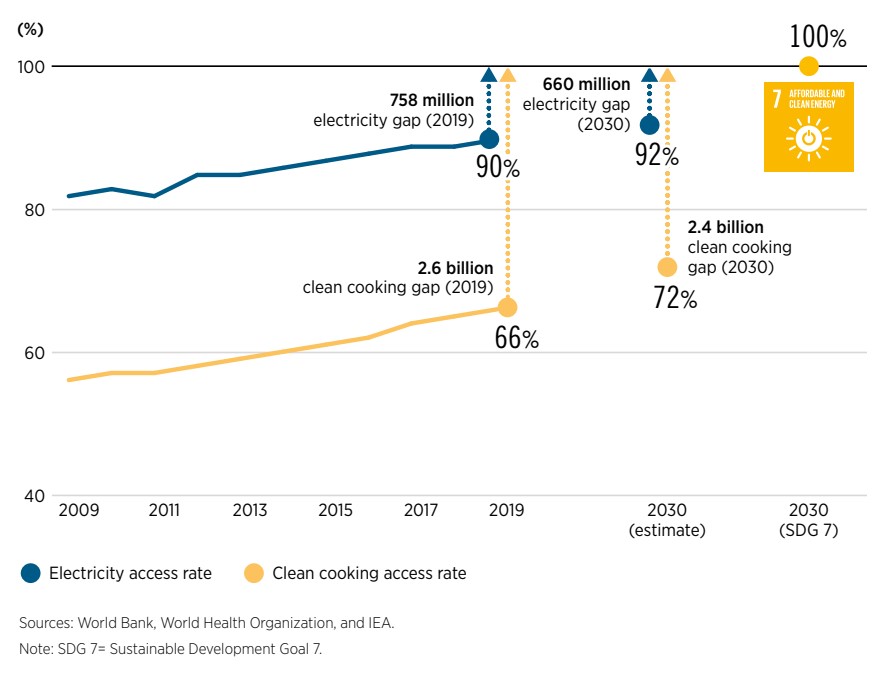

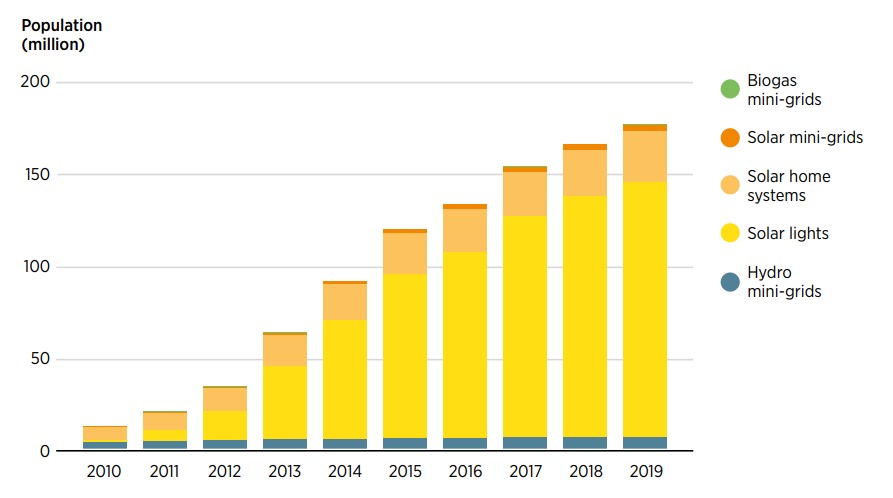

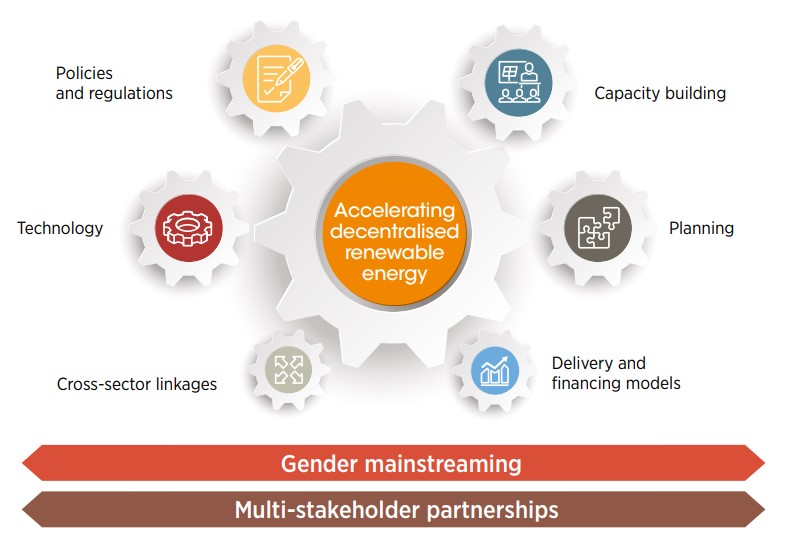

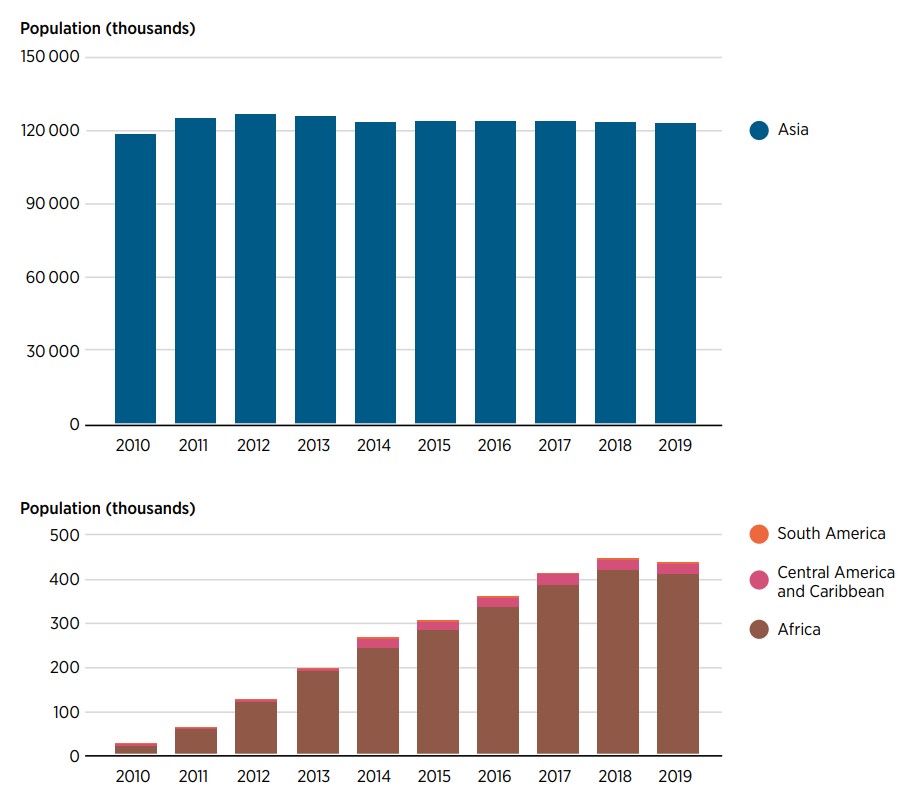

Achieving universal access to modern energy by 2030 is a vital pillar of a just and inclusive energy transition aligned with the 1.5°C goal. Despite advances, the universal energy access goals of United Nations Sustainable Development Goal 7 are in jeopardy. An estimated 758 million people were living without electricity globally in 2019; 2.6 billion had no access to clean cooking fuels and technologies. On the current trajectory, the world is set to miss the target of universal access by a wide margin. Decentralised renewable energy solutions can play a crucial role in solving the access problem while supporting the delivery of essential services and income-generating activities across sectors.

The year 2022 is presenting new challenges, with concerns about rapidly rising energy prices and energy security. At the same time, the 1.5°C climate goal is slipping farther out of reach; short of dramatic and immediate action, it will slip away for good. This edition of the World Energy Transitions Outlook sets out how both agendas can be addressed through an accelerated energy transition, with the deployment of renewables scaled up across sectors. The business case for more renewables is becoming stronger, and the benefits will be wide-ranging. But clear plans and strategies are needed. The time to act is now. The rest of the decade to 2030 is a critical milestone to ensure that 1.5°C remains a viable target for 2050.

Introduction

In Paris in 2015, signatories to the United Nations Convention on Climate Change agreed to pursue efforts to keep the rise in global temperatures to well below 2°C and try to limit the temperature increase to 1.5°C above pre-industrial levels by 2050. In 2021, IRENA presented a pathway to 1.5°C in the first edition of World Energy Transitions Outlook (WETO) in 2021. The pathway decarbonises all end uses, with electrification and energy efficiency as primary drivers, enabled by renewables, green hydrogen and sustainable modern bioenergy.

Putting the energy sector on a pathway to 1.5°C can also help address other important global concerns such as energy price volatility and energy security, two issues that have come into the spotlight since the publication of WETO 2021. The economic and social impacts of rapidly rising energy prices are increasingly being felt by consumers and businesses around the world. Energy security concerns, especially in Europe, are pushing policy makers to look for a faster deployment of alternatives, with renewables, energy efficiency and hydrogen at the top of the list.

At the same time, the climate crisis remains as urgent as ever, as evidenced by the latest report of the Intergovernmental Panel on Climate Change (IPCC) released at the end of February 2022. With climate change already wreaking substantial (and sometimes irreversible) damage to ecosystems, settlements, and infrastructure, the world faces multiple climate hazards, even if the warming can be contained to 1.5°C (IPCC, 2022). Exceeding this threshold, which appears increasingly likely, would result in additional severe impacts that are not only costly in economic terms but threatening to human well-being and survival.

Some important progress has been made in recent years to move the energy system away from fossil fuels, especially by adding renewables-based electricity capacity, which more than doubled over the past decade. However, this progress is still not ambitious enough to put the world on the right path to 1.5°C. Domestic and industrial heat, industrial processes and the transport sector remain highly reliant on fossil fuels in most countries, contributing significantly to emissions and perpetuating exposure to volatility in the prices of fossil fuels.

The probability of reaching the 2050 target depends on making sufficient progress in the near term, with the period to 2030 crucial for accelerated action across all energy use sectors. 2030 is also a critical year for achievement of the United Nations Sustainable Development Goals (SDGs), notably SDG7, which aims to ensure affordable, reliable, sustainable, and modern energy for all.

2022

Achieving the 2050 target by accelerating the deployment of renewables and taking vigorous action to raise energy efficiency is a no-regrets strategy that meets climate objectives. It also offers the benefits of a just and inclusive energy transition, such as universal energy access, job creation, poverty reduction, and a fair sharing of adjustment benefits and burdens.

By laying out a map for the coming eight years, Part A of WETO 2022 aims to help policy makers navigate the path to 2050. It also articulates the socio-economic impacts of the 1.5°C pathway and suggests ways to speed progress towards SDG7 on universal access to energy.

-

Chapter 1 recaps the IRENA 1.5°C Scenario and examines progress made to date through a set of key performance indicators. The chapter also examines the outcomes of the 2021 Glasgow climate conference and other high-level events such as the United Nations High Level Dialogue on Energy. It then presents the most likely emissions trajectory based on announcements and pledges from key countries.

-

Chapter 2 proposes a roadmap of priority actions towards 2030. It sets out what needs to be done in terms of technology deployment, examines the investment needed and discusses the policies that will have to be implemented to achieve the transition. It highlights the importance of a broad policy framework that can address deep social, economic, and environmental challenges.

-

Chapter 3 looks at the link between policy and the socio-economic aspects of the energy transition and how benefits can be more fairly distributed. It examines two policy baskets and the impacts on GDP, jobs, and welfare, with results for a range of countries.

-

Chapter 4 makes the point that accelerated progress on the SDG7 energy access goal must be part of the energy transition, with a focus on the role of cost-effective and environmentally sustainable renewables-based solutions for expanding access to electricity and clean cooking fuels and technologies.

Part B contains three technical deep-dives on electrification, bioenergy and critical materials.

-

Chapter 5 focuses on the role of electrification for decarbonising end-use sectors. It examines how the power sector can cope with much higher loads, as well as higher shares of variable renewables. It also includes case studies of heat pumps and green hydrogen, emphasising the role of international trade.

-

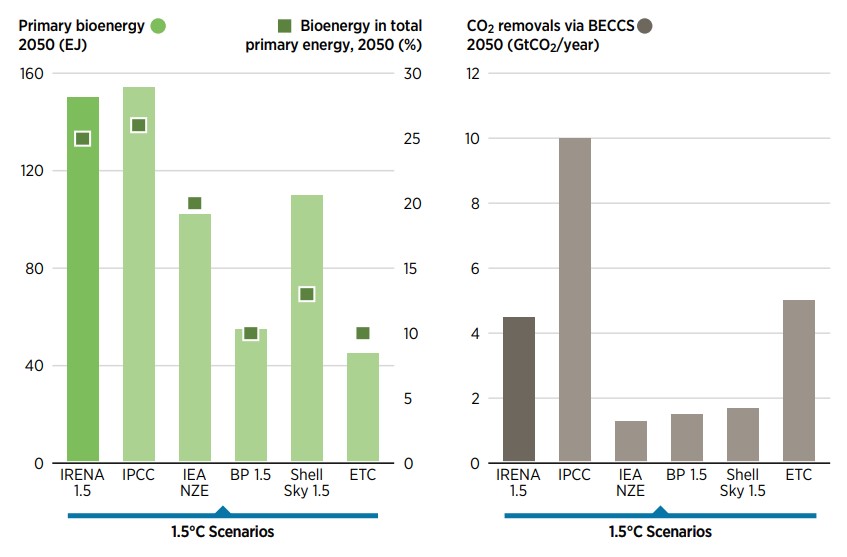

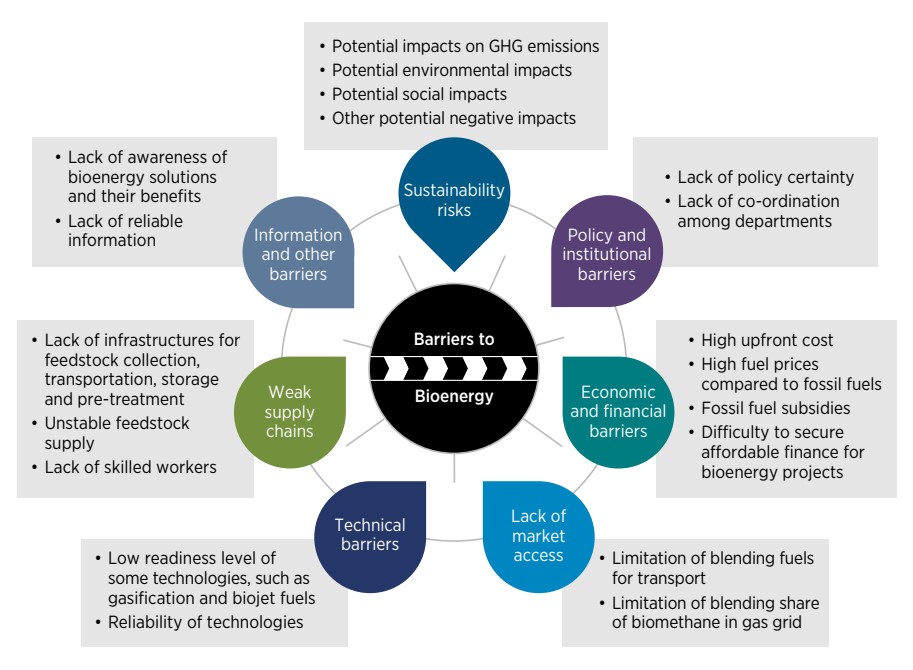

Chapter 6 analyses the important role of bioenergy in the 1.5°C Scenario. It discusses the challenges of scaling up global biomass supply, highlighting the importance for sustainability of strong governance and regulations. Policies to overcome barriers to greater biomass deployment are also explored.

