Geopolitics of the Energy Transition

Acknowledgements

This report was authored under the guidance of Elizabeth Press (Director, IRENA Planning and Programme Support) by Thijs Van de Graaf (IRENA consultant and lead author), Martina Lyons, Isaac Elizondo Garcia, Ellipse Rath (IRENA) and Benjamin Gibson (ex-IRENA).

The authors are grateful for the reviews, inputs and support provided by IRENA colleagues Roland Roesch, Rabia Ferroukhi, Anastasia Kefalidou, Claire Kiss (ex-IRENA), Deepti Siddhanti, Divyam Nagpal, Francis Field, Francisco Boshell, Griffin Thompson (IRENA consultant), Kathleen Daniel, Kelly Rigg (IRENA consultant), Michael Renner, Mirjam Reiner, Paul Komor, Sophie Sauerteig (ex-IRENA), Stephanie Clarke, Ute Collier and Zhaoyu ‘Lewis’ Wu.

Other valuable inputs were provided by Sara Geeraerts (IMEP); André Månberger, Dastan Bekmuratov, Gavkharkhon Mamadzhanova, Ida Dokk Smith, Indra Overland, Julia Loginova, Mari Tønnessen, Philip Swanson, Roman Vakulchuk and Tatjana Stankovic (NUPI).

Peer review was provided by Henry Sanderson (Benchmark Mineral Intelligence); Jan Morrill, Paulina Personius, Payal Sampat and Vuyisile Ncube (Earthworks); Sebastian Sahla (EITI); Yana Popkostova (European Centre for Energy and Geopolitical Analysis); Irina Patrahau (HCSS); Karsten Sach (IRENA consultant); Patrícia Alves Dias and Vangelis Tzimas (JRC); Hans Olav Ibrekk and Jonas Volden Weltan (MFA, Norway); Jean- Philippe Bernier and Jeffrey Akomah (Natural Resources Canada); David Manley (NRGI); Clarisse Legendre, Louis Marechal, Luca Maiotti and Przemyslaw Kowalski (OECD); Jim Krane (Rice University's Baker Institute); Kathryn Sturman (Sustainable Minerals Institute); Leonardo Buizza (SYSTEMIQ Ltd, ETC); Ligia Noronha and Maria Jose Baptista (UNEP); Matthew David Wittenstein (UN ESCAP); Virginie Nachbaur (University of Rouen Normandy); Aaron NG, Anna Wendt, Dennis Mesina and, Salim Bhabhrawala (US Department of Energy); and Dolf Gielen (World Bank).

IRENA is grateful to the following national representatives for their responses to the survey: Nirod Chandra Mondal (Bangladesh); Robbie Frank (Canada); Moussa Ousman (Central African Republic); Jarkko Vesa (Finland); Nicolas Leconte (France); Stefano Raimondi (Italy); Brian Richardson (Jamaica); Paul Mbuthi (Kenya); Harold Madriz (Nicaragua); Rosilena Lindo (Panama); Marco Antonio Santiváñez Pimentel (Peru); Josephine Bahr Ljungdell (Sweden); Brian Isabirye (Uganda); Mahek Mehta (United Kingdom); Aaron Ng (United States); and Sosten Ziuku (Zimbabwe).

IRENA also thanks the following expert survey respondents for their valuable inputs: Phung Quoc Huy (Asia Pacific Energy Research Centre); Paul Huggins (Carbon Trust); Coby van der Linde (Clingendael International Energy Programme); Sebastian Sahla (EITI); Leonardo Buizza (Energy Transitions Commission/Systemiq Ltd.); Yana Popkostova (European Centre for Energy and Geopolitical Analysis); Reed Blakemore (Global Energy Center; Atlantic Council); Elrika Hamdi (IEEFA); Veronica Navas Ospina (IFC); Christian Breyer (LUT University); Sohbet karbuz (OME); Mostefa Ouki (Oxford Institute for Energy Studies); James Bowen (Perth USAsia Centre); Ramona Liberoff (Platform for Accelerating the Circular Economy); Michael Reckordt (PowerShift e.V.); Jim Krane (Rice University's Baker Institute); Kingsmill Bond (RMI); Dirk Uwe Sauer (RWTH Aachen University); Rainer Quitzow (SWP); Irina Patrahau (The Hague Centre for Strategic Studies); Matthew Wittenstein (UN ESCAP); Rudiger Tscherning (University of Calgary); Karla Cervantes Barron (University of Cambridge); Dolf Gielen (World Bank); and Mirza Sadaqat Huda (Yusof Ishak Institute).

Editing was provided by Steven Kennedy, and design by weeks.de Werbeagentur GmbH.

Foreword

More so than any other sector or industry, energy is a core driver of socio-economic outcomes and geopolitical landscapes. As the world transitions toward more resilient, inclusive and clean energy systems, the essential role of renewable energy is clearer than ever before. This transition is set to induce far-reaching and transformative changes, and recent years have demonstrated yet again how the global energy system is intricately intertwined with geopolitics.

IRENA’s analytical work on geopolitics began in 2018 with the formation of the Global Commission on the Geopolitics of Energy Transformation, which culminated in a sweeping overview of the geopolitical implications of a global shift to renewables in the 2019 report, A New World: The Geopolitics of the Energy Transformation. In 2020, IRENA created the Collaborative Framework on the Geopolitics of Energy Transformation as a forum for dialogue on the geopolitical implications of this shift. In response to priorities voiced by IRENA’s members during those discussions, IRENA undertook a detailed study on the future of hydrogen in the 2022 report, Geopolitics of the Energy Transformation: The Hydrogen Factor.

In Geopolitics of the Energy Transition: Critical Materials, the focus pivots to a theme that embodies both the future and the past. Today, it is abundantly clear that the energy transition will require a dramatic increase in the supply of critical materials. Projections for rapidly growing materials demand create both opportunities and the spectre of geopolitical risks. Yet the rush for raw minerals and metals is not a new phenomenon; be it coal, gold or any other extractive commodity in human history, this is, in many ways, a familiar paradigm. Mining has all too often played out as a tale of extremes – simultaneously characterised by the newfound comforts and prosperities, and a legacy of poor labour records, displacements, polluted waterways and degraded land in the communities where mines operate. A renewables-based energy transition provides a chance to rewrite the script for extractive commodities and ensure their value chains are more inclusive, ethical and sustainable.

The report draws on a wide range of sources to provide a balanced and nuanced perspective on the many complex issues at play. It is intended as a resource for policy makers, industry leaders, researchers and civil society actors who seek to understand and address the geopolitical challenges of a renewables-based energy transition.

I would like to express my thanks to IRENA’s membership for supporting this work and to the many expert reviewers who provided valuable input and feedback throughout its production. I hope that this report will contribute to a more informed and constructive dialogue on critical materials and help the world advance towards a more sustainable and equitable future.

Director-General, IRENA

Summary for Policy makers

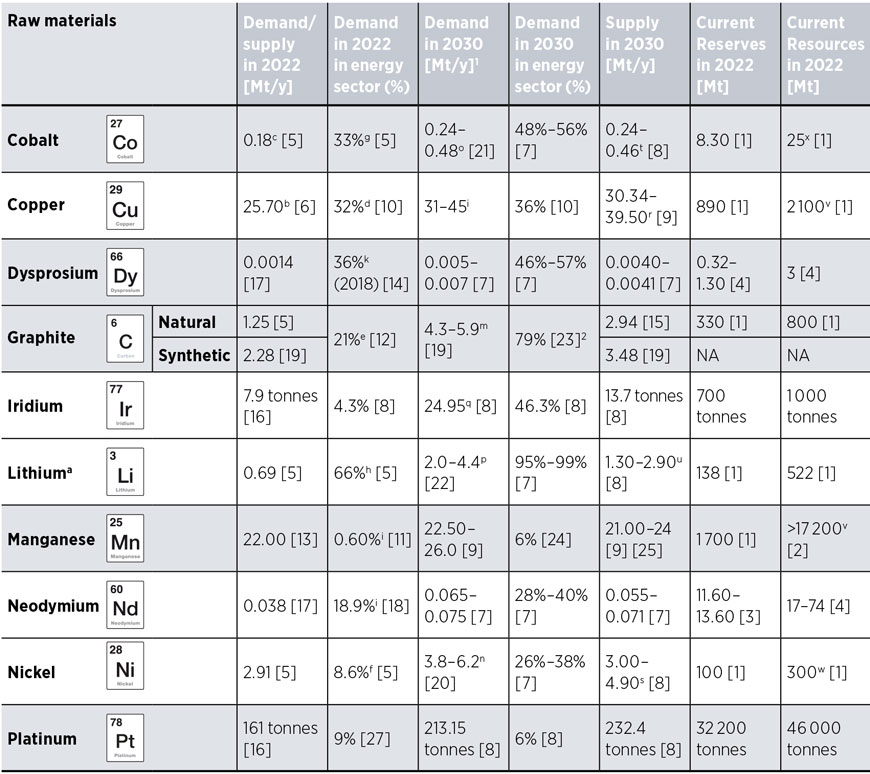

The energy transition will be a main driver of demand for several critical minerals. The transition will be mineral- and metal-intensive. At present, the bulk of the demand for such materials is for uses unrelated to the energy transition; but as the transition progresses, demand for many materials is projected to grow. IRENA’s 1.5°C scenario documents the vast scale of the energy transition infrastructure - and critical materials - needed to achieve climate stabilisation. This will include 33 000 GW of renewable power and the electrification of 90% of road transport in 2050. Already, a mismatch between supply and demand for several minerals is evident, with particularly high levels observed for lithium.

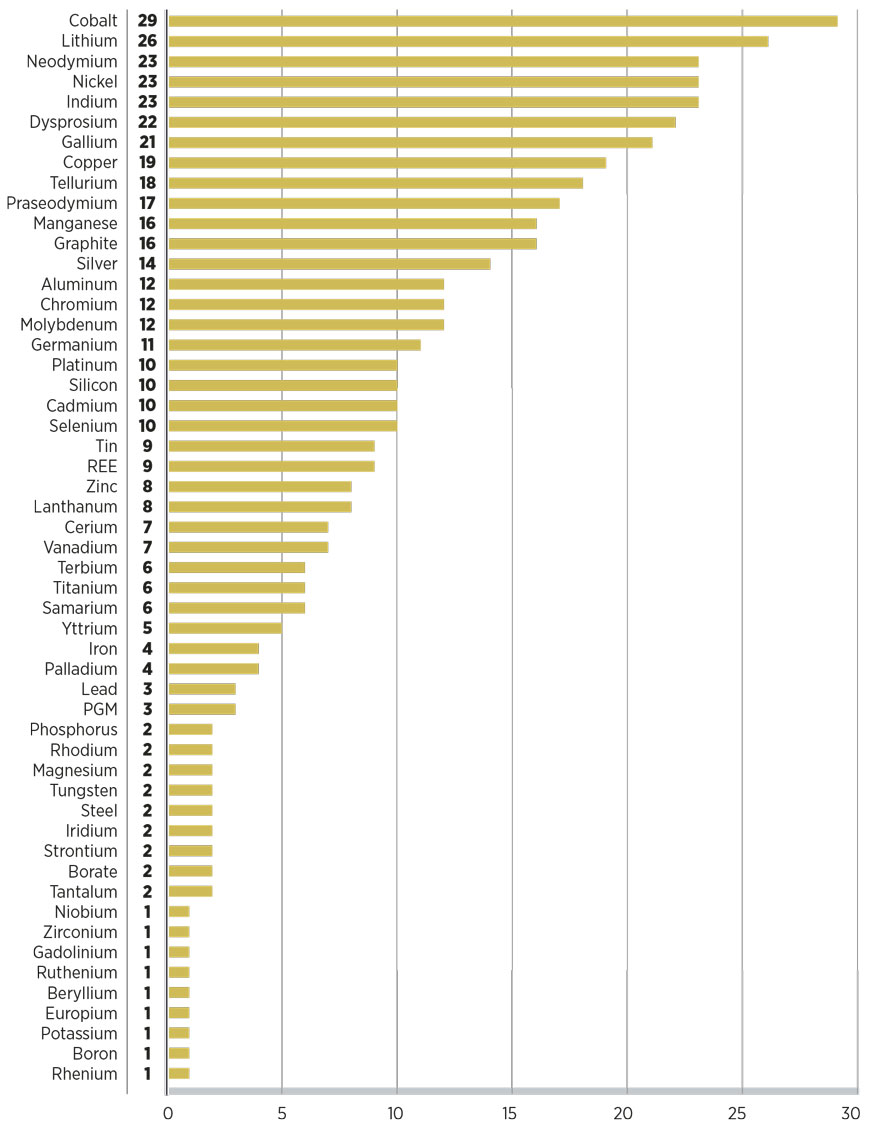

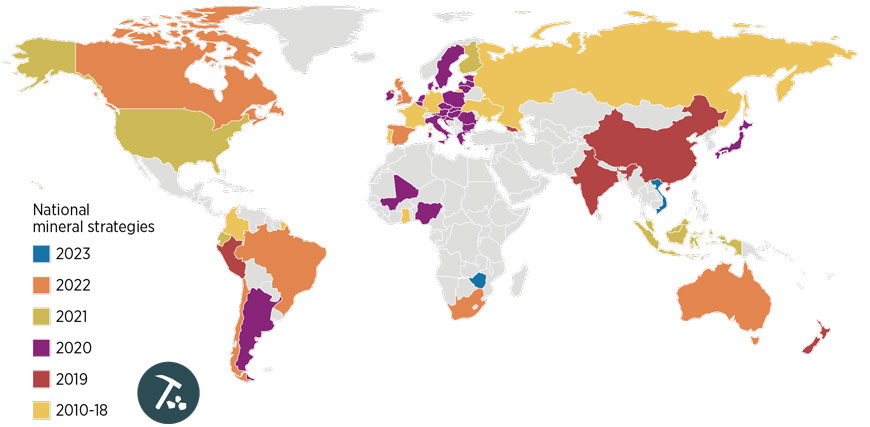

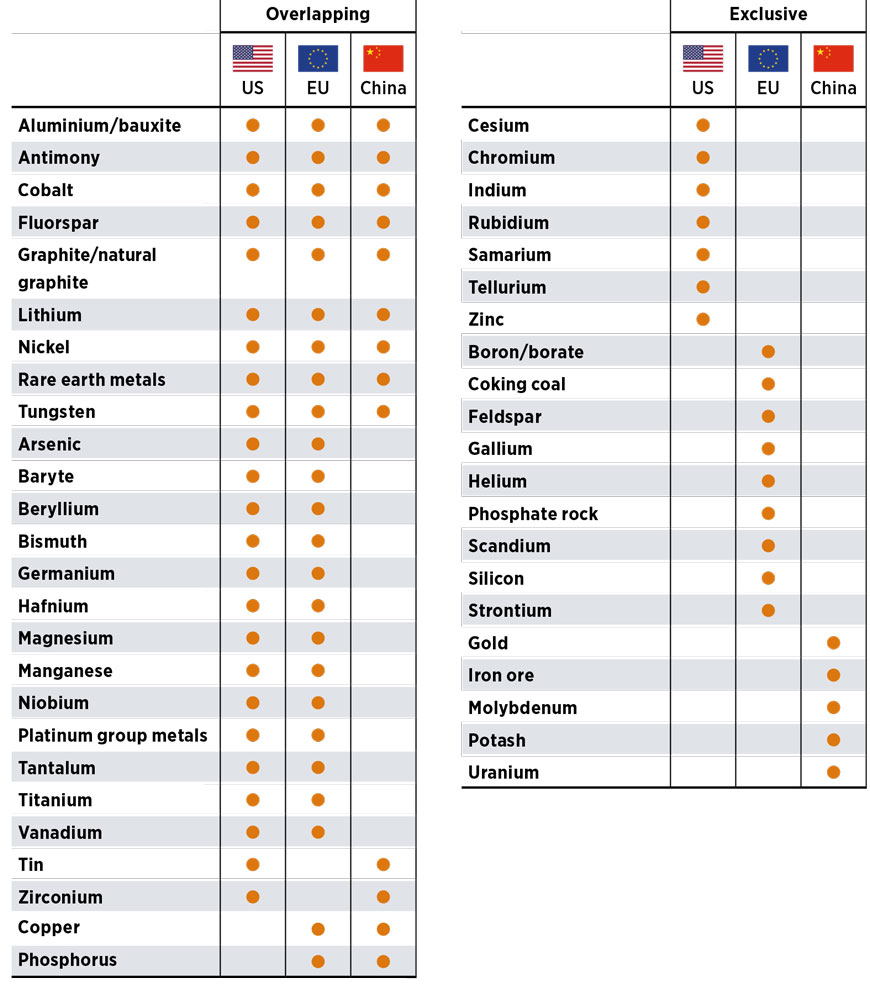

Assessment of the criticality of materials is dynamic and continuously changing owing to economic, geopolitical and technological factors. Presently there is no universally accepted definition of critical materials. Many countries and regions maintain lists of critical materials, which typically mirror current technologies, the prevailing global dynamics of supply and demand, and the context in which the assessments are conducted. The factors for determining criticality therefore remain subjective and location-specific. IRENA’s review of 35 lists of critical materials reveals that 51 materials used for the renewables-based energy transition appeared on at least one list.

