2.5 Chemicals and petrochemicals

Chemicals are crucial to our daily lives and are used in many industries, technologies and household products. Most emissions from the sector stem from a small number of these chemicals, particularly ammonia, methanol and steam cracking products (ethylene, propylene, butadiene and aromatics).

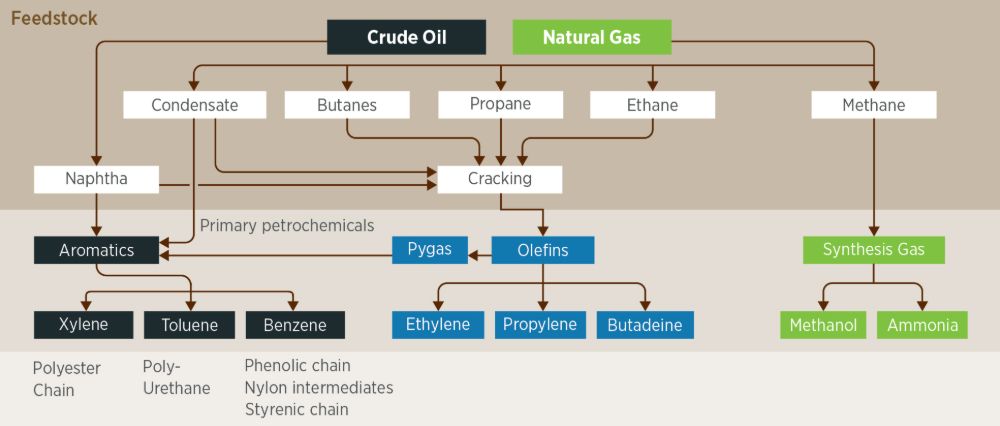

Ammonia is a crucial commodity, used mostly (about 85%) in the production of synthetic nitrogen fertiliser. It is therefore also critical to global food security. Methanol is an essential building block in the production of a wide array of compounds, including solvents, resins and pharmaceuticals. High-value chemicals (HVCs), such as olefins (principally, ethylene, propylene, and butadiene) and aromatics (including benzene, toluene, and xylenes), are essential building blocks for a variety of products across several industries, including plastics, synthetic organic fibres like nylon, and other polymers (IRENA, 2020).

Emissions and energy use

The production of ammonia, methanol and HVCs – also known as “primary chemicals” – has been increasing over the last few decades. This production currently relies almost entirely on fossil fuels and feedstocks.

Over the last decade, ammonia production has grown modestly, however, at an average annual growth rate of 1% (IEA, 2024e). In 2022, approximately 187 Mt of ammonia was produced globally and was primarily sourced from natural gas (72%) and coal (26%) (BNEF, 2024b). In the case of methanol, production has almost doubled over the last decade, growing at an average annual rate of 6.5% (IEA, 2024e). In 2022, around 106 Mt of methanol was produced globally, and currently over half of all methanol production is in China (Methanol Institute, 2024). Around 65% of global methanol comes from natural gas, 35% from coal and 0.2% from renewable sources (IRENA et al., 2021).

Demand for HVCs has been increasing steadily over the past decade, with an average annual growth rate of 3% (IEA, 2024e). In particular, the production of plastics has almost doubled since the beginning of this century and reached around 414 Mt at the end of 2023. Today, 90% of plastic products are still made from fossil feedstocks. In 2023, bio-based plastics constituted 0.7% of total plastics production, or 3 Mt in absolute terms. Globally, around 9% of global plastics production comes from the recycling of plastic waste (Plastics Europe, 2024).

In 2023, the production of these primary chemicals was responsible for approximately 1343 Mt of direct CO2 emissions, or about three-fourths of the total chemical and petrochemical sector’s CO2 emissions (IEA, 2023a). Ammonia production is responsible for the bulk of total direct CO2 emissions from primary chemicals production (45%), followed by methanol production (28%), with the remainder coming from the production of HVCs (IEA, 2024e).

Although the primary chemical production is the largest energy consumer in the chemical and petrochemical sector, it is only the third largest CO2 emitter. Primary chemical production is responsible for roughly equal amounts of emissions from energy used in production processes and from feedstock use. Therefore, some carbon-based materials are contained both in products currently in use and those in controlled and uncontrolled waste disposal systems (IRENA, 2020).

Under IRENA’s Planned Energy Scenario, with limited interventions and actions, the chemical and petrochemical sector’s CO2 emissions could more than triple, from 1.3 Gt in 2022 to 4.7 Gt in 2050 (IRENA, 2023a). At present, most post-consumer plastic is landfilled, incinerated or mismanaged, with only 9% being recycled globally (OECD, 2022). Low recycling and energy recovery rates increase energy use and CO2 emissions. In addition, poor waste management practices contribute to air and water pollution, which impacts local ecologies. This highlights the urgent need to transform the sector from a climate and sustainability perspective.

Figure 17: Overview of feedstocks and petrochemical products

Decarbonisation pathways

The chemical and petrochemical sector’s emissions derive from energy used in production processes as well as energy carriers used as feedstock for chemicals. Both sources need to be eliminated if the sector’s emissions are to be reduced to zero. To achieve this, a combination of decarbonisation pathways is necessary. These routes include reducing demand by increasing the reuse and recycling of products; reducing energy consumption by improving the energy efficiency of processes; adopting renewable-based alternatives to fossil fuel feedstocks; and switching to renewable-based electricity and the use of CO2 capture, utilisation and storage (CCUS) technologies, including bioenergy with CO2 capture and storage (BECCS) (IRENA, 2020).

Some technological pathways are already commercially available and can be scaled up in the coming decades. These include energy efficiency improvements, substitution of fossil fuels with bio-based feedstocks for some chemicals, electrification of multiple heating processes, and renewable hydrogen.