-

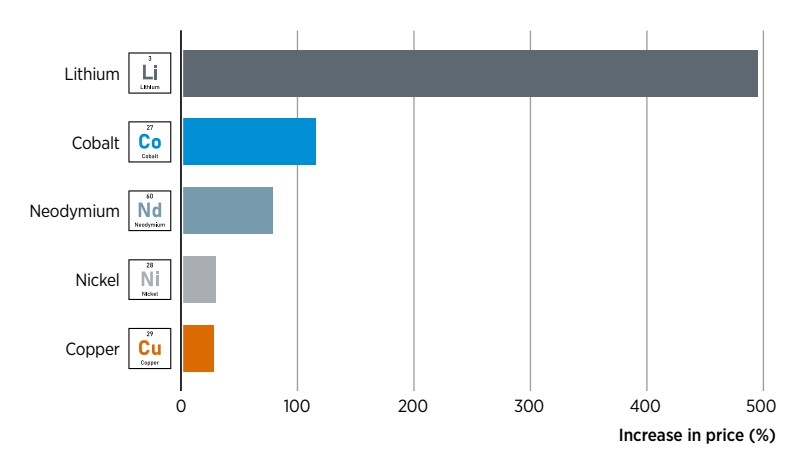

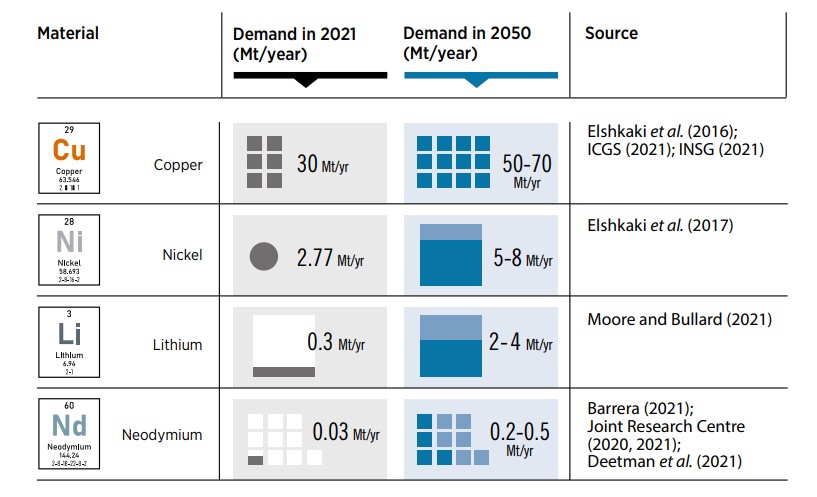

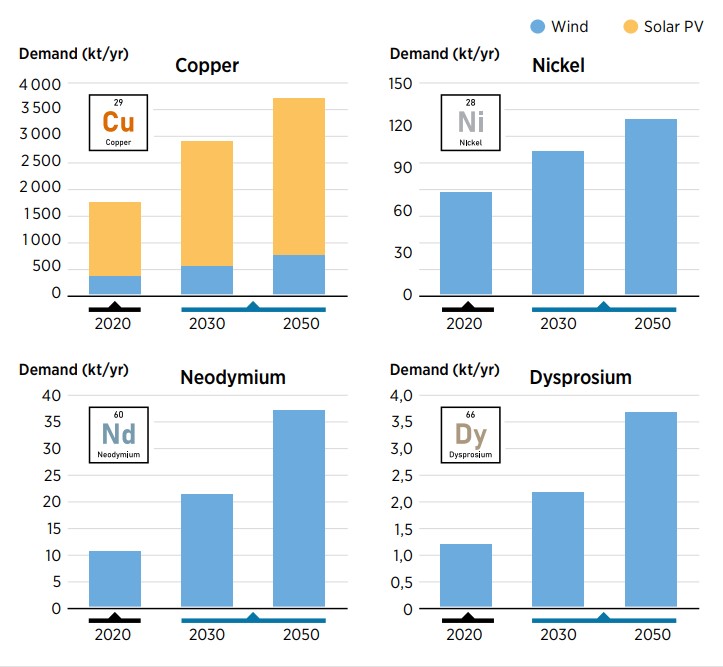

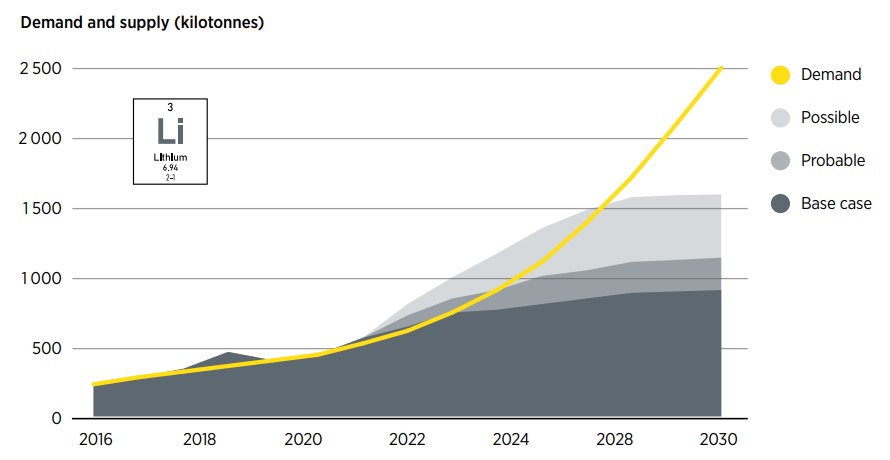

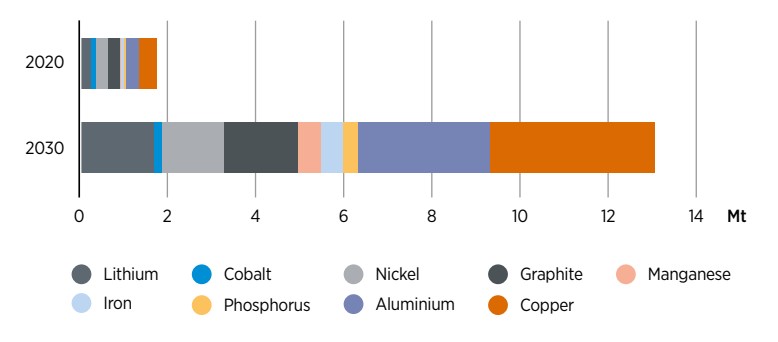

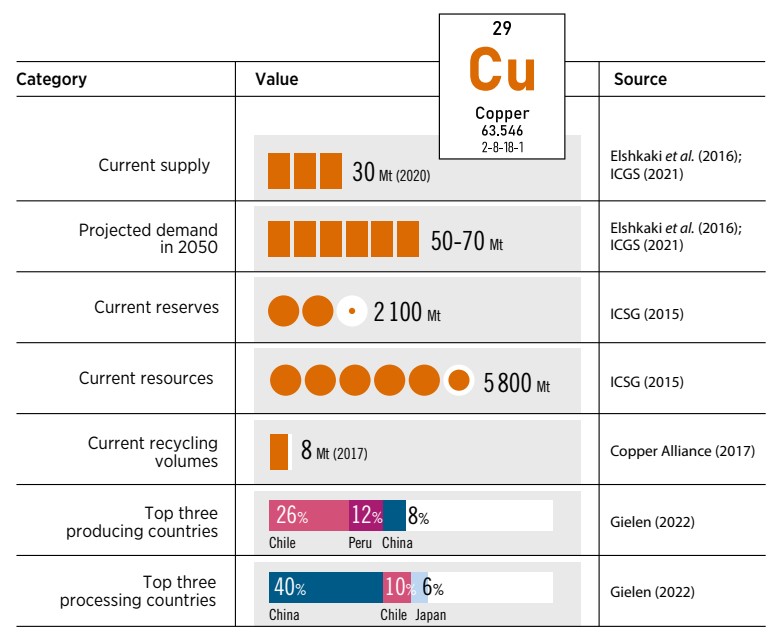

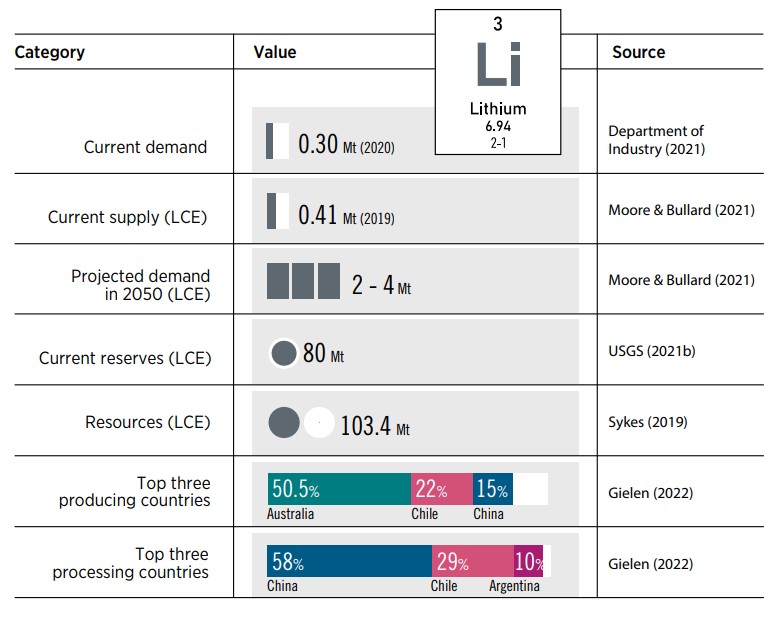

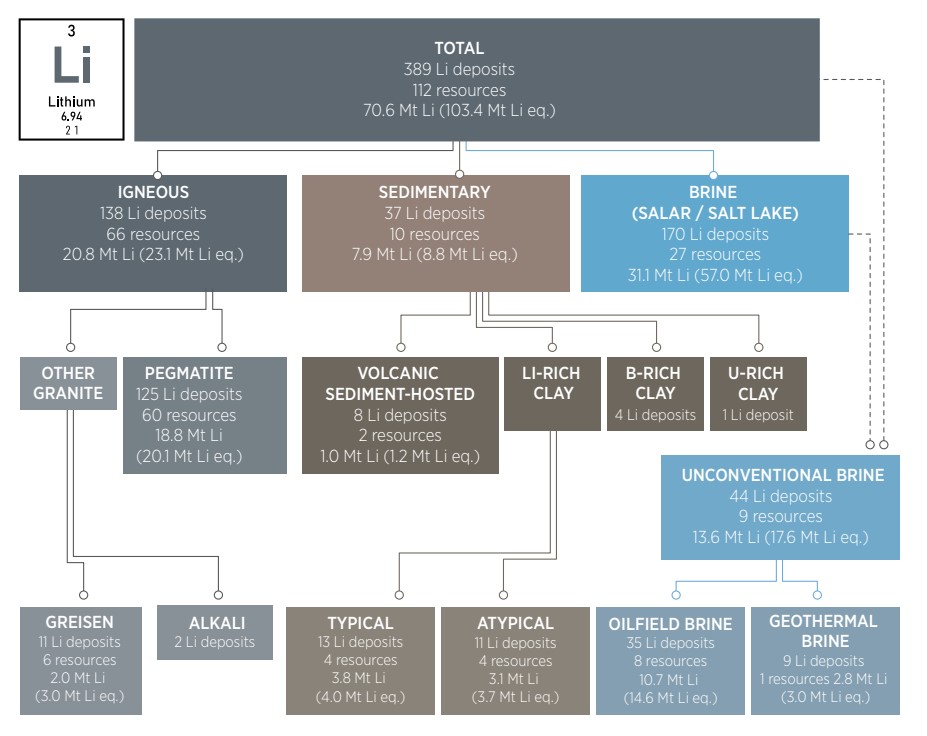

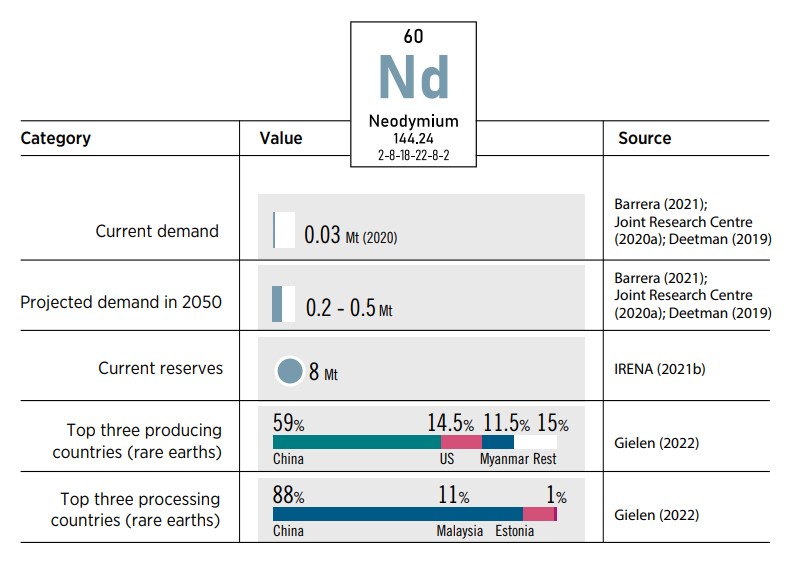

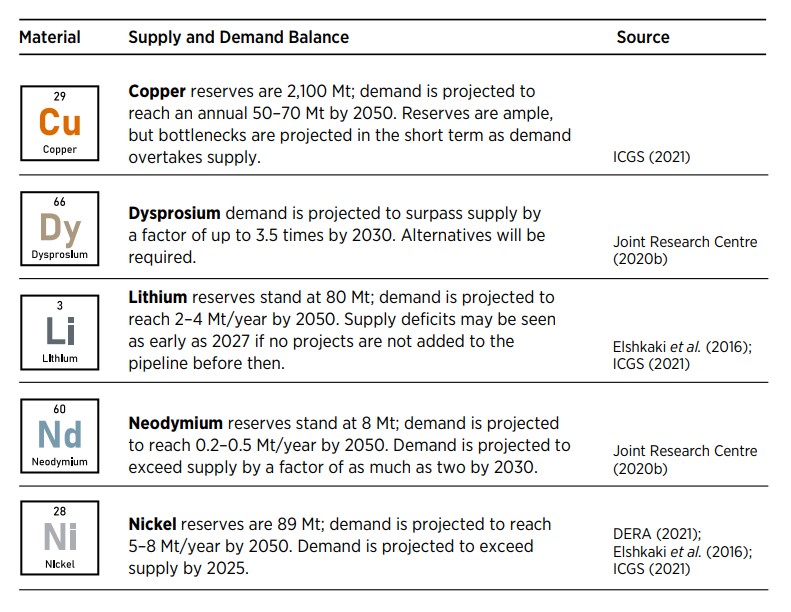

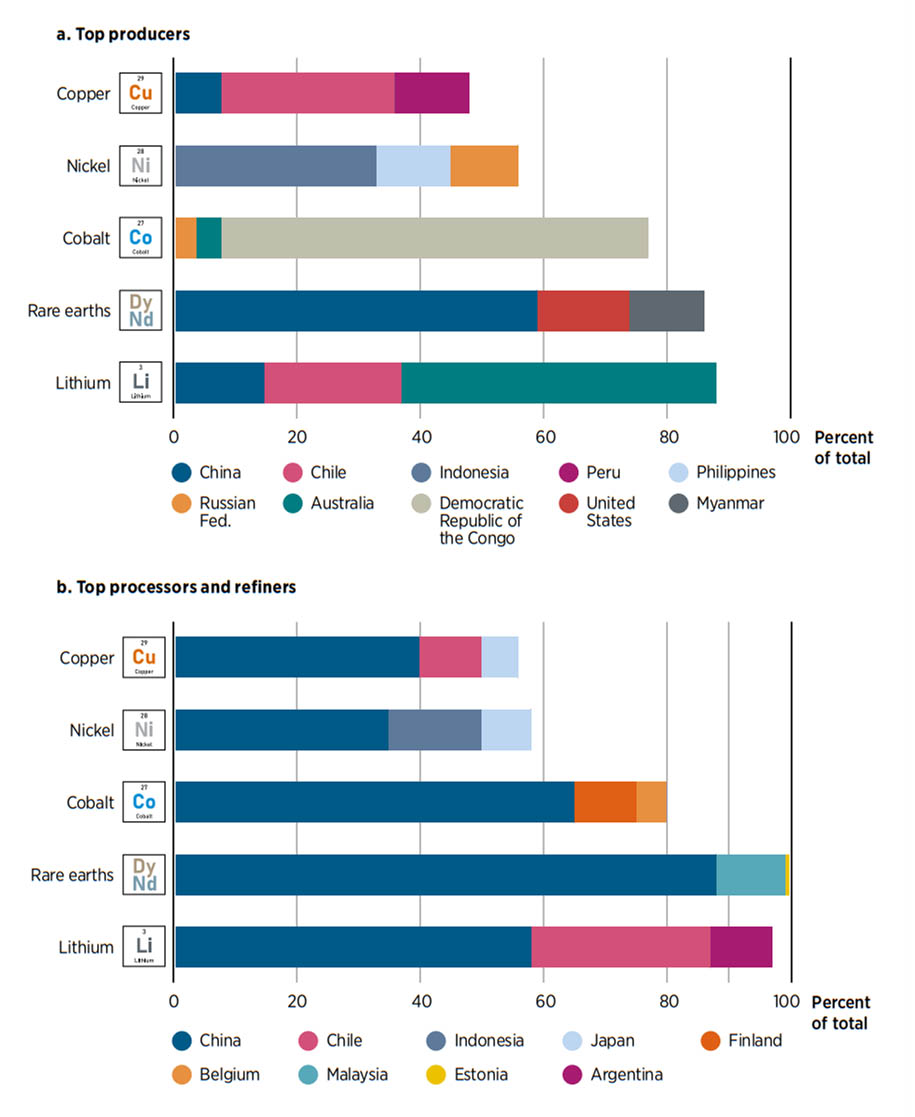

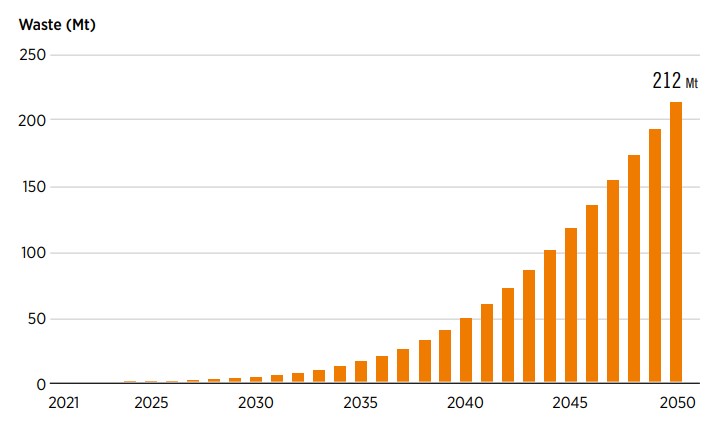

Chapter 7 provides insights into the materials (metals and minerals) that are critical to delivering the 1.5°C Scenario. It includes an in-depth discussion of demand and supply aspects and considers options for mitigating the risk of supply shortages, including enhanced international governance.

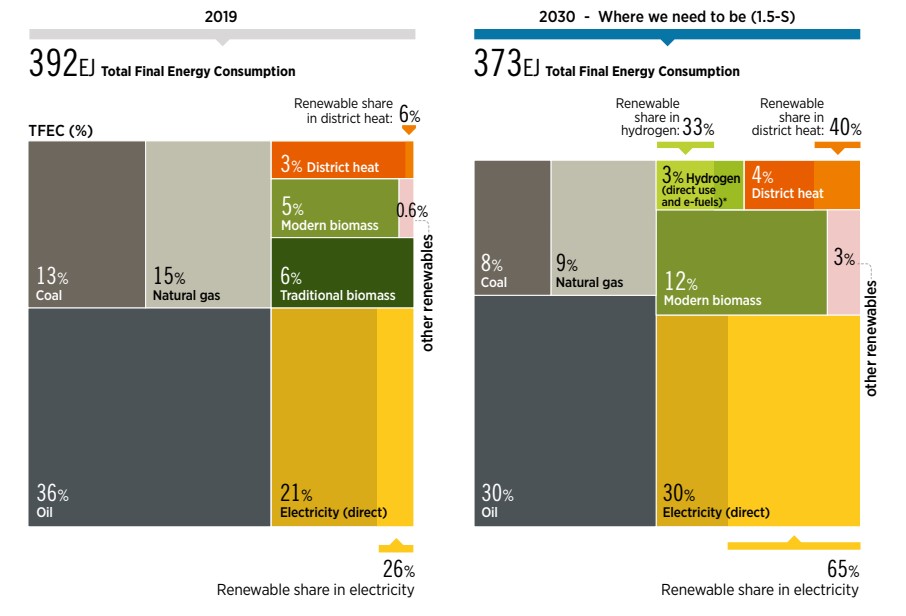

Highlights

- Despite good progress in some areas, there are large gaps between the current deployment of energy transition technologies and the levels needed to achieve the 1.5°C Paris climate goal. A 1.5°C compatible pathway requires a massive transformation of how societies consume and produce energy. By 2050, the world would need to have net zero emissions, requiring a cut of nearly 37 gigatonnes (Gt) of annual emissions. Global energy consumption would need to decrease by 11% from 2019 levels though ambitious energy efficiency improvements, with a simultaneous increase in the share of renewables in the global energy mix – to 79% by 2050, from 19% in 2019. Renewables would have to increase across all end-use sectors, while a high rate of electrification in sectors such as transport or buildings would require a ten-fold increase in renewable electricity capacity by 2050.

- A 1.5°C compatible pathway would bring long-term energy security and energy price stability. Energy efficiency and renewables combined can make countries less dependent on energy imports, diversify supply options and help decouple economies from volatile international fossil fuel price fluctuations.

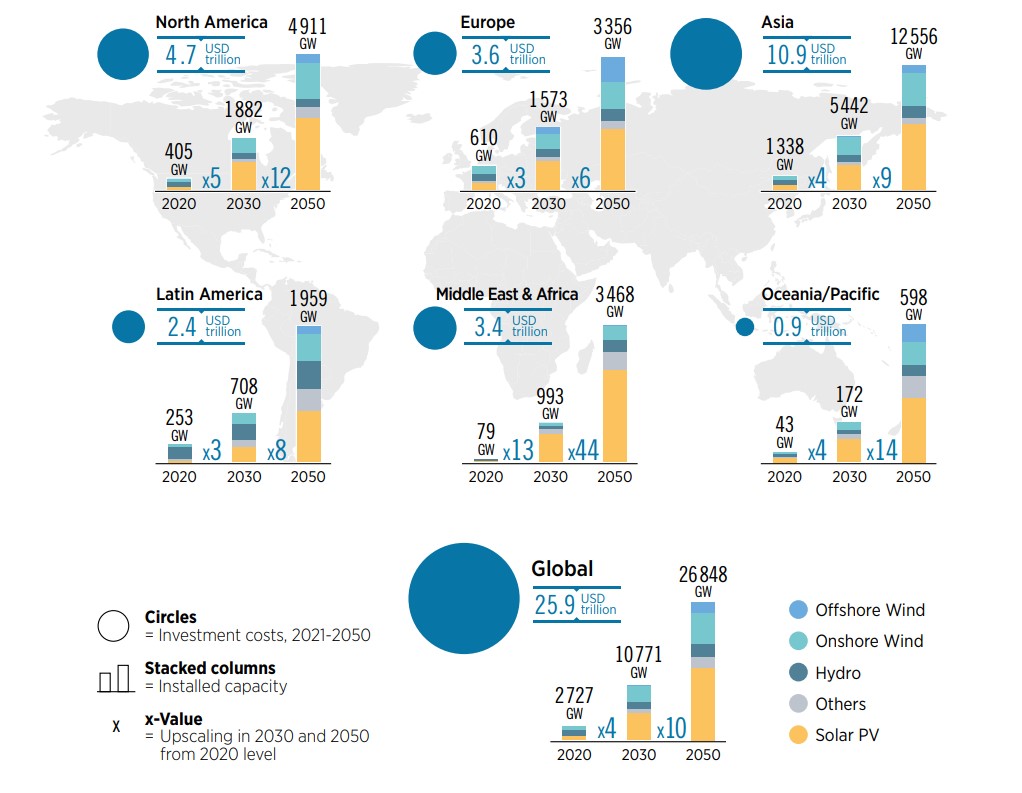

- The required scale-up of renewables would require significant and decisive co-ordinated actions across public and private sectors. This would require political will, comprehensive policy frameworks targeting a myriad of barriers and greater levels of both private and public investment.

- Investments in energy transition technologies, while having reached record levels, are still not large enough and are concentrated in just a few countries and regions. For the energy transition to become truly global, access to financing has to widen considerably. Energy transition cumulative investments would need to reach more than USD 115 trillion by 2050.