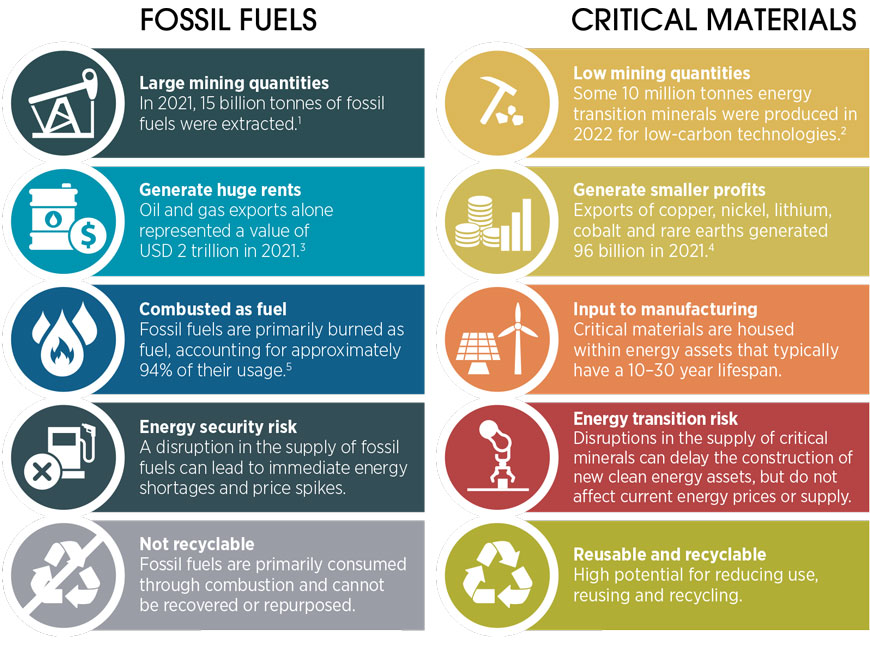

Critical material supply disruptions have minimal impacts on energy security, but outsized impacts on the energy transition. The current notion of energy security revolves around the continuous accessibility of energy sources, primarily rooted in concerns over fossil fuel supply. By contrast, renewable energy technologies that are already built could continue to operate for decades, even if supplies of critical material inputs were disrupted. Therefore, the risk associated with disruptions in the supply of critical materials is less about energy security and more about the potential slowdown of energy transitions.

Dependency risks and supply dynamics of critical materials fundamentally differ from those of fossil fuels, given vastly different characteristics and patterns. A prominent concern is that energy transitions will entail trading dependency on fossil fuels for dependency on critical materials. However, significant differences in their production, trade and use do not warrant such an assumption (Figure S1). Moreover, projections of critical material demand and use are fraught with uncertainties across distant time horizons, so a careful assessment of associated risks is required to understand and proactively manage them.

There is no scarcity of reserves for energy transition minerals, but capabilities for mining and refining them are limited. In the short to medium term, market constraints are likely to emerge, partly due to underinvestment in upstream activities. It is unlikely that a worldwide shortfall of any one mineral will hinder the energy transition. Production has surged for many energy transition minerals, and reserves mined from economically viable sources have grown. Moreover, disruptive innovation - such as efficiency improvements and material substitutions - are already reshaping demand.

FIGURE S1 Critical materials are fundamentally different to fossil fuels

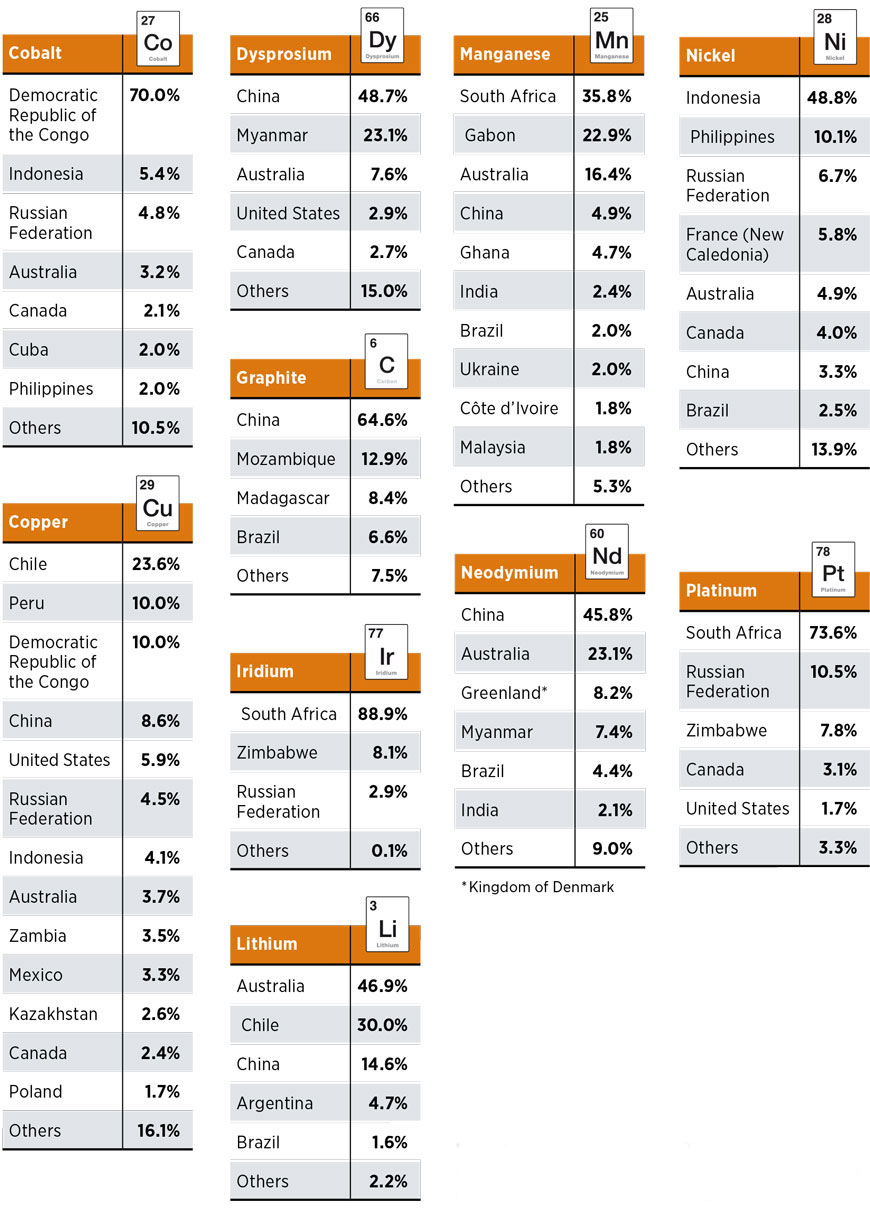

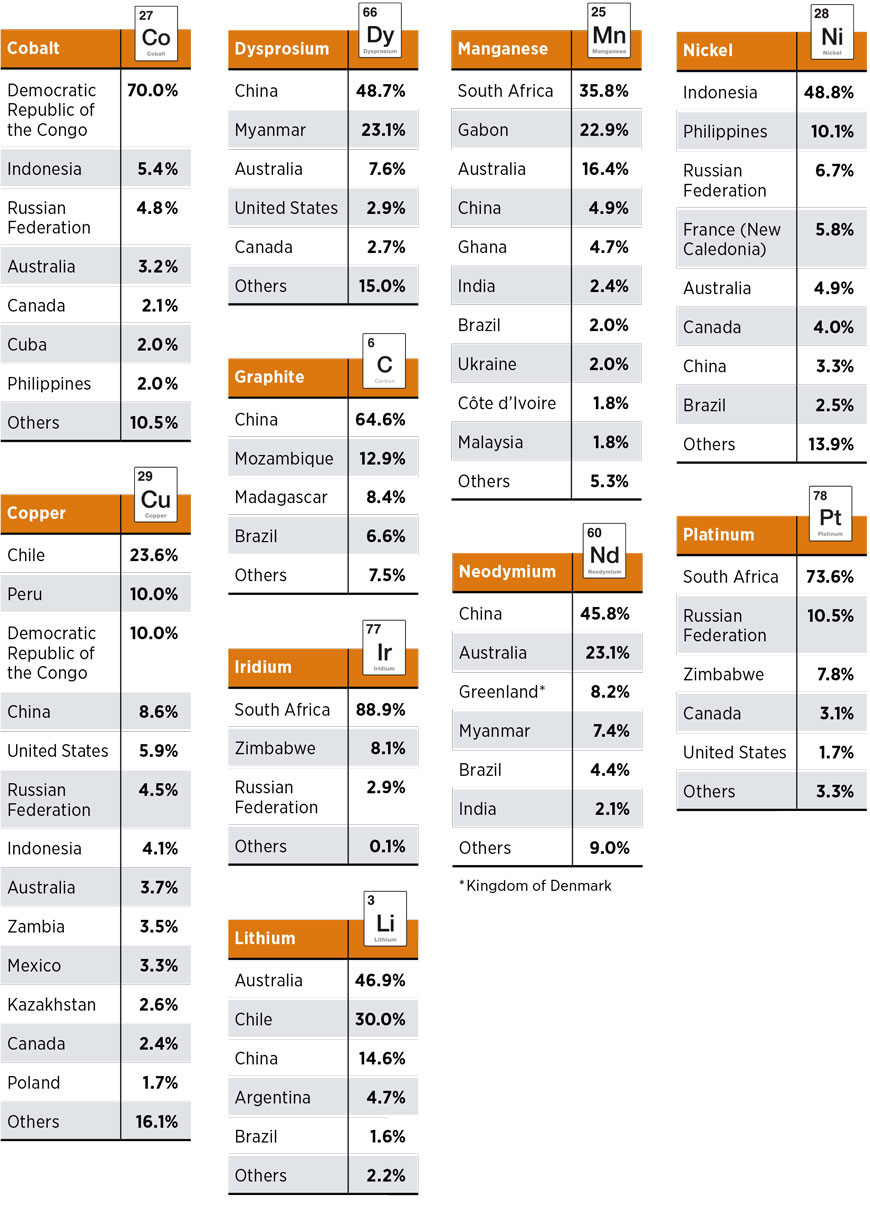

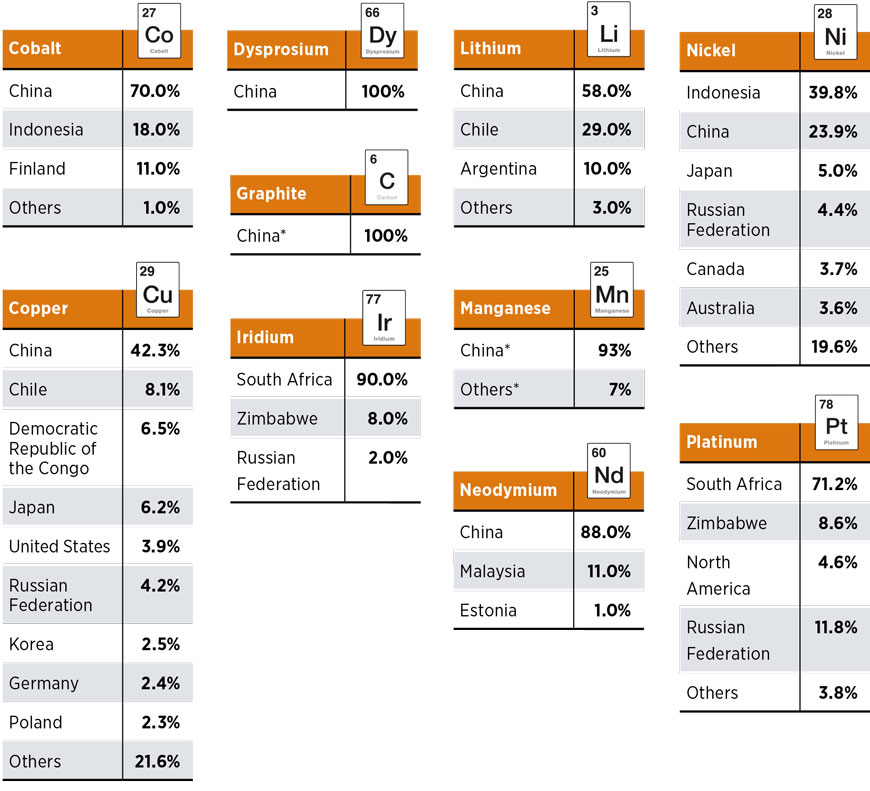

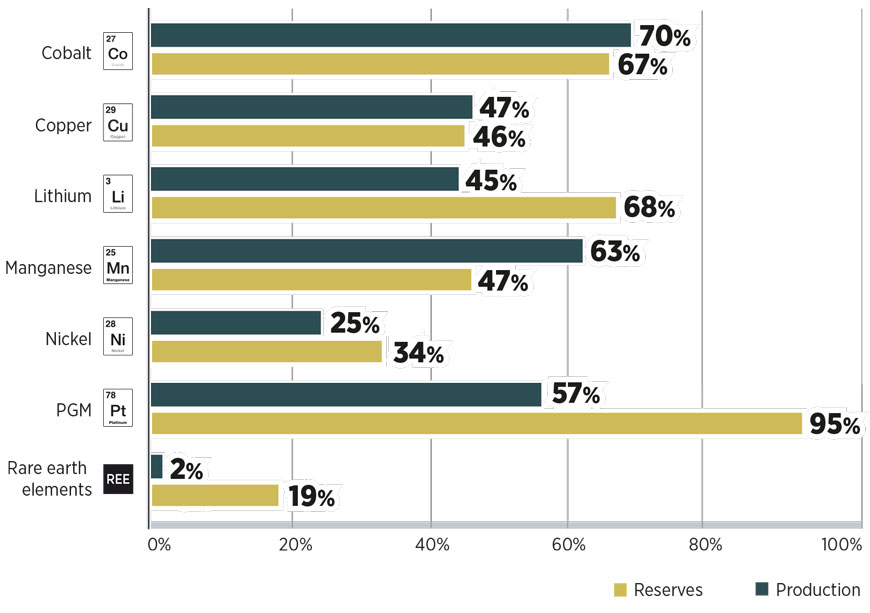

The mining and processing landscape of critical materials is geographically concentrated, with a select group of countries playing a dominant role. In the mining of critical materials, dominant positions are held by Australia (lithium), Chile (copper and lithium), China (graphite, rare earths), the Democratic Republic of Congo (cobalt), Indonesia (nickel) and South Africa (platinum, iridium). This concentration becomes even more pronounced in the processing stage, with China currently accounting for 100% of the refined supply of natural graphite and dysprosium (a rare earth element), 70% of cobalt, and almost 60% of lithium and manganese (Figure S2).

FIGURE S2 Key mining countries for select minerals

Source: (US Geological Survey and US Department of the Interior, 2023; JRC, 2020; USGS, 2023b).

The mining industry is dominated by a few major companies, yielding small and often oligopolistic markets. These large multinational corporations and state-owned or -controlled enterprises operate across multiple countries and possess the resources and skills needed to develop complex mines. As a result, the industry is highly concentrated, with a few companies controlling a significant portion of global production and trade. The top five mining companies control 61% of lithium output and 56% of cobalt output.

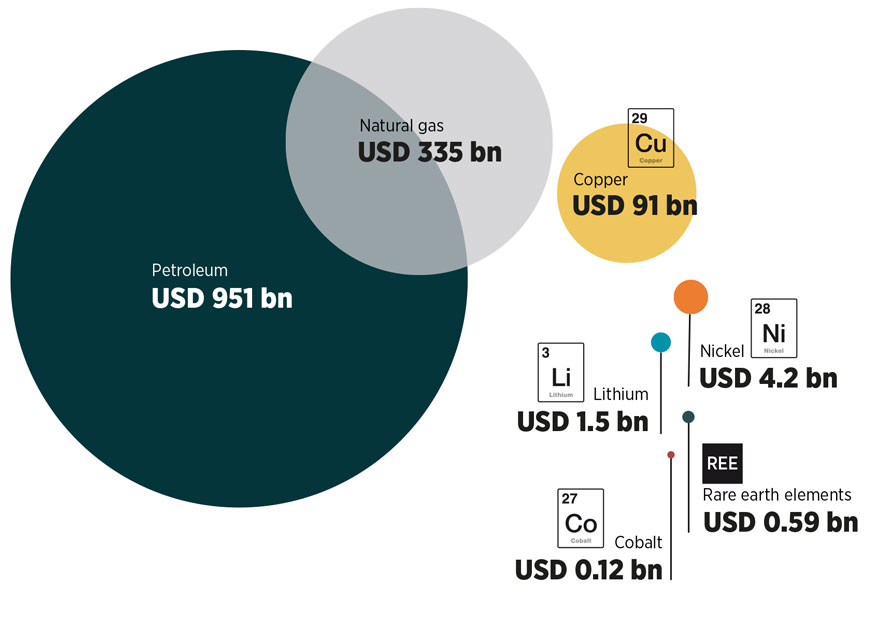

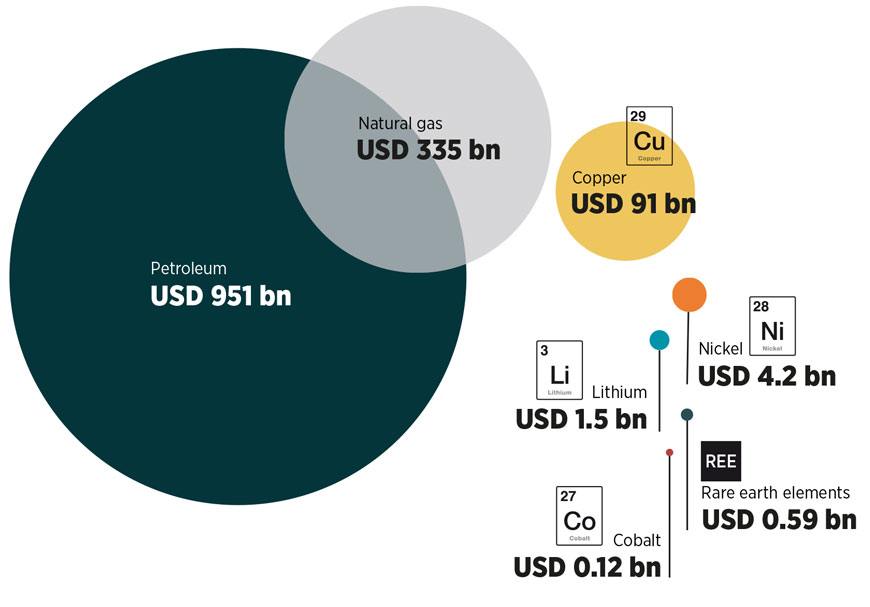

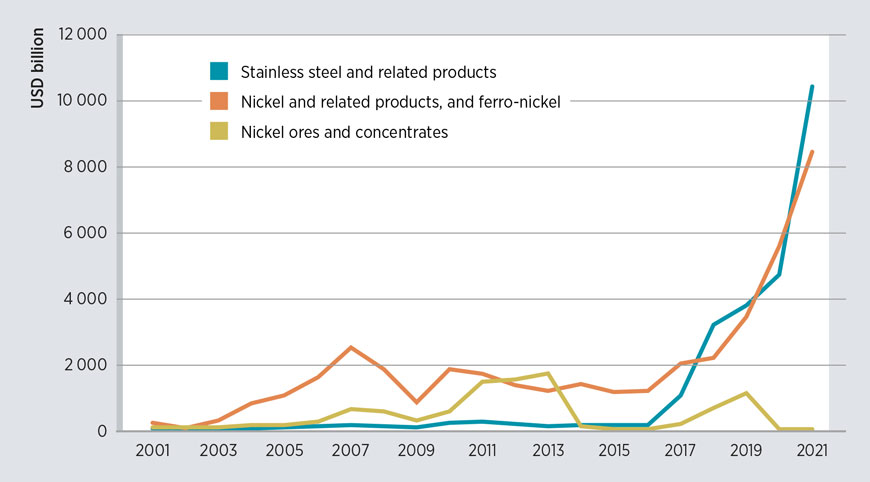

Trade in critical materials is many orders of magnitude smaller by value than trade in fossil fuels. Unlike oil, most critical materials are not widely traded on exchanges. While this limits opportunities to hedge against price volatility, it allows commodity traders to play a key role in matching producers and consumers.

