Delivering on the UAE Consensus: Tracking progress to tripling renewable energy capacity and doubling energy efficiency by 2030

KEY FINDINGS

URGENT ACTIONS FOR POLICY MAKERS

KEY RECOMMENDATIONS

NATIONALLY DETERMINED CONTRIBUTIONS

- Nationally Determined Contributions in 2025 (NDC 3.0) must more than double existing renewable energy targets, which fall 5.8 TW short of the 2030 tripling goal, and must be measurable, specific and better aligned with national energy plans, allowing the private sector to align with national goals to ensure a robust pipeline of renewable energy projects.

- Agreement on a New Collective Quantified Goal (NCQG) for climate finance at COP29 will be vital for enhancing financial support for climate action as well as inspiring ambitious NDCs.

POLICY AND REGULATION

- Policies and regulations need to be strengthened to deal with barriers and bottlenecks, including fiscal policies and incentives for renewables and energy efficiency measures.

- Permitting delays and administrative barriers must be reduced, but still account for legitimate community concerns; e.g. by creating a centralised authority to oversee permitting and disputes.

- Environmental and social concerns must be addressed at the strategic level and better integrated in project permitting through environmental and social impact assessments.

- Laws and regulations should advance sustainable practices, public-private partnerships, and investment to encourage reuse and recycling of materials through circular economy approaches.

SUPPLY CHAINS, SKILLS AND CAPACITIES

- Regionally diversified and resilient supply chains are essential for supporting the acceleration of renewable energy deployment and can: minimise supply–demand imbalances for key equipment; mitigate price volatility; and permit greater local value creation.

- Sustainable supply chain assurance schemes are needed to encourage socially responsible procurement processes for renewable power (e.g. Solar Stewardship Initiative; Hydropower Sustainability Standard).

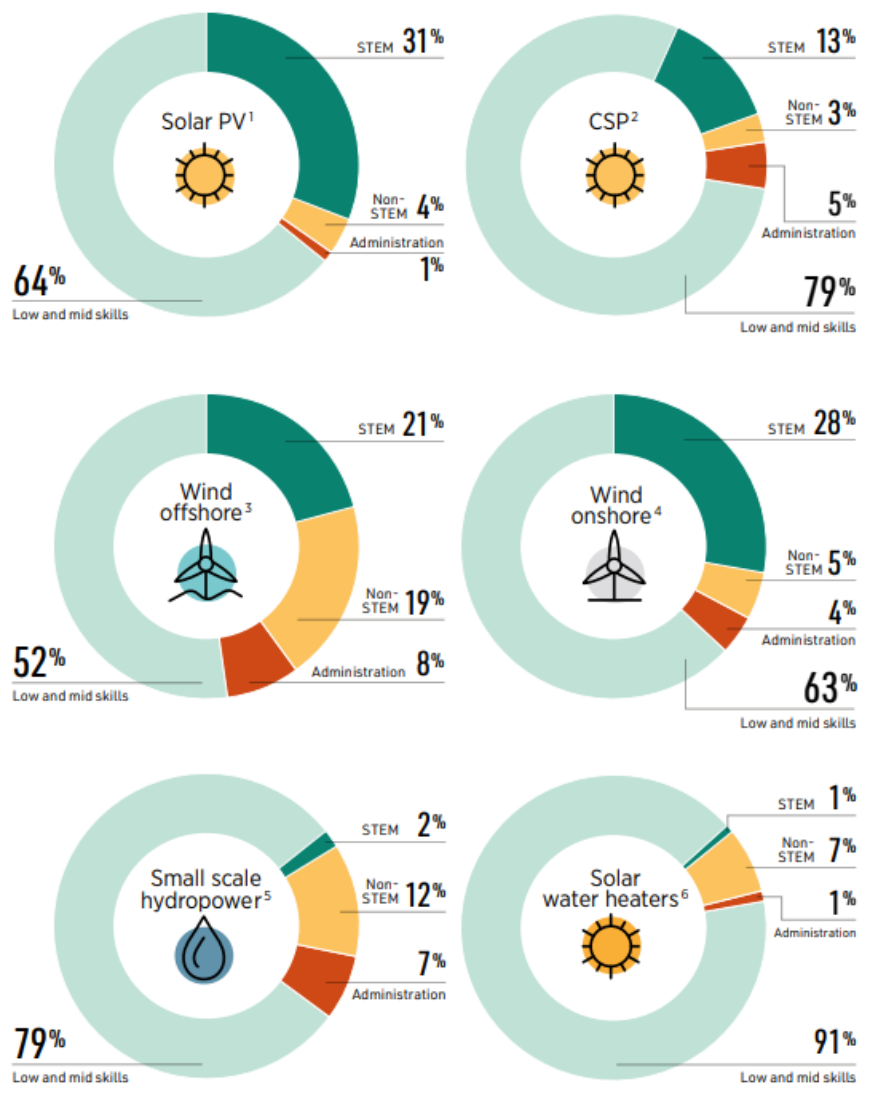

- Education, training, re-skilling and up skilling should be prioritised, and engage those traditionally excluded from the energy workforce, including women, minorities and other under-represented groups.

- Energy transition skills requirements necessitate stable, long-term energy planning with co-ordination among industry, government, labour representatives, and educational and training institutions.

FINANCE

- Financing must be made available at better terms, especially for emerging markets and developing economies (EMDEs), by mitigating country and currency exchange risks and delivering broader availability of concessional finance and grants.

- Governments must work to strengthen energy sector cashflows and attract public finance in the form of government spending and international grants.

- The positive impact potential of projects (i.e. on energy access, poverty, sustainable development and the environment) must be embedded in evaluations for financing.

INTERNATIONAL COLLABORATION

- International collaboration is crucial in channelling funds to create enabling environments to develop the renewable energy sector and fund projects that have the best chance of achieving climate, development and industrialisation goals.

- Immediate efforts are needed to establish multilateral initiatives that promote knowledge-sharing and capacity-building to deliver a just transition that safeguards nature and biodiversity.

- North-South and South-South dialogues should be cultivated; groups like the G7 and G20 must mobilise support and investment; and just transition funds should be established and operationalised in emerging economies.

INFRASTRUCTURE AND SYSTEM OPERATION

- Modernised infrastructure development must be delivered urgently, including: integrated power capacity planning and grid expansion; and accelerated grid modernisation and digitalisation.

- Power sector structures need reform to integrate renewables; and multistakeholder processes are essential to this process.

- All regions require enhanced system flexibility through demand-side management and grid optimisation; interconnectors will play a crucial role in enhancing grid resilience.

- Infrastructure development requires better spatial planning and regulatory reforms to support the rapid deployment of grids and rid-enhancing technologies, including advanced sensors, optimisation tools and storage.

Forewords

Francesco La Camera

|

|

Dr Sultan Al Jaber

|

|

H.E. Mukhtar Babayev, COP29 President-Designate

|

|

André Corrêa do Lago

|

|

Bruce Douglas

|

|

THE UAE CONSENSUS

COP28 delivered the historic UAE Consensus, an ambitious negotiated response to the First Global Stocktake charting progress against the Paris Agreement. It includes unprecedented language around transitioning away from fossil fuels in a just, orderly and equitable manner. The negotiated text – agreed by 198 Parties in Dubai – also includes a number of global goals, such as calls for tripling renewable energy, halting deforestation and doubling energy efficiency by 2030.

IRENA has been designated the custodian agency for tracking and reporting on two of these goals; this report is the first edition of an annual series charting progress toward them.

28. Further recognizes the need for deep, rapid and sustained reductions in greenhouse gas emissions in line with 1.5 °C pathways and calls on Parties to contribute to the following global efforts, in a nationally determined manner, taking into account the Paris Agreement and their different national circumstances, pathways and approaches:

(a) Tripling renewable energy capacity globally and doubling the global average annual rate of energy efficiency improvements by 2030;

– UNFCCC, Outcome of the First Global Stocktake, 2023.

Disclaimer and acknowledgements

Acknowledgements

This report is the result of a collaboration between the International Renewable Energy Agency, the COP28 Presidency, the COP29 Presidency, the Global Renewables Alliance, the Ministry of Energy of the Republic of Azerbaijan and the Federal Government of Brazil.

The report was led by Francis Field, Ute Collier and Ricardo Gorini, and authored by: Mengzhu Xiao, Faran Rana, Diala Hawila and Sean Collins (IRENA); Stuti Piya (IRENA consultant); and Ana Rovzar, Louise Burrows and Michael Taylor (GRA).

Substantive contributions were provided by: Celia García-Baños, Michael Renner, Sonia Al-Zoghoul, Jerome Nsengiyaremye, Nazik Elhassan, Dennis Akande, Samah Elsayed, Toyo Kawabata, Hannah Sofia Guinto, Francisco Gafaro, Juan Pablo Jimenez Navarro, Deborah Machado Ayres, Jinlei Feng and Emanuele Bianco.

Strategic liaison was provided by: Dr. Abdulla Malek (UAE Consensus/COP28); Elnur Soltanov (COP29 Chief Executive Officer); H.E. Orkhan Zeynalov (Deputy Minister of Energy of the Republic of Azerbaijan) and Nazrin Habizada; Bruce Douglas (GRA); Laís de Souza Garcia (Ministry of Foreign Affairs, Brazil); and Gürbüz Gönül (Director, IRENA Country Engagement and Partnerships); Binu Parthan, Zhanar Kuanyshkaliyeva and Negar Fayazi (IRENA).

Valuable inputs and reviews were provided by Roland Roesch (Director, IRENA Innovation and Technology Centre) and Marcin Ścigan (UAE Consensus/COP28); Julian Prime, Norela Constantinescu, Luis Janeiro, Arina Anisie, Nopenyo Dabla and Adrian Gonzalez (IRENA); and Isaac Elizondo Garcia (IRENA consultant).

Publications and production were provided by Stephanie Clarke; communications and digital support were provided by Nicole Bockstaller, Daria Gazzola and Manuela Stefanides (IRENA), Maram Alkadhi (COP29), and the communications teams of the report partners.

The report was produced by IRENA, with graphic design by weeks.de Werbeagentur GmbH.

Cover photographs: © fogcatcher/shutterstock.com (left side); © zef art/shutterstock.com (middle); © Curioso.Photography/shutterstock.com (right side)

Disclaimer

This publication and the material herein are provided “as is”. All reasonable precautions have been taken by the copyright holders to verify the reliability of the material in this publication. However, neither IRENA, the COP28 Presidency, COP29 Presidency, GRA, Ministry of Energy of the Republic of Azerbaijan, the Government of Brazil, nor any of their officials, agents, data or other third-party content providers provides a warranty of any kind, either expressed or implied, and they accept no responsibility or liability for any consequence of use of the publication or material herein.

The information contained herein does not necessarily represent the views of all Members of IRENA or the GRA and its constituent associations. The mention of specific companies or certain projects or products does not imply that they are endorsed or recommended by IRENA, the COP28 Presidency, COP29 Presidency, GRA, Ministry of Energy of the Republic of Azerbaijan or the Government of Brazil in preference to others of a similar nature that are not mentioned. The designations employed and the presentation of material herein do not imply the expression of any opinion on the part of IRENA or the partner organisations concerning the legal status of any region, country, territory, city or area or of its authorities, or concerning the delimitation of frontiers or boundaries.

RENEWABLE POWER

The tripling of installed renewable power generation capacity by 2030 is a key pillar of the UAE Consensus and a critical milestone for keeping the 1.5°C goal within reach (COP28 UAE, 2023). IRENA’s World Energy Transitions Outlook 1.5°C Scenario provided the analytical basis for the goal, as documented in a joint report with the COP28 Presidency and the Global Renewables Alliance (COP28 Presidency et al., 2023). This resulted in 133 countries pledging to triple global installed renewable power capacity by 2030 compared to 2022 levels at COP28, and to the call in the Outcome of the First Global Stocktake for all Parties to the United Nations Framework Convention on Climate Change (UNFCCC) to contribute to efforts to triple renewable energy capacity globally and double the global average annual rate of energy efficiency improvements by 2030 (UNFCCC, 2023).