- The recent pledges made by countries at the 26th United Nations Climate Change Conference (COP26) in Glasgow and in their updated Nationally Determined Contributions (NDCs) are welcome but they are still not ambitious enough to achieve climate goals. There is an estimated gap of 20 Gt between the updated NDCs and other pledges made around COP26 (e.g. related to net zero emissions and cutting methane), and the efforts required to realise the 1.5°C climate goal by 2050. In addition, NDCs must be translated into concrete actions, with specific targets (e.g. for renewable energy), and policies covering all end uses to attract the investment needed. Rapid acceleration is needed to close the gap if policy makers want to be serious about achieving the Paris climate goals.

- On a positive note, the costs of renewable electricity are continuing to fall and renewables are now the cheapest power options in most regions. In 2020, a total of 162 gigawatts (GW), or 62% of the total new renewable power generation capacity added globally, had electricity costs lower than the cheapest source of new fossil fuel-fired capacity. The global weighted-average levelised cost of electricity (LCOE) of newly commissioned utility-scale solar photovoltaic (PV) projects fell by 85% between 2010 and 2020, that of concentrated solar power (CSP) by 68%, onshore wind by 56% and offshore wind by 48%. Renewables are now the default option for capacity additions in the power sector, where they dominate investments.

1.1 Introduction

This chapter recaps the key aspects of IRENA’s 1.5°C Scenario, as set out in more detail in the 2021 World Energy Transitions Outlook (WETO), and examines progress made to date. Section 1.2 summarises six components of an energy transition that, as outlined in the 2021 WETO, would be robust enough to meet the 1.5°C climate goal by 2050. Key performance indicators (KPIs) related to the six components are identified, to help track progress. This section also compares IRENA’s 1.5°C pathway with those of a number of other studies, with a focus on G20 members.1

A 1.5°C compatible pathway requires a massive transformation of how societies consume and produce energy

Section 1.3 then tracks the progress of the energy transition, assessing gaps and the urgent need to accelerate investments. This includes an examination of the latest trends in renewable energy costs and prices. The section also considers whether countries are implementing energy transition policies and presents the most likely emissions trajectory based on announcements at the 2021 Glasgow climate conference and pledges from key countries.

1.2 Technological avenues towards the 1.5°C Scenario

By 2050, annual abatement of 36.9 gigatonnes (Gt) of carbon dioxide (CO2) is achievable, compared to a reference case based on planned targets and policies2 (Figure 1.1). The 1.5°C Scenario outlined in the 2021 WETO envisions six technological avenues of an energy transition compatible with meeting the 1.5°C Paris climate goal (IRENA, 2021a):

-

Renewables: Renewable electricity generation sources such as solar PV, wind etc., and the direct use of renewable energy, such as solar thermal and biomass.