FIGURE S3 Value of exports for selected commodities (2021)

Note: Numbers represent trade in raw, unprocessed fuels and ores only.

The full extent of reliance and exposure to disruptions is not always obvious. Mineral commodities sourced from different countries can be embedded in imported finished and semi-finished products, thus obscuring potential links and vulnerabilities. Moreover, import transactions are sometimes attributed only to the country of the last shipment, not to the country in which the material was originally mined or manufactured.

Each critical material has a unique geography of trade which, on an aggregate level, entangles countries in a broader web of interdependence. All countries rely on a functioning global market for critical materials and related technologies, given that they either import these commodities or rely on a steady demand for their materials, components or finished products. Trade patterns vary enormously across countries, sectors and technologies, and reveal the true interdependence of countries in terms of mineral supply and demand.

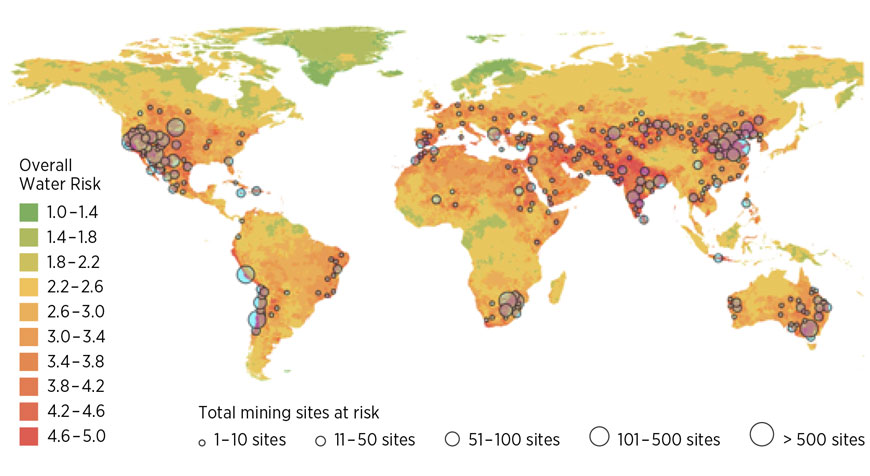

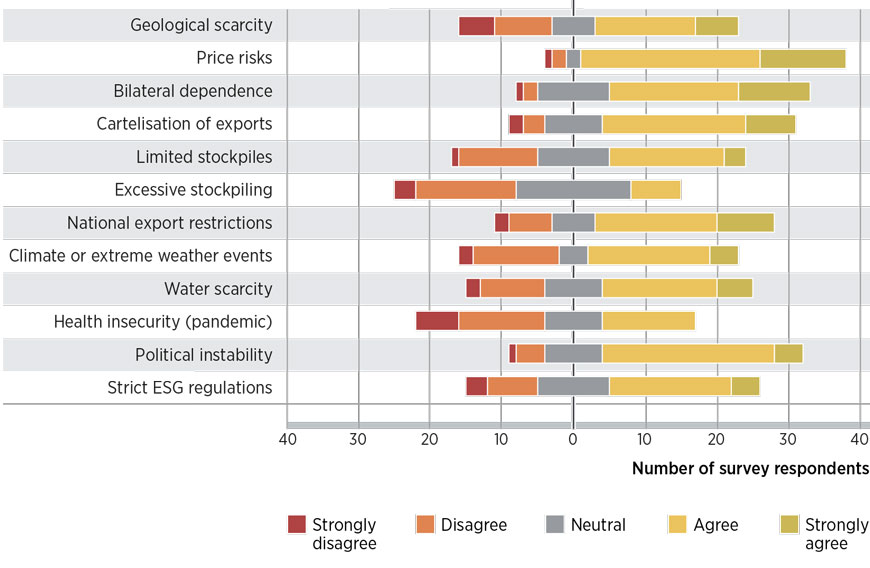

Supply chains are currently vulnerable to diverse geopolitical risks (Figure S4). Interruptions in the supply of minerals can affect multiple industries and reverberate throughout the economy. Supply shortages and related risks could arise, particularly in the short to medium term, as demand for selected materials increases, and mining and processes remain concentrated. In the medium to long term, trade flows for critical materials are unlikely to lend themselves as easily to geopolitical influence as oil and gas. This is because reserves of such materials are abundant, geographically widespread and can be processed in many locations.

FIGURE S4 Key geopolitical risks to the supply of materials

Critical materials trade flows are not likely to be cartelised. Mineral supply is concentrated geographically, and corporations with large market shares in key segments of mineral value chains dominate their mining and refinement. This concentration of production could potentially lead to the formation of commodity cartels. However, previous attempts to establish such cartels have mostly failed, serving as a significant deterrent for many producer countries.

Geopolitical considerations should consider structural trends that could have long-term implications for the availability of, and demand for, mineral commodities. These trends include not only the geographical concentration of mining and processing but also the decline in mineral ore grades, the substitution possibilities for certain materials, and end-of-life management, among others. These factors have the potential to magnify the impact - and in some instances the probability - of geopolitical risks.

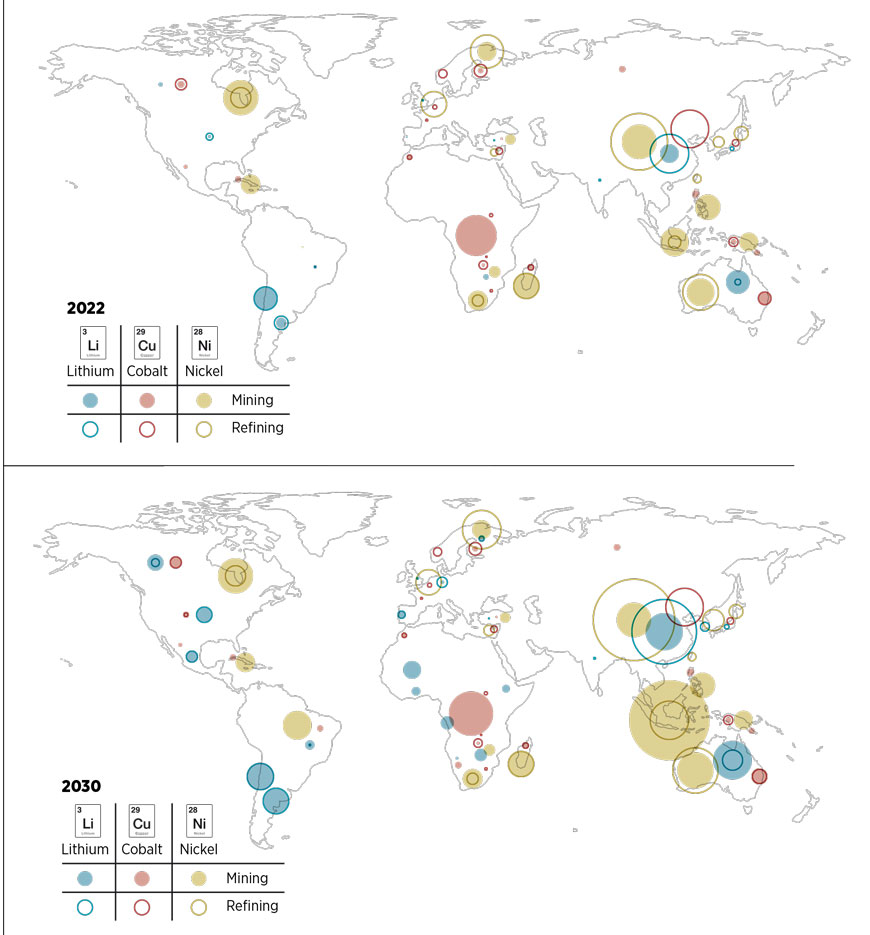

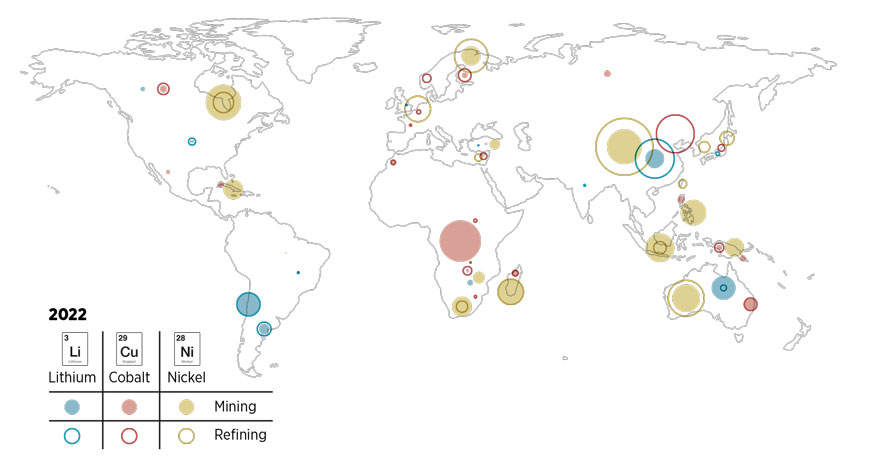

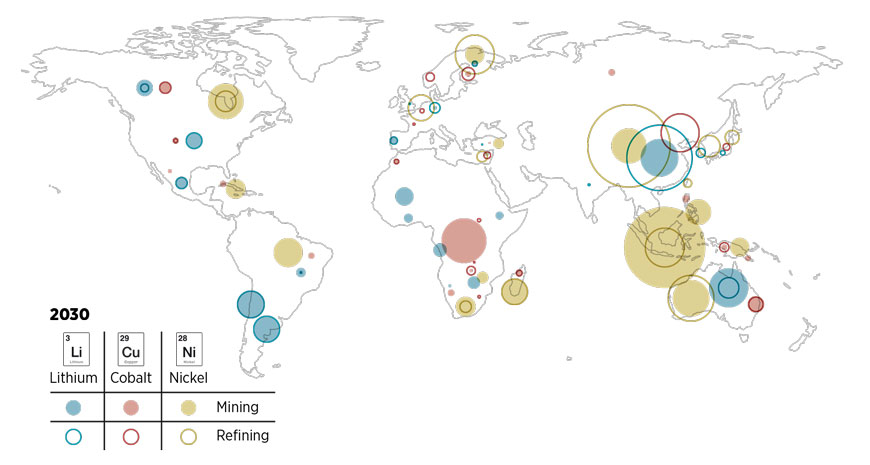

The centralised supply chains for many materials are likely to remain as they are for the foreseeable future. Many countries are trying to restructure supply chains, but new mining and processing facilities have long lead times, making it difficult to rebalance supply and demand dynamics (Figure S5). Moreover, adjusting these supply chains necessitates careful balancing of economic factors, environmental impacts and the well-being of local populations.

FIGURE S5 Mining and refining supply for selected critical materials, 2022 and 2030

Disclaimer: These maps are provided for illustration purposes only. Boundaries and names shown on the maps do not imply any endorsement or acceptance by IRENA.

Innovations in technology can influence demand by introducing substitutes, enhancing efficiency, optimising designs and incorporating new materials. Disruptive innovation is adding to the uncertainty of future demand. For example, changes in electric vehicle battery chemistry over the past eight years have significantly reshaped the demand for specific materials. As new technologies continue to emerge, the market is likely to experience further shifts before eventually consolidating around a limited number of dominant materials and technologies. Consequently, predicting future demand for certain materials can be quite difficult, particularly in the long term.

Stockpiling of critical materials is not a robust solution for mitigating supply risks. Critical materials are indispensable for manufacturing and constructing energy assets. This brings into question the efficacy of stockpiling transition minerals for the energy sector compared to other sectors, such as defence. If not handled judiciously, stockpiling can exacerbate market limitations, drive up prices, and lead to an uneven energy transition that excludes poorer countries and delays climate action.

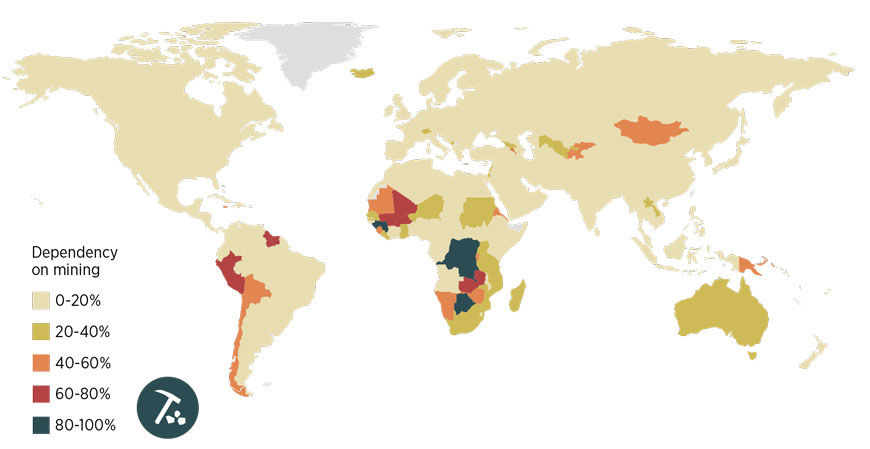

Critical material reserves are widely distributed, opening opportunities to diversify the mining and processing of materials. Developing countries currently account for much of the global production of the materials needed for the energy transition, and their share in reserves is even greater, but not fully explored (Figure S6). For example, Bolivia has 21 million tonnes of lithium reserves - more than any other country - but it produced less than 1% of world supply in 2021. Countries can utilise their mineral resources to draw in industries involved in the middle stages of production (processing) or even in the end stages (battery and electric vehicle manufacturing).

FIGURE S6 Share of global exploration budget for materials by country, 2012 and 2022

Based on: (S&P, 2023).

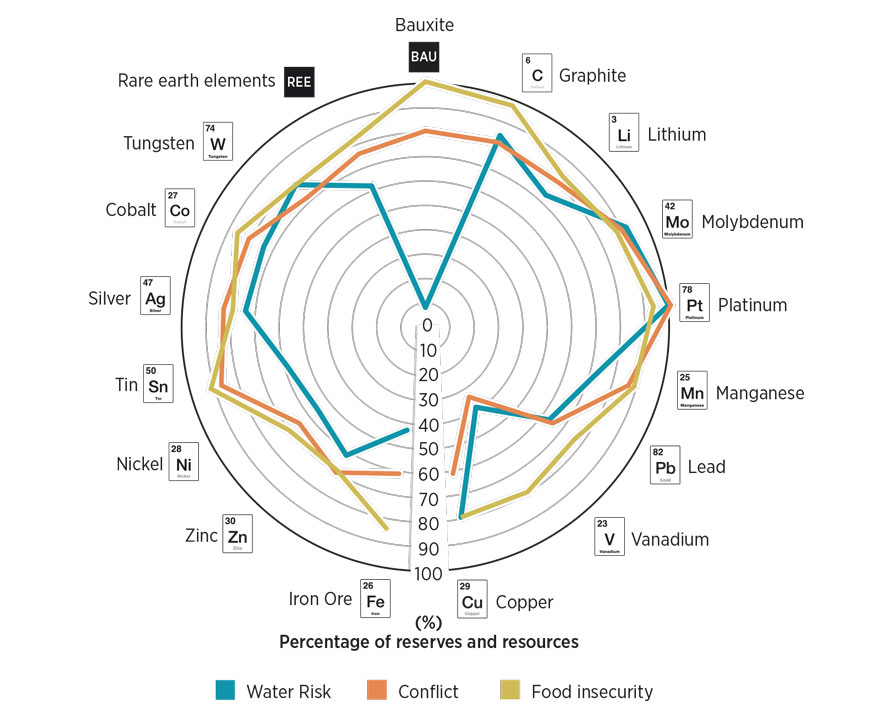

An estimated 54% of energy transition minerals are located on or near indigenous peoples’ land, underscoring the need for robust and early community engagement. Over 80% of lithium projects and more than half of nickel, copper and zinc projects are located in the territories of indigenous peoples. More than a third of mineral projects relevant to the energy transition are on, or near, indigenous territory or farmers’ land that faces a combination of water risk, conflict and food insecurity. Over 90% of platinum reserves and resources, for example, are on, or near, indigenous peoples’ or rural land facing these three risks, followed by molybdenum (76%) and graphite (74%).