The 1.5°C Scenario identifies a pathway for the energy transition that aligns with the Paris Agreement goal of limiting the global average temperature increase to 1.5°C above pre-industrial levels by the end of this century (IRENA, 2023a). It emphasises the use of readily available technological solutions, particularly low-cost renewables combined with energy efficiency measures, which – when scaled up rapidly – can help achieve the 1.5°C target. The Scenario outlines a sharp and continuous decline in carbon dioxide (CO2) emissions, reaching net zero by 2050.

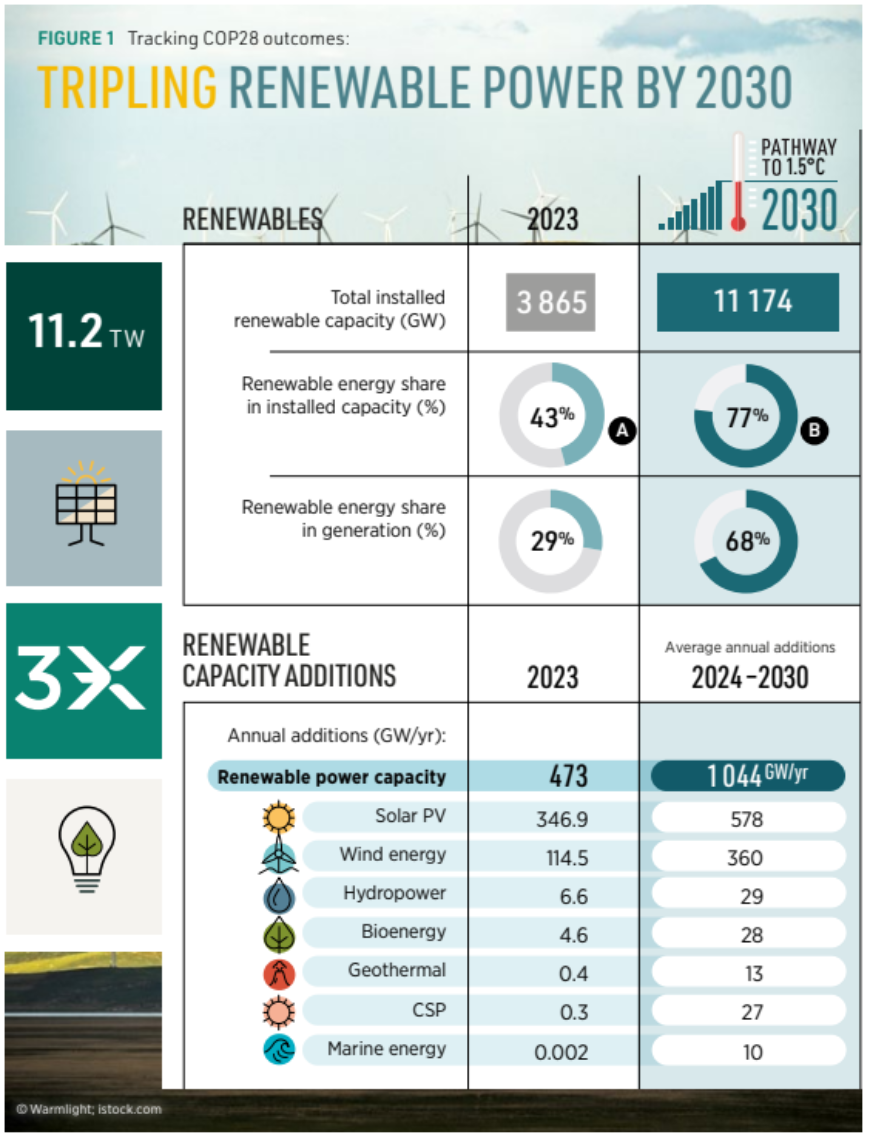

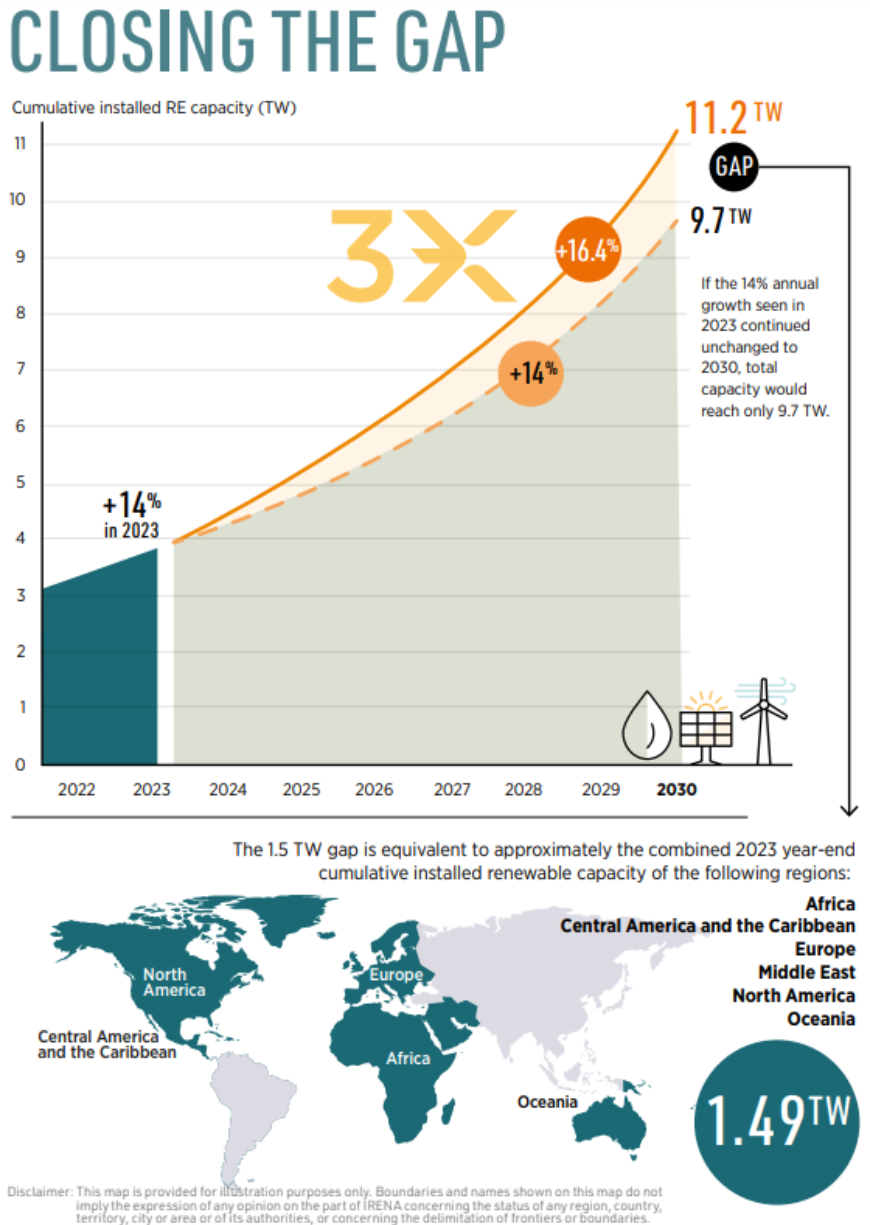

Achieving the tripling of renewable power capacity to reach 11.2 terawatts (TW) 1 requires an average annual addition of 1 044 gigawatts (GW) between 2024 and 2030 (inclusive), representing a compound annual growth rate of 16.4% in total installed renewable power capacity (IRENA, 2024a); this has risen from the 16.1% growth required over 2022-2030. Despite an acceleration in renewable energy deployment (reaching 14% growth in 2023), therefore, current progress falls short of the trajectory required, as illustrated in Figure 1. If capacity additions were to continue at 14% per year to 2030, the shortfall to the 11.2 TW target would be 1.5 TW – equivalent to the combined installed renewable capacity of Europe, North America, Oceania, the Middle East, Africa, Central America and the Caribbean today (see Figure 4).

FIGURE 1 Tracking COP28 outcomes:

Notes: TW = terrawatt; GW = gigawatt; yr = year; PV = photovoltaic; CSP = concentrated solar power; wind data includes onshore and offshore; hydropower data excludes pumped hydro.

For a detailled split see Figure 2.

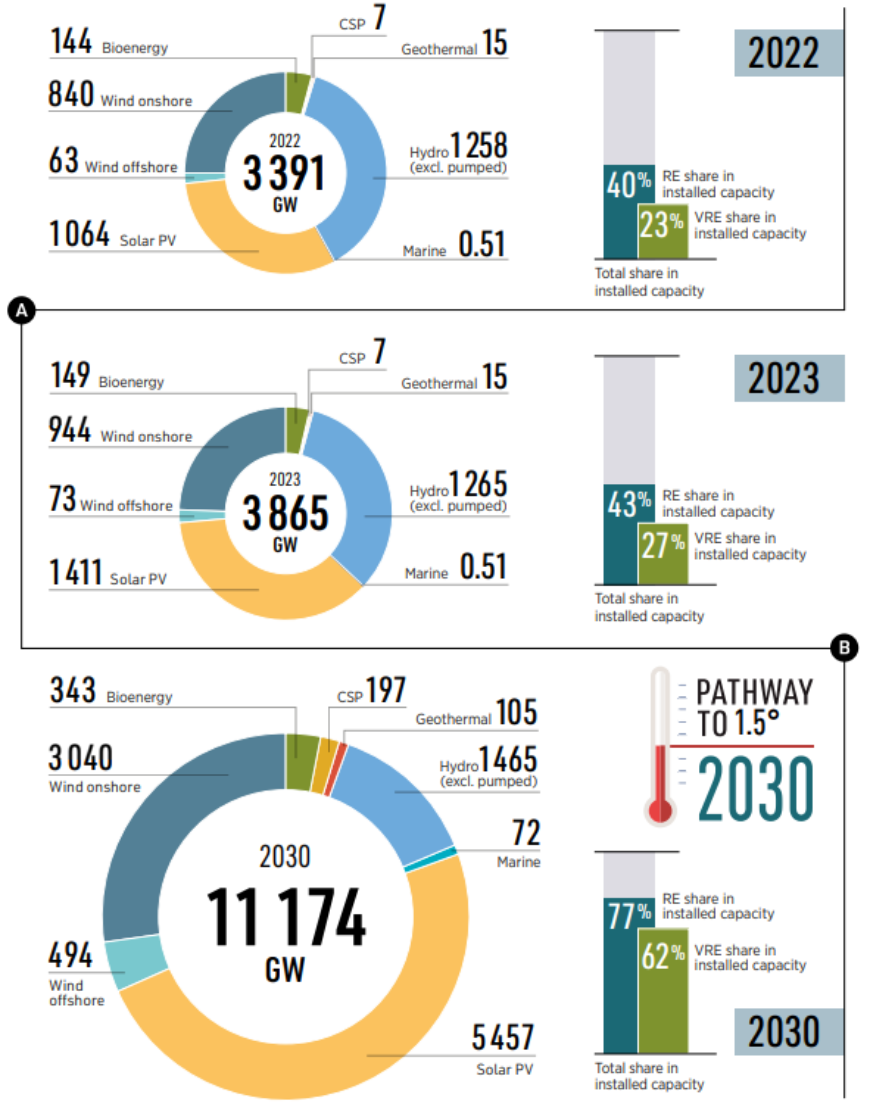

A record 473 GW of renewable power capacity was added globally in 2023, 54% higher than in 2022; yet this still falls short of the pace required to meet the 2030 target of 11.2 TW. New capacity additions of onshore and offshore wind, hydropower, geothermal, bioenergy, concentrated solar power (CSP) and marine energy in 2023 lagged far behind the requirements of the 1.5°C pathway (IRENA, 2024b). The significant acceleration in solar photovoltaic (PV) deployment – with 346.9 GW added in 2023 (73% higher than in 2022) – indicates that this is the only renewable technology that is on track to grow annual additions each year to reach its target of 5.5 TW of capacity required by 2030 (see Figure 2). Whilst a further ramp-up in net annual additions is needed to ensure an average 578 GW of solar PV capacity is added each and every year between 2024 and 2030, this is achievable considering the strong cost-competitiveness of the technology, its short project development lead times, excellent and exploitable resource potentials, and the global manufacturing capacity throughout the solar PV supply chain.