-

Energy conservation and efficiency: Measures to reduce energy demand and increase the energy efficiency of end-use applications, including structural changes (e.g. relocation of steel production with direct reduced iron, a modal shift in transport) and circular economy practices (e.g. alternative cement materials).

-

Electrification of end-use sectors: Direct use of clean electricity in transport and heat applications.

-

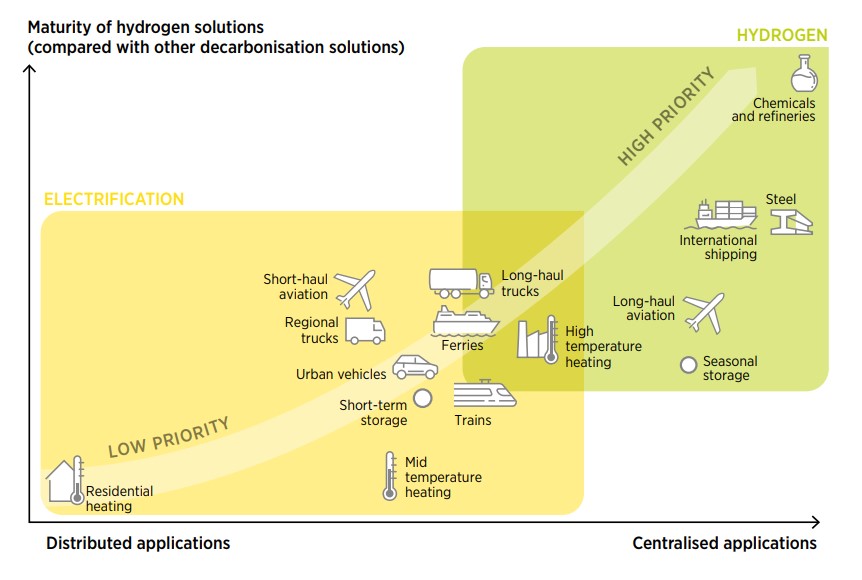

Hydrogen and its derivatives: Direct use of clean hydrogen (predominantly green hydrogen) along with synthetic fuels (green ammonia and methanol) and clean hydrogen-based feedstocks.

-

Carbon capture and storage (CCS): The carbon captured and stored from point-source fossil fuel-based and other emitting processes, mainly in industry.

-

Bioenergy coupled with carbon capture and storage (BECCS) and other carbon removal measures: Bioenergy coupled with carbon is captured and stored: in electricity, heat generation and industrial process (e.g. cement kilns and chemical production).

Pursuing these six technological avenues at a rapid pace would result in significant emission reductions between today and 2050, paving the way to a net zero carbon world by mid-century.

FIGURE 1.1 Reducing emissions by 2050 through six technological avenues

CCS = carbon capture and storage; BECCS = bioenergy with carbon capture and storage; RE = renewables; FF = fossil fuel; GtCO2 = gigatonnes of carbon dioxide.

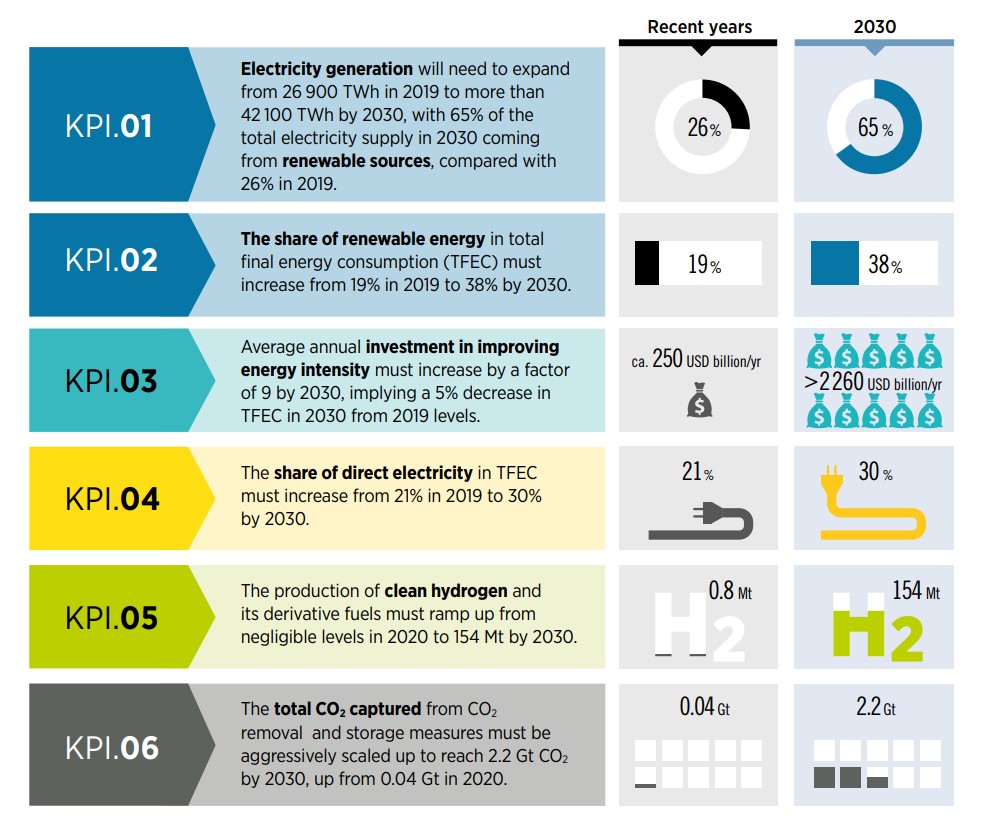

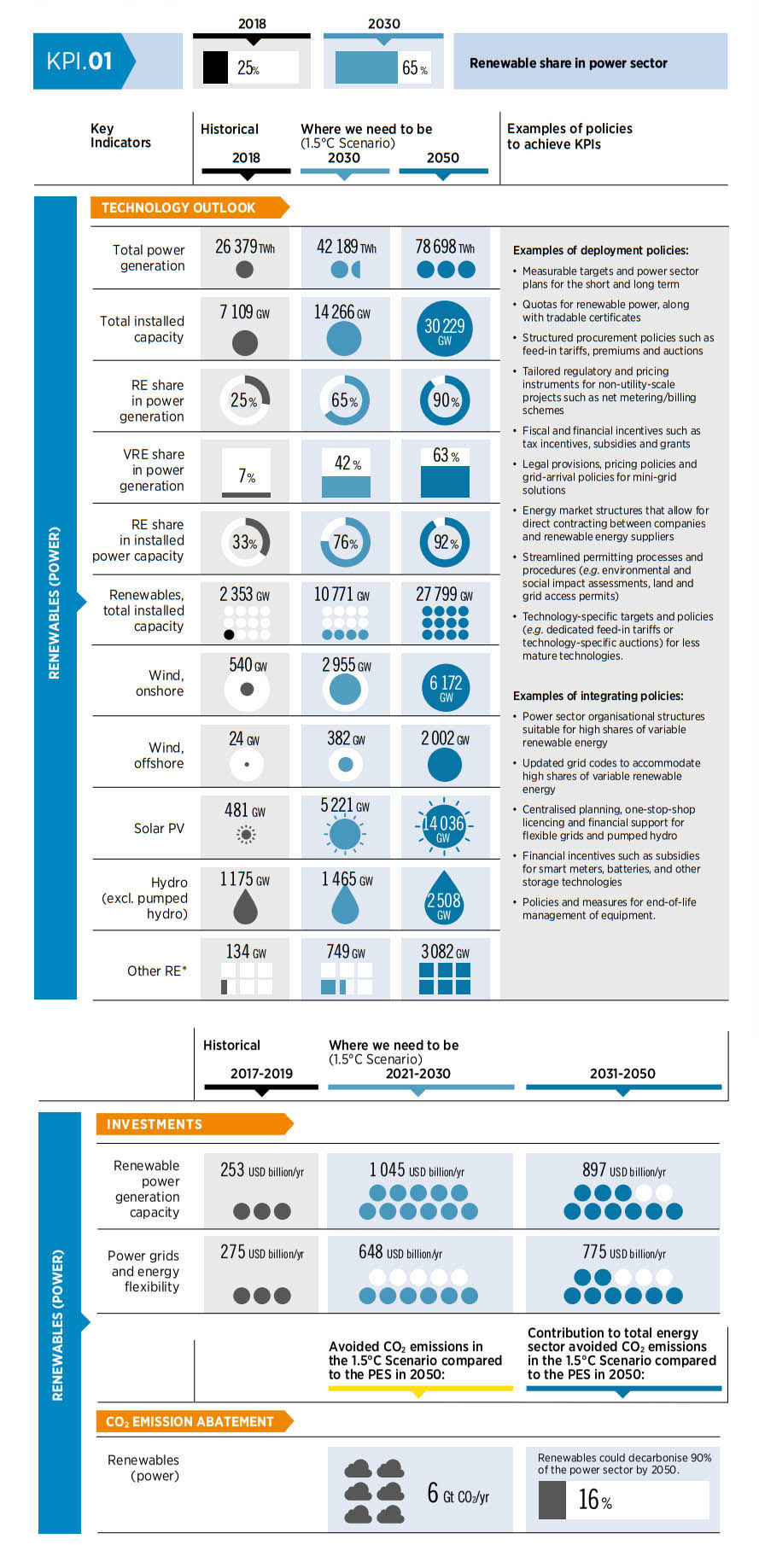

To achieve this level of emissions abatement by 2050 would require a very large scale-up from current levels. Figure 1.2 presents the KPIs and corresponding targets that need to be reached by 2050 to achieve net zero emissions. A range of policies and measures are needed to create the right enabling frameworks for investment and deployment.

Reaching net zero emissions by 2050 is not necessarily enough to reach the 1.5°C target. To stay within the estimated ranges of the global carbon budget (as set out by the Intergovernmental Panel on Climate Change [IPCC]), reducing cumulative emissions is crucial. Figure 1.3 presents the IRENA 1.5°C Scenario emissions reduction trajectory and the implications for the energy mix over time.

FIGURE 1.2 Key performance indicators for achieving the 1.5°C Scenario by 2050

To meet this trajectory, a major acceleration of renewable energy, energy efficiency, electrification, hydrogen and derivatives, as well progress in BECCS/CCS, is needed. Deployment across all technological avenues needs to speed up immediately to meet challenging milestones by 2030. The next section will examine what progress has been made to date and assess to what extent the world is on the right pathway towards a 1.5°C world.

FIGURE 1.3 Evolution of emissions in accordance with the deployment of technological avenues, 2018–2050

BOX 1.1 Scenario comparison

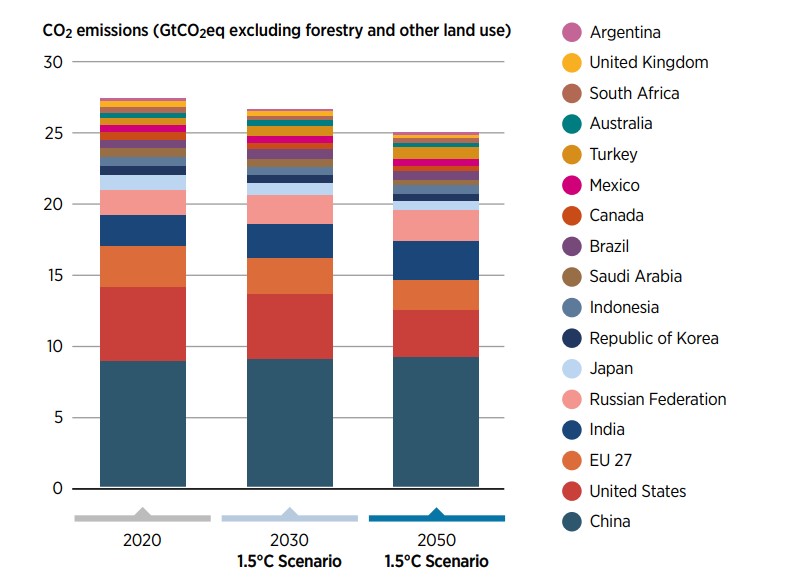

Under the 2015 Paris Agreement, most countries agreed to reduce their carbon emissions to keep global warming to “well below 2°C” and try to limit the temperature increase to 1.5°C with respect to preindustrial levels by 2050. The G20 economies account for over 70% of global CO2 emissions. Hence, the actions of these countries are critical, not only in terms of their fossil CO2 emissions, but also in terms of their financial support of the decarbonisation efforts of less developed countries.

Key decarbonisation strategies for G20 economies

IRENA has assessed nearly 50 recent scenario studies covering all G20 members. The first finding is that there is a limited number of relevant 1.5°C and net zero modelling-based studies for G20 economies (and even fewer for emerging countries). This is a clear indication that NDCs and pledges are yet to be integrated in sectorial plans. Also, few studies include modelling outputs, because of gaps in publicly available data. For studies that feature outputs, differences in modelling methodology, geographical coverage, sectoral aggregation level, economy and energy system assumptions, time horizons, and the policies and scenarios modelled make it difficult to compare outputs in a straightforward manner.

FIGURE 1.4 Fossil CO2 emissions of G20 members

Yet it is possible to see common trends in the decarbonisation pathways of G20 members. A set of indicators was developed to characterise the scenarios. Figure 1.5 summarises key outputs for G20 members, benchmarked against 1.5°C global studies from IRENA, the International Energy Agency (IEA) and the Intergovernmental Panel on Climate Change.