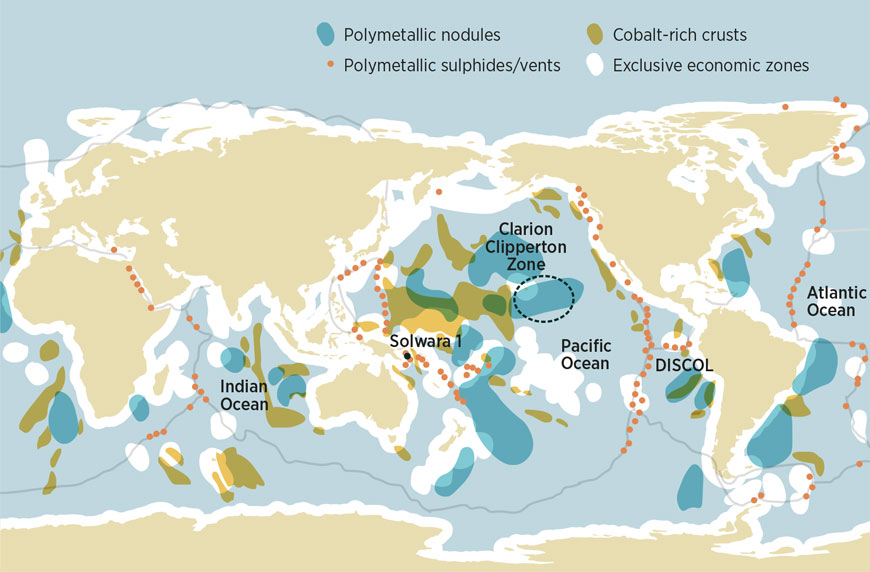

The pursuit of critical materials could spark geopolitical competition in areas known to contain significant deposits, such as the Arctic, outer space and the deep sea. The Arctic is known to have vast reserves of critical materials such as nickel, zinc and rare earths, and the region’s mineral abundance contributes to its strategic importance. Given the presence of ample terrestrial reserves, a cautious approach is warranted in the case of outer space and the deep sea, due to uncertainties surrounding potential environmental impacts and regulatory frameworks.

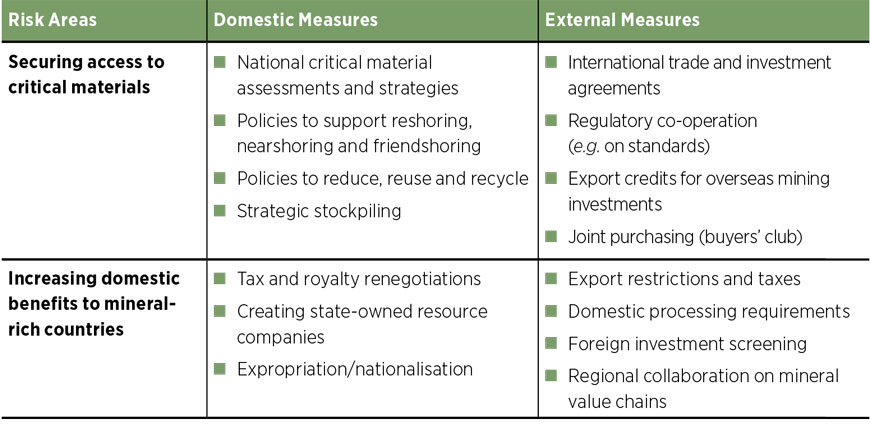

Helping developing countries to realise new opportunities in supply chains could improve resilience while narrowing the global decarbonisation divide. A key question is whether the energy transition supports developing countries to not just increase their exports of primary ores but to also move up the value chain and attract higher-margin activities such as mineral processing. Processed materials like steel and alumina do not just command significant price premia over unrefined ores; they also reduce the input cost of infrastructural and industrial projects, spurring local economic development.

Regional co-operation could help countries capture a greater share of the value of producing minerals. Rather than pursuing one-on-one deals with - often - foreign companies, co-ordinated regional approaches could be more effective in ensuring that conditions attached to foreign investment are favourable for mineralrich countries. Co-ordination across regions is also important, as most countries would benefit from pooling respective mineral supplies if they intend to build downstream industries.

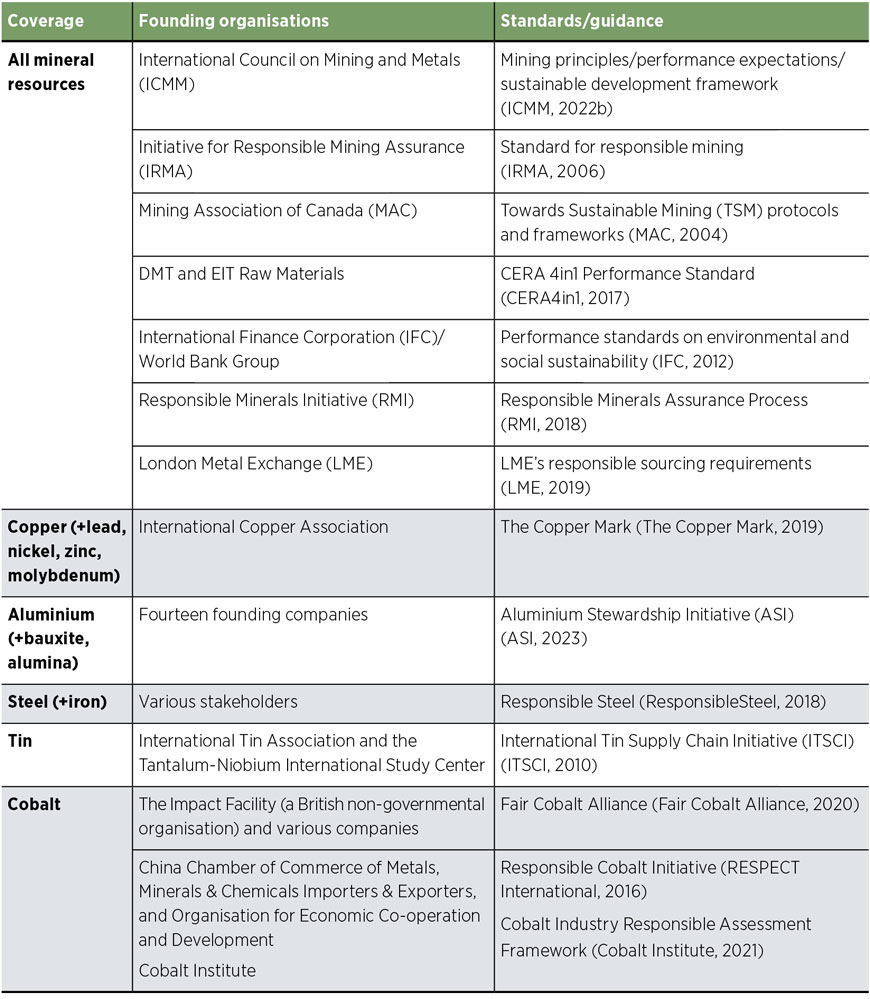

The patchwork of international and transnational initiatives requires greater coherence to bring about more responsible, sustainable and transparent supply chains. The growing recognition of challenges associated with the critical materials supply chain has spurred the development of an array of initiatives and regulatory frameworks by governments, businesses and civil society groups. Most of these are voluntary. The result is a patchwork of standards that risks sowing confusion for stakeholders and highlights the need for greater visibility and coherence.

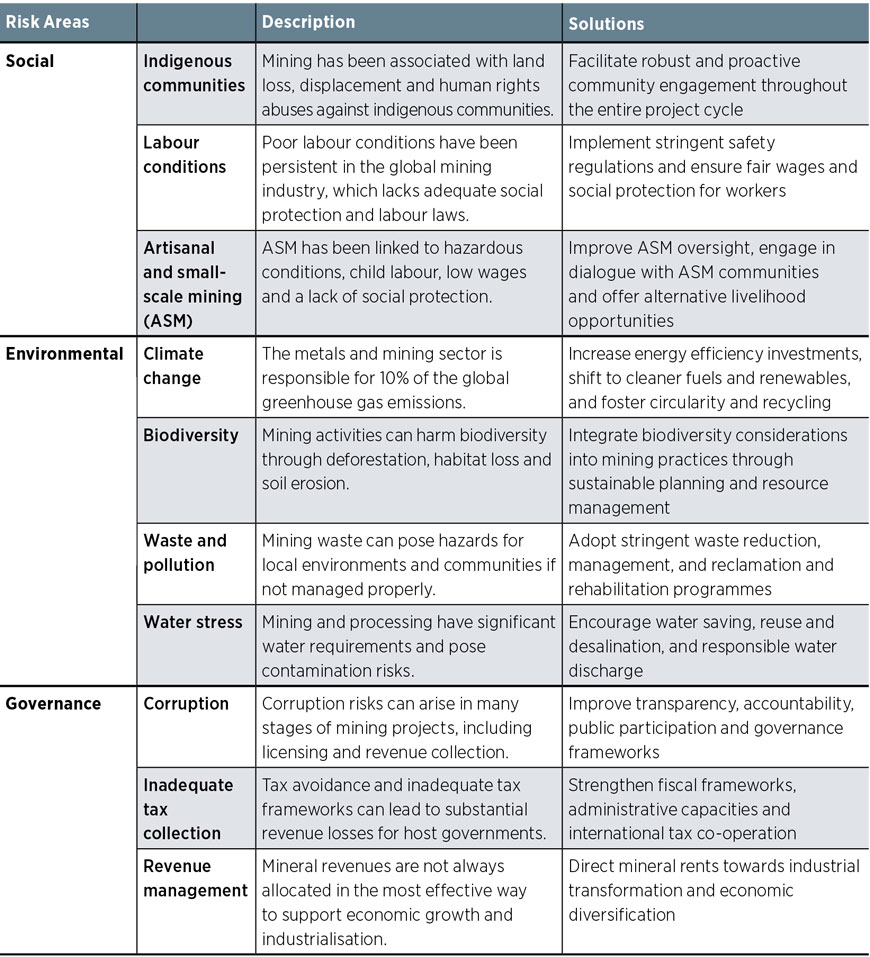

A renewables-based energy transition, if well-planned and executed, can rewrite the legacy of extractive industries. As has been the case with extractive industries for centuries - and even with today’s awareness and standards - mining activities and processes carry risks for local communities such as labour and other human rights abuses, land degradation, water resource depletion and contamination, and air pollution. Stronger international co-operation to raise and enforce standards and longer-term corporate views will be essential for sustainable development and social license.

1.1 Critical materials and the energy transition

Demand for critical materials is projected to grow rapidly with the renewables-based energy transition. IRENA’s 1.5°C Scenario posits that renewables will constitute 91% of the energy mix by 2050, a shift that would increase renewables-based installed capacity from 3 300 gigawatts (GW) in 2022 to 33 000 GW in 2050. Under this scenario, 90% of all road vehicles will be electric by 2050 and hydrogen will account for 14% of total final energy consumption. These shifts would require annual tripling of new renewables, to an average deployment of 1 000 GW (IRENA, 2022a, 2023a).

Such a buildout of clean energy technology and infrastructure will greatly increase demand for certain minerals and metals, grouped in this report under the term “critical materials”. Critical materials are today the focus of much international dialogue and diplomacy. Their production and processing are highly concentrated geographically, posing challenges related to resource security and geopolitical dynamics. Strategies to diversify the supply and production chains for these materials are starting to emerge, reflecting multiple economic, political and social considerations.

Presently there is no universally accepted definition of critical materials (Figure 1.1). The factors for determining criticality remain subjective and location-specific. Core criteria typically include economic importance (for a specific economy of interest) and level of supply risk, as influenced by factors such as scarcity and proximity of supply, complexity of extraction and refining processes, concentration of supply across different parts of the value chain, and lack of viable substitutes (IRENA, 2022a).

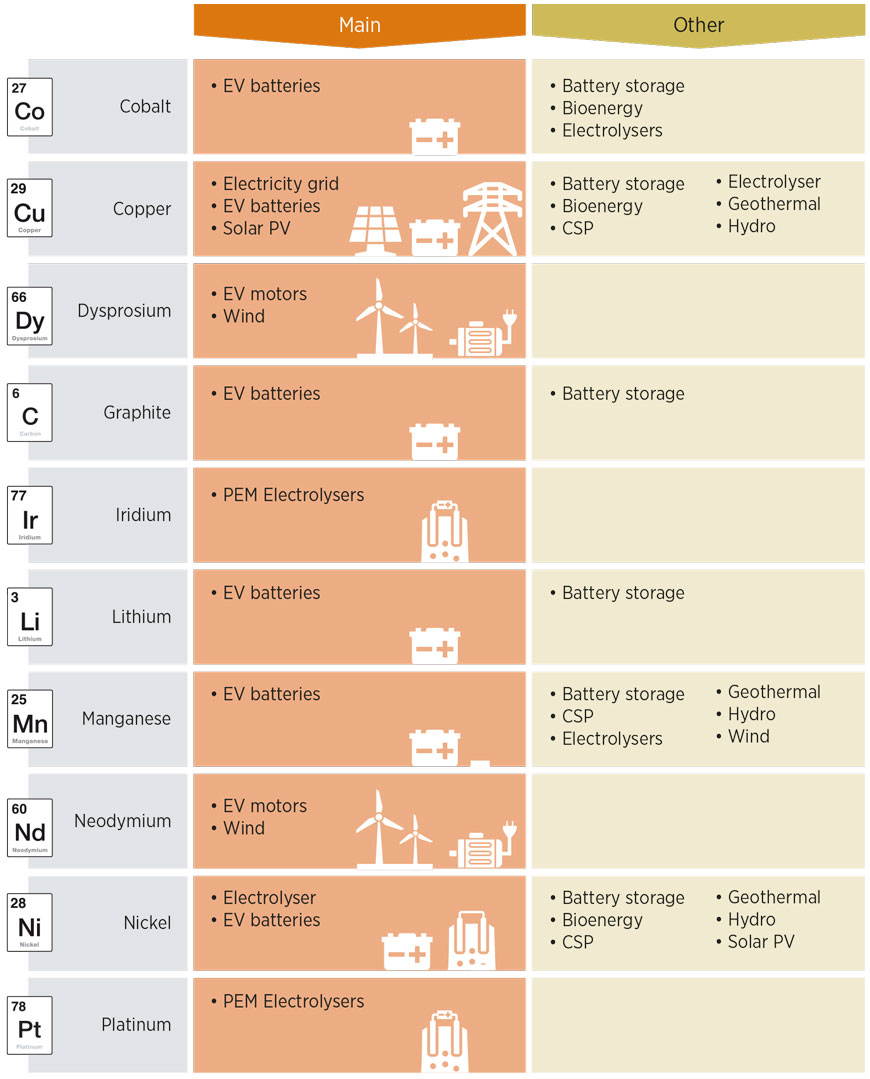

For the purposes of this report, “critical materials” refers to minerals and metals generally viewed as highly important as inputs for a renewables-based energy transition, including but not limited to cobalt, copper, graphite, iridium, lithium, manganese, nickel, platinum, and selected rare earth elements. Various other materials are mentioned in this report in reference to real-world energy technology as well as policy examples and case studies with geopolitical relevance.

FIGURE 1.1 Energy transition materials defined as critical by countries and regions (35 lists, 51 materials), 2023

Notes: REE = rare earth elements; PGM = platinum group metals.

Critical materials are valuable commodities, but their economic value is not as significant as that of fossil fuels, which today account for 2% of global GDP (IRENA, 2022b). With the exception of copper, the most valuable base metal in terms of market size, the value of trade flows for other minerals and metals is many orders of magnitude smaller than oil and gas markets (see Figure 1.2). The sector will grow in coming years, but volumes and values will not be comparable to fossil fuels today.

With supply bottleneck risks and long development cycles for mining projects, a prominent concern is that the renewables-based energy transition will entail trading the dependency on imported fossil fuels for dependency on imported critical materials. However, the dependency risks and supply dynamics of critical materials differ fundamentally from those pertaining to fossil fuels. Fossil fuels are consumables primarily used for energy production, whereas critical materials are essential inputs for energy transition components, equipment and devices.

FIGURE 1.2 Value of exports for selected commodities (2021)

Note: Numbers represent trade in raw, unprocessed fuels and ores only.

In case of a supply disruption, the operation of energy infrastructure and machinery that run on coal, gas or oil would come to a halt. Such disruptions would have an immediate impact on consumers and households, triggering a gamut of social, political and financial challenges. In contrast, disruptions in critical materials would not have an impact on the existing energy infrastructure and equipment, though they would potentially slow the speed and increase the cost of decarbonisation. The risk of disruptions in the supply of critical materials is therefore less an energy security risk than a risk to the speed of the energy transition (see Figure 1.3).

FIGURE 1.3 Critical materials are fundamentally different from fossil fuels

IRENA expects the technical evolution of critical materials to be shaped by three shifting and overlapping dynamics. The first dynamic, most dominant in the short to medium term, will be marked by physical constraints and challenges in keeping up with rising demand for certain critical materials. The second – which is already occurring at scale – will bring disruptive innovation, with new ideas and experiments to reduce materials consumption. The third dynamic – still nascent – will usher in a larger role for circular economy, including more advanced and widely adopted methods of reducing, reusing and recycling critical materials.

FIGURE 1.4 Three dynamics of critical materials development for energy transition

1.2 Physical constraints

Potential undersupply in the short to medium term is a result of the lack of investment in upstream activities. This is due to numerous factors including long lead times in opening new mines and processing of manufacturing plants, uncertainty regarding future demand, price volatility, a lack of downstream transparency, and local opposition, among others (IRENA, forthcoming). Moreover, the mining and processing of critical materials are heavily concentrated in a handful of countries (see Chapter 2).

