2.2 Shipping

Maritime transport is vital to the world’s economy, enabling international trade and commerce and facilitating the movement of goods and resources across the globe. In 2022, international seaborne trade reached 11 billion tonnes, or over 80% of global trade by volume, mainly dominated by dry bulk, oil shipments and containerised trade (UNCTAD, 2023).

About a third of seaborne trade involves the transportation of fossil energy products (Jones et al., 2022). Therefore, maritime transport is not only a consumer of energy but also a means for its transport. The decarbonisation of power systems, road transport and heat production with renewable electricity will result in steep demand reductions for fossil energy products and, consequently, for the shipping of these energy commodities. But the sector will still play an important role in unlocking and accelerating the decarbonisation of other transport and industrial sectors, helping satisfy the resulting demand for green fuels and chemicals instead.

Ships are long-lived assets, with the vessels deployed in the next few years largely shaping the fleet and fuel mix that will occur two to three decades from now. Therefore, the transition to renewable energy-powered vessels needs to happen as soon as possible, or the world risks missing 2050 net-zero targets.

Emissions and energy use

Maritime transport is among the least carbon-intensive transport modes in terms of emissions per passenger-kilometre and per tonne-kilometre (European Environment Agency, 2023). However, the sector is still a major polluter given the sheer magnitude of its activity. In 2023, energy consumption in the shipping sector reached 11.2 exajoules (EJ). This equates to 3% of total global energy consumption and to 10% of all transport-related energy consumption worldwide (IEA, 2023a).

Maritime trade activity has also roughly doubled in the last 20 years, going from 55 trillion tonne-kilometres (tkm) in 2002 to 111 trillion tkm in 2023 (UNCTAD, 2022). According to the projections used by the International Maritime Organization (IMO) in its 2020 greenhouse gas (GHG) study, maritime trade activity is expected to increase by between 40% and 100% by 2050 (IMO, 2021a). The lower end of this range corresponds to scenarios with steep reductions in oil and coal demand due to the energy transition. The trade activity increase could also change depending on the future evolution of demand for natural gas.

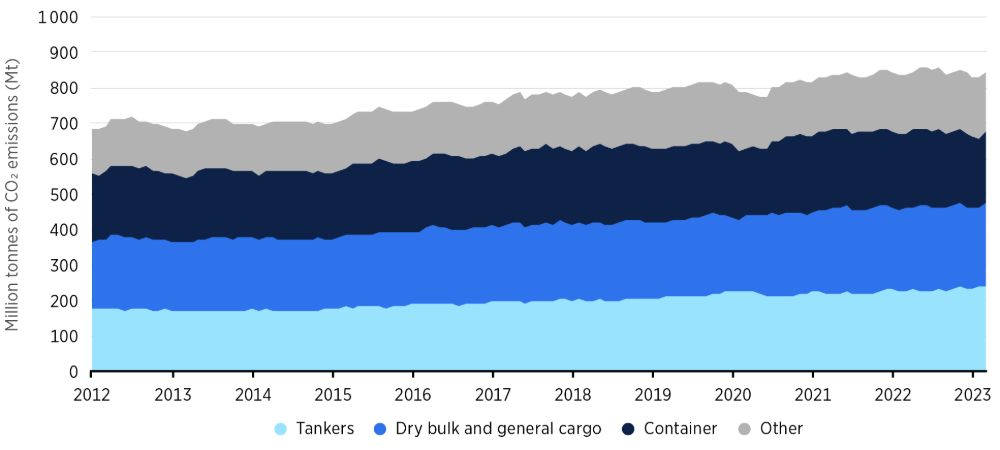

In 2023, the shipping sector’s CO2 emissions amounted to over 0.86 Gt (Figure 7). This is equivalent to between 2% and 3% of total global CO2 emissions, or roughly 10% of transport-related emissions (IEA, 2023a). Roughly 80% of the shipping sector emissions come from international shipping (IMO, 2021a).

Figure 7: CO2 emissions by main vessel types, 2012-2023

Source: UNCTAD, 2023.

The shipping sector is heavily dependent on inexpensive, low-grade fossil fuels such as heavy fuel oil and marine diesel oil. In 2020, the IMO introduced a global regulation aimed at significantly curbing sulphur oxide emissions (IMO, 2021b). This regulation prompted a rapid and widespread change within the sector towards adopting very low sulphur fuel oil or installing onboard scrubbers to curb these emissions. This showcased the ability of the sector to rapidly adapt and implement policy-driven changes.