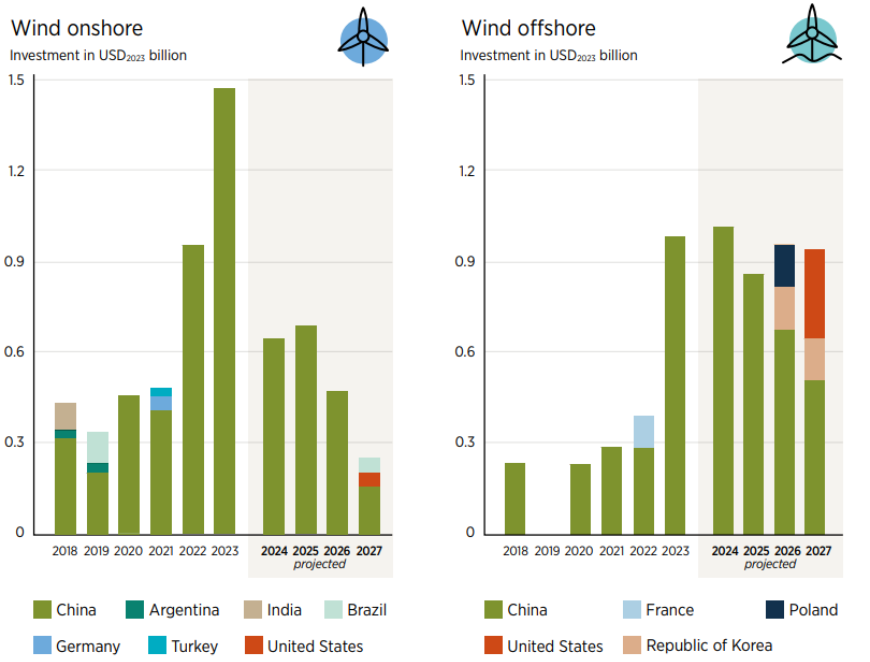

Global wind power capacity additions increased slightly to reach a new record in 2023, with 114.5 GW of capacity added; onshore wind, in particular, saw a significant increase in new capacity additions, at 103.9 GW – this increase almost matched the previous record of 105 GW achieved in 2020. Moreover, 11 GW of offshore wind capacity was added. However, current wind capacity additions are still insufficient; for onshore wind they were one third of the average needed each and every year to 2030 – and only one sixth of the average offshore wind additions needed – to meet the 3.5 TW target of overall wind capacity (see Figure 2). With recent annual capacity additions growing less than required to remain on a 1.5°C pathway, the implicit renewable power generation target will be missed by an even wider margin; this is due to the higher capacity factors of these technologies compared to solar PV 2 (IRENA, 2024c).

Just over six years remain to install the 2.5 TW of wind capacity required; urgent actions are therefore needed to address key bottlenecks such as overly lengthy permitting timelines, sluggish progress in grids and infrastructure expansion, and supply chain and skilled workforce constraints. Accelerating the speed of deployment requires collaboration between stakeholders across the energy sector, as well as policy makers and regulators, to resolve these bottlenecks and establish a sustainable project pipeline.

FIGURE 2 Global installed renewable electricity generation capacity in the 1.5°C Scenario, 2022, 2023 and 2030

Notes: GW = gigawatt; CSP = concentrated solar power; PV = photovoltaic; RE = renewable energy; VRE = variable renewable energy; bioenergy includes biogas, biomass waste, and biomass solid; hydropower data excludes pumped hydro.

Hydropower (excluding pumped hydro) capacity additions in 2023 experienced a disappointing fall to just 6.6 GW (compared to average capacity additions of 21 GW in the period 2018–2022), (IRENA, 2024a). To deliver the hydropower capacity additions required means achieving a four-fold increase compared to 2023 levels, each and every year to 2030 – and addressing key barriers such as longer development timelines, relatively high investment costs (in a number of markets), extended payback times, grid connection problems and issues of public acceptance. Nevertheless, the proven track record of hydropower – if complemented by enhancements to existing policy and urgent implementation of actions addressing key barriers – mean the target is still achievable (IHA, 2024).

Bioenergy, geothermal, CSP and marine energy together added only 5.2 GW of new capacity in 2023 (IRENA, 2024a), of which bioenergy represented 87%. Capacity additions in bioenergy need to average six times the 2023 additions each year to 2030, while for geothermal the increase needed is almost 35 times the capacity delivered in 2023. CSP and marine energy also require a considerable scaling of capacity additions as the 2023 level falls substantially below the target. Targeted policies, government support, increased research and development, and innovative financing are all essential to overcome the lag in capacity additions for these technologies.

Although recent capacity additions for these technologies have lagged behind expectations, the rapid expansion of the global solar PV industry demonstrates that, with the right policies and incentives, other renewable energy sources can also accelerate quickly to meet 2030 targets. However, the longer policy changes are delayed, the greater the challenge will become.

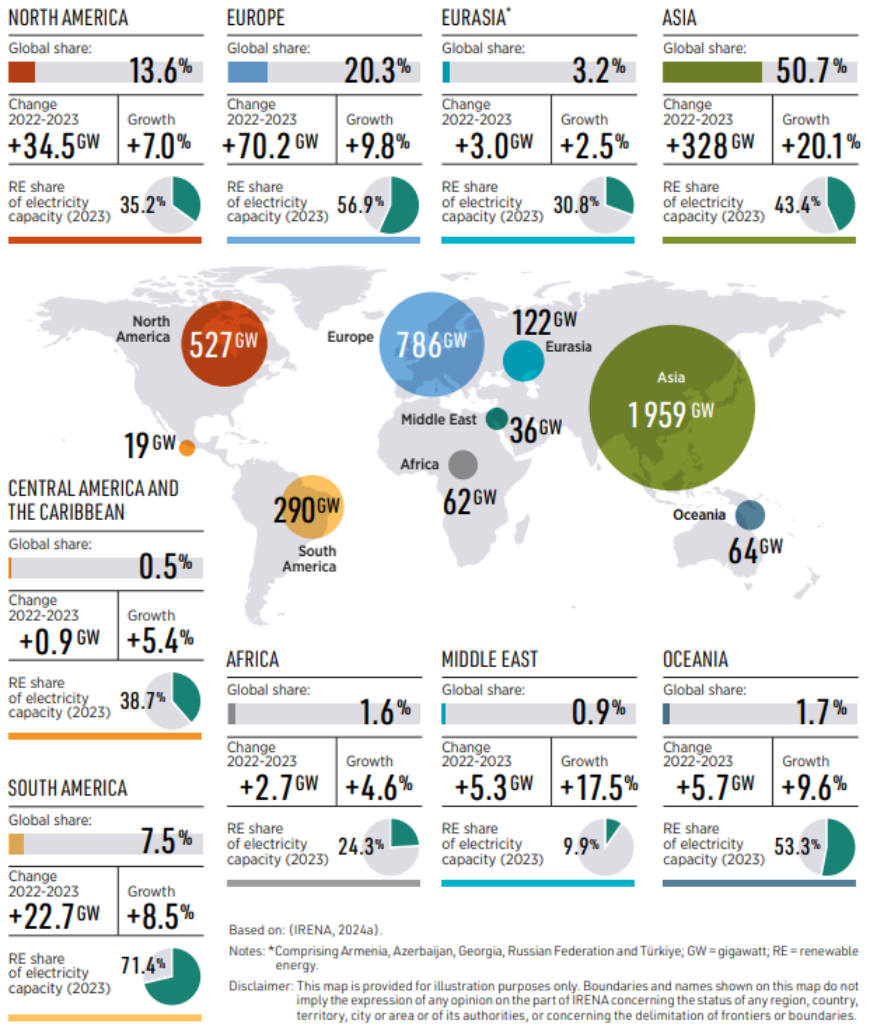

While global additions have continued to rise, the geographic deployment of renewable power capacity remains highly uneven. As shown in Figure 3, Asia, Europe and North America accounted for almost 85% of global installed capacity at end-2023. Meanwhile, the more than 1.4 billion people living in Africa in 2023 benefitted from just 1.6% of the global share of newly installed renewable power capacity. Worse still, at least 571 million people in Sub-Saharan Africa still had no access to electricity. The continent had among the smallest year-on-year growth in deployment – almost half of that seen in Europe (with a population of about 598 million in 2023). It is, therefore, crucial to accelerate the adoption of diverse renewable technologies across all continents.

FIGURE 3 Renewable power capacity by region in 2023

To achieve the tripling goal, global annual renewable power capacity additions must average 1 044 GW (16.4% compound annual growth rate) through 2030. Installed capacity must grow from 3.9 TW in 2023 to 11.2 TW in 2030, requiring an additional 7.3 TW in less than seven years. Solar PV (55%) and wind energy (34%) will play key roles in closing this gap. In 2023, cumulative installed renewable capacity increased by 14% relative to 2022, whereas 16.1% growth was required to remain on the 1.5°C pathway. If the 14% growth rate seen in 2023 were to remain for the remaining years of the decade, the world would miss the tripling target of 11.2 TW in 2030 by around 1.5 TW – a shortfall of 13.5% (see Figure 4) (IRENA, 2024a).

Current national plans and targets are set to deliver only half of the required annual renewable power capacity growth. These plans would deliver just 48% (3.5 TW) of the necessary capacity increase, with global installed capacity reaching only 7.4 TW by 2030 – 34% (3.8 TW) short of the tripling target. This shortfall indicates that existing policies and plans are insufficient to limit global temperature rise to 1.5°C, underscoring the need for urgent policy interventions.

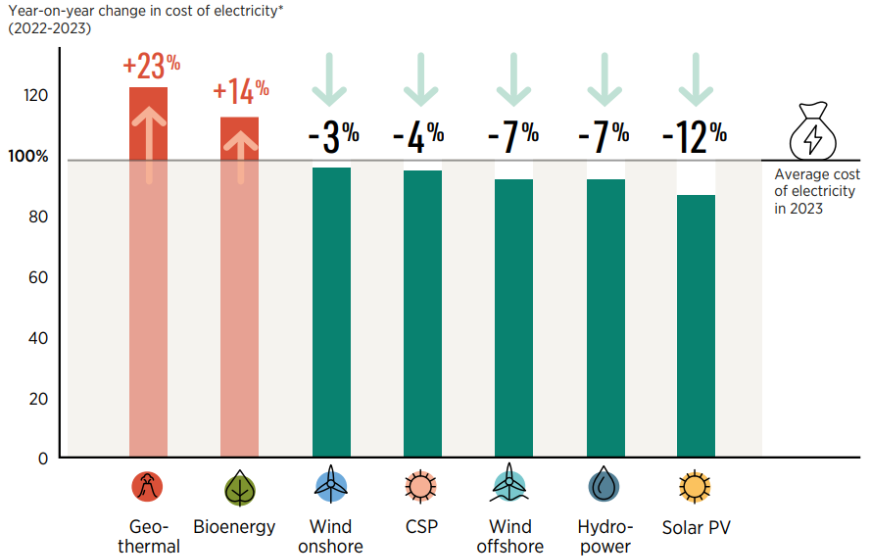

The continuing cost reductions and near universal competitiveness of renewable power generation make a compelling case. In 2023, the year-on-year global weighted average levelised cost of electricity (LCOE) decreased for all technologies except bioenergy and geothermal (see Figure 5). Solar PV saw the largest drop in LCOE. Offshore wind and hydropower also decreased in cost in 2023, reversing the upward trend observed in 2022.