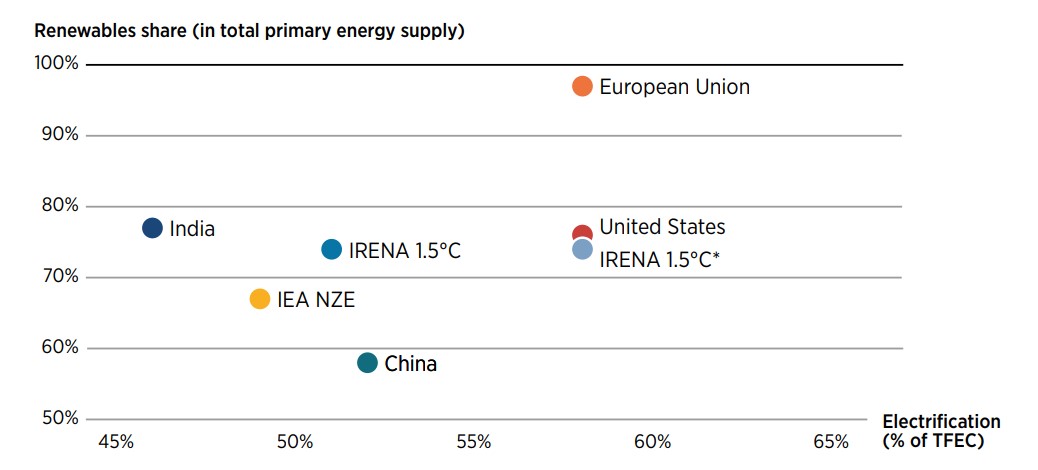

FIGURE 1.5 Shares of renewables versus electrification in 2050 across various scenarios

Note: IRENA 1.5°C* represents the additional electrification share required to produce green hydrogen; TFEC: Total Final Energy Consumption

The strategies suggested by G20 studies are comparable with those observed in IRENA’s WETO, as well as those from IEA and the IPCC Integrated Assessment Modelling community. The scenarios from key economies such as India, the United States of America (United States), China and the European Union are considered in Figure 1.5 as they are responsible for more than 50% of global emissions. The modelling studies considered indicate that:

-

Renewables are key to the energy transition, reaching over 50% of primary energy supply and up to 100% of electricity generation.

-

Electrification of final energy use increases to about 50% across G20 members.

-

Electric vehicles are key to electrification and emissions reduction, replacing fossil fuel vehicles in all G20 economies.

-

Energy efficiency is a decarbonisation pillar in most studies across all end-use sectors.

-

Clean hydrogen plays a key role across many studies, particularly in hard-to-abate sectors.

Less robustness across scenarios for some mitigation options

There is less consensus across the explored scenarios regarding bioenergy, afforestation and carbon capture and storage. In most studies, these mitigation options play a limited role. More stringent targets (i.e. net zero emissions) will likely result in an increased role for afforestation and net negative emission technologies.

It should be noted that in most of these studies, uncertainty is not usually modelled and therefore only some of the pathways are considered as solutions for the deep decarbonisation of energy systems. Because of this, caution is advised when considering a range of values to represent specific outputs from pathway solutions. Any conclusions could be misleading, especially if studies are modelled using different emission targets.

1.3 Progress towards the energy transition – 2022 status

Recent years have seen many positive developments, indicating that the global energy transition is well under-way. Renewable power capacity additions and energy transition investments have reached new heights, while costs have continued to come down (Box 1.2). Energy efficiency investments have increased, and energy intensity has improved. End-use electrification, especially through the sale of electric vehicles, has accelerated. Hydrogen has become a major topic for energy policy makers with new strategies and policies under development in many countries.

Following the same framework and the six components of the energy transition strategy (Figure 1.1), Table 1.1 shows that despite these positive developments, the pace of change is still not enough. The table illustrates various indicators for each component and shows the required acceleration in pace from recent years to achieve the 1.5°C target by 2050.

TABLE 1.1 A roadmap to 2050 – tracking progress of key energy system components to achieve the 1.5°C target

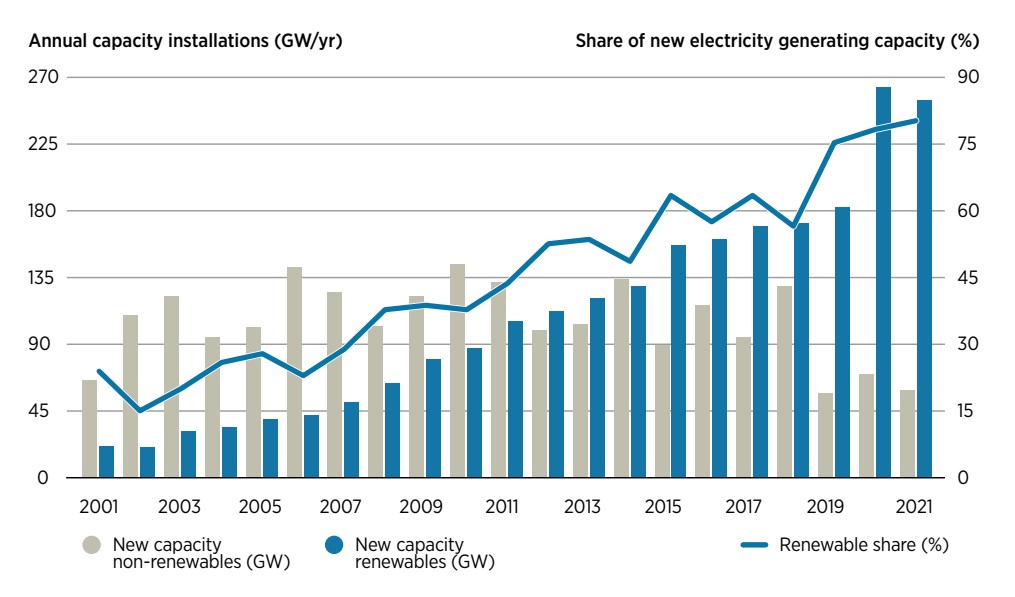

1.3.1 Renewable electricity capacity

Renewables have made impressive progress in the power sector. Over the past decade, renewables capacity increased by 130%, while non-renewables only grew by 24% (Figure 1.6). In 2021, the total installed capacity of renewable electricity reached 3 064 GW, generating around an estimated 8 000 terawatt-hours (TWh) of electricity. To meet the 1.5°C Scenario, installed capacity will have to more than triple by 2030 (see Chapter 2) which will require annual capacity additions to ramp up significantly. However, 2021 saw an overall slow-down in capacity additions, although renewables fared better than non-renewables. Policy makers need to urgently address the growing gap between current deployment and what is needed to get on the 1.5°C pathway.

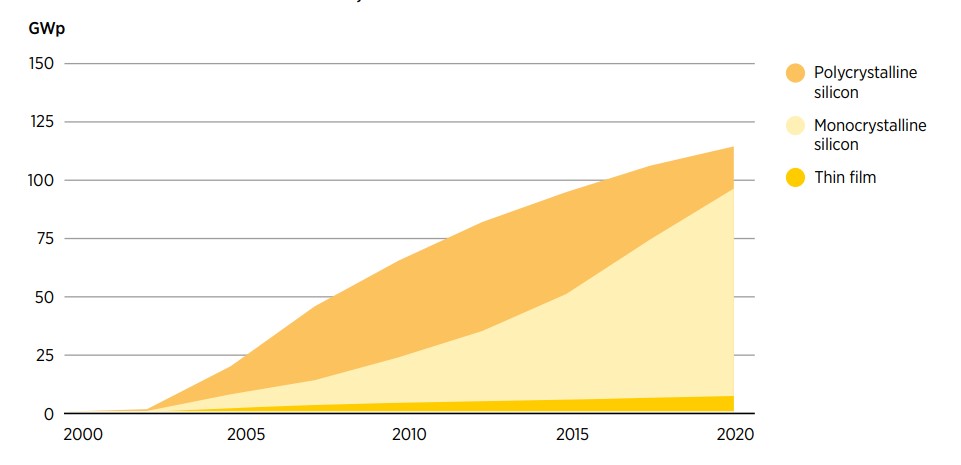

Among renewable technologies, solar PV installations have seen the fastest growth, with a 21-fold increase in the 2010-21 period, as a result of major cost reductions backed by technological advancements, high learning rates, policy support and innovative financing models. By the end of 2021, the cumulative installed capacity of solar PV reached 843 GW globally; 133 GW of capacity was commissioned in 2021 alone, with 57% of the installations in Asia (IRENA, 2022i).

Wind power also experienced significant growth and wind installations increased by over four-fold between 2010 and 2021. In 2021, the cumulative installed capacity of onshore wind power reached about 769 GW across the globe. As with solar PV, Asia leads the market with 358 GW of cumulative installed capacity and was home to more than 48% of installations in 2021. The offshore wind market remains small compared to onshore wind, with 56 GW of cumulative installed capacity by the end of 2021. Asia and Europe each contributed equally 50% (28 GW) to this total capacity (IRENA, 2022i).

Renewable electricity capacity additions have been outpacing those of non-renewables since 2014, with solar PV and onshore wind power dominating the growth

Hydropower continues to be the largest renewable power source in terms of installed capacity. In 2021, global hydropower installed capacity (excluding pumped hydro) reached 1 230 GW, 40% of total renewables capacity. Other renewable power technologies such as bioenergy, geothermal, solar thermal and ocean power also grew rapidly during the past decade, albeit from a small base. The combined installed capacity of these renewables reached 166 GW in 2021, 86% of which was bioenergy power (IRENA, 2022i).

FIGURE 1.6 Share of new electricity capacity, 2001–2021

The global weighted-average LCOE of newly commissioned utility-scale solar PV projects fell by 85% between 2010 and 2020

BOX 1.2 Costs, energy prices and the energy transition

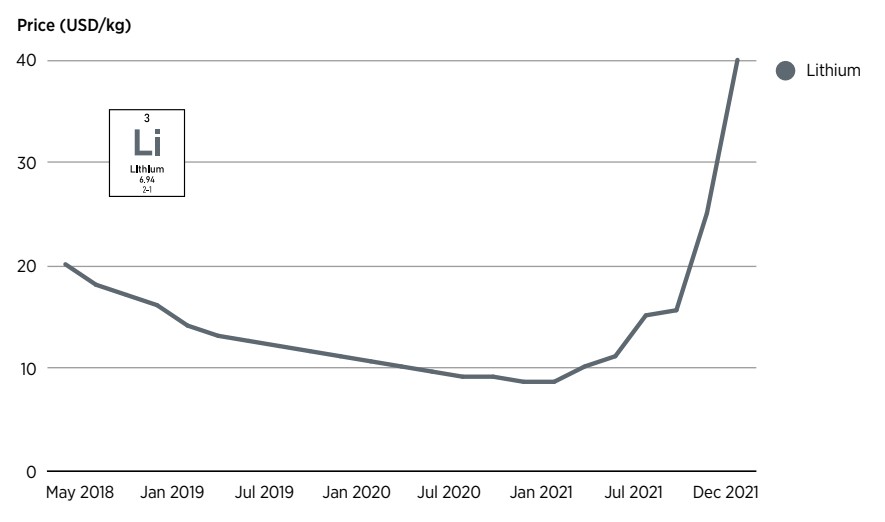

One bright spot in 2020–2021 was the resilience of renewable power generation supply chains and record growth in new deployment. There was no disruption to the trend of continued cost declines for solar and wind power in 2020. Tight supply chains in 2021 were driven by a range of factors, including higher commodity prices, and led to higher solar photovoltaic (PV) module and wind turbine prices. The impact on 2021 costs has yet to be fully assessed, but it may not have been significant. This may not be the case for 2022, however, as many projects deployed in 2022 will have contracted for equipment in 2021. In view of recent fossil fuel price trends, renewable power prices have become more competitive in relative terms.

Renewable power generation technologies today are typically the cheapest sources of new electricity generation. In 2020, a total of 162 GW, or 62% of the total new renewable power generation capacity added globally, had electricity costs lower than the cheapest source of new fossil fuel-fired capacity.3 Since 2010, globally, a cumulative total of 644 GW of renewable power generation capacity has been added with estimated costs lower than the cheapest fossil fuel-fired option.

The global weighted-average levelised cost of electricity (LCOE) of newly commissioned utility-scale solar PV projects fell by 85% between 2010 and 2020, that of CSP by 68%, onshore wind by 56% and offshore wind by 48%. All commercially available solar and wind technologies fall in the range of, or even undercut, the cost of electricity from new fossil-fuel plants.

The results of competitive procurement of renewables through auctions or power purchase agreements (PPAs) confirm the cost competitiveness of renewables. Data from the IRENA renewable auction and PPA database indicate that utility-scale solar PV projects that have won recent competitive procurement processes – and that will be commissioned in 2022 – could have an average price of USD 0.04/kilowatt hour (kWh) (Figure 1.7). This is a 30% reduction compared to the global weighted-average LCOE of solar PV in 2020 and is around 27% less (USD 0.015/kWh) than the cheapest fossil-fuel competitor, namely coal-fired plants.

The auction and PPA data suggest offshore wind costs will fall within the range of USD 0.05/kWh to USD 0.10/kWh in Europe in the period up to 2023, with new markets or delayed projects likely to have higher costs. The lower end of this range for offshore wind suggests projects will be competitive against wholesale electricity prices in a number of European markets. The data also suggest a growing number of projects will have very low electricity costs, at below USD 0.03/kWh. Indeed, the 18 months since 2020 saw three record low bids for solar PV, starting with USD 0.0157/kWh in Qatar, USD 0.0135/kWh in the United Arab Emirates and USD 0.0104/kWh in Saudi Arabia. Surprisingly, values below USD 0.02/kWh are not impossible, even if they were unthinkable only a few years ago.

Indeed, with the rapid increase in fossil fuel costs in 2021 and 2022, the economic outlook for renewable power is becoming even more compelling. The cost of fossil fuel increased by a factor of 6.5 from USD 21/Megawatt hour (MWh) at the beginning of 2021, to USD 136/MWh on 5 October, before dropping back to a low of USD 75/MWh on 29 October, and surging to EUR 212/MWh on 21 December. In February 2022, derivatives linked to the Dutch Title Transfer Facility (TTF) ranged between USD 82 and 98/MWh (ICE, 2022).4

Landed thermal coal prices in Europe increased by a factor of 3 from USD 72/tonne at the beginning of the year to peak at USD 274/tonne on 5 October. Prices saw a correction at the beginning of November, and traded between USD 145 and USD 164/tonne over the first half of February 2022 (Argus Media and IHS McCloskey, 2022). Higher electricity demand, especially in China, saw coal demand increase in 2021, pushing up prices.

FIGURE 1.7 The global weighted-average LCOE and PPA/auction prices for solar PV, CSP, onshore wind and offshore wind, 2010–2023

In Europe, the increase in fuel prices were bolstered by rising CO2 emissions allowance prices in the European Emissions Trading Scheme (ETS). These prices increased from USD 40/tonne at the beginning of 2021 to trading between USD 99 and USD 114/tonne over January and the first half of February in 2022.