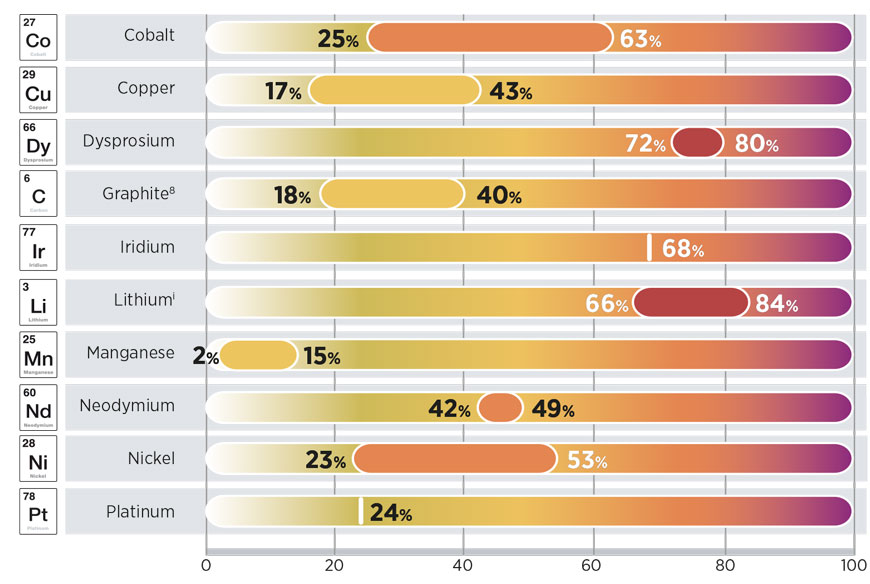

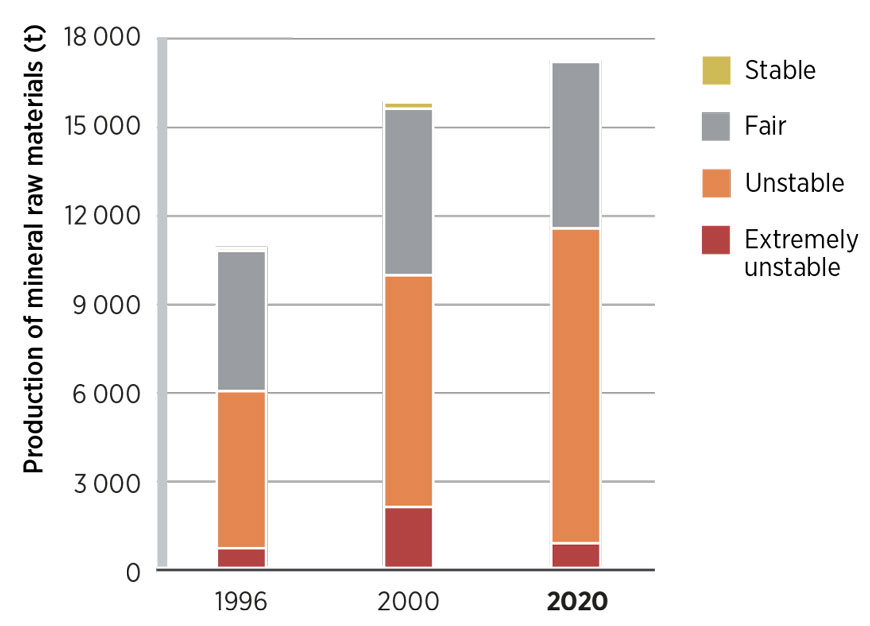

Market demand for critical materials in 2022 predominantly originated from non-energy transition uses, except for lithium. For example, over 90% of nickel was used in iron and steel production; over 80% of graphite was used for steel, aluminium and ceramics; and over 80% of manganese was used in steel and chemical production, and foundry and welding (IRENA, forthcoming). However, energy transition technologies are increasingly requiring critical materials, and may exceed the demand from non-energy uses in some cases (IRENA, forthcoming). This trend is especially notable for lithium, cobalt, graphite and dysprosium. IRENA’s short-term scarcity ratio (see Figure 1.5) compares the supply of materials in 2022 with the demand expected in 2030. 1

FIGURE 1.5 Assessing disparity between current supply and anticipated demand in 2030 for selected materials*

Note: *A short-term scarcity ratio compares the mine production of selected material in 2022 with the demand expected in 2030; see Annex for calculation methodology.

To avoid a demand-supply gap for materials with a high scarcity ratio, increasing the mining and processing capacities is essential. There is no scarcity of geological reserves and they are geographically widespread. As the focus on critical materials increases, so are new discoveries. For instance, Norge Mining recently announced that the phosphate, titanium and vanadium deposits found in Norway could supply the current global demand for at least 50 years (The Economist, 8 June 2023).

Apart from boosting mining and processing, bridging the gap requires improving material recovery from tailings and recycling technologies. Such advancements require government investment in infrastructure, the design of enabling legal frameworks, including mandates through public policy, and research and innovation in recycling technologies.

1.3 Disruptive innovation

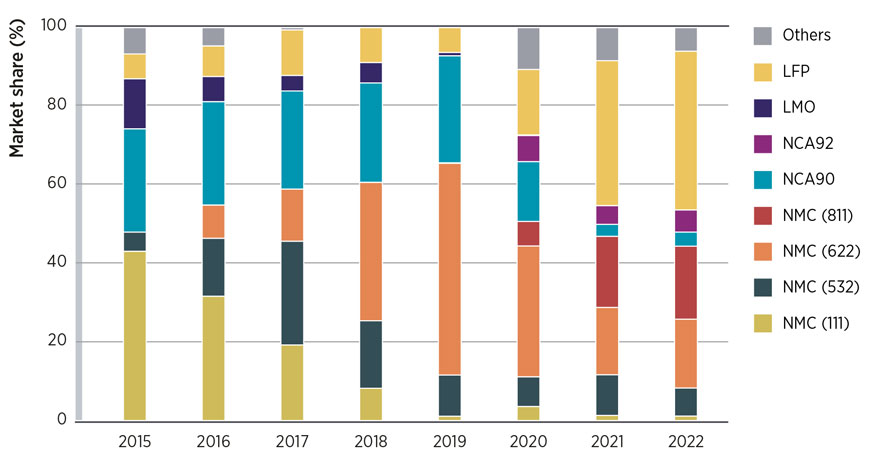

Technological innovation affects the demand for materials through factors such as substitution, efficiency improvement, design optimisation and the introduction of new materials. There are multiple uncertainties in projecting and assessing the demand-supply gap for critical materials in energy transition technologies. A prime example is electric vehicle (EV) batteries. Significant shifts in the EV battery chemistry mix occurred since 2015 (Figure 1.6).

FIGURE 1.6 Rapidly changing global EV battery chemistry mix between 2015 to 2022

Note: The numbers following NCA indicate nickel's proportion in the NCA battery chemistry, whereas the numbers following NMC indicate nickel's proportion in the NMC battery chemistry; for example, NMC (622) means 6 parts of nickel, 2 parts of manganese and 2 parts of cobalt. LFP = lithium iron phosphate; LMO = lithium manganese oxide; NCA = nickel cobalt and aluminium; NMC = nickel manganese and cobalt.

Today, the EV battery industry is dominated by lithium-ion batteries, a technology that has undergone multiple advancements in key components that significantly influence material demand. Graphite-based anode chemistry holds a 70% market share due to its high performance. However, emerging anode chemistries, such as 100% silicon-based anodes, lithium metal anodes and aluminium or aluminium alloy anodes, have the potential to reduce or eliminate the demand for graphite, depending on the speed of research and development (IRENA, forthcoming). For cathodes, the most commonly used chemistries include nickel manganese cobalt oxides (NMC), nickel cobalt aluminium oxides (NCA) and lithium iron phosphate (LFP). NMC and LFP are expected to remain the most prevalent batteries in this decade, although which technology will ultimately prevail remains a question (see Box 1.1). Emerging battery technologies, such as sodium-ion batteries, have the potential to disrupt the EV battery market by replacing critical materials such as lithium and cobalt with less expensive or more abundant options, such as sodium (IRENA, forthcoming).

BOX 1.1 Uncertainties in projecting the demand and supply gap for critical materials: The example of electric vehicle batteries

Lithium iron phosphate (LFP) batteries emerged in the 1990s from the laboratory of John Goodenough, who had won the Nobel Prize for lithium-ion batteries, at the University of Texas–Austin. Several start-ups (e.g. A123 Systems) saw an opportunity to shift away from cobalt and nickel, but LFP’s lower energy density did not draw the interest of automakers such as Tesla and General Motors causing start-ups like A123 Systems to go bankrupt. (McFarland, 2022). However, later, as cobalt and nickel became significantly more expensive, automakers began exploring battery chemistries with fewer critical materials. LFP batteries started to replace nickel manganese cobalt (NMC) batteries in entry-level, inexpensive vehicles, while NMC remained the chemistry of choice for high-performance vehicles. As an indication of this change, the market share of LFP batteries grew significantly from a single digit in 2015 to 40% in 2022 (BNEF, 2022a).

Rapid expansion of LFP, however, cannot be linked solely to innovation. China is the key market for LFP batteries, where they are used in over 40% of EVs, compared to 6% in Europe and 3% in the United States and Canada (BMI, 2022). China’s preference for LFP results from uncertainties regarding the availability of cobalt and nickel at affordable prices. China thus concluded a long-term agreement between the patent owners – a consortium of universities in the United States (University of Texas–Austin and MIT) and Canada (University of Montreal and CNRS) – and Chinese battery manufacturers, BYD and CATL. The agreement lifted license fees if LFP batteries were used exclusively in China (IRENA, forthcoming). These patents expired in 2022.

Rare earth elements, namely, neodymium and dysprosium, are ubiquitously used for permanent magnets in electric generators (i.e. wind energy) and electric motors (i.e. EVs). Rare earth permanent magnets are used for onshore as well as offshore wind applications, and are likely to become more common in turbines. However, significant efforts are being made to replace neodymium with other rare earth elements, including praseodymium, dysprosium and terbium, or to develop rare earth free permanent magnets (electromagnets). This could potentially change the demand outlook for neodymium and dysprosium (Gielen et al., 2022a).

Similarly, innovation in solar photovoltaic technology may alter the demand for raw materials, prompting a shift away from silicon in conventional crystalline silicon and less-efficient thin-film solar power technologies. For instance, perovskite solar cells have garnered increased research and development focus, resulting in rapid efficiency improvements over their crystalline silicon counterparts (up to 25%) (Wu et al., 2021). Other promising technologies include organic solar cells, copper indium gallium selenide cells, dye-sensitised solar cells and quantum dot solar cells. Even though these technologies hold significant potential, they are still in the process of being developed and commercialised, and their performance, durability and cost-effectiveness are still being studied and improved upon.

TABLE 1.1 Selected energy-related technology applications, 2023

1.4 Report scope

This report expands on the above providing a forward-looking examination of geopolitical and geoeconomic considerations and implications of the anticipated scale-up of demand and supply of critical materials. It builds on IRENA’s work to date and analyses the evolving landscape of supply chains and trade patterns, the socioeconomic and sustainability considerations surrounding extraction and processing around the globe, and the strategic importance of critical materials for economic competitiveness and the speed of a renewables-based energy transition.

Chapter 2 examines the geopolitical themes of trade, security, and interdependence. These have always been closely connected with extractive industries in a broad sense, and will remain so with the scale-up of materials critical to the energy transition.

Considerations around sustainability, communities and livelihoods are the focus of Chapter 3, reviewed under the broader term of human security. The chapter sharpens lines of connection between extractive industries and implications for the social economy, environment, and climate in exporting countries, their neighbours and, ultimately, the world.

Chapter 4 shifts the focus from diagnosis to strategic responses and policy considerations. This closing chapter does not provide a universal set of recommendations, but rather reviews the main strains of policy approaches to the challenges and opportunities presented by the scale-up of critical materials for the energy transition.

Highlights

- The mining of critical materials is highly concentrated in specific geographical locations. Australia (lithium), Chile (copper and lithium), China (graphite, rare earths), the Democratic Republic of Congo (cobalt), Indonesia (nickel) and South Africa (platinum, iridium) are the dominant players. Processing is even more geographically concentrated, with China accounting for more than 50% of the world’s refined supply of (natural) graphite, dysprosium (a rare earth), cobalt, lithium and manganese.

- Reserves are distributed relatively evenly, presenting opportunities to diversify supply chains in the long run. One solution would be increased investment in exploration, especially in underexplored regions such as Africa. International collaboration in conducting geological surveys could help these regions attract exploration investments.

- Trade in critical materials is many orders of magnitude smaller by value than trade in fossil fuels. Unlike oil, most critical materials are not widely traded on exchanges. While this limits opportunities to hedge against price volatility, it allows commodity traders to play a key role in matching producers and consumers.

- Each material has a unique trade geography, which, when viewed collectively, interconnects multiple countries in a wider network of interdependence. No country can insulate itself fully from the risks of price shocks or supply disruptions related to critical materials, since these factors may adversely affect the cost and pace of the energy transition.

- The availability of materials is influenced by several structural conditions, including the geographical concentration of mining and processing, decline in mineral ore grades, the limited extent of end-of-life recycling, the dependence on by-product production for many critical materials and the limited short-term substitution possibilities for certain materials.

- Six geopolitical risks to the supply of materials in the short to medium term are identified and assessed: external shocks (e.g. war), resource nationalism (e.g. expropriation), export restrictions (e.g. export bans), mineral cartels (e.g. co-ordination of production), political instability (e.g. social unrest) and market manipulation (e.g. short squeezing).

- The pursuit for critical materials could spark geopolitical competition in areas known to contain significant deposits, such as the Arctic, outer space and the deep sea. However, a cautious approach is warranted in the case of outer space and the deep sea, due to uncertainties surrounding the environmental impact and regulatory frameworks, along with the presence of ample terrestrial reserves.

This chapter provides a comprehensive overview of the key players involved in the value chains of critical materials. In doing so, it highlights the high geographical concentration of supply but also the crucial role of the private sector and commodity traders. Moreover, it scrutinises prevailing trade trends and the corresponding supply risks and vulnerabilities, which encompass the potential perils associated with the weaponisation or cartelisation of supplies, as well as non-political disruptions, such as climate-related hazards and pandemics. Further, it highlights the intensifying geopolitical contestation for critical materials, especially within the global commons, including the exploration and extraction activities unfolding in the deep sea.

2.1 Key players in mineral and metal trading

The critical material supply chain

The pathway of minerals from mines to finished products involves a complex, and often opaque, network of actors and processes. 2 Figure 2.1 shows some of the key stages in the value chains of the mineral and metal industries.

FIGURE 2.1 Schematic representation of a mineral- or metal-dependent value chain

The geological presence of resources alone is not sufficient for undertaking mining projects and the actual mining of mineral ores is preceded by multiple stages. These require meeting several enabling conditions, including compliance with mining and environmental regulations, and the acquisition of necessary permits and licenses. After fulfilling legal requirements, mining companies undertake several steps before extracting resources from the ground. This includes assessing the resource base, conducting feasibility studies and, in some instances, constructing demonstration plants. These processes can take several years and involve significant costs.

Subsequently, the mining stage begins, where mineral ores are extracted from either open-pit or underground mines using drilling and/or blasting techniques. The extracted ores are then transported (typically on conveyors or trucks) to a nearby processing plant, where they are converted into shippable products through multiple steps, which vary depending on the raw material and may involve processes such as grinding, crushing and chemical processing. It is worth noting that while these processes are typical for larger-scale mining operations, artisanal and small-scale mining may employ more rudimentary methods, such as manual labour and simple tools. The involvement of traders in the purchase and transport of the refined minerals further underscores the complexity of the mineral supply chain.

The next stage is metallurgy or refining, which is crucial to remove residual impurities from metal to meet the purity requirements of different markets. This process involves various techniques, such as smelting, roasting and electrolysis, and can generate substantial waste and emissions. The final product from refining is sold to manufacturers, who use the metal in a wide range of areas, including electronics, batteries and construction material. Increasingly, there is a growing trend of recycling products, including certain waste products that are generated during their life cycles.

Geography of mineral mining and processing

The mining of materials is highly concentrated in specific geographical locations (Figure 2.2). For example, more than 70% of platinum is mined in South Africa; 70% of cobalt is mined in the Democratic Republic of Congo; more than 60% of natural graphite in China; almost 50% of nickel in Indonesia; almost 50% of lithium in Australia and almost 50% of dysprosium in China. Mineral processing is even more concentrated (Figure 2.3). China is the dominant player, with a 100% share of global refined supply for natural graphite and dysprosium (a rare earth element) over 90% for manganese, 70% for cobalt, almost 60% for lithium and approximately 40% for copper.

FIGURE 2.2 Key mining countries for select minerals

Source: (US Geological Survey and US Department of the Interior, 2023; JRC, 2020).

FIGURE 2.3 Key processing countries for selected minerals

* latest data available as of 2023; America = Canada, Mexico and the United States; * 2021.

Any country’s dominance in metallurgy poses significant challenges for resource security and geopolitical dynamics. The envisaged increase in demand presents an opportunity to make the existing value chains more resilient, positively impact national balance sheet and support the global transition to a low-carbon economy (Figures 2.4 and 2.5). Mineral-rich countries stand to gain from the growing demand for critical materials. For example, the Australian government expects lithium and base metal exports to equal the value of its coal exports by 2027-2028 (The Hon Madeleine King MP Media Releases, 2023). Diversifying processing towards countries with abundant renewable energy sources can reduce the emission footprint. Countries such as Chile, which have abundant solar energy resources, are exploring the use of solar power to decarbonise copper refining (Lyng, 2022). Western Australia, a renewable energy hotspot, is attracting new investments in midstream critical mineral projects, including three rare earth and three lithium processing facilities (see Figure 2.4) (Government of Western Australia, 2022).