Since 2010, the global chemical and petrochemical sector’s energy intensity has improved at a steady average annual rate of between 0.5% and 1%. Despite these efficiency gains, however, the sector’s energy demand has been growing by around 3% per year (IRENA, 2020). Under IRENA’s 1.5°C scenario, an annual energy efficiency improvement of 3% for production processes will be necessary over the next three decades (IRENA, 2023c).

Applying the principles of the circular economy in the sector would have several economic, social and environmental benefits. Circular economy measures generally include increased reuse, mechanical and chemical recycling, material substitution and the use of sustainable feedstocks to reduce demand.

Globally, the production of plastics is expected to more than double by 2050, to 986 Mt per year (IRENA, 2023c). Meanwhile, the reuse and recycling of petrochemical products is still limited and insufficient. At present, mechanical recycling is dominant, with less than 0.1% chemically recycled (Plastics Europe, 2023). This is mainly because the economics of chemical recycling are not yet favourable. Indeed, impurities or expensive sorting requirements may make the process economically unfeasible (IRENA, 2020).

The substitution of renewable ammonia for conventional ammonia can make a major contribution to decarbonising the chemical and petrochemical sector. Today, ammonia is mostly produced via the Haber-Bosch process, with natural gas the dominant fuel and feedstock. Renewable ammonia can be produced from green hydrogen. This hydrogen is converted into ammonia in a synthesis process using nitrogen separated from air. Although the technology is commercially available, production costs for renewable ammonia are significantly higher than for fossil-based ammonia. The production cost of natural gas-based ammonia and coal-based ammonia is currently between USD 110 per tonne and USD 340 per tonne. Renewable ammonia production costs for new plants are currently estimated to be between USD 720 per tonne and USD 1 400 per tonne. This will potentially decrease to between USD 310 per tonne and USD 610 per tonne by 2050 (IRENA et al., 2022).

Renewable methanol can be derived from biogenic feedstocks (biomethanol) or synthesised 21 from green hydrogen and CO2 (e-methanol). Biomethanol can be produced via gasification or anaerobic digestion processes. A wide array of biomass feedstocks can potentially be used. These include agricultural and forestry waste, landfill biogas, sewage, municipal solid waste, and black liquor from the pulp and paper industry. The production cost of natural gas-based methanol and coal-based methanol is currently between USD 100-200 per tonne and USD 150-250 per tonne. The production costs of biomethanol are expected to remain higher than for fossil-based methanol, however, within an estimated range between USD 327 per tonne and USD 1 013 per tonne, depending on the costs of the feedstock (IRENA et al., 2021).

E-methanol can be synthesised from green hydrogen and a sustainable source of carbon. This can be CO2 from BECCS or direct air capture. The estimated production costs for e-methanol are higher than those for biomethanol and fossil-based methanol, within a broad range between USD 800 per tonne and USD 2400 per tonne, depending on the costs of hydrogen and the costs of sourcing sustainable carbon. With anticipated decreases in renewable power generation costs, the cost of e-methanol could potentially decrease to levels between USD 250 per tonne and USD 630 per tonne by 2050 (IRENA et al., 2021).

The use of sustainably sourced biomass to replace fossil fuels and feedstocks is an option for decarbonising the production of HVCs. As an example, life-cycle emissions could be significantly reduced in the plastics sector if bio-based plastics were substituted for fossil fuel-based plastics. Plastics preferably need to be both bio based and biodegradable. But the high cost of bioplastics acts as a major barrier to their uptake. In addition, the technology readiness level is relatively low, and further innovation and pilot deployments are needed to build knowledge, confidence and economies of scale (IRENA, 2020).

Bio-based alternatives to primary petrochemicals include bioethanol, bio-ethylene and bio-aromatics. For example, ethylene can be readily produced from bioethanol. Bio-based ethylene has been produced on a commercial scale for some years now, although the volumes are relatively small, at less than 1% of total global ethylene production. Increased efforts are needed to scale up production and drive down costs, as these are currently higher than fossil fuel ethylene (IRENA, 2020).

Using synthetic hydrocarbons for feedstocks and renewables for energy supply is another option for the decarbonisation of HVCs. Hydrogen can be produced from renewable energy-powered electrolysis and synthesised with a sustainable carbon source in the presence of a catalyst to produce hydrocarbon feedstocks, which could be a substitute for primary petrochemicals.

A major bottleneck for the widespread use of synthetic hydrocarbons, however, is the cost-effective sourcing of sustainable carbon (i.e. that is not captured from fossil fuels). Presently, obtaining clean CO2 from either biomass or direct air capture is expensive and significantly raises overall production costs. These costs will need to fall substantially for this approach to be a competitive alternative to the use of biomass feedstocks (IRENA, 2020).

Across the sector, direct electrification can play a role in decarbonising heat processes. E-crackers, which are electric alternatives to the traditional high-temperature steam cracker process used to produce HVCs, are currently being tested in several pilot plants. Shell and Dow have installed an experimental electric-powered heat steam cracker furnace unit at the Energy Transition Campus in Amsterdam, the Kingdom of the Netherlands, testing it as a replacement for gas-fired steam cracker furnaces. The unit has the potential to scale up by 2025 (Shell, 2022). In addition, at a test facility in Germany, BASF, SABIC and Linde have commenced construction of the world’s first demonstration plant for large-scale electrically heated steam cracker furnaces. This plant aims for a 90% reduction in CO2 emissions compared with conventional technology (BASF, 2022). For low and medium temperatures, heat pumps can be deployed. Research efforts are currently under way to increase the temperature range of heat pumps to a maximum of 200°C (IRENA, 2023b).

Figure 18: Summary of decarbonisation pathways for the chemical and petrochemical sector