FIGURE 4

FIGURE 5 Global average cost of electricity from newly commissioned ultility-scale renewable power, 2022-2023

The decline in renewable electricity costs has made renewables the most economical choice for power generation in almost all areas of the world. In 2023, 81% (382 GW) of new renewable power generation capacity was estimated to produce electricity at a lower cost than new fossil fuel-based options, given average fossil fuel costs in 2023. These new projects deployed in 2023 will generate cumulative undiscounted savings of at least USD 409 billion 3 over their lifetimes 4 (IRENA, 2024d).

Costs for battery storage, which reached 95.9 GWh gross capacity in 2023 worldwide, also continue to fall. Between 2010 and 2023, battery storage project costs have declined 89%, from USD 2 511/kWh to USD 273/kWh. This cost reduction has been driven by scaling up manufacturing, improved materials efficiency and improved manufacturing processes (IRENA, 2024d). The falling costs of storage create new opportunities to address constraints to the rapid scale-up of renewable power deployment (e.g. by using storage to alleviate grid constraints, shift solar and wind production to when demand is high, provide ancillary grid services, etc.).

The path to tripling renewable capacity by 2030 demands focused efforts on expansion and modernisation of grids and increasing energy storage capacities. The power system of tomorrow must evolve from a fossil fuel-based system to one in which the majority of generation is from renewables (a significant proportion of which will come from solar and wind). Under IRENA’s 1.5°C Scenario, the tripling of global renewable capacity must be accompanied by significant enhancement and expansion of power grid networks (both transmission and distribution), the modernisation and digitisation of power system operations, and increased adoption of grid flexibility options such as energy storage and demand side management (see section 2.1). An additional factor to consider is that global power generation needs will grow by nearly 40% by 2030 compared to 2022 levels. While demand growth and variable renewable technologies, like wind and solar, drive a need for flexibility – past a certain point – other renewable technologies, such as hydropower, geothermal and bioenergy, can contribute to meeting these flexibility needs by providing more consistent and controllable power output. There will be some benefits from dispersed renewable power generation to end users, but power will also need to flow from the best renewable resource areas to demand centres, necessitating grid enhancement and expansion. Energy storage – a crucial component for transitioning to decarbonised power systems – enhances grid stability and reliability, and can unlock significant cost savings by providing ancillary services to the power market and through energy arbitrage.

As storage costs continue to fall and the technology improves, storage will play an increasingly important role in providing the clean flexibility required in the future electricity system.

Pumped hydro storage is well-established and is the dominant technology, with total installed capacity reaching around 142 GW by end-2023 (IRENA, 2024a). However, the battery storage landscape is rapidly evolving and is expected to continue to accelerate as costs fall. In 2023, 42 GW (over 90 GWh) of battery storage was added, marking more than double the capacity additions observed in 2022 (IEA, 2024a). Utility-scale systems accounted for almost two-thirds of the additions, while the remaining 35% was accounted for by behind-the-meter battery storage. The capacity growth was driven by China, the EU and United States, collectively accounting for nearly 90% (IEA, 2024a). China commissioned 23 GW (triple the additions of 2022), followed by the United States with almost 8 GW, and the European Union with approximately 6 GW in 2023 (IEA, 2024a). While in China and the United States, utility-scale projects accounted for around 66% and 90% of the new capacity growth, respectively, more than 90% of the growth in the EU was attributed to behind-the-meter storage (IEA, 2024a).

Some major economies are promoting the deployment of battery storage through financial incentives, subsidies, setting targets and allocating funds for research and development. Lithium-ion technology dominates battery energy storage. Lithium iron phosphate (LFP) has been the dominant battery chemistry in the stationary energy storage market since 2021 and the market growth is driven by low cost, higher energy densities, longer cycle life, and improved safety compared to nickel-based lithium-ion batteries (IRENA, 2024d).

The tripling goal must be underpinned by a four- to ten-fold increase in battery storage capacity, from a total of 86 GW in 2023 (IEA, 2024a) to between 360 GW and 900 GW by 2030, while pumped hydro storage capacity would need to more than double from 142 GW in 2023 to 320 GW by 2030, providing much needed short- and long-term system flexibility (see section 2.1). Other forms of storage such as flow batteries and thermal storage are now being deployed at scale and will also be needed to complement batteries and pumped hydro storage in meeting an increased clean flexibility need.

A significant expansion of electrolysers for green hydrogen production is required by 2030 for long-term decarbonisation. Under the 1.5°C Scenario, low-emissions hydrogen demand would grow from negligible levels today to almost 15 exajoules (EJ) (125 megatonnes [Mt]) by 2030, concentrated largely in the industry sector (14 EJ) for green steel production, and as feedstock in the chemicals and petrochemicals industries. Of the low-emissions hydrogen produced in 2030, 40% is envisaged to be produced via electrolysis using renewable electricity. The electricity needed for green hydrogen production worldwide would amount to around 6% of power generation in 2030. This implies cumulative installed electrolyser capacity will need to grow from 2.9 GW in 2023 (IEA, 2023a) to reach around 470 GW by 2030. Integrated planning and development of a full supply chain and manufacturing capacity is needed to meet this growing hydrogen and electrolyser demand.

ENERGY EFFICIENCY

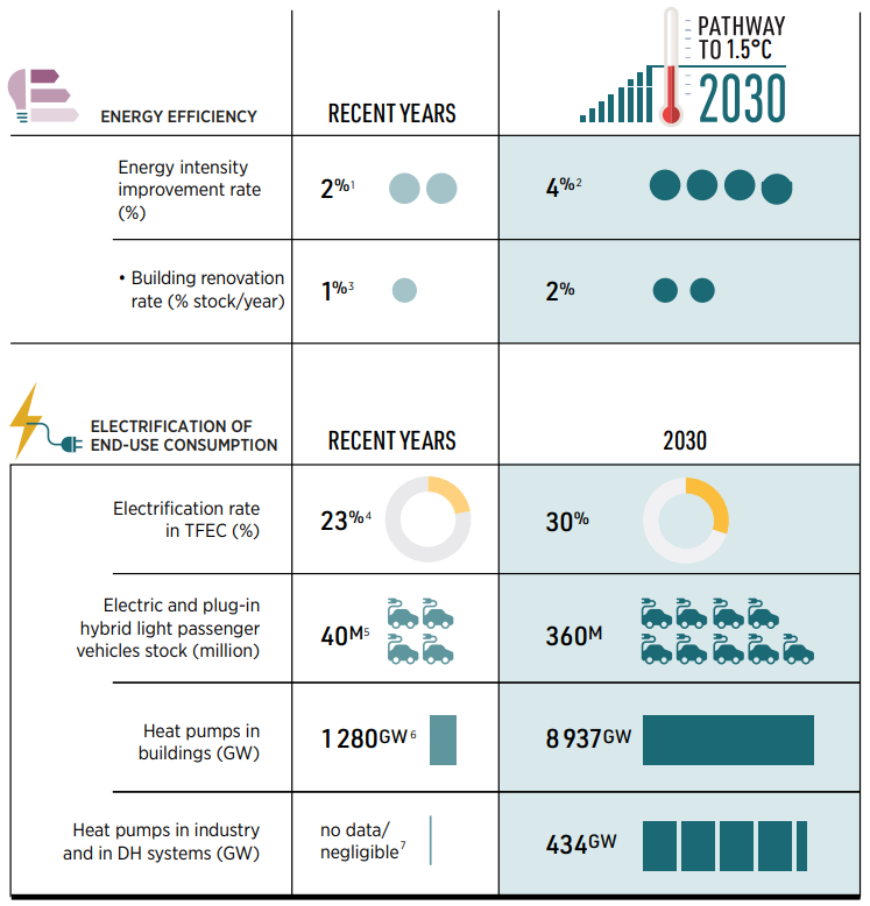

Doubling energy efficiency by 2030 is the crucial complement to the tripling renewable power goal. Achieving the energy transition requires adopting more energy-efficient technologies, securing structural and behavioural changes, and accelerating energy efficiency measures across all end-use sectors (see Figure 6).

Energy intensity improvement in 2022 was around 2% and remained largely unchanged in 2023; an annual improvement rate of at least 4% is needed through to 2030 to meet the goal. This will require a range of actions across all sectors, such as shifting from private passenger vehicles to public transport; transitioning from passenger aviation and road freight to rail; better building insulation; more heat pump installations; more widespread use of efficient electric motors, particularly in industrial sectors; and the implementation of circular economy principles.

Renovating existing building stock is key to realising significant energy savings, as buildings account for a large share of global energy consumption. However, global renovation rates remain at very low levels – around 1% of building stock per year – well below what‘s needed to meet climate goals. While momentum is growing in retrofitting buildings with energy-efficient technologies, there must be a significant acceleration to achieve the necessary reductions in energy use by 2030.

Accelerated electrification, as a key efficiency improvement measure, is based on the adoption of more energy-efficient technologies (including electric heat pumps and electric vehicles [EV]) that consume less energy than fossil fuel alternatives, while reducing emissions and increasingly so as the grid comes to rely on renewable energy, thus supporting decarbonisation. This dual benefit of energy savings and emission reductions underscores the critical role of electrification in achieving both efficiency and sustainability goals.

Electric cars reached a record 18% of total car sales in 2023, driven by increased competition, policy support and technological advancements. Sales of electric heavy-duty vehicles (HDVs) are also increasing, albeit more slowly, but accelerated take-up and expanded charging infrastructure is needed to further push electrification across more vehicle modes. EV market shares are growing, particularly in the car (18% of sales) and two/three-wheeler (13%) segments, whilst electric vans, buses and trucks account for under 5% of sales today and need to be deployed far more quickly to meet net-zero ambitions (IEA, 2024d).

FIGURE 6 Tracking global energy efficiency and electrification of end-use consumption by 2030

[1] Energy intensity improvement achieved in 2022.

[2] Average annual improvement rate required between 2023 and 2030.

[3] Estimated percentage of renovated buildings in the global stock in 2021.

[4] 2022 value, IEA World Energy Statistics & Balances (IEA, 2024b).

[5] 2023 value (IEA, 2024c).

[6] 2023 value estimated from (IEA, 2021, 2024d).

[7] No database of industrial heat pumps is available today (Schlosser et al., 2020). They are assumed to have a negligible share of the total final energy consumption in industrial process heat supply (Agora Energiewende, 2023).

The progress achieved in transport electrification in 2023 was significant, therefore, but remains insufficient. Under IRENA‘s 1.5°C Scenario, the global transport electrification rate in total final energy consumption 5 would need to reach nearly 7% by 2030, with road transport offering the greatest potential. To achieve this, the combined battery electric vehicle (BEV) and plug-in hybrid electric vehicle (PHEV) light passenger vehicle stock will still need to increase from around 40 million in 2023 (IEA, 2024d) to 360 million by 2030 – requiring a trajectory far above current growth rates (IRENA, 2024b). This nine-fold increase would result in EVs accounting for 20% of the global vehicle stock and contributing a comparable share to total transport activity by 2030.

Sales of heat pumps, which are crucial for the energy-efficient decarbonisation of the heating sector, grew rapidly with the fossil fuel price crisis of 2022, but fell slightly in 2023. After a global annual rise of 11% in 2022, driven largely by strong growth in Europe (the fastest-growing market for heat pump technology, with an annual increase in global sales of 38%). Although preliminary data shows that global sales fell by 3% in 2023, heat pumps remained well above the levels expected prior to the rapid growth seen in 2022, indicating that heat pump adoption is still progressing from a stronger-than-anticipated baseline. China experienced the most significant growth, with a 12% increase in sales, spurred by the lifting of COVID-19 restrictions on consumer activity (IEA, 2024c). However, in Europe, heat pump sales declined by about 5% in 2023 compared to 2022, dropping from 2.77 million to 2.64 million units, the first decline of the decade (Azau, 2024). Sales in Germany saw notable growth, but this was offset by a sharp decline in Poland, which had been one of the fastest-growing markets in the world in 2022 (Azau, 2024).