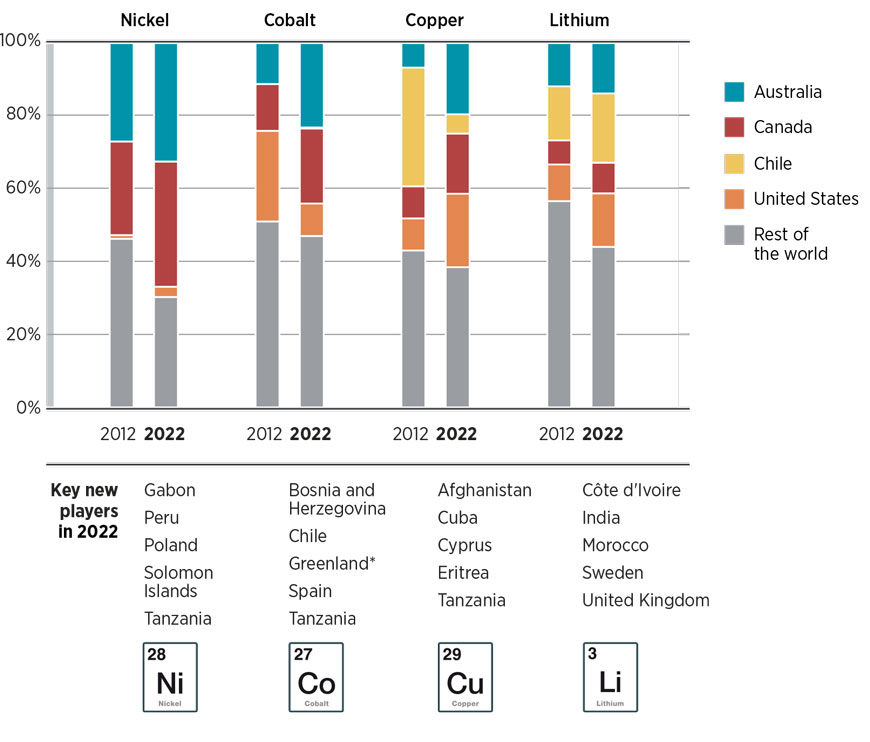

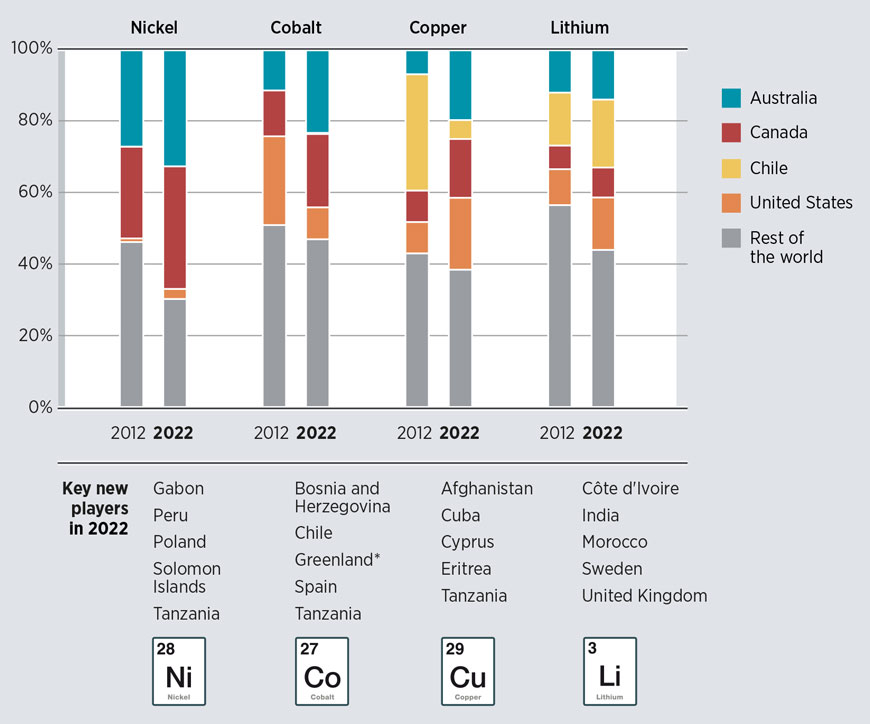

Global critical mineral reserves are relatively more evenly distributed than current mineral production. This opens opportunities for diversifying supply. Large parts of the Earth’s crust, predominantly in developing countries, remain unexplored. For instance, Africa, which has about 20% of the global land mass area, has attracted only about 14% of global mineral exploration investment (Ericsson and Olöf, 2019). Addressing this situation requires not just increasing global exploration spending (Box 2.1), but also continuous collection and sharing of mineral resource data across continents. At present, most of the work is undertaken by countries that are members of the Organisation for Economic Co-operation and Development (OECD). For example, the Australian, Canadian and US geological surveys jointly launched the Critical Minerals Mapping Initiative, which covers over 60 countries (Calam, 2020). Geological work in countries that are not members of the OECD could benefit from increased regional as well as global collaboration. An example is the African Union’s Africa Mining Vision, which was launched in 2009 and is being hindered from realising its full potential due to a lack of resources (Ushie, 2017).

FIGURE 2.4 Mining and refining supply for selected critical materials, 2022

FIGURE 2.5 Mining and refining supply forecasts for selected critical materials, 2030

Disclaimer: These maps are provided for illustration purposes only. Boundaries and names shown on the maps do not imply any endorsement or acceptance by IRENA.

BOX 2.1 Mineral exploration budget

An exploration budget refers to the funds allocated to identifying potential mineral deposits in an area. Not all exploration projects result in a new mine, and even if they do, it takes several years from discovery to opening the mine.

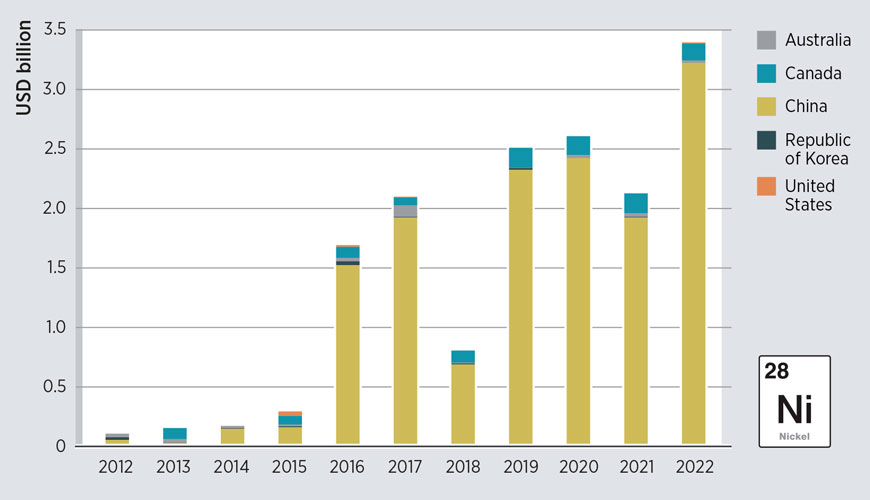

A large majority of the exploration budget for selected minerals comes from countries of the OECD, dominated by Australia, Canada, Chile and the United States who increased their exploration budgets for nickel, cobalt, lithium and copper in the past ten years (Figure 2.6). China and Viet Nam increased their budgets for nickel; DR Congo, Morocco and Zambia increased their budget for cobalt; Peru, Germany and Zimbabwe increased their budgets for lithium; DR Congo and Ecuador increased their budgets for copper. South Africa dominates exploration budgets for platinum, with Zimbabwe increasing its budget in recent years.

FIGURE 2.6 Share of global exploration budget for select materials by country, 2012 and 2022

Based on: (S&P, 2023).

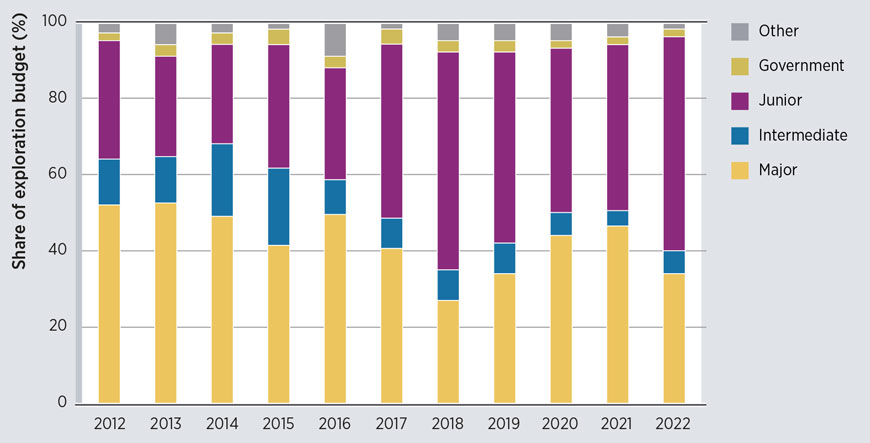

The mining sector does not sufficiently invest in exploration. Between 2012 and 2022, junior mining companies’ share of global exploration budgets grew from 31% to 56% for battery cathode materials (lithium, cobalt and nickel), while majors’ share shrunk from 52% to 34% in the same period. Governments’ share in exploration budgets was constant, at about 6% (Figure 2.7).

FIGURE 2.7 Share of global exploration budget for select materials by type of investment, 2012-2022

Based on: (S&P data, 2012-2022).

Industry players

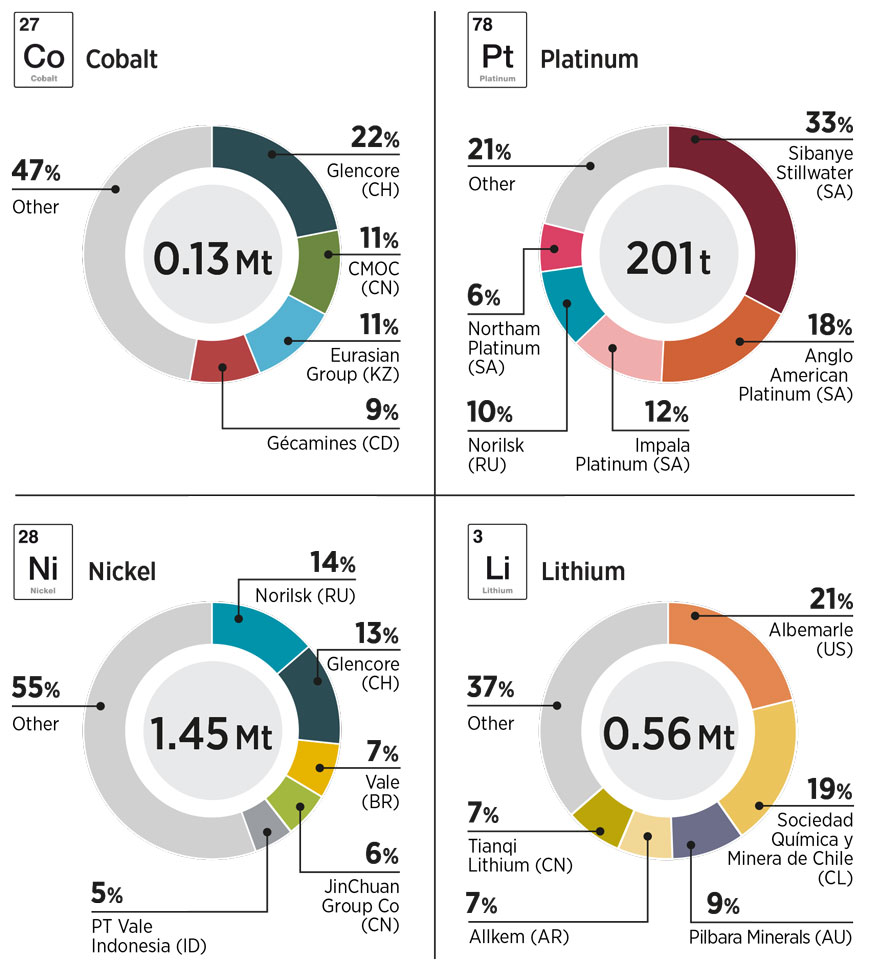

The mining industry is dominated by a few large multinational corporations and state-owned/controlled enterprises (SOEs), which operate across multiple countries and possess the necessary resources and skills to develop complex mines. The industry is highly concentrated, with these corporations and SOEs controlling a significant portion of global production and trade. For example, the top five mining companies control 61% of lithium output and 56% of cobalt output (see Figure 2.8).

FIGURE 2.8 Market share of major mining companies in select materials, 2021

Note: a) Total global production in megatonnes (Mt) and tonnes (t) provided for each mineral. b) AR=Argentina; AU=Australia; BR = Brazil; CD=Democratic Republic of the Congo; CH=Switzerland; CL=Chile; CN=China; ID=Indonesia; KZ=Kazakhstan; RU=Russian Federation; SA = South Africa; US=United States of America.

The ownership structure of a mining company can impact its risk tolerance and the environments in which it operates. SOEs may be more willing to invest in riskier environments that publicly listed companies may avoid. A notable example of this are Chinese SOEs, which have a significant presence in Africa’s mining industry, including in countries where risks, real or perceived, may deter other investors (Ayuk et al., 2020).

Some of the largest companies in the mineral and metal industry value chain are vertically integrated, meaning they operate across multiple stages of the value chain (e.g. BHP, Rio Tinto and Freeport-McMoRan). Other companies specialise in specific stages. For instance, some specialise in mineral extraction but do not have the facilities to process or refine them. Other companies specialise in refining raw materials into metals but do not have the facilities to mine or process minerals. Many recycling companies specialise in collecting and processing specific types of waste materials rather than operating across the other parts of value chains.

The energy transition is changing corporate strategies and value chains in the mining industry. For instance, BHP, the world’s largest mining company by market capitalisation, is divesting its oil and gas business and positioning itself as a mining company focused on the energy transition (Quiggin, 2021). The growing demand for critical materials is also attracting companies from outside of the traditional mining industry. Tesla, an EV manufacturer, is building a lithium refinery in Texas and is looking to expand its footprint in the minerals mining and processing business (Agatie, 2023). Some mining companies are keen to invest in new businesses linked to the energy transition. For example, the Fortescue Metals Group has created a new unit to invest in renewables, green hydrogen and green ammonia.

Metal exchanges

Unlike commodities such as oil, many transition metals and minerals are not widely traded on exchanges. Copper is an exception and is widely traded in spot and futures markets. Other specialty commodities, such as cobalt, lithium and rare earths, are primarily sold through negotiated bilateral contracts between producers and consumers (World Bank, 2022). The low liquidity and product heterogeneity of certain metals pose challenges to the development of effective hedging tools (Azevedo et al., 2018).

Selected exchanges for minerals and metals have been created. An example of this is the London Metals Exchange (LME), which was set up in 1877 by merchants and financiers to facilitate international metal trading. Given that metals took three months to arrive from Chile (copper) and Malaysia (tin), the three-month contract became the primary traded futures contract on the LME (Buchan and Errington, 2018).

Today, the LME remains the world’s foremost metal trading platform, setting global reference prices for critical materials such as copper, nickel and cobalt. 3 The LME platform facilitates the daily trading of more than USD 60 billion in futures (Burton, 2022), and the range of metals and minerals traded on the exchange continues to be expanded (Table 2.1). For example, the LME began trading copper in 1877, followed by nickel in 1979, cobalt in 2010 and lithium in 2021 (Table 2.2) (LME, 2023).

TABLE 2.1 Key materials and year of introduction on the London Metals Exchange

Commodity futures and derivatives are also traded on other, smaller exchanges, including the Shanghai Futures Exchange and the Dubai Gold and Commodities Exchange. Cobalt and lithium contracts were introduced recently on metal exchanges but have not yet received wide acceptance as hedging tools by industry participants. This situation presents a challenge for companies seeking to hedge their exposure to these critical metals, for instance, car manufacturers that want to lock in lithium prices (Sanderson, 2021).

Metal exchanges play a crucial role in price signalling. It is easy to access unambiguous price information for metals traded widely on exchanges. By contrast, it is difficult to ascertain the actual agreed-upon price for metals that are often traded directly between parties and not traded widely on exchanges. While some companies specialise in posting price listings, they rely on buyers and sellers voluntarily disclosing their prices, which may not always be timely or reliable. This situation gives trading companies a significant advantage as they have access to metals’ true market prices as well as transaction-related information.

