2.4 Iron and steel

Steel is an indispensable material in our modern world. Its strength, durability, versatility and recyclability make it suitable for a vast array of applications. It is widely used in buildings and infrastructure (more than 50% of total steel use globally), mechanical and electrical equipment (close to 20%), transportation vehicles (around 17%), domestic home appliances and many other areas that support society and its well-being (WSA, 2024a). The demand for steel closely follows the development of an economy, particularly in the early stages of industrialisation. Furthermore, steel plays a vital role in the energy transition, as it is used in several renewable technologies, such as EVs, wind turbines, and solar photovoltaic structures (IRENA, 2024b).

Emissions and energy use

Steel production has been increasing consistently over time. In absolute terms, the global production of crude steel rose around ten-fold from 189 million tonnes in 1950 to almost 1.88 billion tonnes in 2024 (WSA, 2024b). This significant rise in steel production has also led to an increase in CO2 emissions from the sector. Currently, the production of steel is carbon intensive, relying primarily on fossil fuels, both for energy and as reductants in the processing of iron ore. For every tonne of steel produced in 2023, approximately 1.9 tonnes of CO2 were emitted into the atmosphere. That same year, the iron and steel sector alone was responsible for about 7% of global energy and process-related CO2 emissions. In absolute terms, this was equivalent to 2.8 Gt of direct CO2 emissions (IEA, 2024a).

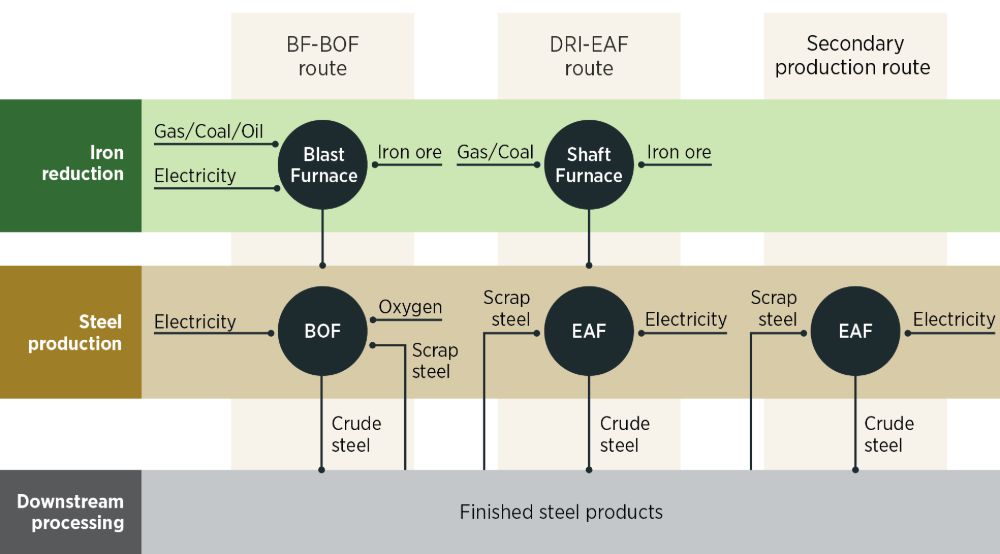

Steel can be produced via primary or secondary routes. Primary steel production involves two steps: (i) ironmaking, where iron ore is reduced to pig iron in a blast furnace (BF) or sponge iron is produced via direct reduction (DRI) 15 , and (ii) steelmaking, where the iron is processed in a basic oxygen furnace (BOF) or an electric arc furnace (EAF), depending on the type of iron input. In secondary steel production, steel scrap is reclaimed and melted in an EAF, without the need for a new iron ore reduction process.

Figure 13: Traditional pathways for steel production

Source: (IRENA, 2023d).