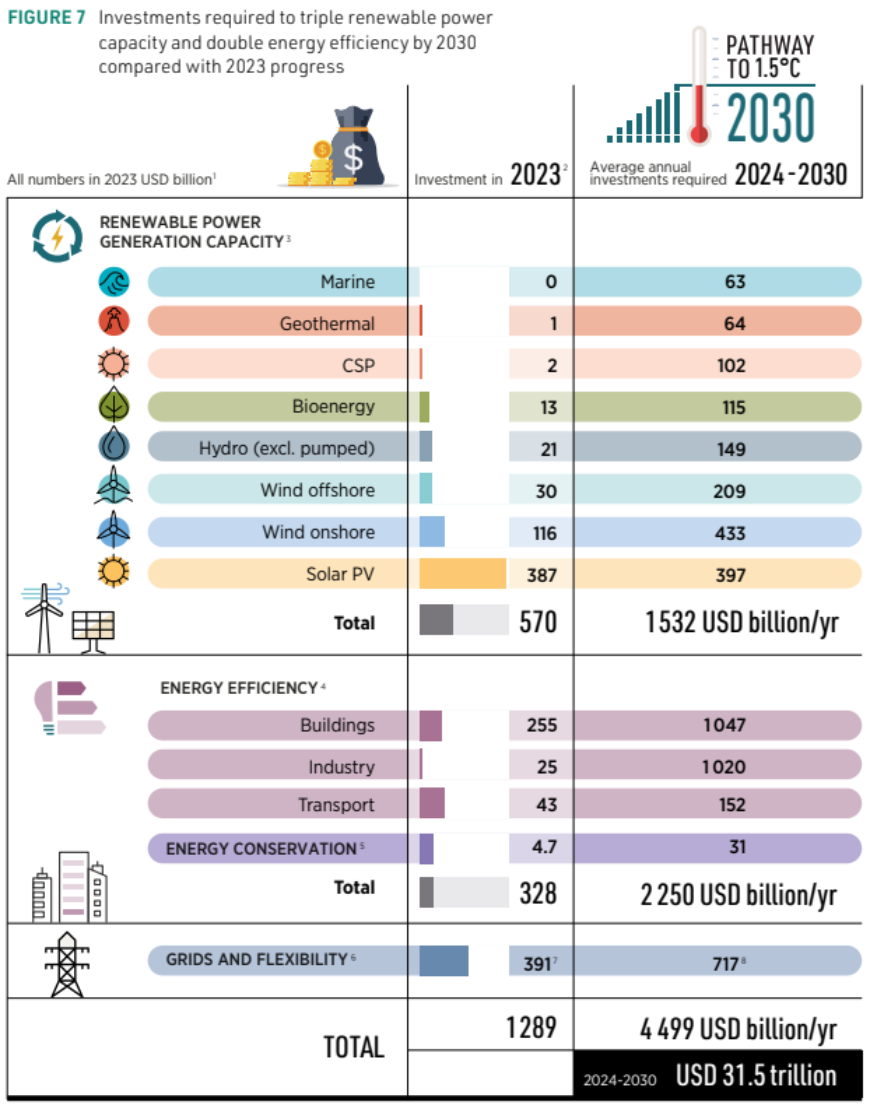

INVESTMENTS IN RENEWABLE POWER AND ENERGY EFFICIENCY

Meeting the UAE Consensus renewable energy and energy efficiency goals will require USD 31.5 trillion in cumulative investment in renewables, grids, flexibility measures, energy efficiency and conservation by 2030. Specifically, annual average investments in renewable power capacity between 2024 and 2030 need to triple compared to 2023 levels. While the technological maturity of renewables and supportive policies have positioned the industry at the heart of climate and energy strategies, there is still a substantial investment and finance gap; first, in the volumes needed for the tripling goal globally; and second, in the share of investment going to emerging markets and developing economies (EMDEs). The same is true for energy efficiency policies and electrification.

Despite reaching a record high of USD 570 billion in 2023, 6 investments in renewable capacity remain well short of the average USD 1.5 trillion needed every year between 2024 and 2030. Moreover, in 2023, 84% of investments went to China, the European Union and the United States, while Brazil and India accounted for just over 6%. Investments in most other regions also remain below the levels required. Indeed, given the relatively small number of projects completed in Africa each year, renewable power investments in Africa are highly volatile and declined 47%, from USD 8.98 billion in 2022 to USD 4.79 billion in 2023. Sub-Saharan Africa, home to 567 million people without access to electricity, received 40 times less than the world average per capita energy transition related investment (IRENA, 2024e).

A major scale-up of investment and finance is needed from public and private sources, encouraged by international collaboration and more conducive policies. Crucially, public funds available to support projects need to increase and be better targeted, more timely and more efficient in order to bridge the current investment gap and address the disparities in investment across regions and countries. Policies and global climate frameworks must also be adapted and the focus shifted to ensure efforts to fund the energy transition reach EMDEs as part of a just and equitable transition. This includes undertaking reforms to development finance institutions (DFIs) and directing financial flows to countries and regions that have so far received minimal investments to support their development and participation in the global energy transition, while undertaking policy and financial derisking measures to lower the cost of capital (IRENA and BNDES, 2024).

While annual investments for solar PV are on track to meet the tripling goal, other technologies such as wind, hydropower, bioenergy, CSP and geothermal remain under-funded on an annual basis (see Figure 7). For instance, in 2023, investments in offshore wind (USD 30 billion) and hydropower (USD 21 billion) were only 14% of that required each year to 2030, while for CSP and geothermal they were just 2% of what is needed. Even the investment in onshore wind stood at only 27% of requirements. Annual investments in wind technologies must increase by more than four times the current levels, hydropower by over seven times, and bioenergy by around nine times; and significant investment is also urgently needed to refine dispatchable geothermal, CSP and high-potential marine technologies (Figure 7).

It is also important to emphasise the need for a commitment to significant investment in the electricity network and flexibility measures, in parallel to renewable power capacity expansion. For several years, investment growth in electricity grid networks (transmission and distribution) has lagged in comparison to the growth in renewable power investments.

Investments in grids and flexibility measures need to nearly double compared to current levels; yet recent growth in grid investments is alarmingly low. An average of USD 717 billion per year is needed in grids and flexibility between 2024 and 2030 (IRENA, forthcoming-a), nearly double the investment of USD 391 billion made in 2023 (BNEF, 2024a; IEA, 2024e). A significant portion (85%) of the investment required between 2024 and 2030 must be allocated to strengthening electricity grids, while the remainder should be directed towards energy storage for enhancing flexibility. Investments in electricity grids are not only insufficient but have grown at an annual average growth rate of less than 1% between 2016 and 2023. In contrast, investments in battery storage – and emerging sector comparably – have grown rapidly, doubling for the second year in a row to reach USD 41 billion in 2023 (IEA, 2024e). These investments are expected to continue growing as costs decline.

Investments in energy efficiency will need to increase almost sevenfold. Doubling energy efficiency will require annual investments of USD 2.2 trillion in buildings, transport and industry each year between 2024 and 2030 (IRENA, 2023a). Current investments – USD 323 billion in 2023 – represent around one-seventh of required levels. In fact, energy efficiency investments declined by 6% in 2023 (compared to 2022). The decline is primarily attributed to trends in Europe, which represented more than one-third of energy efficiency investments globally in 2023 (IEA, 2024f). 7 China – representing 13% of investments – also experienced a 23% decline in energy efficiency spending, while North America (mainly the US, Canada and Mexico) experienced a 26% uptick, accounting for 16% of global energy efficiency investments. A significant portion of the remaining investments are attributed to other advanced economies, such as Japan and the Republic of Korea. EMDEs accounted for less than 10% of the total.

FIGURE 7 Investments required to triple renewable power capacity and double energy efficiency by 2030 compared with 2023 progress

[1]All figures have been adjusted for inflation and are represented in real terms; i.e. 2023 US dollars.

[2] IRENA estimation as of July, 2024; BNEF, 2024b; IEA, 2023a, 2024e; Siepen et al., 2024.

[3] Renewable power generation capacity: Investment in deployment of renewable technologies for power generation.

[4] Energy efficiency in industry: Improving process efficiency, demand-side management solutions, highly efficient energy and motor systems and improved waste processes. Energy efficiency in transport: All passenger and freight transport modes, notably road, rail, aviation and shipping. Vehicle stock investments are excluded. Energy efficiency in buildings: Improving building thermal envelopes (insulation, windows, doors, etc.)

[5] Energy conservation: Investments in energy conservation includes those in bio-based plastics and organic materials, chemical and mechanical recycling and energy recovery.

[6] Grids and flexibility: Investment in transmission and distribution networks (excluding public EV charging stations investments), smart meters, pumped hydropower and battery storage among other energy storage technologies.

[7] 2023 investment includes investment in transmission and distribution networks and battery storage. [8] The average annual investment requirement is based on the lower bound estimates for battery storage capacity of 360 GW (details see section 2: Infrastructure, grids and storage).

INFRASTRUCTURE, GRIDS AND STORAGE

The tripling of renewable power capacity requires timely grid connections, minimal curtailment, efficient transmission and sufficient investments in supply- and demand-side flexibility to ensure reliable energy delivery to consumers.

More broadly, the 1.5°C Scenario requires an increase in the share of direct use of electricity in the total final energy consumption (TFEC) of end-use sectors (excluding non-energy) from the current 23% to 30% by 2030. Electrifying sectors such as heating and transportation can create synergies with the power sector (a strategy known as ‘sector coupling’). This involves using various ‘power-to-X’ technologies – such as electric vehicles, heat pumps, green hydrogen and other synthetic fuels – that not only consume electricity but also provide new flexibility beyond the power sector. These solutions can reduce the strain on grid infrastructure and enable decentralised renewable generation that can be consumed on-site to further ease grid pressure. However, long-term planning and development of supporting infrastructure (such as charging and refuelling stations, green fuel transportation pipelines and ports) are critical.

An increasing challenge in a number of key markets to the rapid expansion of renewable power is the lag in grid investments – even compared to today’s growth in deployment of renewable power. In 2023, investments in grid infrastructure and flexibility measures amounted to USD 391 billion (95% of which was invested in grid infrastructure, and the remainder in battery storage) (BNEF, 2024a; IEA, 2024f), which is significantly below the USD 717 billion required each year to 2030 meet the target (IRENA, 2024b). This under-investment not only hinders the integration of new renewable capacity, but also increases project risks due to uncertainties in grid connection timelines and potential curtailment, which undermines generation capacity investments and can raise the cost of capital, reducing the benefits of the transition to consumers.

The situation varies regionally, with some areas experiencing more severe bottlenecks than others, underscoring the need for region-specific strategies. For instance, Europe and North America are grappling with a delayed acceleration of grid investment while, in parts of North America, aging grid infrastructure requires vital upgrades. As a result, they struggle to accommodate the current growth of renewables, leading to increased curtailment, particularly in wind-rich regions like Germany (Stoica, 2024; Wehrmann, 2024) and Texas (Shenk, 2023). North America invested an average of USD 88 billion per year in grid infrastructure between 2018 and 2023, while Europe invested USD 62 billion per year (IEA, 2024f). However, investment growth remains well below the levels needed.