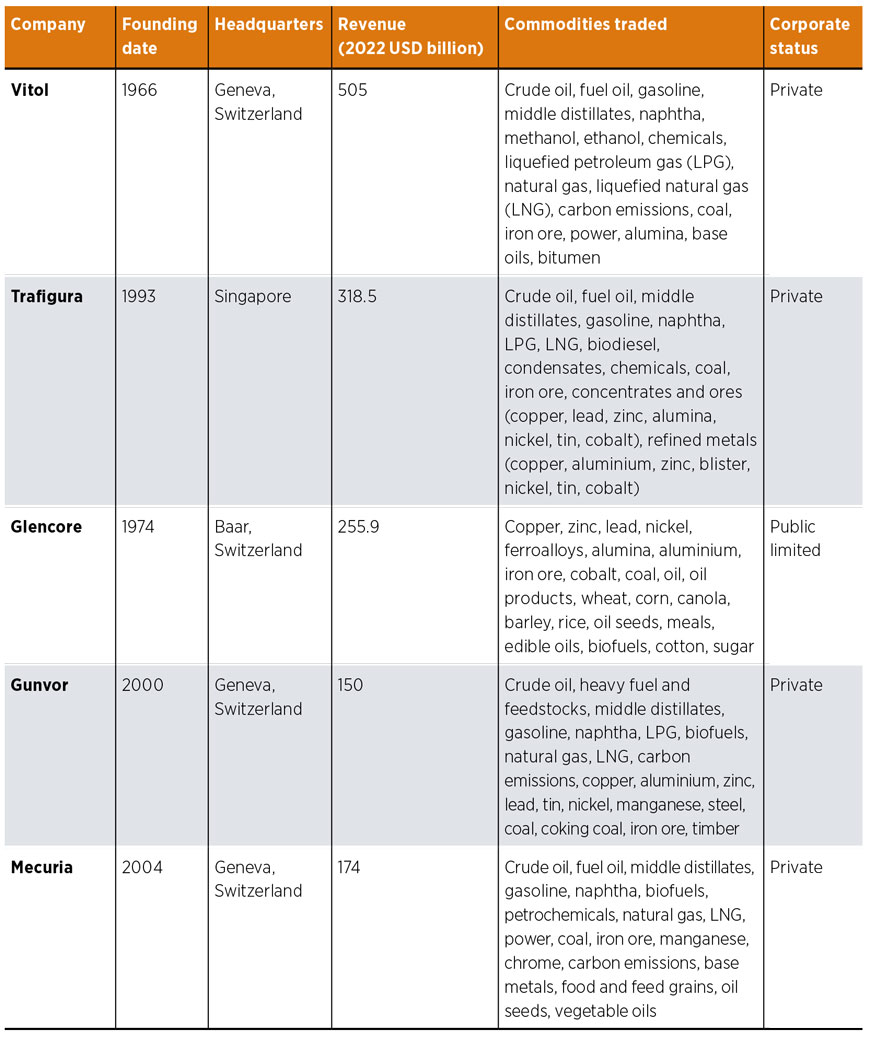

Commodity traders

Independent traders have a key role to play given the fragmented nature of some mineral markets and the remoteness of some producers (Table 2.2). Apart from companies that trade physical commodities, metals markets have often attracted significant attention from investors, including hedge funds, investment banks and commodity index funds (Humphreys, 2011). These traders and speculators often do not produce or use commodities as such but play a role in matching producers and consumers in different parts of the market. In recent years, commodity traders have faced calls for greater oversight and regulation (Blas, 2022).

TABLE 2.2 Top commodity trading houses by revenue

Note: Glencore was founded as Marc Rich and Co. AG.

Trade dependencies

This section presents an analysis of the bilateral trade flows related to critical materials. Figure 2.9 shows the top bilateral trade flows by value for five critical materials in 2022: copper, lithium, manganese, nickel and platinum. It shows how copper is the most valuable material by trade value. The graph also demonstrates the geographic diversity of mining countries, but also how important mining is to several, relatively small economies such as Chile and Peru.

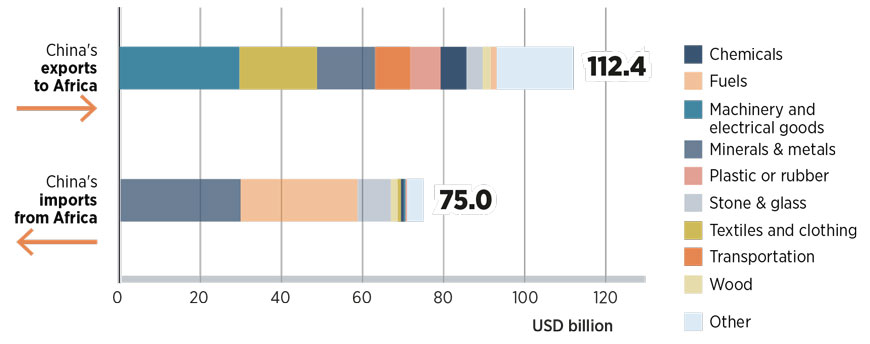

Finally, the data indicates that China is among the top importers, even though it is commonly perceived as dominating critical material supply chains. It is the world’s largest importer of raw or unprocessed nickel, copper, lithium, cobalt and rare earths. As such, the country relies on imports for inputs but dominates large portions of the midstream and downstream capacity for many critical materials.

Three caveats must be considered when examining trade dependencies (Nassar et al., 2015). First, in trade statistics, import transactions are at times attributed only to the country of last shipment rather than the country where the material was originally mined or produced. Second, mineral commodities sourced from a different country can be embedded in imported finished and semi-finished products, thus obscuring the true import reliance and exposure to foreign supply disruptions. For example, neodymium and other rare metals are embedded in permanent magnets; any country importing these magnets would still be vulnerable to disruptions in rare earth supply. Third, foreign firms can own and control mineral assets and operations partially or completely. Chinese firms, for instance, have equity stakes in lithium projects in Australia and Chile, a rare earth deposit in Greenland 4 and cobalt operations in the Democratic Republic of Congo, Papua New Guinea and Zambia. Research found a 2% to 14% increase in the share of global cobalt production and an 11% to 33% increase for cobalt intermediate materials (Gulley, 2022) when accounting for the equity stakes of Chinese firms. Foreign mineral assets are also owned by American, British, Canadian, Japanese, Korean and other companies.

FIGURE 2.9 Bilateral trade flows by value for select materials in 2022

Notes: All data refer to unprocessed ores and concentrates, except for lithium, where we rely on data for lithium carbonates and lithium oxide and hydroxide. Import data was used and only individual EU countries were included.

2.2 Supply risks and vulnerabilities

Nearly all countries are susceptible to unforeseen supply interruptions since none are self-sufficient in all materials. Even countries with a smaller manufacturing base are prone to trade disruptions. Although they may not rely heavily on direct raw material import, they nonetheless rely on a functioning global market for critical materials and technologies since they import parts or finished goods (e.g. solar panel modules) for renewable energy installations (Patterson, 2018).

The risk of supply chain disruption directly affects companies using imported minerals or finished goods to manufacture solar panels, wind turbines and batteries. However, multiple industries can be affected by supply interruptions, which could reverberate throughout the economy. The impact could be widespread given multiple sectors – from industry and digital infrastructure to agriculture – rely on minerals and metal commodities for manufacturing goods.

The probability of, and vulnerability to, supply disruptions is measured using various indicators. One review identified no less than 30 indicators of supply risk (Schrijvers et al., 2020). Risk assessments can also be conducted at different levels, including for a single or a group of countries, companies, products and economic sectors.

Figure 2.10 presents six sources of supply risk for critical materials. While not exhaustive, the list covers some of the most widely discussed geopolitical risks to the supply of critical materials in the short to medium term (i.e. five to ten years), especially for countries that rely heavily on imports (Nassar et al., 2020). Other types of risks, such as environmental and social risks, are discussed in Chapter 3.

Geopolitical risks should be assessed considering certain structural trends that could have long-term implications on the availability of mineral commodities. These trends include the geographical concentration of mining and processing, the decline in mineral ore grades, the limited extent of end-of-life recycling, the dependence on by-products for many critical minerals and the limited short-term substitution possibilities for certain materials (Nassar et al., 2020). These structural factors have the potential to magnify the impact and, in some instances, the probability of the geopolitical supply risks discussed above.

FIGURE 2.10 Key geopolitical risks to the supply of materials

1. External shocks

Global critical material supply chains, which are interconnected, are susceptible to disruptions that may be caused by natural events, such as earthquakes, or could result from human action, either intentional (e.g. trade disputes) or unintentional (e.g. power outages). In recent years, for example, global raw material supply chains have been disturbed by shocks such as the COVID-19 pandemic, the war in Ukraine and the global energy crisis.

In 2020, the COVID-19 pandemic led entire economies to go into lockdown, resulting in a sharp decline in the global demand for metals. At the same time, supply was disrupted by the closure of hundreds of mines, smelters and refineries. For example, Peru, which accounts for 12% of the global copper supply, closed all its mines between March and early June of 2020 – the longest government-mandated mine closure (Yu et al., 2021). South Africa’s 21-day mine closure disrupted 75% of the global platinum supply (Njini and Biesheuvel, 2020).

Although metal markets swiftly recovered from the initial price and demand collapse in March 2020, they faced several major disruptions ever since. One major shock came in the form of the 2021-2022 global energy crisis. In the second half of 2021, for example, Chinese magnesium plants were partially closed due to nationwide energy shortages, as a response to the country’s power crisis. Since China accounts for about 85% of the world’s magnesium production, the effects reverberated globally and prices skyrocketed (Hume, 2021). This was felt especially strongly in Europe, which depends on China for 95% of its magnesium supply. European industry groups warned of an imminent supply depletion, threatening thousands of businesses and their workers (Burton, 2021). Similarly, in South Africa, frequent power cuts since 2022 have curbed the output of platinum group metals (Njini, 2023).

The war in Ukraine was another external shock. It disrupted certain commodities, such as nickel and aluminium, and led to price surges, even though metal markets may have been less affected by it than other commodity markets, especially food and energy. Before 2022, Ukraine was a key exporter of pig iron. The Russian Federation was the world’s largest exporter of pig iron, enriched uranium, palladium and nickel. It also accounted for a significant share of platinum and refined aluminium exports. The sanctions have so far avoided blanket restrictions on the import of key metals, instead introducing selected import duties and tariffs. 5 For instance, Russian metals giant Norilsk Nickel, a key supplier of nickel and palladium, has largely been exempted from the sanctions (MacDonald, 2022). Looking further into the future, sanctions limiting access to high-tech imports could hinder mining and processing companies since they rely on equipment and software licenses from foreign firms (Bloomberg News, 2022).

Parts of the critical material value chain are also exposed to the physical effects of climate change – from sea level rise to more frequent and severe weather events. Some materials, for example, nickel, cobalt and rare earths, are mined and processed in areas that are likely to be at a greater risk of heavy rainfall and floods. An example of this could be found in 2020, when a “once-in-a-century” flood in China’s southwest province of Sichuan shut down rare earth processing plants and damaged inventory (Daly and Zhang, 2020). Other mining activities are likely to be hit by drought and water scarcity. For example, approximately 50% of lithium mining is in high water stress areas. Given that lithium mining has a substantial water requirement, this could create conflicts surrounding the use of water (IEA, 2022).

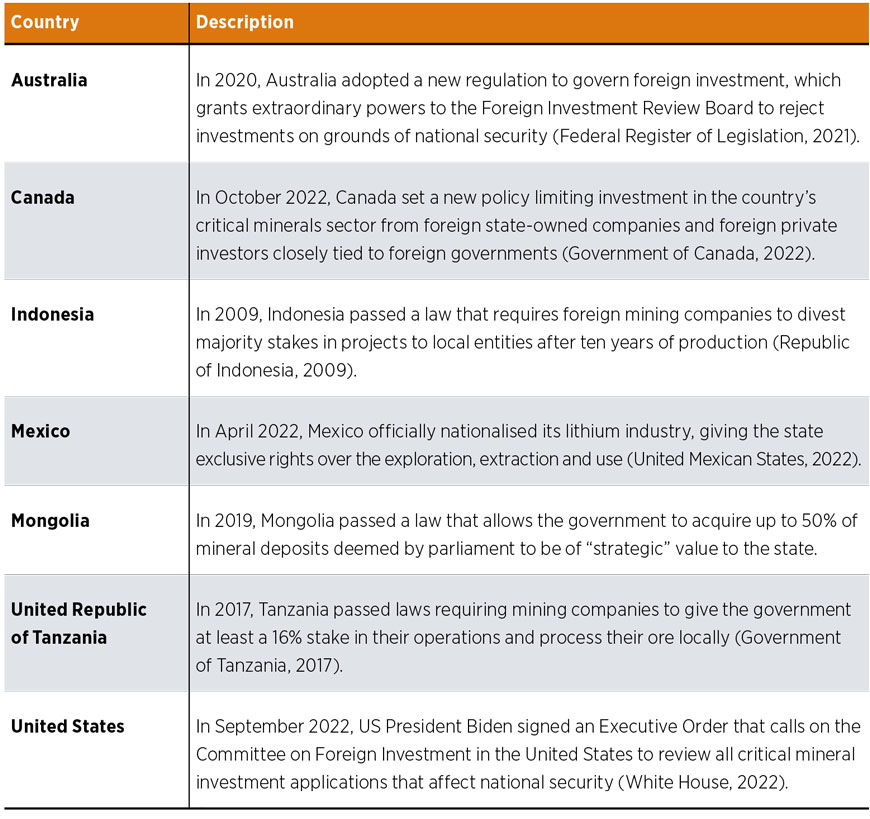

2. Resource nationalism

In recent years, numerous governments have increased state control over their mineral resources to enhance the benefits from extraction or address its adverse impacts. This has been accomplished through, for example, tax regime strengthening, royalty renegotiation, creation of state-owned mineral companies, nationalisation of critical material industries and restrictions on foreign investments. This trend can be observed in many countries, including Australia, Canada, Chile, Mongolia, Namibia, Peru, South Africa and Zambia, among others.

Policies aimed at revising ownership and access rights over natural resources can impact global supply. For example, a royalty payment dispute brought supply from the Democratic Republic of Congo’s Tenke Fungurume copper and cobalt mine to a standstill for several months after mid-2022. This disrupted 15% of the global cobalt supply (White and Hook, 2023). Chile’s announcement in April 2023 of its decision to nationalise the lithium industry raised concern among some analysts and industry groups, even though longterm impact on global supply is not visible (see Box 2.2) (Dempsey and White, 2023).

The broad banner of “resource nationalism” is widely used to describe this trend. However, it is worth noting that the term puts together a diverse set of policies and obscures the complex set of motivations that can drive them (Ward, 2009). The recent trend of stricter mineral sector regulations is reminiscent of the 1970s, when many mineral-rich countries, including newly independent ones, adopted state-interventionist policies and set up state-owned natural resource companies in the minerals sector. As commodity prices declined in the 1980s and 1990s, and the global political consensus shifted in favour of unfettered markets, the minerals sector was swept by a wave of liberalisation, deregulation and privatisation of state assets (Dietsche, 2014). By the early 2000s, there were only a few state-owned metal mining companies left. In 2005, for example, the state had a majority ownership stake in just three of the world’s top 25 metal mining companies (Codelco in Chile, Alrosa in the Russian Federation and Debswana in Botswana). Eighteen of the top 25 metal mining companies were fully private (UNCTAD, 2007).

BOX 2.2 Chile’s strategy for lithium

In April 2023, Chilean President Gabriel Boric announced the country’s decision to nationalise its lithium industry. Chile holds the world’s largest lithium reserves and ranks second in lithium production. President Boric stated that the country’s lithium reserves represent “an opportunity for economic development that will likely not be repeated in the short term” and that nationalising the industry will enable the country to build “a Chile that is more just, more sustainable, and more democratic” (Sharp, 2023). The government would look to protect biodiversity and share mining benefits with indigenous and surrounding communities.

At present, two companies are mining in Chile: Sociedad Quimica Y Minera de Chile (SQM) and Albemarle. Under the plan, a separate state-owned company would be created to produce lithium – a move that would need to be approved by Congress. The plan envisages the issue of future lithium contracts through publicprivate partnerships, in which the state would hold a majority share (Stott and Bryan, 2023). The government would also not terminate current contracts (Government of Chile, 2023), but has expressed hope that companies would be open to state participation before they expire. SQM’s contract is currently set to expire in 2030 and Albemarle’s in 2043.

Some analysts are concerned that nationalisation of the lithium industry may deter potential partners, shift foreign direct investments to other countries and adversely affect the Chilean lithium industry as well as global supply (Innovation News network, 2023; Sharp, 2023). However, the government has indicated a gradual and pragmatic approach to bringing the sector under state control through partnerships. Chile has a positive track record with Codelco, the state copper company, which was established after the nationalisation of Chilean copper mining in 1971 during the Allende administration (Malone and Bazilian, 2023). Codelco is the world’s largest copper mining company and, according to the Chilean think tank Cenda, generates over three times the tax revenue per unit of production compared with private companies (Mining.com, 2022).

Many countries have also increased scrutiny of foreign investments, not just in the mining industry but across various sectors (UNCTAD, 2023). Australia and Canada, for instance, have recently implemented stricter foreign investment regulations in their mineral sectors. In Australia, foreign investment in the mining sector is subject to screening by the Foreign Investment Review Board, while the Canadian government has introduced a new national security review process for foreign investment. This trend of increased government scrutiny of foreign investments reflects concerns about national security, environmental sustainability, and local ownership and control over natural resources. Table 2.3 shows a few illustrative examples of how foreign investment in the mining sector is facing increased scrutiny across different jurisdictions.

TABLE 2.3 Illustrative examples of increased foreign investment scrutiny in the minerals sector

3. Export restrictions on critical materials

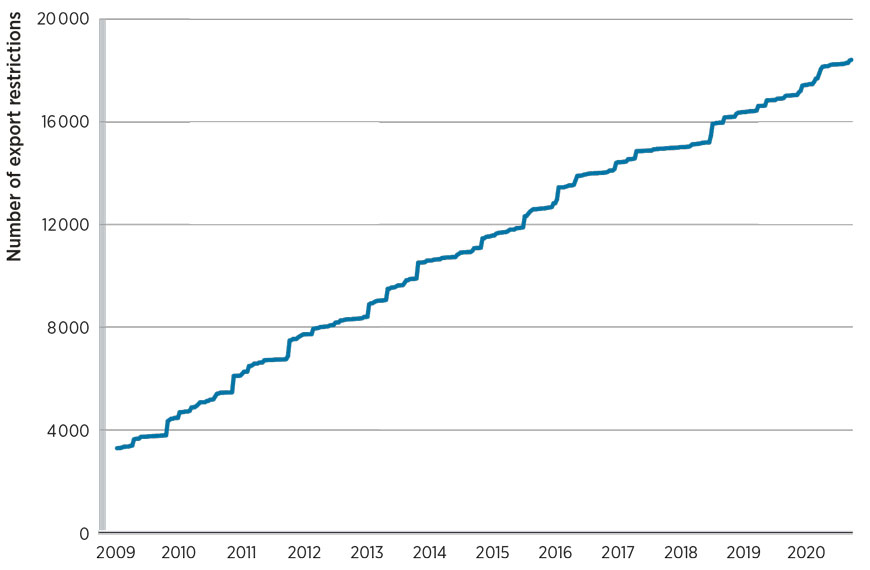

Export restrictions on raw materials are a growing concern in international trade. Incidences of such restrictions have grown more than fivefold over the past decade (Figure 2.11) (OECD, 2023). According to the OECD, about 10% of the global value of critical raw material exports has faced at least one export restriction measure in recent years (OECD, 2023). 6 Export restrictions take multiple forms, including export quotas, export taxes, obligatory minimum export prices, or licensing.