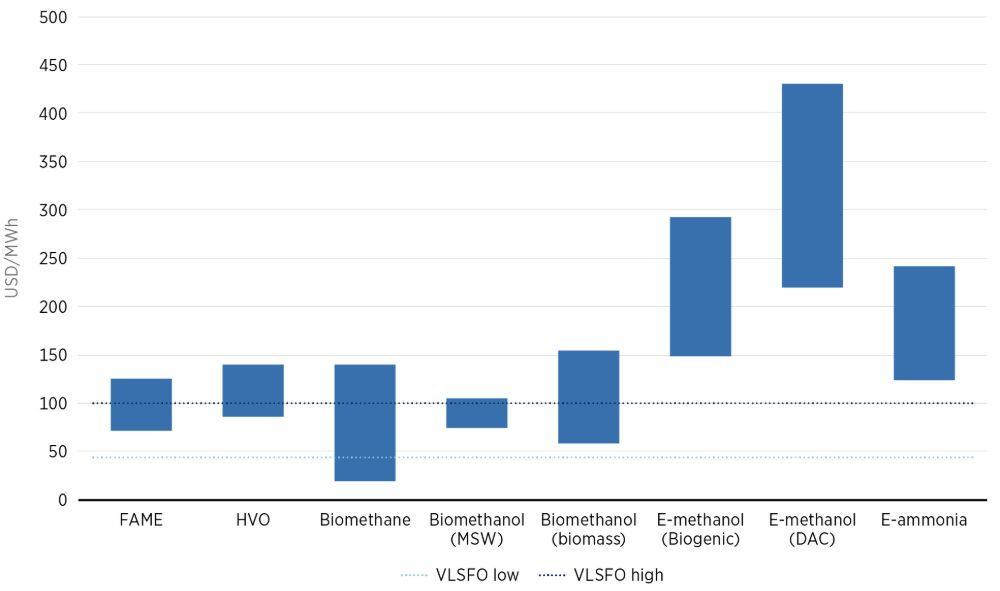

There are a number of net-zero compatible alternatives to conventional marine fuels, such as sustainably produced low-carbon biofuels, green e-fuels, and hybrid power- and biomass-to-liquid fuels. 10 However, these all come at a considerable cost premium. Depending on the spot price of conventional marine fuels, biofuels can cost up to twice the price of the conventional fuel, and e-fuels may be three to four times the price of conventional fuel, or even higher (IRENA, 2021a; Ship & Bunker, 2024). Reductions in alternative fuel costs will therefore be needed to turn shipping away from its fossil fuel dependency.

Most trade activity is undertaken by container ships, bulk carriers, and fuel and chemical tankers. While these types of vessel account for only 20% of the global fleet, they are responsible for 80%-85% of the GHG emissions associated with the shipping sector (IMO, 2021a; UNCTAD, 2023). This means that targeted interventions can have outsized implications in terms of emission reductions.

Decarbonisation pathways

Maritime transport-related emissions have steadily increased over the last decade and are expected to reach 130% of their 2008 levels by 2050 if no action is taken (UNCTAD, 2023). This highlights the urgency of moving away from the shipping sector’s current fossil fuel dependency – something that could be achieved through the application of several decarbonisation pathways.

IRENA’s 1.5°C scenario estimates that roughly 17% of the emission reductions necessary by 2050 could come from changes in global trade dynamics triggered by the energy transition. These changes would come mainly in the form of an overall reduction in global fossil fuel use caused by the decarbonisation of various sectors as they strive to become carbon neutral. This would, in turn, cause a reduction in fuel tanker activity and consequently a reduction in the shipping sector’s energy demand (IRENA, 2023c).

Another important driver for decarbonisation would be the adoption of energy-efficient technologies and operational measures, such as high-efficiency propellers, wind-assisted propulsion, waste heat recovery systems and speed optimisation. Such energy efficiency improvements could have an immediate impact and could potentially contribute 20% of the CO2 reductions the shipping sector requires by 2050, according to IRENA’s 1.5°C scenario (IRENA, 2023c). Savings from energy-efficient technologies, beyond those mandated by the IMO’s Energy Efficiency Design Index Phase 3, are estimated to be in the order of 25% for container vessels, 18% for bulk carriers, 18% for tankers and 26% for liquefied natural gas carriers (MAN ES, 2023).

Energy savings alone will not be enough to take shipping all the way to net-zero emissions. The remaining emissions will need to be abated through the adoption of renewable-based alternatives – such as electric propulsion, biofuels and e-fuels – to displace the use of conventional fossil-based marine fuels. According to IRENA’s 1.5°C scenario, these renewable-based alternatives could contribute over 60% of the sector’s necessary emission reductions (IRENA, 2023c).