These developments, combined, have resulted in a surge in electricity generation costs. Over January and the first half of February 2022, the fuel-only cost (including CO2 permits) of a recent, representative coal-fired power plant increased by about USD 61–92/MWh from a year previous. The total fuel cost of a hard coal plant in Europe was therefore between USD 117/MWh and USD 148/MWh. The increase alone is higher than the total lifetime cost of electricity of new solar PV and onshore wind projects in most of Europe. For natural gas, the increase is even more dramatic, with the fuel cost of generated electricity from a combined cycle gas plant increasing by USD 133–167/MWh from the beginning of 2021, to total USD 186–220/MWh. Even if prices decline in 2022, the economic damage wrought by this period of high prices is real.

The recent price volatility is a reminder that most renewables have an inherent advantage for consumers, given that their output can be purchased for the entire life of the asset at a fixed price. Thus, renewables’ deployment can help to hedge against the risk of fuel price increases, protecting final consumers.

The deteriorating economics of fossil fuel-fired power plants do not always appear to be correctly priced by the market. The era of steady prices of coal and natural gas, central to the investment mindset of many utilities, appears to be in the past. For instance, the 20-year rolling average historical price of natural gas in Europe increased by 46% between 2010 and 2021, while the 15-year rolling average experienced a similar increase.5 Even if natural gas prices were to ease later this year, the long-term trend towards higher prices and volatility, even excluding carbon pricing, implies that new natural gas-fired power plants are being squeezed by rising fuel costs over their 30-year economic life by falling renewable power generation costs and capacity factors, as gas plants need to operate more flexibly to accommodate large shares of variable renewables. A similar dynamic can be observed for coal, with volatile and increasing fuel prices, in combination with falling capacity factors. Even in 2021, when coal generation increased, the benefit of higher capacity factors in amortising coal plants’ fixed operation and maintenance costs was not even noticeable given the spike in coal prices.

What is less appreciated is that the growing cost advantage of new renewable power generation over natural gas-fired power plants creates more economic opportunity for low-carbon flexibility measures to become economic. These include battery deployment, long-duration storage, demand-side measures, sector coupling (e.g. with electric vehicles), biomethane and hydrogen. The idea that fossil fuel alone will support larger shares of solar and wind looks set to be overtaken by the improved economics of alternative sources of flexibility. This is at the same time that the cost of these flexibility options continues to decline. BloombergNEF’s (BNEF) battery pack price index (a composite of EV and stationary products) fell 89% between 2010 and 2021 from USD 1 200/kWh to USD 132/kWh (BNEF, 2021). In Germany, small behind-the-meter residential batteries fell in cost by 71% between 2014 and 2020 (IRENA, 2022a).

1.3.2 Other key milestones

In addition to the growth of renewables deployment in the electricity sector, the use of renewables in various end-use sectors – through modern biomass, biofuels, solar thermal and geothermal – also increased, reaching more than 45 exajoules (EJ) in 2019. Most of this (more than 95%) came from bioenergy, while the direct use of geothermal and solar thermal remained relatively low, at 0.9 EJ and 1.4 EJ, respectively. Despite the fact that renewable energy consumption in end-use sectors is increasing in absolute terms, there is a need to increase in comparison to other fossil fuel-energy sources by 2050.

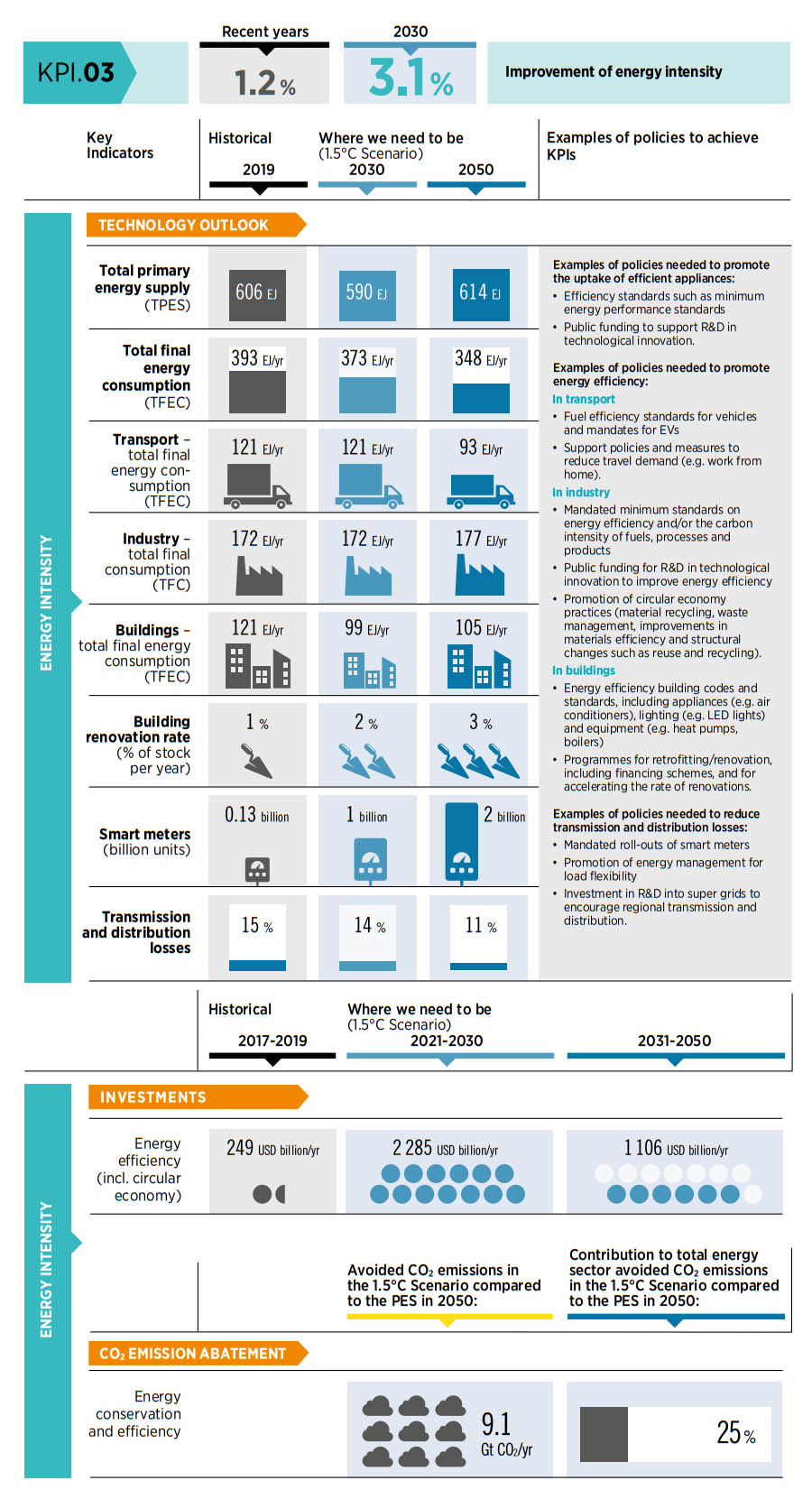

In recent years,6 the rate of energy intensity improvement reached about 1.2%, and last year it has recorded less than half of the recent year average amid the COVID-19 crisis (IEA, 2021b). Total energy efficiency investment in 2020 reached USD 250 billion, with buildings accounting for more than two thirds of the total. The energy intensity improvement rate should increase nearly two and a half times to 2.9% per year by 2050. Based on these estimates, efforts are currently off track and there is great need to accelerate the rate of renovations.

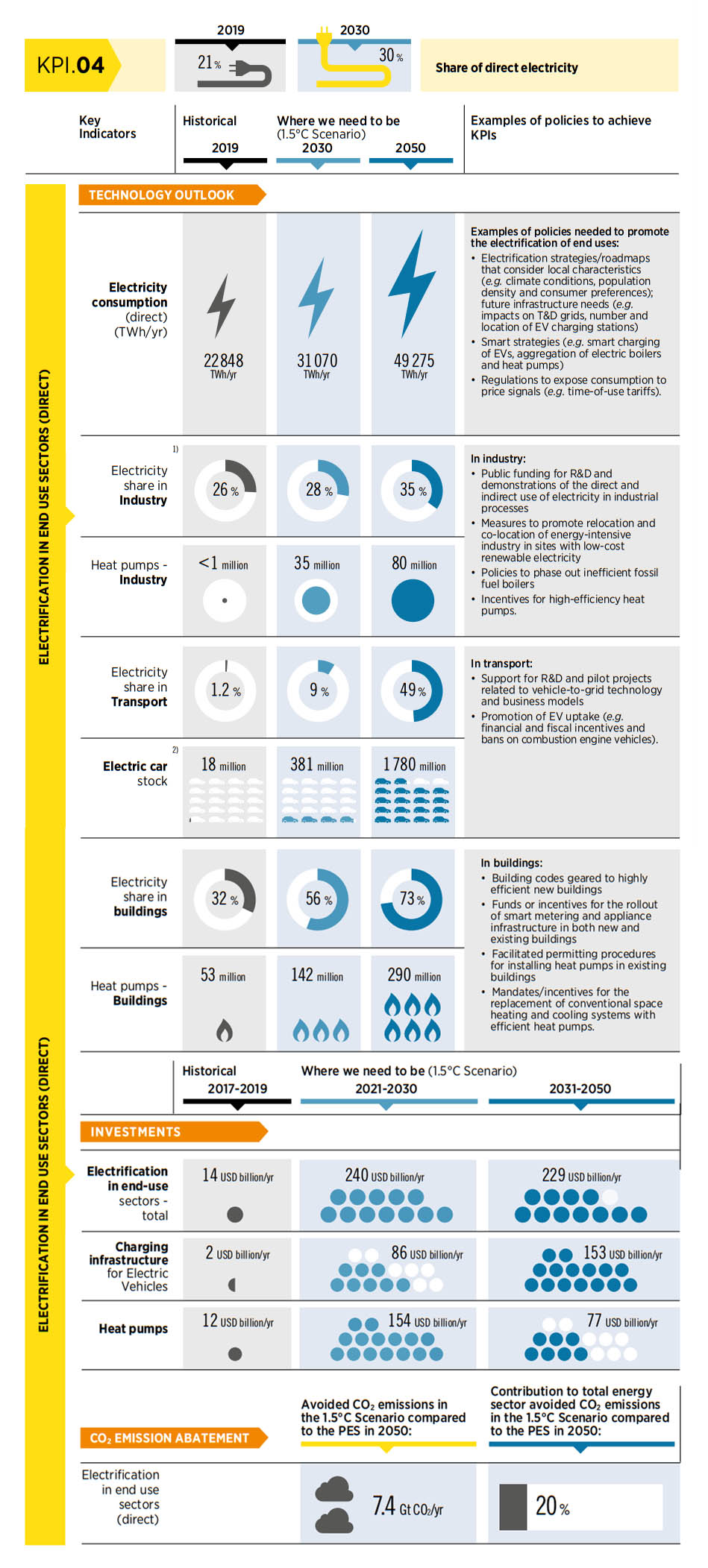

Electrification can contribute both to decarbonisation and to the improvement of energy efficiency. Direct electricity consumption in end-use industries increased significantly over the past decade, reaching around 22 850 TWh by 2019, accounting for 22% of total energy consumption. The direct electricity consumption was distributed between end-use sectors like industry (about 9 500 TWh), buildings (about 10 900 TWh) and transport (420 TWh). The number of new electric passenger cars on the road will need to significantly increase from almost 7 million per year7 in 2021 to 147 million by 2050. This is an increase of 25 times from the current level, indicating urgent need to scale up deployment.

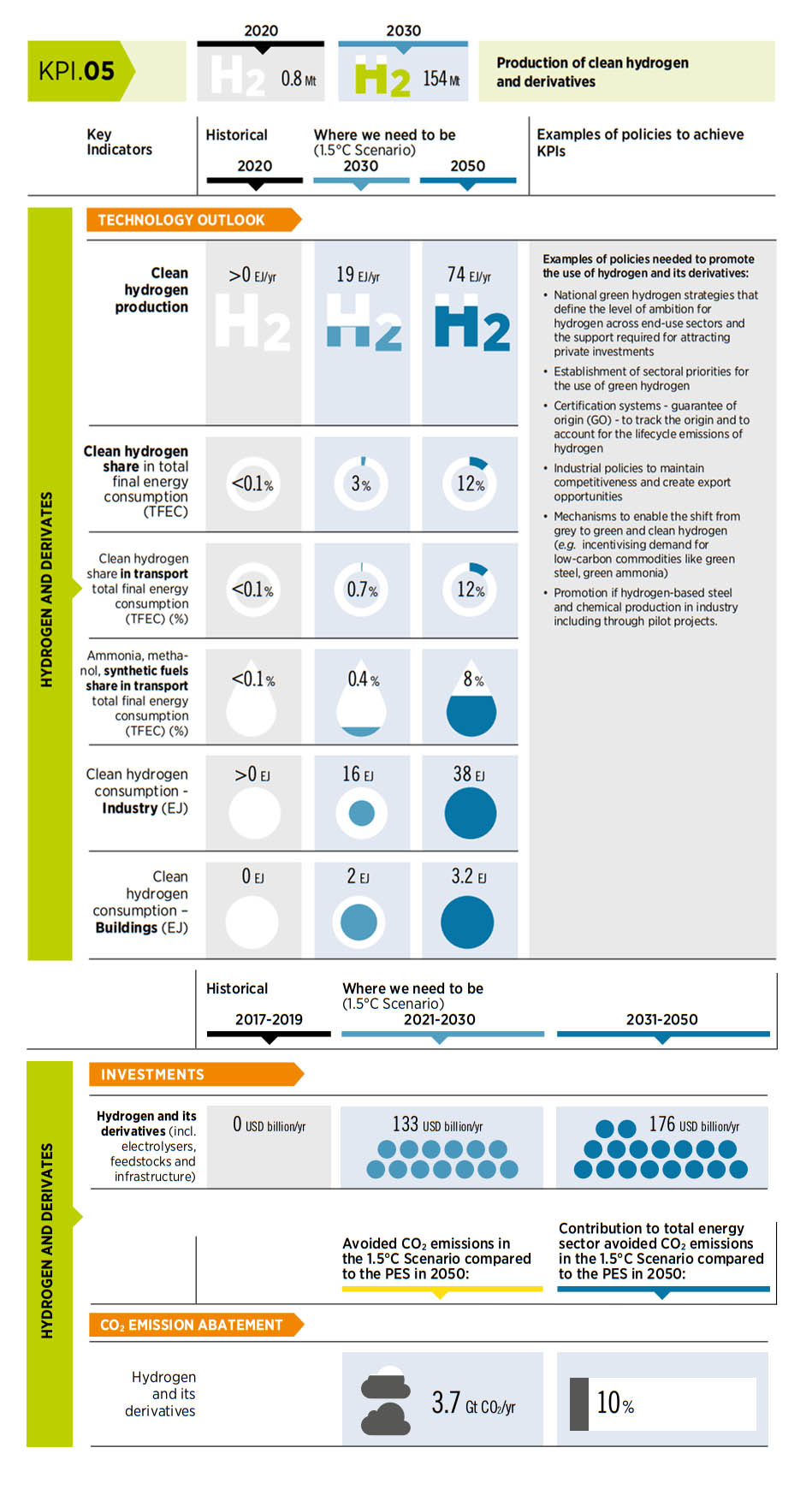

The electrolyser market required to produce clean hydrogen is still small but is expected to play a significant role in decarbonising the energy sector in the coming decades. Electrolyser capacity additions more than doubled in 2021, reaching 458 MW and were expected to grow four-fold or even five in 2022 (BNEF, 2022a). To reach the 1.5°C target, an annual increase in electrolyser capacity of at least 150 GW is required by 2050.