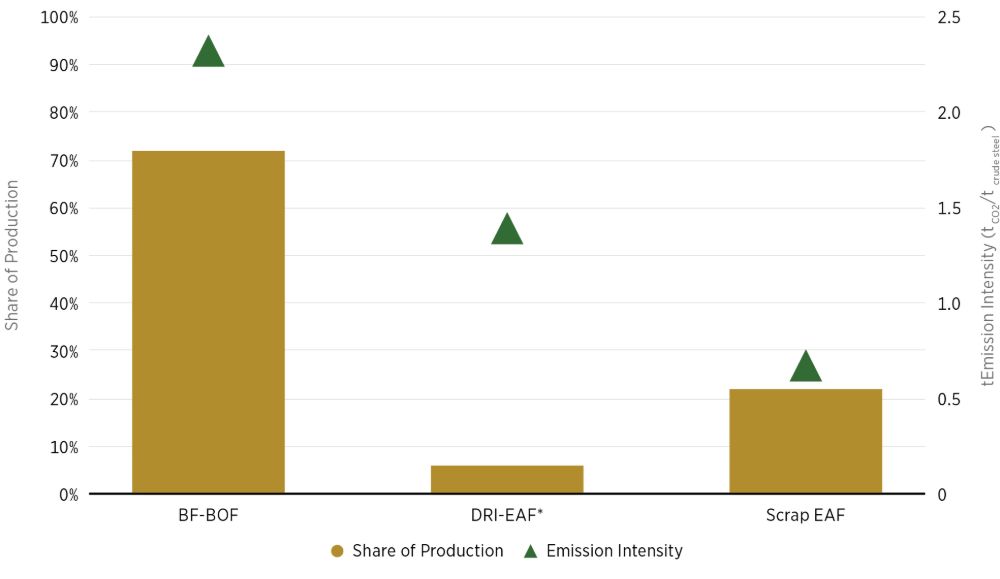

BF-BOF is currently the predominant production route and constitutes 72% of global steel production (Figure 14). This route is also the most energy and emission intensive, as it relies on coal, coke and other coke products as the primary reductant agent and energy source. In 2023, the energy intensity via the BF-BOF production route stood at around 24.2 GJ per tonne of crude steel cast and the emission intensity was around 2.3 tonnes of CO2 per tonne of crude steel cast (WSA, 2024c).

Secondary steel production is based on scrap and accounts for roughly about 21% of global production. Secondary production is the least energy and emission-intensive production route, as it mostly relies on electricity. In 2023, the average emission intensity of the scrap-based EAF route was around 0.7 tonnes of CO2 per tonne of crude steel cast (WSA, 2024c). The DRI-EAF route, however, is more energy and emission intensive than the scrap-based route due to its current reliance on natural gas or coal for the iron reduction process. In 2023, the energy intensity via the DRI-EAF production route was around 23.13 GJ per tonne of crude steel cast, slightly lower than the BF-BOF production route. However, the emission intensity was significantly lower than the BF-BOF production route at around 1.43 tonnes of CO2 per tonne of crude steel cast (WSA, 2024c). Although the scrap EAF route only accounts for 21% of all global steel production, recycled scrap accounts for roughly 30% of the total metallic raw material inputs of that global production (WEF, 2024; WSA, 2024a, 2024b).

Figure 14: Share of production routes and their estimated emission intensities in 2023

Source: (WEF, 2024; WSA, 2024c, 2024a).

Decarbonisation pathways

Largely driven by the growth of emerging economies, demand for steel is expected to rise from about 1 880 megatonnes (Mt) per year today to over 2 400 Mt per year by 2050 (IEA, 2024a; WEF, 2024). It is therefore paramount to transition away from the current fossil fuel-dependent production routes towards renewable-based production pathways. IRENA’s 1.5°C scenario highlights the need for a combination of strategies to decarbonise the iron and steel sector, including increased scrap recycling; process efficiency; material efficiency; and renewable-based primary steel production, mainly using green hydrogen (IRENA, 2023f).