Direct electrification can also play an important role in the decarbonisation of vessels working short and inland routes (i.e. ferries and coastal and river transports). Today’s battery technologies could already enable the electrification of vessels on such routes, as well as small cruise ships and roll-on/roll-off ships. In addition, the electrification of new ships with routes of up to 1 000 km has been made possible by recent battery technology improvements. The two 700 teu (twenty-foot equivalent unit) container ships built by Cosco Shipping Lines in 2023 are a good example of this (COSCO, 2023; IDTechEx, 2023).

Further improvements in battery technologies, paired with potential cost reductions, could see electrification become an increasingly relevant option for a wider set of use cases. Furthermore, the importance of cold ironing 11 as a part of port electrification efforts cannot be overstated. Some vessel types, such as tankers and bulk carriers, spend considerable time at berth; consequently, a considerable proportion of their emissions – over 20% – occur while they are in port (IMO, 2021a).

Sustainably produced, low-carbon biofuels, such as biodiesel, renewable diesel, 12 bio-LNG (liquefied natural gas) and biomethanol can be effective short- to medium-term options for shipping. Biofuels boast high technological readiness, allowing them to be immediately harnessed as blends or drop-in fuels, requiring little to no changes in terms of operation and infrastructure. However, the rapid scale-up of sustainable biomass sourcing requires careful consideration of its potential negative impacts, such as land use change and life-cycle GHG emissions. Substantial policy interventions in the agriculture sector and robust certification mechanisms are needed to counter them.

Overall, three main barriers have limited the potential of biofuels in shipping: economic, sustainability and availability concerns. Despite these challenges, biofuels are a key decarbonisation option for the sector, not only as a fuel but potentially as a source of biogenic carbon for e-fuel production, (The production of biofuels, in particular ethanol, is also a source of biogenic carbon that can be used for the production of renewable e-fuels). Biofuels are the cheapest non-fossil fuel alternative; any sustainability concerns can be addressed through good practices (IRENA, 2022a).

The availability of sufficient sustainable biomass is not a hard constraint on biofuels playing an important role in decarbonising the shipping sector. IRENA suggests that the global technical potential for sustainable advanced biofuels is at least 114 EJ (IRENA, 2016a), roughly 11 times the energy demand for shipping. Current biofuel production globally is only around 4.5 EJ, is mostly food and feed crop based (90%) and is used mainly for road transport (OECD/FAO, 2023). As road transport is trending fast towards electrification, there is an opportunity to switch automotive biofuel production towards the production of biofuels for other sectors, such as shipping and aviation.

In the medium- to long-term, e-fuels produced from green hydrogen – in the form of e-methanol, e-ammonia and e-methane – could also play a significant role in the shipping sector’s decarbonisation. These fuels bring advantages, including that they can be produced with zero-carbon renewable power and that their potential to satisfy demand is virtually unlimited, given direct air carbon capture technologies. These fuels also come with limitations, however, and should not be perceived as “silver bullets” in shipping sector decarbonisation.

Figure 8: Cost comparison of renewable marine fuels

Source: IRENA, 2018, 2021a; IRENA and AEA, 2022; IRENA and Methanol Institute, 2021; Ship & Bunker, 2024.

One of the main challenges for e-methanol and e-methane as synthetic fuels is that they need carbon for their synthesis. This means that for these e-fuels to be truly green, the carbon needs to come from sustainable sources (i.e. from biogenic sources) or be captured directly from the atmosphere. Fossil-sourced carbon would make these fuels unsustainable and incompatible with net-zero goals. Potentially, they would have even greater life-cycle emissions than conventional marine fuels (MAN ES, 2023). Indeed, the cheap and sustainable sourcing of carbon should be a key consideration when discussing e-fuels, as it could become a bottleneck in their deployment and an important component of their cost. To achieve cost efficiency, cheap sources of biogenic or atmospheric carbon and green hydrogen would likely have to be near one another to prevent the high costs of transporting either one for the manufacture of e-fuels. Biogenic sources are currently the cheapest source of carbon; the alternative is direct air carbon capture, whose prospects for cost reduction are uncertain.

E-ammonia has the advantage that it does not require a carbon source, so it can be produced in any location as long as there is a cheap supply of low-carbon energy. However, the main challenges for ammonia as a marine fuel come from its toxicity to people and the environment and the operational challenges it presents. Ammonia engine technologies are still only under development. The use of ammonia as a marine fuel will require robust operational and safety standards and creates the need for new capacities and skills among personnel to guarantee its safe handling, although there are already standards for its handling in the chemical industry.

A final important aspect to consider when discussing e-fuels is their efficiency. E-fuels require significantly more primary energy than alternatives such as direct electrification and some biofuels. The use of e-fuels should therefore preferably be limited to cases where more efficient alternatives are unfeasible. As all alternative fuel options have their own set of challenges, a combination of renewable-based options will likely be needed to fully decarbonise the sector.

Figure 9: Summary of decarbonisation pathways for shipping