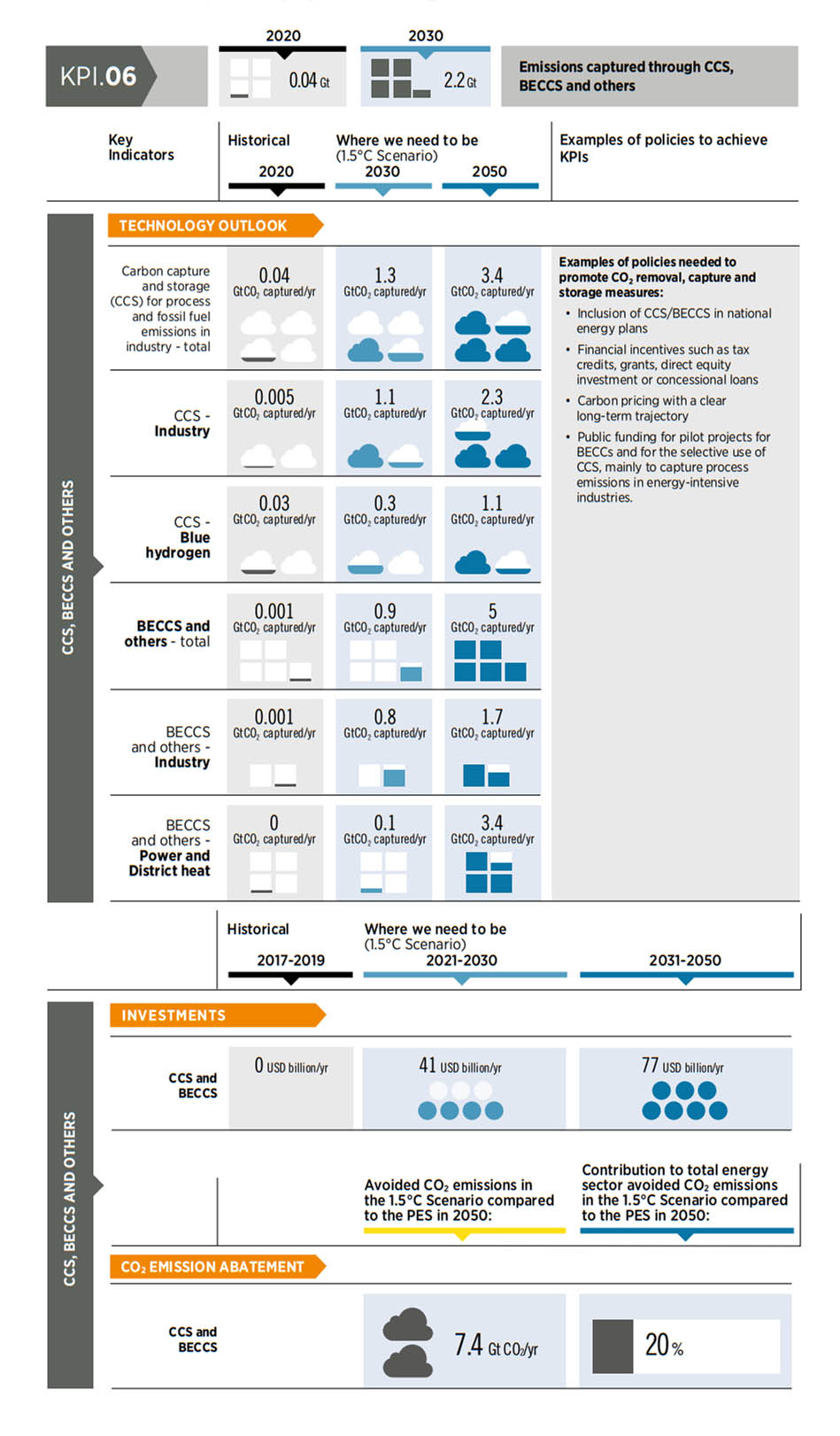

As of early 2021, 24 commercial fossil fuel-based CCS facilities were in operation globally with an installed capacity of about 0.04 Gt/year of energy- and process-related CO2 emissions (IRENA, 2021b). There are three operational commercial facilities that use bioenergy with CCS (BECCS) and seven commercial plants are in development. The current capture capacity of operational commercial BECCS plants is very small at 1.13 Mt/year. The status of CCS/BECCS deployment is not on track, from 2030 onwards deployment should increase, reaching around 3.5 Gt/yr and 5 Gt/yr in 2050, respectively.

Electrifying end-use sectors using renewable power leverages synergies with energy efficiency measures and brings additional energy intensity improvements. As such, electric vehicles and heat pumps are much more efficient than comparable fossil fuel-based systems.

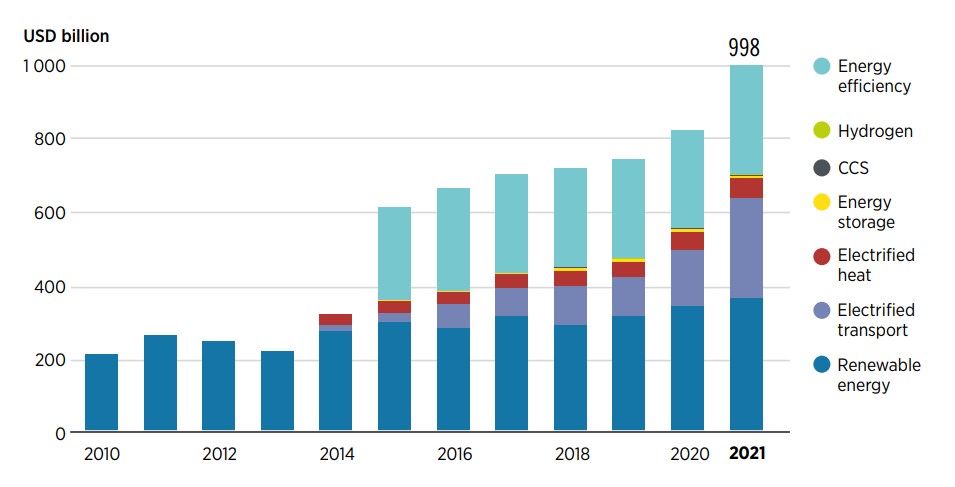

1.3.3 Investments

Beyond deployment data, to assess progress, it is important to look at investment flows, both in terms of technologies and geographical distribution. In 2021, energy transition-related investment was just shy of USD 1 trillion,8 a 21% increase from the year before (Figure 1.8) (BNEF, 2022b; IEA, 2021c). Renewable energy was still the largest sector as it attracted USD 366 billion (excluding large hydropower),9 up 77% from the previous year. Electrified transport saw the largest increase in 2021, with USD 273 billion invested in EVs and associated charging infrastructure, up 77% from 2020. Electrified heat investments continued to increase, albeit not at the same pace as electrified transport, attracting USD 53 billion. Hydrogen attracted USD 2 billion. In addition to these direct investments in the deployment of technologies relevant to the energy transition, another USD 165 billion was invested in climate technology companies, mostly focused on the energy and transport sectors, and is likely to be used in the coming years to scale up operations related to the energy transition (BNEF, 2022b).

FIGURE 1.8 Global investment in energy transition technologies, 2010–2021

Note: a) Data for hydropower >50 MW were not available for 2019–2021 at the time of publishing. In addition, for previous years, the investments presented were compiled at the project level and only cover a percentage of total large hydropower investments as information on investments are not disclosed for all projects. These figures should therefore be treated as an underestimate. For other renewable energy technologies where investments were not disclosed, BNEF estimates were used.

b) Energy efficiency data come from the IEA (2021c) and are available only for 2015–2021. The 2021 data are an estimate. These values are in constant 2019 USD billions while all other values are from BNEF (2022b) are in current prices and exchange rates. Due to the lack of more granular data, the units could not be harmonised across the two databases. For this reason, these numbers are presented together for indicative purposes and should not be used to make cross-comparisons between the different data sources.

Despite their relatively steady growth, investments in energy transition technologies remain concentrated in a handful of regions and countries. The Asia-Pacific region accounted for almost half of global investments in 2021.10 The region was led by China, the top destination for investments globally, with USD 251 billion (up from USD 151 billion in 2020). This excludes energy efficiency and large hydropower and features a considerable increase of investment in renewables and electrified transport. China is followed by Japan, with increased investments in renewables and electrified heat, and India. The rest of the Asia-Pacific region, including the whole of Southeast Asia, attracted less than 8% of global investments. Europe accounted for around 28% of global investments, more than half of which went to a handful of countries: Germany, the United Kingdom of Great Britain and Northern Ireland (United Kingdom), France and Spain. It is interesting to note that in Germany, the United Kingdom and France, investments in electric transport were considerable in 2021 and dominated the increase in investments compared to 2020. The Americas attracted almost a fifth of global investments, and the United States alone, the second largest global destination for investments, accounted for more than USD 105 billion (up from USD 94 billion in 2020), distributed evenly across renewables, electric transport and electric heat. This means that the rest of the Americas, including all of Latin America, accounted for less than 4%, followed by the Middle East and Africa, which together account for no more than 2% of the total.

These trends clearly show ongoing disparities in countries’ ability to attract investments. About 84% of global investments were focused in China, Europe, the United States, Japan and India, whereas many countries with reduced public spending struggled to attract investments. These trends have become more pronounced as COVID-19 recovery packages were introduced in advanced economies best positioned to mobilise public financing, attracting record-high investments. Meanwhile, the majority of the developing world still faces great challenges in mobilising financing for critically needed energy projects ranging from electrifying health clinics to powering industry and development. These challenges were prominent even before the pandemic but subsequently, the fiscal space for recovery and sustainable development efforts became further constrained by additional obstacles to access financing, limited public and private investments and continuing debt service obligations (UN, 2021a).

International co-operation and the international flow of public financing will be more critical than ever to achieve a global energy transition that is just and inclusive. In 2019, international public financial flows to developing countries in support of renewable energy, for example, amounted to less than USD 11 billion, which is equivalent to less than 3.5% of global investments in renewables. Top funding countries include China, France, Germany and the United States, together with the EU institutions, multilateral development banks, and climate funds such as the Climate Investment Funds and Green Climate Fund. The majority of this funding went to Sub-Saharan Africa (about 37%, or USD 4 billion), Central and Southern Asia (19%, USD 2.1 billion), Western Asia and Northern Africa (17%, USD 1.8 billion), and Latin America and the Caribbean (14%, or USD 1.5 billion). The Oceania region attracted the smallest share of investment – USD 132 million. In emerging markets, international financial flows will continue to play an important role, as direct investments in energy transition assets and in attracting private capital through policies and measures.

1.3.4 Policies

Governments have helped move capital towards clean energy investments by setting out trajectories towards net zero carbon economies, but to date, efforts are not at the level of ambition required to put us on track. As of mid-November 2021, 91 parties – accounting for almost 64% of global greenhouse gas (GHG) emissions – had submitted NDCs that were more ambitious than the original ones. In addition, 134 countries revealed that they are considering net zero targets (Box 1.3). Although these announcements show increased political commitment to the energy transition, they are still not ambitious enough, as they are projected to reduce emissions by only approximately 20% by 2030 compared to business as usual before the first NDC (IRENA, 2022b). Moreover, for NDCs to be effective at driving investments in the various elements of the energy transition, they must be translated into concrete actions in the form of specific targets (e.g. for renewable energy) and policies covering all end uses and sectors.

Policies for renewable energy are more widespread but they do not always reflect the level of ambition in NDCs, and they continue to focus on the power sector. As of 2021, almost all countries had set renewable energy targets at the national level. But mismatches still exist between renewable targets in NDCs and those in national energy plans for many countries. Moreover, 170 targets continue to focus on the power sector, with only 54 in the transport sector and 54 for renewable heating/cooling. In 2020, 145 countries had introduced policies to support renewables in the power sector, while only 70 countries had introduced national-level policies in transport and only 61 countries had introduced national renewable heating/cooling policies, mostly focused on buildings (REN21, 2021). More targeted policies and measures are needed to drive renewable energy in all end uses, together with electrification.

Policies and measures are driving electrification in transport, but progress remains focused in high-income countries that have the financial means, adequate infrastructure and power capacity to support deployment. By the end of 2020, at least 52 jurisdictions had committed to targets for EVs, compared to 38 in 2019 (REN21, 2021). Measures such as financial incentives, public procurement, public support for charging infrastructure, free parking and preferred access have all contributed to the surge of uptake. Some of the top destinations for investments in electrified transport in 2021, such as Germany and France introduced financial support schemes for EVs as part of their COVID-19 recovery package. As a result of increased policy attention, global EV sales continued their pandemic-era surge, increasing around 17% in 2021 (BNEF, 2022c). Along with the increase in EV deployment, electric charging infrastructure also saw a sharp increase in 2021. Public charging connectors increased to around 1.8 million globally, almost doubling from 2019 (BNEF, 2022d).

Accelerating the energy transition will require a stronger policy focus on end uses such as heating, cooling and transport

The uptake of electric heating/cooling increased steadily in the past 7 years, although at a relatively slow pace compared to other energy transition sectors, and progress has been focused in a handful of countries. Much of this growth is due to countries increasingly adopting financial incentives for heat pumps such as grants, rebates, tax incentives and loan programmes. These include the United States, Japan and several European countries, mainly France and Germany. More efforts are needed to bring this deployment to developing countries where a high demand for cooling is expected as temperatures rise.