Meanwhile, in the Asia-Pacific region, rapid renewable expansion in countries including China (ISS, 2024) and India (Kumar and Majid, 2020) is being constrained by insufficient grid development, contributing to significant energy curtailment and regional disparities. Latin America (Deakin, 2023; IEA, 2023c) and Africa (IRENA, 2021) face even greater challenges, with substantial underinvestment in grid infrastructure exacerbating the task of integrating renewables. These regional differences highlight the critical need for targeted investments and strategies that address specific local and regional bottlenecks, ensuring that global renewable energy goals are met in a timely and equitable manner.

Interconnectors play a crucial role in enhancing grid resilience and supporting wider renewable integration across regions. In Europe, projects linking northern and southern countries will help balance supply and demand, reducing curtailment (ENTSO-E, 2024). Similar efforts are underway in Asia with the ASEAN Power Grid, and in Africa with the West African Power Pool (ACE, 2024). North America and Latin America are also exploring cross-border interconnections to optimise renewable energy integration (DoE, 2023; OLADE, 2023). Expanding interconnector capacity globally is essential for reducing bottlenecks, improving energy security, and enabling a more flexible and resilient power grid.

Power system capacity planning and grid expansion should be combined with an accelerated push for grid modernisation and digitalisation. This will require a streamlining of permitting processes, fast-tracking projects of national significance, improving spatial planning and implementing regulatory reforms that support the rapid deployment of grids and grid-enhancing technologies. Similarly, grid expansion and reinforcement plans need to anticipate deployment pathways for renewables and demand growth from electrification (especially EV charging infrastructure), to avoid any mismatch in timing that delays grid connections and/or results in increased curtailment.

Optimising existing grid capacity and reducing the need for new infrastructure is crucial; it is also achievable through grid-enhancing technologies like advanced sensors, 8 optimisation tools, 9 demand flexibility and storage. Demand and supply management plays a vital role by reducing strain on the grid during key periods and thereby deferring or reducing the need for new investments as well as better utilising existing assets. It also supports the integration of variable renewable energy (VRE) by aligning demand with renewable generation, thereby minimising curtailment.

Growth in storage solutions will also be key for achieving renewable goals and in bridging the gap between renewables growth and grid expansion. Electricity storage can mitigate the delays currently evident in the rollout out of grid enhancements and expansion. Traditionally dominated by pumped hydropower, the storage landscape is rapidly evolving and outside of China, most growth is now from lithium-ion batteries, flow batteries and thermal storage.

Pumped hydropower, with around 142 GW of capacity, remains the largest contributor to global storage. However, stationary battery storage is expected to see exponential growth, with capacity projected to increase from 86 GW in 2023, to as much as 900 GW by 2030, where the amount deployed depends on the rollout of complementary flexibility assets such as demand side management (DSM) measures, interconnection and sector coupling based on ongoing IRENA analyses (IRENA, 2023a). This would exceed the generation capacity of pumped hydropower, which would need to grow to 320 GW by 2030. Given that pumped hydropower facilities typically have far longer duration storage than batteries, the total energy that can be stored in pumped storage will likely remain considerably higher by 2030. This will be important as the need for longer duration storage increases as the proportion of variable renewables in the power generation mix increases.

Given the long lead times to develop pumped hydro in Europe and North America, markets and policy makers are focusing on battery storage to balance renewables, while the Asia-Pacific region – particularly China – is expanding both pumped hydropower and batteries (EIA, 2023; Rayner, 2024). Africa and Latin America are exploring diverse storage options in addition to batteries, such as flow and thermal storage, tailored to local conditions (Deign, 2021; IRENA and AfDB, 2022). Although some technologies will likely dominate the provision of storage needs, there is no ‘one-size-fits-all’ solution. A varied approach to diversify storage technologies – one that takes specific regional conditions into account – is key to building a flexible and resilient renewable power system globally.

Regulatory frameworks and business models that incentivise investment in a variety of storage solutions need to be supported for storage to thrive. Setting specific storage targets for 2030 is important, but there must also be a focus on longer-term goals, particularly for long-duration storage. This includes pumped storage, which has long project lead times, and early-stage technologies that require time to scale and drive down the cost curve, as have done batteries. Establishing clear targets for 2030, 2035, 2040 and beyond for storage in mechanical, thermal, chemical and electrochemical forms will be crucial. Storage can also provide an economic, clean solution to the need for flexible supply sources as solar and wind penetration grows and they are increasingly being paired together in some markets (e.g. the United States and Australia).

To ensure a smooth energy transition, all regions should prioritise system flexibility through demand-side management (DSM) and grid optimisation. DSM and grid optimisation can provide low-cost and rapidly deployable solutions to relieve grid constraints and integrate higher shares of solar and wind power. The implementation of DSM measures, such as time-of-use pricing and flexible load management, can allow power systems to better align electricity consumption with renewable generation, reducing strain on the grid during peak demand. Furthermore, optimising existing grid infrastructure through advanced sensors, automation and real-time data analytics can help maximise efficiency and minimise the need for costly new infrastructure. In this regard, promoting co-location of renewable energy with electrified industrial consumers could also result in more efficient use of the grid connection points and allow additional time for grid expansion.

However, achieving this will require significant regulatory reforms that incentivise investment not only in storage solutions but also in grid modernisation and the development of innovative business models. Governments and regulatory bodies must create a supportive policy framework that encourages private investment in these areas, while also fast-tracking critical projects and reducing bureaucratic barriers.

RECOMMENDATIONS

- Integrated power capacity planning and grid expansion must be aligned with an accelerated push for grid modernisation and digitalisation, supported by robust implementation frameworks and structured, long-term, multi-stakeholder collaboration.

- Streamlined permitting processes, improved spatial planning and regulatory reforms are essential for the rapid expansion of grids and deployment of grid-enhancing technologies (advanced sensors, optimisation tools and storage).

- National energy, renewable market growth and grid expansion plans must align, requiring regular review and co-ordinated efforts among, government, regulatory bodies, market authorities, industry participants and consumers.

- Modernising grids is critical in Europe and North America, while the Asia-Pacific, Latin America and Africa face challenges in expanding grid infrastructure and storage due to underinvestment.

- Measurable national and regional targets for grids and flexibility, including storage, should be established.

- All regions should prioritise enhancing system flexibility through demand-side management, storage, grid optimisation, and co-location of renewable energy with electrified industries. Clear national targets with regional co-ordination by 2030 will ensure effective integration of renewable energy.

POLICY, REGULATION AND NDCS

Reflecting the UAE Consensus in NDCs and national energy plans

The outcome of the first Global Stocktake at COP28 called on all Parties to the UN Framework Convention on Climate Change to contribute to efforts to triple renewable energy capacity globally and double the average annual rate of energy efficiency improvements by 2030 in a nationally determined manner, taking into account the Paris Agreement goals (UNFCCC, 2023). Led by the COP28 Presidency, 133 UNFCCC Parties joined a collective ‘pledge’ to this effect (COP28 UAE, 2023). However, there was no clear mechanism included to ensure how the two collective targets will influence national or regional targets, as Parties prepare their third generation of Nationally Determined Contributions (NDC 3.0) to the Paris Agreement, due to be submitted in 2025 (UNFCCC, n.d.).

Three Parties (Panama, Madagascar, and Namibia) have submitted revised NDCs since COP28; but only one (Namibia) has enhanced its ambition in terms of renewable energy targets. Among the latest NDCs submitted (as of September 2024), 109 Parties – collectively accounting for around 81% of the world’s greenhouse gas (GHG) emissions – have updated and enhanced their NDCs at least once compared to their initial submissions dating back to as early as 2015 (Climate Watch, 2024). Some Parties, such as Oman, have even updated their second NDC.

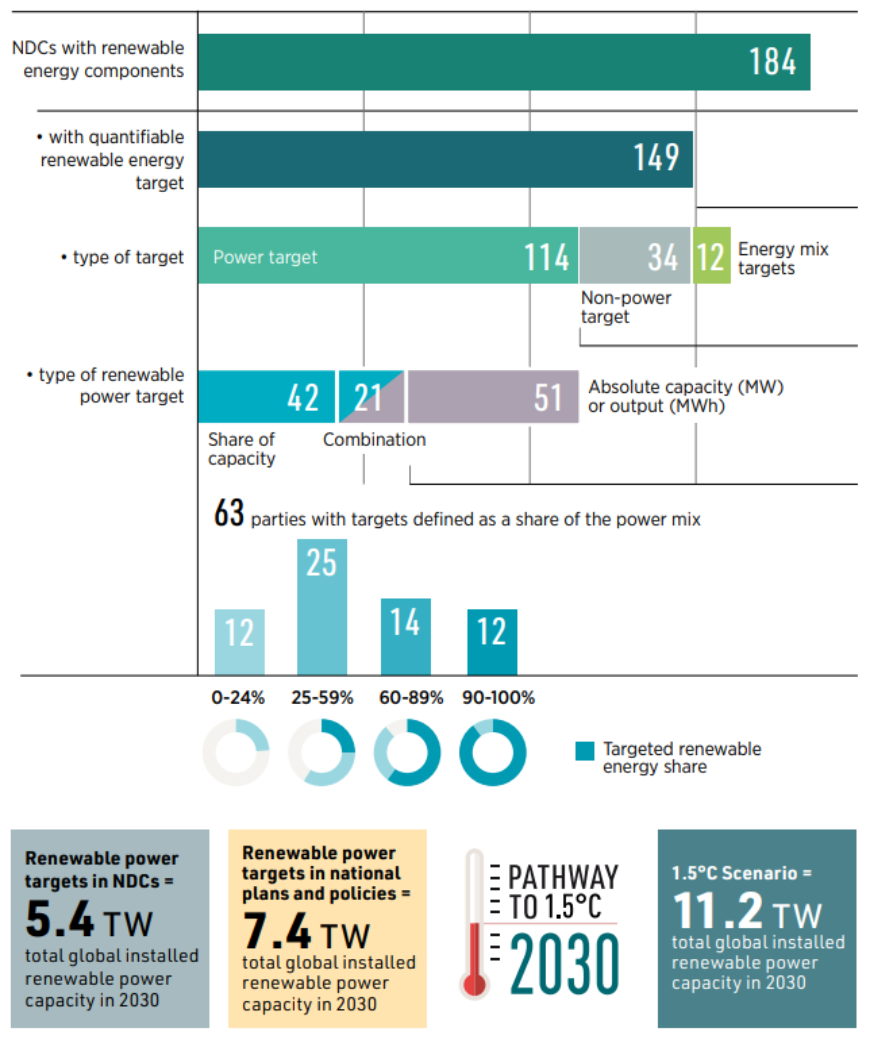

To date, 184 Parties 10 have included renewable energy components in their current NDCs, of which 149 had a quantifiable target. Of these quantifiable targets, 114 focus on the power sector, of which 41 presented them in the form of absolute targets – mostly in the form of capacity (megawatts [MW]) and some in terms of output (megawatt hours [MWh]) (Figure 8). While 42 Parties presented them as share-based, an additional 21 Parties presented them as a combination of both absolute and share-based targets. Of these 63 Parties with targets defined as a share of the power mix, 12 commit to achieving a renewable energy share lower than 24%; 25 commit to a share between 25% and 59%; 14 commit to shares between 60% and 89%; and 12 commit to shares between 90% to 100% – and most of these are small island developing states (SIDS) that make up a minute fraction of global renewable power generation.

IRENA’s quantification of renewable power targets in NDCs finds that existing targets aim to collectively increase total renewable power capacity to only 5.4 terawatts (TW) by 2030. 11 To meet the tripling target of 11.2 TW, commitments made in the next round of NDCs must more than double the existing targets. The gap is considerable; current NDC plans suggest new capacity additions to 2030 would total just 1.5 TW, compared to the 7.5 TW of additions required. With only six years remaining for implementation, such commitments need to be accompanied with immediate and effective action on the ground.

Two regional goals were established in 2023; the revised EU Renewable Energy Directive of 2023 set a new target of 42.5% of renewable energy in total EU energy consumption by 2030 and aimed for 45% (EC, 2023a). The Association of Southeast Asian Nations (ASEAN) has set aspirational targets of a 23% share of renewables in total primary energy supply (TPES) and 35% share of installed power generation capacity by 2025 (ASEAN, n.d.).