FIGURE 2.11 Global incidence of export restrictions on raw materials, 2009-2020

Notes: The y-axis shows the number of export restrictions in force. The database covers information on 65 industrial raw materials and 80 exporting countries, which accounted for 97% of the world’s mineral and metal production in 2018. The methodological note available at www.oecd.org/trade/topics/trade-in-raw-materials/documents/methodological-noteinventory- export-restrictions-industrial-raw-materials.pdf.

Export restrictions especially for critical materials appear to be on the rise, with several countries implementing major export bans. Zimbabwe banned the export of raw lithium in December 2022 (Marawanyika and Ndlovu, 2022). Similarly, Indonesia banned bauxite export in June 2023 (Shofa, 2023). Around the same time, Namibia prohibited the export of raw lithium and other critical materials (Nyasha Nyaungwa et al., 2023). These recent measures reflect a growing trend of countries taking steps to encourage domestic processing and attract downstream industries.

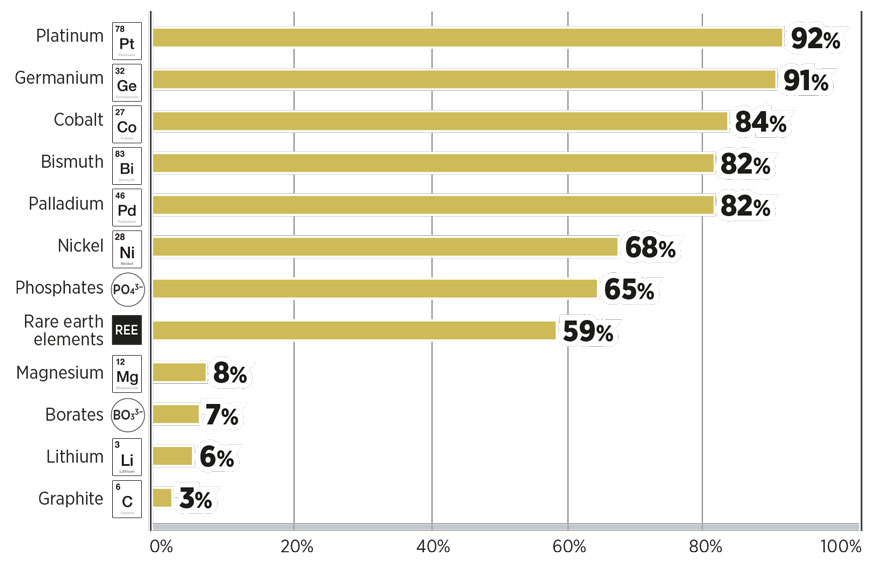

Export restrictions on raw materials are not a new phenomenon. In 1937, the League of Nations constituted a Committee for the Study of the Problem of Raw Materials to assess the incidence of export restrictions and export duties (League of Nations, 1937). Such restrictions vary significantly based on the raw material (Figure 2.12). They are not solely implemented by mineral-rich countries. Countries seeking to reduce reliance on raw material imports often impose export restrictions to retain secondary sources, such as waste and scrap (OECD, 2023).

FIGURE 2.12 Share of global exports subject to an export restriction, 2020

Notes: For ease of reading, the label “Germanium” has been used to denote the following group of materials: germanium, niobium, vanadium, gallium, indium and hafnium.

Quantitative import and export restrictions are largely prohibited under Article XI of the WTO’s General Agreement on Tariffs and Trade, except under certain limited exceptions, such as environmental conservation, national security or assuring raw material supply. These exceptions must meet specific conditions, for example, not protecting domestic industries or discriminating against other countries. The measures should also not unfairly restrict international trade.

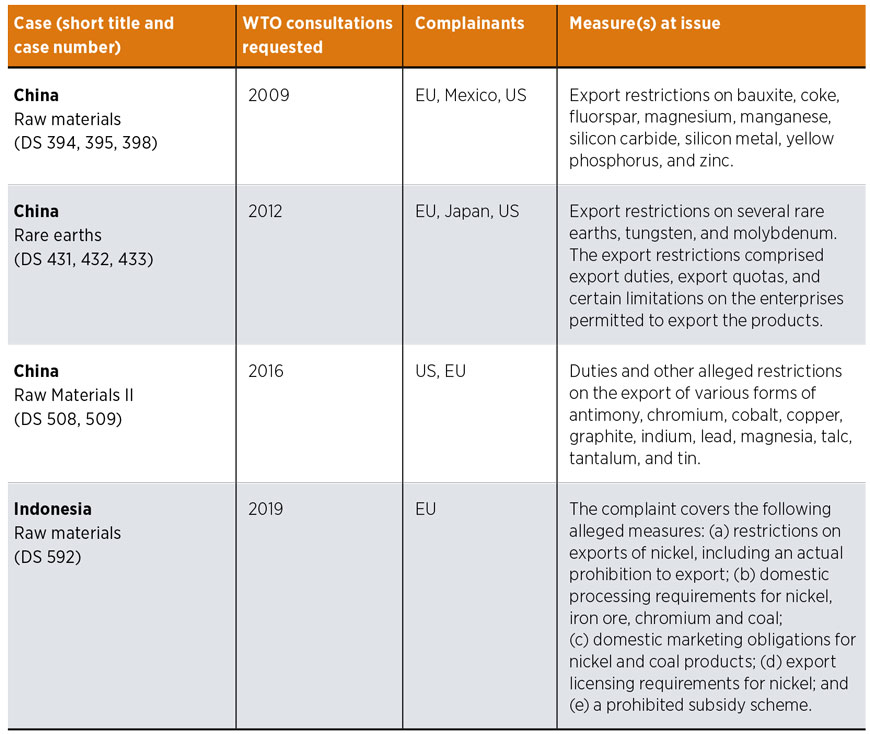

The growing trend of export restrictions on critical materials has triggered a series of trade conflicts, some of which are being addressed at the World Trade Organization (WTO) (Table 2.4). These disputes cannot be linked solely to the energy transition given that the materials involved have a much wider application beyond the energy sector, such as steelmaking (molybdenum) or the chemical industry (fluorspar). The mineral trade dispute that received the most attention was the rare earth crisis of 2010-2011 (see Box 2.3).

TABLE 2.4 Recent World Trade Organization (WTO) trade disputes over export restrictions on critical materials

The existing international trade framework has traditionally focused on reducing import restrictions. While import tariffs have decreased over time through multilateral trade negotiations, export taxes are not subject to any WTO regulations, except for some recently acceded members, which have agreed to reduce or eliminate them under their WTO accession agreements.

BOX 2.3 The rare earth crisis of 2010-2011

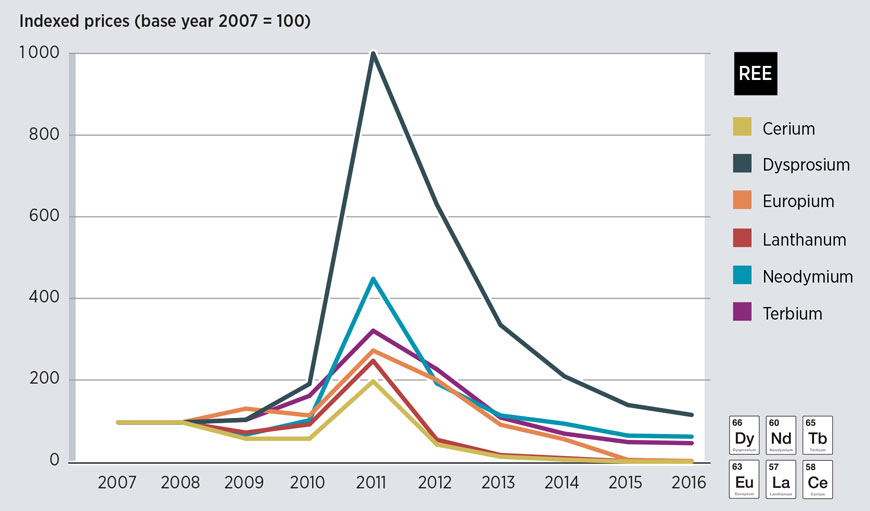

Rare earths are a group of 17 chemical elements whose properties make them valuable for use in modern, high-tech applications. Today, they are used mostly in permanent magnets electric motors (for electric vehicles) and generators (e.g. in wind turbines) (Garcia, 2020). The United States dominated global rare earth production until the 1990s, after which China became the biggest producer.

By the early 2000s, China had a near monopoly, mining approximately 95% of the world’s rare earth elements (US Geological Survey and US Department of the Interior, 2010). However, increasing concerns over environmental pollution, illegal mining and resource depletion led the government to decide on developing a downstream industry (Wübbeke, 2013). Starting in 2006, the country introduced several regulations, including export quotas, production quotas, export taxes and restrictions on foreign investment (Shen et al., 2020). Export quotas were introduced gradually, but in 2010, China decreased its export quota for rare earths by 37%, resulting in a surge in rare earth oxide prices since alternative supplies were lacking (see Figure 2.13).

Apart from export quotas, Chinese shipments to Japan were reportedly interrupted for a few weeks between September and November 2010 after the detention of a Chinese fishing trawler’s captain amid a maritime dispute (Wilson, 2018). Reports on the number of delayed rare earth exports, the length of delays and the parties responsible for them continue to be conflicting. Analysis of customs data from the Japanese Ministry of Finance shows that Japanese imports of Chinese rare earths did not decline uniformly following the trawler incident (Johnston, 2013).

The 2010-2011 price spike caused major shifts in rare earths’ supply and demand, leading to price attenuation by 2012. Recycling and substitution reduced demand substantially, while trade deflection, inventory management, the opening of new mines and smuggling ensured residual supply (Gholz and Hughes, 2021).

In March 2012, Japan, the European Union and the United States requested a World Trade Organization consultation over Chinese rare earth export restrictions. China defended the restrictions as necessary for conservation, whereas the complainants countered that they were, “designed to achieve industrial policy goals rather than conservation”. In 2014, the World Trade Organization Appellate Body decided in favour of the complainants, and China was required to lift its rare earth export restrictions.

FIGURE 2.13 International rare earth metal oxide prices, 2007-2016

Note: REE = rare earth elements.

4. Mineral cartels

The high concentration of mineral production raises concerns of market cartelisation and collusion. Mineral supply is concentrated geographically, and corporations with large market shares in key segments of mineral value chains dominate their mining and refinement. This concentration of production could potentially lead to the formation of commodity cartels, groups of major producers that maximise their profits by co-operating on the production, pricing and/or distribution of commodities.

Historically, producer groups and governments have made various attempts to influence mineral markets through collusion (World Bank, 2022). In the early 20th century, there were active producer cartels in the aluminium, copper, nickel, steel, zinc and lead industries (Barbezat, 1989; Bray, 1997; Storli, 2014; Tsokhas, 2000; Walters, 1944). A number of these cartels were created in the 1930s in response to the extremely low prices that prevailed during the Great Depression.

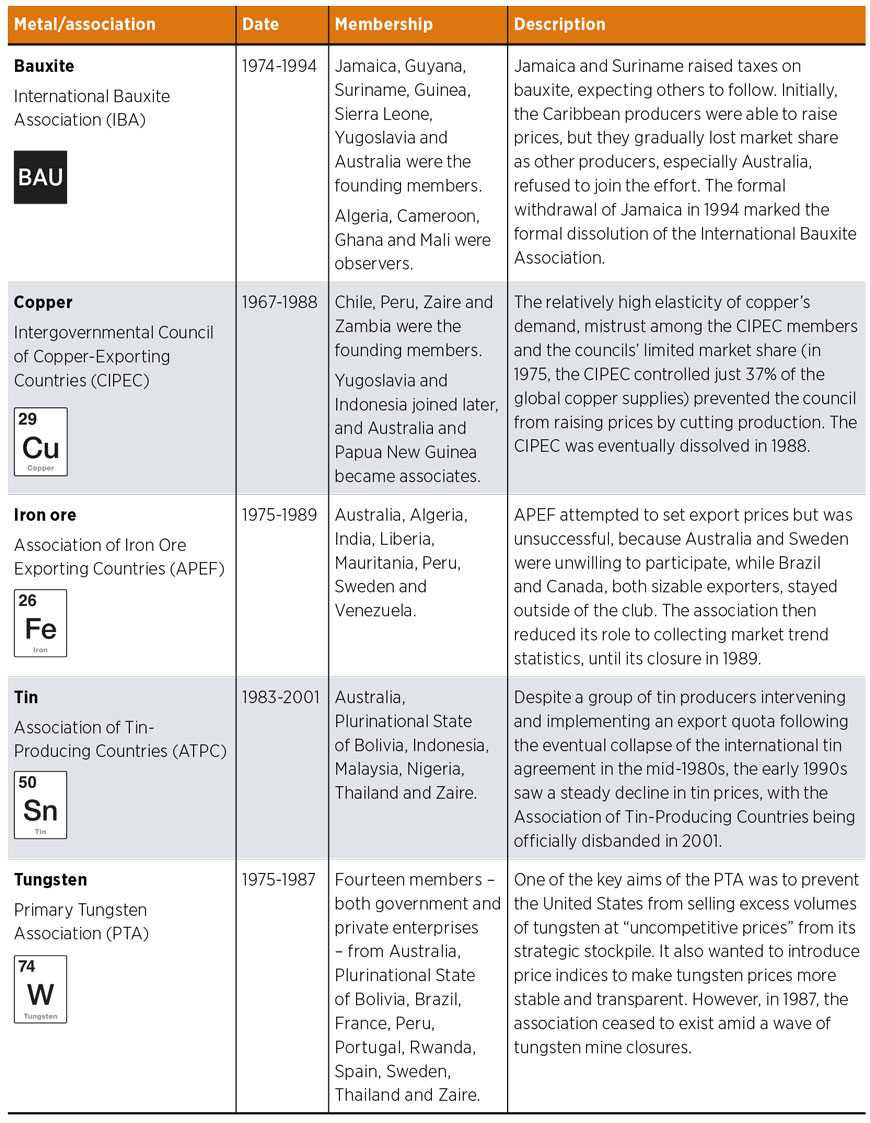

The 1960s to 1970s saw another wave of cartelisation, in the aftermath of decolonisation and a booming world economy, with the creation of several cartels and producer clubs to govern metal markets such as for bauxite, copper, iron ore, tin, tungsten and uranium (see Table 2.5). Many of these attempts were, however, short-lived, 7 as they were plagued by issues such as internal discord, non-participation of major producers, and mineral substitution or innovation in supply and demand technologies.

In addition to producer clubs, there have been several international commodity agreements involving both producers and consumers. For instance, a series of international commodity agreements governed the tin market from 1956 till 1985, when the last international tin agreement collapsed (Hillman, 2010). These agreements aimed to stabilise the tin market by establishing a buffer stock system that would allow producers to store excess supplies during periods of oversupply and release them during periods of shortages. While this system kept tin prices elevated for several years, it also encouraged the substitution of tin with aluminium, especially in the beverage can industry (World Bank, 2022).

In recent years, several mineral producing countries have again considered the idea of cartelisation, although plans and proposals for new mineral cartels do not meet the criteria for establishing commodity cartels (Box 2.4).

TABLE 2.5 Metal producer clubs in the 1970s to 1980s

BOX 2.4 Prospects for cartelisation in the platinum, nickel and lithium markets

Most new proposals will struggle to meet all the conditions for a successful commodity cartel. For a commodity cartel to be successful, it must bring together dominant producers with substantial market shares that have firm ownership of mineral production within their respective states. There must exist high entry barriers, preventing new producers from entering the market and competing with existing producers. Product homogeneity is another important factor, where commodities standardised to the point where they are virtually identical across producers. This attribute is essential for the members of a successful commodity cartel to co-ordinate production and pricing strategies effectively.

Demand elasticity is another crucial factor that affects the feasibility of a commodity cartel. It refers to how quickly and to what extent a product’s demand might shift in response to high prices. A commodity cartel has limited control over price if a product is highly elastic, meaning consumers are willing to reduce its consumption at higher prices or could swiftly shift to substitutes. Conversely, a commodity cartel may have greater control over price if a product is relatively inelastic, meaning consumers have few or no substitutes.

Platinum

The Russian Federation and South Africa signed a memorandum of understanding on platinum group metals (PGMs) at the March 2013 BRICS (Brazil, Russia, India, China and South Africa) summit. Together, they hold a substantial share of the PGM market – over 80% of global platinum supply and over 96% of global PGM reserves – hindering the entry of potential competitors (US Geological Survey and US Department of the Interior, 2022).

In practice, however, there are major obstacles to the creation of a PGM cartel since none of the countries has a state-owned company monopolising PGM mining. Any production cuts would require the buy-in of several private companies, including Norilsk Nickel, Anglo-American Platinum and Impala Platinum. Further, production cuts designed to increase prices could lead to job losses in the labour-intensive PGM industry, which is the largest mining employer in South Africa. 8 The alternative of purchasing platinum from producers and storing it to support prices could strain government finances (Stoddard, 2013).

Finally, sustained high prices would likely adversely impact demand as industrial users would intensify efforts to reduce, reuse or recycle PGMs in catalysts and other applications (Kooroshy et al., 2014). Although the Russian Federation and South Africa reaffirmed their commitment to the 2013 memorandum of understanding in 2018, few details have since emerged.

Nickel

Indonesia, the world’s largest nickel miner, is considering the potential establishment of an Organization of the Petroleum Exporting Countries (OPEC)- style organisation for certain battery metals, including nickel, cobalt and manganese (Dempsey and Ruehl, 2022). While the country accounts for almost half of the global nickel production, a share larger than that of OPEC countries in oil production, replicating the OPEC model would not be without challenges.