Political attention is increasingly going towards hydrogen. Today, more than 30 countries have developed or are preparing hydrogen strategies, indicating growing interest in developing clean hydrogen value chains. Dedicated policy action aside from R&D, however, is concentrated in a few countries. Importers of hydrogen are setting up mechanisms to procure green hydrogen, both in national and international markets. More dedicated policy making, at a global scale, will be needed to transition green hydrogen from niche to mainstream.

Increasingly, it is becoming clear that accelerating the pace and depth of the energy transition will require a stronger policy focus on end uses such as heating, cooling and transport. This needs to include support for the electrification of end uses, along with much greater policy efforts in sector coupling. The years to 2030 will be particularly crucial for putting the world on the right path towards 2050. Countries have set out their current and planned policies in updated NDCs, while increasingly also setting aspirational net zero targets. However, as set out in Box 1.3, these pledges, plans and policies still leave a significant gap and are unlikely to result in the more than trebling of the contribution from renewables required for a 1.5°C compatible pathway. What is needed is a fundamental step change compared to current and planned policies. Chapter 2 will set out a roadmap to 2030 to guide policy makers on how to achieve this leap forward.

BOX 1.3 Closing the gap? NDCs and net zero pledges

As of March 2022, 134 countries (almost 70% of all countries) announced that they were considering net zero targets. Of these countries, nine declared that they had already achieved net zero emissions, 14 had net zero targets written into law, 33 mentioned net zero targets in policy documents, 18 had made a declaration or pledge to reach net zero, and 60 were in ongoing discussions regarding net zero targets (Net Zero Tracker, 2021).

By November 2021, out of the 144 NDCs that had a quantified renewable energy target,11 109 focused on power and only 30 explicitly mentioned heating and cooling or transport. In addition, 13 parties committed to a percentage of renewables in their overall energy mixes.

Together with the new and updated NDCs, current and announced net zero pledges are projected to reduce expected emissions by approximately 20% by 2030 compared to business as usual before the first NDCs, with the potential to limit warming to 2.1°C (UNEP, 2021).

In November 2021, at COP26, countries attempted to solve a number of outstanding issues through the Glasgow Climate Pact. In the pact, countries are asked to further raise their ambition and return to the next COP with enhanced NDCs for the period to 2030.

In addition, COP26 saw a number of important announcements, including a pledge by over 100 countries to reduce their methane emissions by 30% by 2030. Furthermore, more than 130 countries agreed to halt and then reverse deforestation. Other pledges regarding coal phaseout and ending coal and gas exploitation by a number of countries are welcome but as things stand, reaching the 1.5°C goal remains extremely challenging. Globally, these pledges are steps in the right direction to combat climate change, but not at the rate required to meet the 1.5°C target. Because of the gaps between present and required targets, as indicated in Table 1.1, there is a growing perception that the world is not adhering to the 1.5°C trajectory.

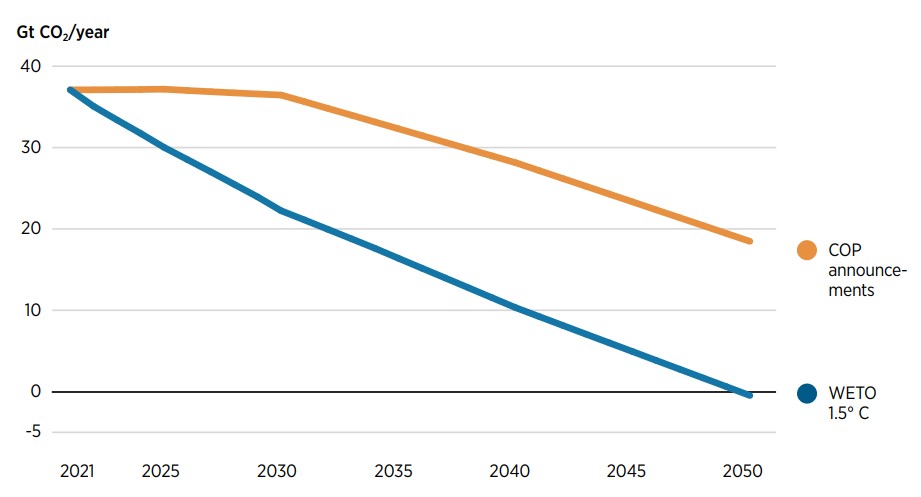

Figure 1.9 shows two estimated future global CO2 emissions trajectories in gigatonnes based on (i) COP26 announcements and (ii) the WETO 1.5°C Scenario.

The area between the orange and grey lines denotes the remaining gap required to achieve the 1.5°C target. To reach the 1.5°C target, emissions levels would need to be at around 22.2 Gt CO2 in 2030, whereas the emissions levels under the COP26 announcement scenario are estimated at 37.5 Gt in 2030. The orange line’s starting point was fitted to be the same as the grey line’s.

The “COP26 announcements” trajectory includes all NDCs and long-term strategies or net zero targets communicated by parties as of 12 November 2021. To estimate emissions for the trajectory, “optimistic” data, i.e. the lowest emission level of the full implementation of the NDC (conditional and unconditional), have been applied.

Despite the increased ambition expressed in COP26 announcements, current climate pledges are insufficient to reach net zero by mid-century, and countries must still raise their mitigation efforts significantly to be capable of decreasing emissions to around one-third of the current expected level by 2050, in order to achieve net zero emissions.

If the climate commitments included in the COP26 announcements trajectory are implemented, CO2 emissions are projected to peak in 2025, due to a 0.2% increase in emissions from 2021, followed by a modest decline until 2030. Following that, a continuous declining trajectory into 2050 begins as a result of governments’ announced long-term strategies and net zero targets.

Although the mitigation ambition level was clearly raised at COP26, substantial additional efforts are required to bridge the gap towards the 1.5°C target, as represented by the WETO 1.5°C Scenario. The emissions gap in 2050 between the COP26 announcements trajectory and the 1.5°C Scenario is still 20 Gt.

FIGURE 1.9 CO2 emission trajectories based on COP announcements and the WETO 1.5°C Scenario

Highlights

To get on a 1.5°C-compatible pathway, the energy transition urgently needs to accelerate. In this 2022 edition of World Energy Transitions Outlook, IRENA lays out a 2030 roadmap to the 1.5°C goal. Priority actions to reach the goal are summarised below.

-

Energy intensity will have to improve. Special attention must be paid to the decarbonisation of buildings, which will require major investments in energy efficient renovation and electrification (USD 1.5 trillion per year in this decade). In transport, massive deployment of smart charging points for electric vehicles (EVs) will be needed in cities and along highways (USD 86 billion per year). Enabling policies and regulations must be put in place to accelerate deployment. The rate of energy intensity improvement must rise to 3.1% per year by 2030, which represents more than a doubling of current rates (1.2% per year in the period 2018-2020).

-

Electrification will have to expand. By 2030, global electricity demand is expected to be 1.3 times what it is in 2019, exceeding 31 000 TWh. If renewables are to supply 65% of all electricity, at least 800 GW of new renewables-based generating capacity will have to be installed each year through the end of the decade, almost three times the current rate. The stock of electric cars is expected to grow more than 20 times from 2021 to 2030, reaching more than 380 million EVs in that year.

-

The share of renewables in the world’s energy supply needs to grow sharply. The share of renewable energy in total primary energy supply will have to rise from 14% in 2019 to around 40% in 2030. Policy makers will have to place greater emphasis on the decarbonisation of end-use sectors.

-

Clean hydrogen and biofuels will play key roles. Clean hydrogen roadmaps and plans, new or modified infrastructure, and implementation of projects all must accelerate through the end of the decade. Clean hydrogen is expected to increase to 154 megatonnes (Mt) by 2030. This implies an investment of USD 88 billion per year for hydrogen electrolysers, infrastructure and feedstock. Quintupling the supply of biofuels by 2030 will require USD 124 billion per year. In industry, policy makers should dedicate special efforts to the cement, iron and steel, and chemical sectors. Dedicated policies and funds will be needed to accelerate the transformation of these sectors.

The 1.5°C Scenario will require investment of USD 5.7 trillion per year until 2030, including a redirection of investments of USD 0.7 trillion per year from fossil fuels to energy transition technologies. While most of the additional capital is expected to come from the private sector (debt and equity raised from capital markets and private investors), public financing will still play a crucial role in facilitating the transition, as markets alone are not likely to move rapidly enough. Public funding will have to almost double to catalyse private finance and ensure that the energy transition unfolds in a just and inclusive way. Public funds are also needed to create an enabling environment for the transition and to ensure 1) that it occurs fast enough to meet climate goals and 2) that it has the best possible socio-economic outcomes.

A comprehensive set of policies will be needed to achieve the necessary deployment of climate friendly renewable technologies by 2030. Deployment policies must include structured procurement mechanisms (e.g. auctions, FITs) and financial and fiscal incentives to build markets, thus facilitating scale-up, reducing technology costs and increasing investment levels in line with the needs of the energy transition. Enabling policies include instruments to support access to finance, policies to phase out fossil fuels, and measures to eliminate market distortions that currently favour fossil fuel use. This will involve phasing out fossil fuel subsidies and changing fiscal systems to factor in the negative environmental, health and social costs of the fossil fuel-based energy system. Monetary and fiscal policies, including carbon pricing policies, will enhance the competitiveness of solutions that advance the transition. Such interventions should be accompanied by a careful assessment of the social and equity dimensions to ensure that the situation of low-income populations is not worsened but improved. Structural and just transition policies, along with the creation of strong institutions to ensure policy co-ordination and cohesion, are required to manage potential misalignments. A holistic global policy framework is needed to bring countries together to commit to a just transition and strengthen the international flow of finance, capacity and technologies.

The need for a comprehensive policy framework is equally great at the international level. The members of the G7 and G20 will have to implement ambitious plans to decarbonise their economies within their own boundaries and beyond. Members should resolve to work together to ensure that renewables make up a 65% share of power generation by 2030. To do that, they must first scale up renewable capacities in their own countries. The members of the G7 and the G20 have a critical leadership role in bringing countries together in pursuit of a just transition. Achieving a just transition will depend on healthy international flows of finance, knowledge, capacity and technology.

2.1 Introduction to the roadmap to 2030

As set out in Chapter 1, significant efforts will be required to ensure that the 1.5°C climate goal can be reached by 2050, especially as the energy trajectory is presently off track. The remainder of this decade will be a critical time to shift gears and put into place the actions, investments, and policies needed to meet the 2050 goal.

Achievement of the 1.5°C climate goal – to limit global average temperature increase by the end of the present century to 1.5°C, relative to pre-industrial levels – is the unifying principle behind IRENA’s 1.5°C Scenario. It prioritises readily available technology solutions, which can be scaled up at the necessary pace for the 1.5°C goal.

By contrast, IRENA’s Planned Energy Scenario (PES) is based on governments’ energy plans, targets and policies as of 2020. It includes the Nationally Determined Contributions (NDCs) undertaken by countries pursuant to the Paris Agreement. It does not include updates made to NDCs and targets from June 2021.12 It can be considered as the reference case for IRENA’s 1.5°C Scenario.

This chapter discusses the actions and policies required by 2030 if the world is to meet the 1.5°C target by 2050. Sections 2.2-2.7 discuss key performance indicators (KPIs) for each of the six technological avenues that are essential for this purpose (see Figure 2.1).

To assist policy makers in identifying priority actions, IRENA has identified KPIs for 1) increasing renewables-based electricity generation; 2) expanding the share of renewable energy in total final energy consumption through direct applications in transport, heating and cooling, and other sectors; 3) accelerating the rate of improvement in energy conservation and efficiency; 4) expanding the share of direct electricity in total final energy consumption; 5) increasing the production of clean hydrogen and its derivative fuels; and 6) raising the amount of carbon dioxide (CO2) captured from carbon capture and storage (CCS), bioenergy with CCS (BECCS), and other CO2 removal and storage measures.

The milestones and key actions required to achieve the targets of the 1.5°C Scenario by 2030 are shown in Figure 2.2.

Section 2.8 summarises investment needs through 2030 by technology, source of supply and sector. It also describes key changes in sources and forms of capital (public and private; equity and debt), demonstrating that the financial capital needed for the 1.5°C Scenario is available and the required shift in investments is achievable.

Section 2.9 describes the comprehensive policy framework that will be needed to support the energy transition, focusing on cross-cutting enabling and integrating policies. It also covers the structural policies needed to ensure a just and inclusive energy transition, as well as the holistic global policy framework that will be needed.

FIGURE 2.1 Key performance indicators for achieving the 1.5°C Scenario by 2030

2.2 Renewables: power

KPI. 01

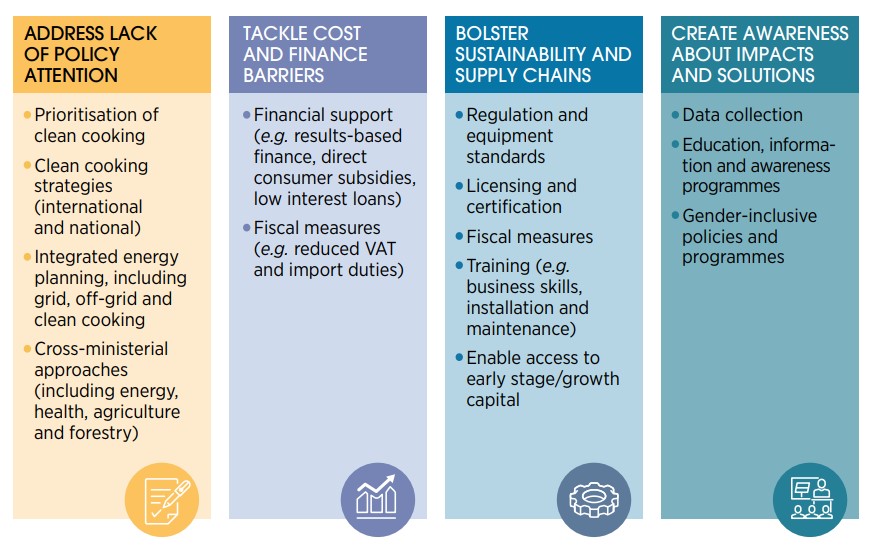

To fulfil the 1.5°C Scenario the electricity sector will have to be thoroughly decarbonised by mid-century. Whether or not that happens will depend on accelerating the deployment for generating purposes of all forms of renewable energy technologies – wind (onshore and offshore), solar photovoltaic (PV), concentrated solar power (CSP), hydropower, biomass, geothermal energy and ocean-based (tidal) energy. Wind and solar PV will lead the transformation, supplying 42% of total electricity generation by 2030 (from just over 10% today) (see Figure 2.3).