FIGURE 8 Renewable energy targets in NDCs globally as of end-August 2024

Renewable energy targets in NDCs must be aligned with those set in national energy plans and legislation. This is not the prevailing case today. As of 2024, 170 countries have set a renewable energy target for power generation, with solar, wind and hydropower dominating technology-specific targets (REN21, 2024); but, as already noted, only 140 have included them in their NDCs. While some of this misalignment between NDCs and national policies is due to temporal gaps, in some cases, targets have been omitted from NDCs despite the presence of an active target in national policy, signalling a mismatch between domestic priorities and commitments to the international community.

It is vital that this misalignment be addressed; integrating renewable ambitions in NDCs and long-term strategies via targets and sectoral plans provides clarity on the level of ambition but also allows the private sector to reciprocate with investment plans and align their strategies with national goals, helping to ensure a robust, bankable pipeline of renewable energy projects.

RECOMMENDATIONS

- In the next round of NDCs a larger number of parties must submit quantified targets and increase the ambition in many of the existing targets should be aligned with national energy plans and legislation, as well as being greater than current market expectation for renewable power growth.

- The more measurable, specific and actionable renewable targets are, the more likely they are to drive deployment. The underlying objectives behind renewable energy deployment must form a key foundation for national target setting, including climate commitments, energy access, energy security, reliability and affordability, industry policies and socioeconomic development goals.

- Implementation plans are crucial. If projects are to be financed and built, stable policy and regulatory environments, market incentives, resilient supply chains, access to financing, power market design, and supportive regulation and permitting rules all need to be in place.

- Multi-stakeholder consultation and collaboration should be maximised, within and between countries. Countries could support peer-to-peer engagement to enhance international co-operation and encourage the highest possible ambition in NDCs. Developed countries, in particular, should rapidly scale up and enhance financial and technical support to EMDEs to support long-term energy transition planning and implementation.

Market incentives

Renewable power and energy efficiency solutions can face many barriers, especially in markets where the regulatory environment, taxation system, market rules and other government policies favour fossil fuels. It is also true, in most cases, that fossil fuel pricing does not reflect its environmental and social costs. Supportive incentives, therefore, can play an important role in accelerating deployment.

Carbon pricing mechanisms can help markets factor in the externalities of fossil fuel use; 39 countries had implemented carbon pricing policies by the end of 2023 (REN21, 2024). In 2023, carbon pricing revenues reached a record USD 104 billion, with some 75 carbon pricing instruments in operation globally (World Bank, 2024). Over half of the collected revenue was used to fund climate and nature-related programmes. More than a decade ago, carbon taxes and emission trading systems (ETS) covered only 7% of the world’s emissions. In 2024, 24% of global emissions are covered.

Some large, middle-income countries including Brazil, Chile, Colombia, India and Türkiye are taking steps towards carbon pricing implementation. While traditional sectors like power and industry continue to dominate, carbon pricing is being considered in new sectors such as aviation, shipping and waste management in the EU.

Despite record revenues and growth, currently, less than 1% of global greenhouse emissions are covered by a direct carbon price at or above the range recommended by the High-level Commission on Carbon Prices to limit temperature rise to well below 2°C. In 2017, a report by the High-Level Commission indicated carbon prices need to be in the USD 50-100/tonne range by 2030 to keep a rise in global temperatures below 2°C. Adjusted for inflation those prices would now need to be in the USD 63-127/tonne range (World Bank, 2024).

Carbon prices are rarely high enough to incentivise renewables or energy efficiency on their own. At a global level, the effective price on carbon emissions from the energy sector was only around USD 3/tonne of CO2 (t/CO2) in 2023. Therefore, carbon pricing needs to be accompanied by other policy measures (e.g. energy efficiency standards).

Governments are also increasingly using carbon market frameworks to attract more finance through voluntary carbon markets and facilitate participation in regional/international compliance markets as well as market mechanisms under Articles 6.2 and 6.4 (i.e. the Paris Agreement Crediting Mechanism [PACM]). An increasing number of NDCs mention the potential use of Article 6 market mechanisms. With the conclusion of the methodological guidance of Article 6.4 expected at COP29, it will be important for countries to prepare national frameworks and plans to take advantage of the mitigation opportunities from these market-based instruments (NDC Partnership, 2024). However, it should be noted that the veracity and reliability of carbon crediting schemes – which are typically unregulated – has been called into question, given that a large share of claimed avoided emissions have not led to actual emissions reductions (Greenfield, 2023; Kenza, 2024).

Tariff-based mechanisms in support of renewable power have been introduced in several countries. France, Serbia and Türkiye have announced new feed-in tariffs (FiTs) or changes to existing mechanisms for systems of various sizes in the past year. Also, many markets retain FiTs to support small-scale renewable generation, given their administrative efficiency.

However, today, most utility-scale renewable power is procured through auctions and tenders. They are widely used, especially for wind and solar PV, and are increasingly being used for renewable-based hydrogen (including in Albania, Algeria, Greece, India and Romania). These can be an effective means to secure the best value for electricity consumers, but care must be taken in their design to ensure they deliver as expected. Policy must also be attuned to changing market circumstances, to ensure adjustments can be made to ensure timely delivery of capacity.

Fiscal and financial policies for renewable power supply, such as tax credits and financial incentives, are still prevalent. Countries that have announced new fiscal and/or financial policies related to renewable power in 2023 include Austria, Brazil, China, Egypt, Greece, Indonesia, Poland and Switzerland (REN21, 2024).

RECOMMENDATIONS

- Stable, clear policies must be introduced to support the procurement of sufficient new renewable capacity in a timely manner, and provide the private sector with the confidence to invest.

- Fiscal policies must prioritise equity in the energy transition; e.g. by investing proceeds from taxes on fossil fuel energy production and carbon pricing mechanisms in enabling infrastructure; energy efficiency programmes for low-income households; or supplementing clean electricity access for low-income populations via green financing schemes.

- Tax credits, levies and/or exemptions on import/export duties for key materials and components in the renewable energy supply chain should be considered.

- Procurement schemes must provide adequate price signals for investment and balance long-term price/cost risk mitigation with socio-economic value creation.

- Trade-offs between ‘lowest-price’ objectives and other policy outcomes such as socio-economic development, system integration and industry sustainability should be carefully evaluated.

Power market pricing and design

Power markets based on bidding at levels around the marginal cost (in highly competitive markets) of fossil fuel power plants has been the bedrock of liberalised electricity markets for decades. However, as the costs of solar and wind have fallen, their shares of the electricity mix have grown rapidly. This has serious implications for power markets, as with zero marginal costs, they can afford to bid down to a value of zero and not lose money through generation.

In periods of low demand and high renewable power generation – which today is increasingly the case in a number of markets in spring and summer – electricity prices would increasingly be trending to zero if sufficient flexibility in demand and supply was in place.

This is happening, but these markets are also seeing increasing periods of negative prices – although this varies significantly depending on such factors as power fleet structure, interconnectivity levels, air conditioning diffusion, heating demand, working schedule and weather conditions. In Europe, which has seen rapid growth in renewable power generation in the last few years, the trend towards higher periods of negative prices is rising (Tani and Millard, 2024).

Power prices in Europe fell below zero for 7 841 hours across the continent between January and August of 2024, with prices falling below EUR -20/MWh in some instances, as solar and wind projects have developed at a faster pace than storage and other flexibility solutions. This compares with a total of 6 428 hours for all of 2023, and 675 hours in all previous five years when the system was more dominated by fossil fuels (Tani et al., 2024). While these prices can be beneficial to consumers they can undermine the viability of renewable energy projects.

This poses challenges to the energy transition: there is likely to be a point where high shares of zero-marginal-cost assets result in electricity markets no longer providing the necessary price signals for long-term investments in new capacity or flexibility; 12 periods of negative prices today are often an indicator that more flexibility in demand and supply is merited.

RECOMMENDATIONS

- Specific procurement mechanisms should be established to secure the required generation and ancillary services, at a low cost, given current market arrangements are increasingly not ‘fit for service’. The dual procurement mechanism, proposed by IRENA, is one possible solution. 13

- Policy makers and regulators must act now to ensure electricity market structures and rules create an enabling environment for increased system flexibility, provided by storage technologies (water reservoirs, batteries, etc.), dispatchable generators, demand side management and demand side response measures.

- Multi-stakeholder processes are essential to the process of delivering electricity market reforms.

Permitting

Updating permitting guidelines for energy transition projects is essential not only for streamlining approval procedures and facilitating project development but also for ensuring these processes are aligned with broader environment, social and development objectives and considerations.

Project developers around the world face cumbersome administrative barriers, permitting procedures and social acceptance issues. Given the urgency of the tripling target and the fact that wind power deployment – in particular – is not scaling fast enough, fit-for purpose permitting procedures are urgently required.

With growing project pipelines around the world, the fact that renewable power developers often need to consult numerous separate stakeholders and official regulators/authorities at the national, subnational and local levels for the necessary permits to build a project has clearly become a constraint.

The global average time required for permitting an offshore wind project is nine years; onshore wind and utility-scale PV permitting processes can also take several years, but are typically shorter than those for offshore wind (GRA, 2024). Hydropower, geothermal and bioenergy projects also face similar barriers and are more like offshore wind in that respect. As we have seen since the fossil fuel price crisis of 2022, smaller scale distributed solar PV projects for end consumers can be deployed more rapidly in many markets, but this is not universally true.

To facilitate project pipelines, policies need to be developed in conjunction with all stakeholders. Industry experience can inform permitting policy changes that accelerate timelines, but still respect the need for due diligence in permitting to meet social and environmental goals. Experience has shown that there are four key areas that can help shift the needle and accelerate permitting, including: administrative consolidation, digitalisation, policy support and public engagement (EC, 2023). Innovation in permitting favours accelerated deployment of renewable energy, especially in contexts where frameworks may be nascent, as in offshore wind (IRENA and GWEC, 2023).

In the European Union, the Revised Renewable Energy Directive, which entered into force in late 2023, provides guidelines for member states to designate “renewables acceleration areas” where renewable energy and associated energy storage projects can benefit from expedited administrative and permitting procedures. Importantly, the directive integrates environmental and grid considerations into the expedited permitting process, ensuring that projects meet certain standards while benefiting from streamlined approval procedures (EC, n.d.).

In the United States, the Energy Permitting Reform Act of 2024 (EPRA) has introduced significant changes to the permitting landscape for renewable energy projects on federal land. The Act aims to simplify and accelerate leasing and permitting processes, eliminate redundant requirements, and integrate energy storage with renewable projects. The Act ensures that federal land can be utilised for critical mineral projects supporting renewable energy development and streamlines environmental reviews for certain low-impact projects. More importantly, this legislative update ties permitting directly to national renewable energy targets by setting a goal of providing permits to reach 50 GW of renewable energy capacity on federal lands. This is an updated target in response to surpassing the original 25 GW goal set by the Energy Act of 2020 (Fishman et al., 2024).

RECOMMENDATIONS

- Reduce permitting delays caused by cumbersome administrative barriers while ensuring that legitimate community concerns about project impacts (economic, social, environmental) are properly addressed; for example by creating a centralised authority to oversee permitting, streamline processes and rapidly resolve disputes.

- Mandate and enforce maximum lead times for applicants and authorities to complete the permitting stages of renewable energy projects, with discretionary additional time under exceptional circumstances for more complex projects.

- Allocate greater resources to permitting authorities, including human resources and investment in digitalisation of permitting process, as well as open-source databases, such as for land titles, mapping data and historical dispute records.

- Expedite processes for developers repowering assets on existing sites and provide the flexibility to adjust a proposed infrastructural, technological, or social approach to projects without having to reapply for new permits.

