2.1 Heavy-duty trucks

Heavy-duty trucks 2 play a crucial role in the global economy. Since 2010, the volume of goods transported by this mode of transport has increased by over 30%, a similar increase to that of global gross domestic product 3 (IEA, 2023a; World Bank, 2024). As a result of this correlation between road freight activity and economic growth, heavy-duty truck activity is expected to more than double by mid-century (ITF, 2023; IEA, 2023a; MPP, 2022). Fast deployment of zero-emission trucks 4 is therefore essential if dependence on fossil fuels is to be reduced and air quality improved, benefiting both the climate and society.

Emissions and energy use

Heavy-duty trucks represent only about 9% of the global vehicle stock (IDTechEX, 2019), yet they are responsible for almost a quarter of all transport-related CO2 emissions. In 2023, this figure translated to around 5% of global CO2 emissions or, in absolute terms, around 1.89 gigatonnes (Gt) of CO2 . In other words, emissions from heavy-duty trucks are larger than those from the international aviation and shipping sectors combined.

Today, heavy-duty trucks rely almost exclusively on diesel (around 95% of consumption). Others rely on other fossil fuels such as petrol and natural gas, and a small number rely on renewable biofuels (which account for less than 5% of total consumption) (IEA, 2023a).

In the last few years, the sector has made some progress towards decarbonisation. The emission intensity of new trucks has decreased by around 14% since 2019, 5 partly due to efficiency measures, operational improvements and an increase in biofuels in the fuel mix (WEF, 2024).

Decarbonisation pathways

Global heavy-duty truck activity is expected to more than double by 2050. With continuous reliance on diesel and limited action taken, by then heavy-duty trucks alone could account for over 75% of all road freight-related CO2 emissions and emit between 2.2 Gt and 3 Gt of CO2 (MPP, 2022; IEA, 2023a).

In the short to medium term, the carbon footprint of the sector can be reduced by introducing stringent efficiency standards for trucks. A modal shift from road-based freight to rail freight could further reduce the energy intensity of the freight transport sector. However, modal shifts typically require substantial investments in infrastructure, which take years to decades to materialise. Over the long term, a combination of renewable-based options, such as the adoption of electric trucks and the use of renewable fuels, is required to reach zero emissions in the sector.

In the zero-emission truck market, electric trucks have an advantage due to their superior efficiency; 6 their market availability at scale; and the benefits they gain from synergies with technological advances in battery electric cars, which are already being deployed in large volumes.

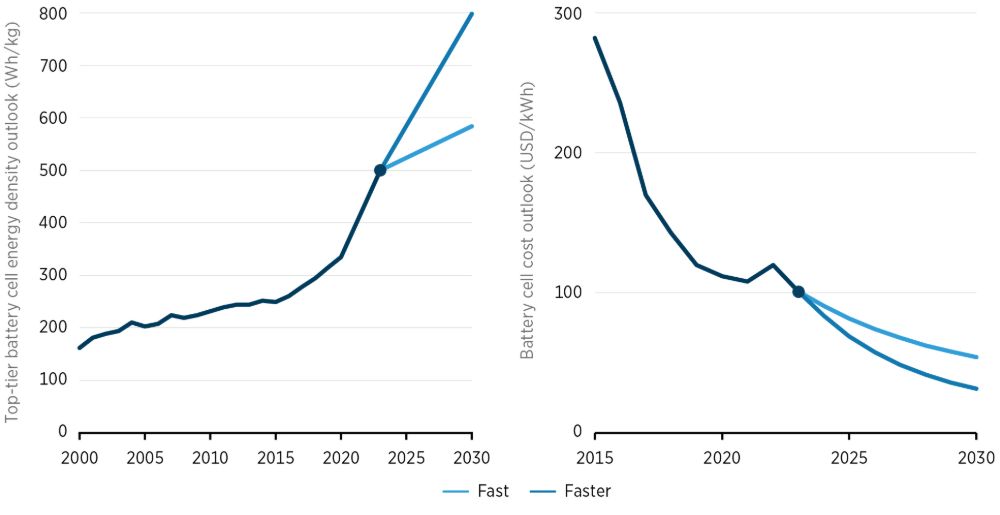

The costs and performance improvements of batteries have also greatly improved the economic case for EVs in recent years. From 2010 to 2024, the weighted average price of lithium-ion battery packs declined 90%, to USD 115 per kilowatt hour (kWh) (Figure 5). Over the same period, the cost of lithium-ion battery cells dropped to below USD 78/kWh (BNEF, 2024a). In 2023, the energy density of some newly commercialised batteries crossed the 500 watt-hours per kilogramme (Wh/kg) mark . As a result, the scope of application of the batteries is quickly expanding to a broader set of road vehicle segments and types of service. Accordingly, electric trucks are gaining attention and emerging as the most promising technological solution for decarbonising these heavy-duty vehicles. Electric trucks have the potential to be cost-competitive in the absence of subsidies and are becoming increasingly available for wider adoption.

Figure 5: Evolution and projections to 2030 for battery cell energy density (left) and costs (right)

Road freight decarbonisation is approaching a turning point, driven by technological progress and growing regulatory and market pressures, and is set to advance more rapidly than anticipated. In recent years, there has been rapid growth in zero-emission vehicle models entering the market. The Zero-Emission Technology Inventory database 7 shows that 154 heavy-duty truck models currently exist or have been announced. Of these, 125 are battery electric and the remaining 29 are fuel cell based.

Since 2020, the average ranges for zero-emission trucks have increased by 11%. The availability of vehicles with a range of 805 kilometres (km) indicates promising capabilities for longer hauls (Global Drive to Zero, n.d.) Electric medium- and heavy-duty trucks accounted for 1.2% of global truck sales in 2022, with over 54 000 units sold. China was the main market, accounting for 70% of global sales (IEA, 2024b). In 2024, a total of 3 400 zero-emission heavy-duty trucks were sold in the European Union (EU). This figure is over four times the total sold in 2022 (820 trucks), indicating strong growth in market demand (ICCT, 2025).

Despite this progress, the current pace of adoption of electric trucks is less than is needed to achieve climate targets. Under IRENA’s 1.5°C scenario, EVs should account for nearly two-thirds of the heavy-duty vehicle stock by 2050 (IRENA, 2023a). To meet this percentage, electric heavy-duty trucks would have to become widely available and be sold in significant volumes in most jurisdictions around the world within this decade. The major challenges that would need to be addressed to support this level of increase in sales include higher upfront costs, insufficient charging infrastructure, an imbalance in taxation of electricity compared with fossil fuels, and there being only incipient supply chains to meet the fast growth in demand for electric trucks.

Even if electric trucks are rapidly adopted, a large fleet of internal combustion engine vehicles will unavoidably be in operation for the next two to three decades. For these, emission reductions can also be achieved in the short to medium term by using sustainably sourced biomass-based diesel substitutes. 8 However, in the longer run, the use of sustainably sourced biomass needs to be prioritised for those sectors where there is limited scope for electrification and other low-carbon alternatives.

There are also ongoing efforts to explore the use of hydrogen trucks. However, the economics and technical characteristics of these vehicles lag far behind those of electric trucks. 9 Moreover, the use of green hydrogen should be prioritised in applications and sectors where it adds the most value to decarbonisation efforts, or in other words where direct electrification with renewable power is not an option, which is not the case for heavy-duty trucks. Applications for which the use of green hydrogen should be prioritised include the production of ammonia, steel and synthetic fuels for long-haul aviation and shipping. In these applications, green hydrogen can be a complementary solution to sustainable biofuels.

Figure 6: Summary of decarbonisation pathways for heavy-duty trucks