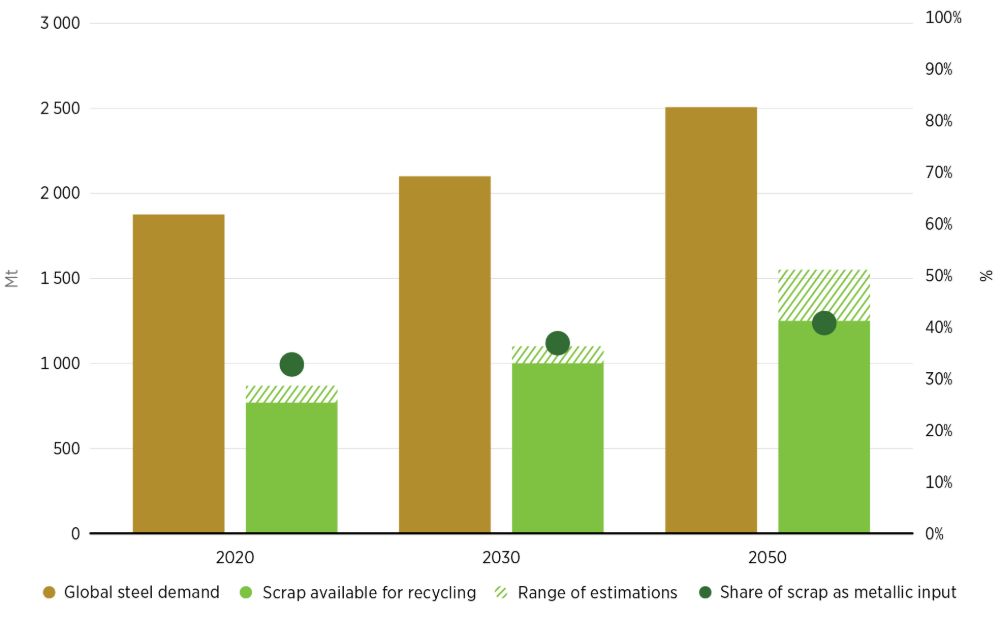

Direct electrification using renewable electricity is set to play a primary role in decarbonising the sector. It will do this by increasing the share of steel produced through the secondary route. When powered by renewable electricity, steel can be produced via the EAF method with near-zero emissions. At the same time, scrap availability is expected to increase along with historic steel production levels and many steel products reaching their end-of-life. Globally, steel scrap availability is expected to increase from between 770 Mt per year and 870 Mt per year currently to between 1 250 Mt per year and 1 550 Mt per year by 2050 (Figure 15). Scrap EAF production already accounts for 32% of the total steel decarbonisation projects announced (IRENA, 2024b).The process of collecting and sorting can be expensive and time-consuming, however, and may limit the use of scrap. In addition, impurities in steel scrap, such as copper and tin, can limit its usability for certain applications. These contaminants can come from previous use and improper scrap management practices (IRENA, 2023c).

In the future, direct electrification could also play a role in the decarbonisation of primary steel production. It could do this by using high- or low-temperature electrolysis to reduce iron ore. However, these technologies are still in their early stages. Companies such as Boston Metal and Electra are focusing on direct electrolysis of the iron ore. This method presents new market opportunities for sustainable steel production, primarily when electricity is based on renewable energy sources.

Figure 15: Global steel demand and scrap availability, 2020-2050

Material efficiency 16 strategies can have a substantial impact in reducing global steel demand. According to IRENA’s 1.5°C scenario, the adoption of such measures could reduce global steel demand by 7% by 2030 and 15% by 2050 (IRENA, 2023c). In addition to reducing direct material demand, these strategies could bring systemic environmental and economic benefits beyond the steel sector. 17 Some challenges exist in the widespread adoption of such strategies, however. These challenges include the need for technical changes, which would happen over several years; regulatory restrictions that may limit the use of alternative materials; the need for additional investments in new manufacturing technologies and processes; and the need for specially skilled labour with technical expertise to adapt to new, evolving measures (IRENA, 2023d).

Yet, owing to the increasing availability of scrap and the demand reductions that can come from the widespread adoption of material efficiency measures, by 2050 as much as half of global steel demand could be satisfied through secondary steel production based on scrap. However, to completely decarbonise the sector, the remaining half of global steel production – which uses the primary steel production route outlined in the Emissions and energy use section – would also have to transition away from fossil fuels towards renewable-based alternatives.

One promising approach is the use of hydrogen-based direct reduced iron (DRI). 18 This process can reduce emissions by around 95%, as showcased by the world’s first batch of renewable-based primary steel, delivered by the HYBRIT plant in Sweden in 2021 (Reuters, 2021). Hydrogen-based DRI is close to commercial maturity and becoming widely accepted as an alternative technology within the industry, with a projected pipeline of about 80 Mt/year.

While the cost differential between conventional and green crude steel produced via hydrogen-based DRI is substantial, the cost impact of using green steel on some higher added-value end products can be relatively low. For instance, an increase of 40% to 70% in the per-tonne cost of steel translates to less than a 1% increase in the overall cost of an average passenger car, and the cost increase for buildings is around 2% (Sandbag Climate Campaign ASBL, 2024).

The widescale adoption of hydrogen-based steel faces several challenges, however. These include the need for high-grade iron ore, access to sufficient volumes of low-cost renewable electricity, 19 a dependable supply of green hydrogen and associated infrastructure; and high costs of production (IRENA, 2023d).

Figure 16: Summary of decarbonisation pathways for the iron and steel sector