Environmental and social considerations

The tripling goal requires a rapid scale up in the deployment of renewable plants and associated infrastructure; it is therefore important to address the potential environmental and social impacts of these developments. In delivering clean electricity, renewable power should also consider its lifecycle impacts and act to minimise any negative effects, such as those relating to the material demand for equipment, including solar panels and wind turbines, or raw materials needed to produce renewable fuels; and the end-of-life management of renewable energy equipment.

Renewable power has demonstrated benefits for the climate, biodiversity and environment and can be used to advance social and equity goals. But trade-offs still need to be made in any new infrastructure project. Policies and measures are therefore needed to ensure that any such trade-offs are carefully considered and the benefits clearly articulated and equitably distributed.

Siting, construction and operation of renewable energy projects and grid infrastructure may have adverse impacts on forests, agriculture and fisheries, wildlife habitat, migratory species, water and marine ecosystems. Decision making around construction and operations of projects can also have adverse impacts on the livelihoods and welfare of local communities. Indeed, there have been some instances where community interests were neglected, and some that caused displacement of people, loss of cultural and sacred sites, as well as instances of intimidation and violence against community activists (BHRRC, 2023; CCSI, 2023). Another concern is that some local communities receive limited or no socio-economic benefits such as jobs and skills training, tax revenues or a stake in project ownership, or opportunities to develop local businesses to supply project needs (IRENA, forthcoming-b).

Environmental and social concerns need to be both addressed at the strategic level and integrated in project permitting through environmental and social impact assessments. For example, at the strategic level, China’s latest five-year plan for renewable energy development specified prioritising the development of solar and wind projects in desert areas, where the environmental impacts might be less compared to other locations and positive environmental benefits are possible through renewable energy deployment (NDRC, 2021). According to the National Environment Impact Assessment Law, China requires the environmental impact assessment (EIA) to be integrated at both overall government planning and project development levels. In Australia, EIA for renewable energy has also been adopted at both strategy and project levels (DCCEEW, 2024). Similarly, the EU’s Revised Renewable Energy Directive applies monitoring and mitigation measures to prevent significant adverse impacts on bird populations and other wildlife during the construction and operation of renewable energy plants (EC, n.d.).

In Canada, there has been a particular focus on the empowerment of indigenous peoples in their clean energy development. As of early 2024, the BC Indigenous Clean Energy Initiative (BCICEI) provided USD 9.8 million in funding to 35 First Nations across British Columbia, supporting a range of clean energy projects. These projects – which include the installation of solar PV systems, energy-efficient technologies like air source heat pumps, and feasibility studies for large-scale wind projects – are designed to meet the energy needs of indigenous communities efficiently and sustainably. They also create employment and business opportunities, contributing to economic growth and well-being in urban and rural indigenous communities throughout British Columbia (Government of Canada, 2024a).

To address the potential impacts associated with material demand and end-of-life aspects of renewable energy equipment, a circular economy approach is key. However, the adoption of a circular economy for renewable energy technologies remains limited because of barriers including high costs for collection, transportation and treatment, poor public awareness of this topic, lack of related information and low technology readiness.

Policies and regulations are therefore needed to enable a circular economy for the renewable energy industry. Circularity-based recycling targets can send long-term signals to investors, industries and local stakeholders. Mandatory measures, such as a ban on landfilling end-of-life renewable products, can enable the development of a circular economy. Notable developments in this regard over the last year include the EU Waste Electrical and Electronic Equipment (WEEE) Directive, updated in early 2024 to add further clarity to timelines for solar PV producers that are required to cover the financing of collection, treatment, recovery and environmentally-sound disposal of waste from photovoltaic panels (EC, 2023b).

Concerning socio-economic impacts, various measures have been taken; in South Africa, for example, independent power producers were mandated to comply with an Economic Development scorecard that sets out various national and local benefit expectations such as job creation, ownership and management control. Since 2023, however, economic development commitments have no longer been mandatory, marking a policy reversal (IRENA, forthcoming-b).

In the United States, Justice40, a US presidential executive order, aims to secure benefits for disadvantaged communities. Justice40 applies to more than 400 federal government programmes on climate, clean energy, and infrastructure. Government agencies administering them are required to ensure that 40% of the overall benefits created flow to disadvantaged communities, defined as facing disproportionate socio-economic vulnerabilities from pollution, underinvestment in critical infrastructure, and environmental and health risks. Programmes that fall under the scope of Justice40 are required to consult with stakeholders and ensure that communities have meaningful involvement in determining outcomes (White House, 2023).

RECOMMENDATIONS

- Environmental and social impact assessments should be integrated into both strategic decision making (policies, plans, programmes) and the permitting process for renewable energy projects.

- Multilateral development banks (MDBs) should ensure environmental and social safeguards are integral components to the projects they finance.

- Renewable energy projects must involve meaningful consultations with communities in their design and implementation.

- Businesses must adhere to international and national labour standards, especially those that concern occupational health and safety. International labour standards aim to ensure decent and productive work in conditions of freedom, equity, security and dignity, and are essential for ensuring that the energy transition provides benefits to all.

- Mandatory policies and regulations, including a ban on landfills and extended producer responsibility, are necessary to enable circular economy practices and address the main concerns related to end-of-life renewable equipment.

SUPPLY CHAINS

Investments in renewable energy supply chains are essential for meeting the tripling goal, including for the manufacture of critical components, particularly for solar PV and wind technologies.

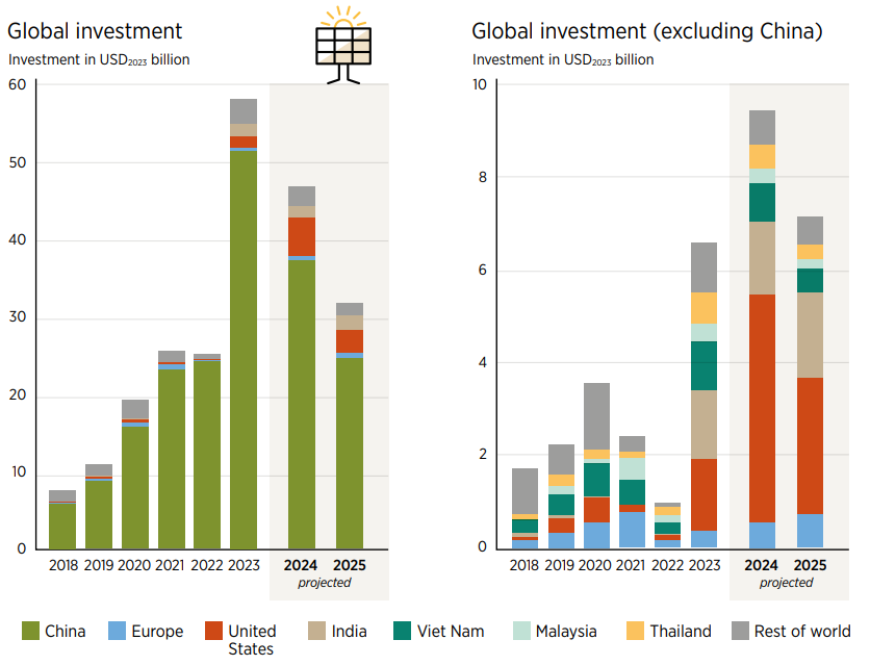

Annual investments in the solar PV supply chain 14 reached a new record-high of USD 58 billion in 2023, growing eight-fold since 2018 (Figure 9) (BNEF, 2024a). Cumulatively, at least USD 146 billion has been invested in the solar PV supply chain since 2018 (BNEF, 2024a). This translates to about 800 GW/year of solar PV manufacturing capacity in 2023 (IEA, 2024g), despite the slowdown in 2022 owing to supply chain disruptions and higher project and equipment costs in the solar PV sector.

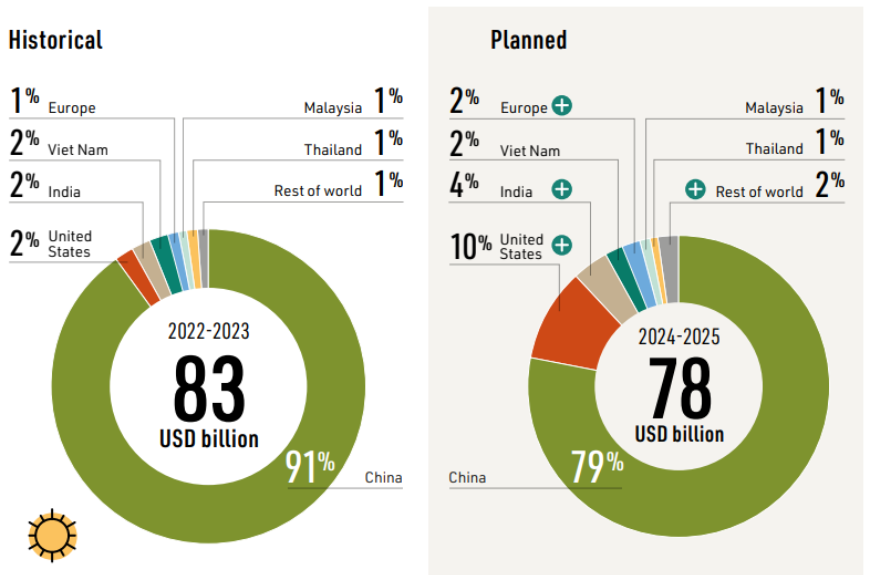

China accounted for 88% of global investments between 2018 and 2023, as the country holds more than three-fifths of the world’s manufacturing capacity for clean energy technologies such as solar PV, wind systems and batteries (IEA, 2023d). The United States and Europe attracted 2% each, while the remainder was shared between India (1%), Southeast Asian economies (4%) and the rest of the world (3%).

Current estimates show that an additional USD 78 billion is planned to be invested worldwide in the solar PV supply chain in 2024-2025 (Figure 10) (BNEF 2024a). The United States will account for 10% of these investments, primarily due to the provision of domestic manufacturing incentives, tariffs and import restrictions under policies such as the Inflation Reduction Act (IRA) (Touriño Jacobo, 2024; Wood Mackenzie, 2024a).

China is expected to realise 79% of planned investment, compared to 91% historically between 2022 and 2023 (Figure 10). Unless new plans and announcements are unveiled in China, investments for 2024-2025 could even fall short of 2023 levels, ending the consistently high annual growth recorded in recent years. However, China is expected to remain the single-largest supplier of solar PV cells, modules and wafers globally.

Investment activity in Europe’s solar PV manufacturing sector has also slowed. Unlike the IRA, the EU’s Net Zero Industry Act (NZIA) does not provide direct subsidies or incentives such as investment or production tax credits, or domestic content bonuses (Wood Mackenzie, 2024a). This has subjected local manufacturers to strong competition owing to the low global prices of modules.

FIGURE 9 Historical and planned investments in the solar PV supply chain (2018-2025)

Notes: Data for China comes from Mainland China. Data for other territories could not be disaggregated from Rest of the world group.

In Southeast Asia, solar PV manufacturing capacity has risen by more than five times since 2018 (Wood Mackenzie, 2024b), with at least USD 6 billion 15 invested over this period. As a result, Southeast Asia is the largest solar PV manufacturer after China, 16 accounting for 6.6% of solar module, cell and wafer manufacturing in 2023 (Wood Mackenzie, 2024b). Nevertheless, investments in countries such as Viet Nam, Malaysia and Thailand are expected to stagnate over 2024-2025 (BNEF, 2024a) in response to US policies to restrict PV imports from the region; the destination of the region‘s PV exports is now increasingly India. While regional demand for PV components has the potential to grow significantly, given ambitious plans for renewables deployment and regional grid interconnections, additional policy interventions may be needed to mitigate risks for solar developers, such as ensuring the availability of grid infrastructure, and enhancing both grid flexibility and storage capacity (Asian Development Bank, 2023).